- Healthcare 150

- Posts

- From Health to Habit: Where the Next Wave of Wellness Growth Will Come From

From Health to Habit: Where the Next Wave of Wellness Growth Will Come From

Wellness has evolved from a personal pursuit into a defining force of the global economy.

Once confined to gyms, spas, and supplements, the sector has transformed into a dynamic, multi-trillion-dollar ecosystem spanning healthcare, technology, real estate, and lifestyle. The post-pandemic consumer no longer views wellness as a luxury but as a necessity — one that influences where they live, how they spend, and what they value. For investors, this evolution represents not only scale but diversity of opportunity, as wellness now sits at the intersection of health science, digital innovation, and human experience.

This report examines how wellness spending is shifting across categories, how products are outperforming traditional service models, which segments are growing fastest, and where capital can best capture emerging momentum. From Brazil’s health-heavy spending to China’s beauty-led expansion and Germany’s fitness-first approach, regional differences reveal the sector’s breadth and depth. At the same time, structural rebalancing — toward scalable consumer products and lifestyle-driven real estate — underscores the global convergence of health and commerce.

The message for investors is clear: wellness is no longer an adjunct to healthcare; it is the new frontier of health. Its growth will be shaped by innovation, integration, and investment strategies that view wellbeing not as a product or service, but as a continuously adaptive ecosystem — one where technology, sustainability, and human aspiration meet.

Global Wellness Spending: Health Still Dominates, but Priorities Are Shifting

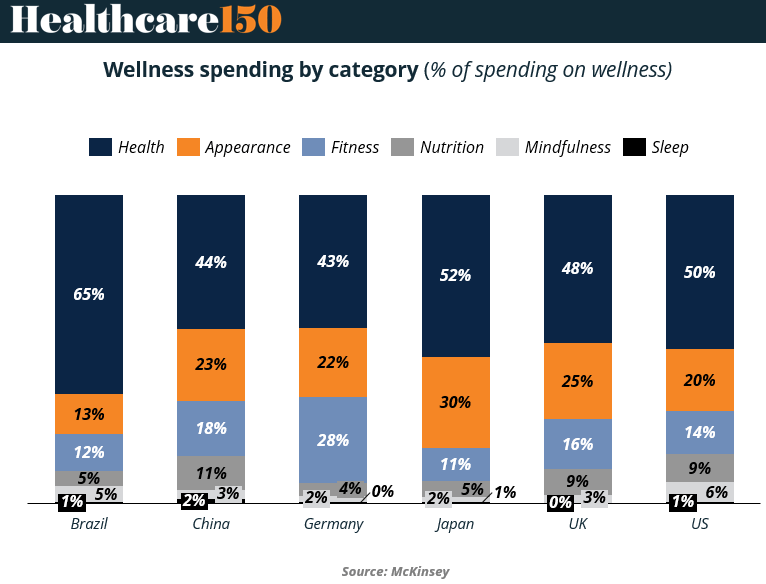

Across major economies, consumer wellness spending patterns reveal a striking truth: while health remains the cornerstone, the definition of wellness is expanding. According to McKinsey’s global survey, health-related expenditures capture the largest share in every market — from a commanding 65% in Brazil to 43–52% in advanced economies like Germany, Japan, and the U.S. Yet, the steady rise of adjacent categories such as appearance, fitness, and nutrition underscores a profound evolution in how consumers and investors alike interpret “wellness.”

This diversification is not merely a lifestyle phenomenon — it’s a market signal. Wellness is transitioning from a medicalized necessity into a multi-dimensional consumer economy, spanning aesthetic services, personal training, digital fitness, functional foods, and sleep technology.

The differences between regions tell investors where growth opportunities lie. China, for instance, allocates nearly a quarter of its wellness spending to appearance, reflecting cultural preferences and an increasingly image-driven consumer market. In contrast, Germany’s higher allocation to fitness signals an appetite for structured, performance-oriented health interventions.

For investors, these distinctions reveal where capital can find differentiated momentum. The next wave of wellness growth will likely arise in the convergence zones — where fitness merges with mental health, nutrition integrates with preventive care, and appearance becomes a form of holistic wellbeing. As consumers around the world redefine what “feeling well” means, portfolios that mirror this diversified spending structure will be better positioned for resilience and long-term return.

Key Insights and Takeaways

Health remains dominant, averaging about half of total wellness spending globally (ranging from 43% in Germany to 65% in Brazil). This underscores the enduring centrality of healthcare-linked products and services within wellness.

Appearance ranks second across all countries, especially in Japan (30%), UK (25%), and China (23%), showing strong cultural and consumer confidence in the aesthetic and beauty segments.

Fitness and nutrition together account for 20–35% of wellness spend in developed markets, suggesting a mature awareness of lifestyle management and a readiness for personalized, data-driven offerings.

Mindfulness and sleep remain underdeveloped markets (<10% combined across all regions) — signaling untapped potential for growth