- Healthcare 150

- Posts

- Wellness Booms, AI Crawls, and Europe Leaves the U.S. Behind

Wellness Booms, AI Crawls, and Europe Leaves the U.S. Behind

Global wellness spending just passed $5 trillion, fueled by products, tech, and lifestyle real estate. The market’s flexing fast—and only investors who adapt to this convergence will keep up.

Good morning, ! This week we’re diving into the sustained growth of the Wellness & Fitness market; the ebay and worst performing HC US stock in 3Q25; and smart healthcare market share by region.

Want to advertise in Healthcare 150? Check out our self-serve ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

Data Dive: Wellness Recast - The $5T Shift From Health to Habit

The global wellness economy has quietly morphed into a $5 trillion force — and it’s no longer just about health. A McKinsey-backed analysis reveals that while health-related spending still accounts for 43–65% of the wellness wallet, growth is now coming from adjacents: appearance (up to 30% in Japan), fitness, nutrition, and even real estate.

The trend? Wellness is becoming infrastructure. From Brazil’s health-heavy mix to China’s appearance-centric tilt and Germany’s fitness-first model, regional spending differences are pointing investors toward opportunity zones. Particularly ripe: the under-10% slices for sleep and mindfulness — nascent sectors primed for tech and therapeutics.

Services (gyms, spas) still take 70% of consumer spend, but the forward momentum lies with products. 37% of consumers plan to increase spend on wellness products versus just 23% on services. Scalable, personalized, and increasingly tech-enabled, products—from wearables to functional foods—are set to dominate.

Add in wellness real estate (16% CAGR), mental health tech (12%), and tourism (10%), and the takeaway is clear: this isn’t a niche anymore. Wellness is now a cross-sector thesis. The winners won’t just sell supplements—they’ll design ecosystems.

Bottom line: As “feeling well” becomes a daily decision, not a destination, investors should target convergence zones—where lifestyle, healthcare, and technology collide.

TREND OF THE WEEK

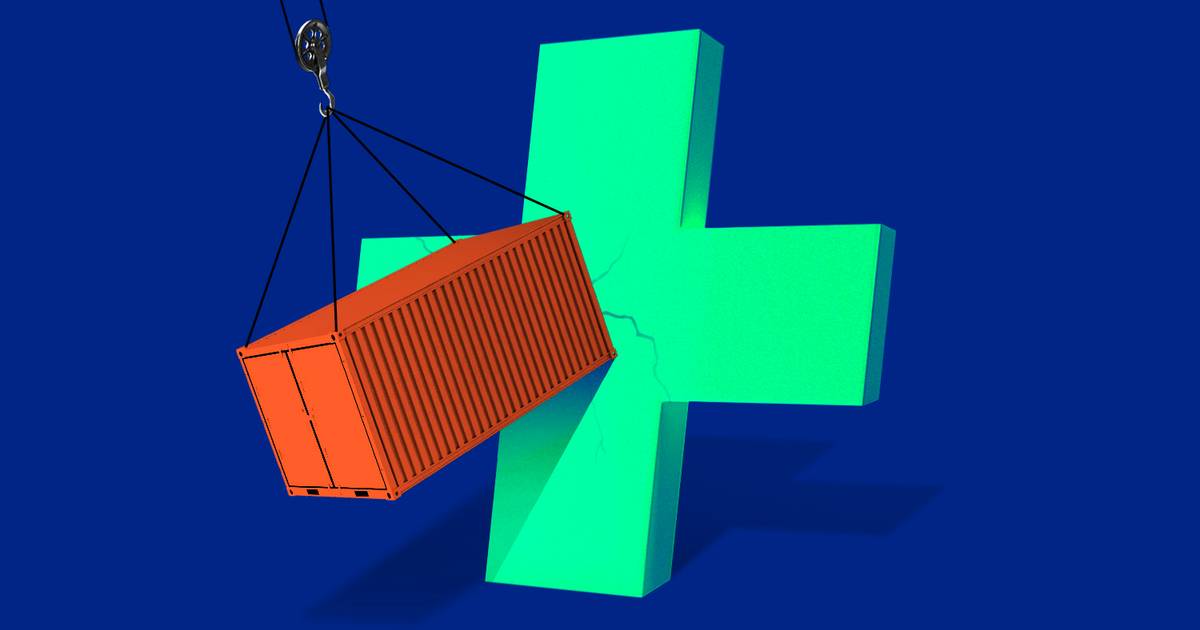

The Great Divergence: Health vs. Property Insurers

Q3 delivered a stark split in insurance equities. Health and tech-driven insurers took a beating - Centene (-36.2%), Molina (-36.0%), and Slide Insurance (-35.1%) led the bottom tier, while insurtechs like Trupanion (-23.4%) and Root (-27.0%) weren’t spared either.

On the flip side? Mid-cap property and specialty players staged a quiet rally. Alignment Healthcare (+24.2%), Mercury General (+21.5%), and HCI Group (+18.1%) all posted double-digit gains. Even legacy life insurer Lincoln National (+17.8%) clawed back relevance.

What’s driving the divide? A cocktail of rising claims costs, regulatory noise, and earnings resets are haunting health names. Meanwhile, property insurers are riding premium hikes, cleaner balance sheets, and a relatively quiet hurricane season (so far).

For PE and strategic investors, the signal is clear: underwriting volatility is back in fashion—and Q4 could widen the gap. (More)

PRESENTED BY TEST DOUBLE

Survey: Tech challenges in the healthcare space

Know an engineering, IT, product, marketing, or strategy leader in healthcare or health tech? We're benchmarking challenges & priorities:

- Budget decreases or increases for IT, product, strategy, and AI

- Focused on legacy modernization, org transformation or something else

- Blockers to change

HEALTHTECH CORNER

Healthcare AI’s Slow Pulse

AI is rewriting playbooks in finance, tech, and consumer goods—but healthcare is still warming up on the sidelines. According to BCG’s 2024 AI Capability Maturity Assessment, healthcare scored 300, lagging behind telecom (313), finance (309), and consumer (305). Growth since 2021? Just 8%, compared to automotive’s 17% surge. The gap is visible in talent, too: only 1 in 1,850 healthcare job postings mention AI skills, versus 1 in 175 for finance. Experts blame regulatory red tape, fragmented data, and cultural silos. The irony: healthcare generates some of the richest datasets in the world. The question is whether organizations can move from pilot projects to scalable solutions before tech outsiders start eating their lunch. (More)

TOGETHER WITH MASTERWORKS

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

DEAL OF THE WEEK

Data Therapy: Qualtrics Prescribes $6.75B of AI

Qualtrics is going full throttle into healthcare with a $6.75B deal to acquire Press Ganey Forsta, a top player in patient experience data. The goal? Combine AI muscle with clinical insights from 41,000+ healthcare clients. It's a clear move to own proprietary data pipelines—aka rocket fuel for generative AI. With Oracle and Palantir eyeing the same space, this is both an offensive and defensive maneuver. Press Ganey’s PE backers Ares and Leonard Green exit stage right, while Silver Lake continues its Qualtrics world domination arc. Call it what it is: an arms race for healthcare-grade data. And this deal? A massive cannon blast. (More)

REGIONAL FOCUS

Europe Takes the Crown

When it comes to smart healthcare, Europe isn’t just keeping pace—it’s leading the race with 32.5% market share. North America follows closely at 29.1%, and the Asia Pacific isn’t far behind with 24.7%—a reminder that future growth may tilt eastward. Latin America (7.9%) and the Middle East & Africa (5.8%) trail, but represent untapped opportunity. Europe’s dominance comes from AI-driven diagnostics, telehealth adoption, and device integration, backed by strong regulations and funding. North America’s edge is innovation-led, with a heavy dose of wearables and data analytics. Asia Pacific, meanwhile, is riding a demographic and digital wave. Investors betting only on mature markets risk missing the next growth engine—and that engine increasingly hums in Asia. (More)

INTERESTING ARTICLES

"The secret of business is to know something that nobody else knows."

Aristotle Onassis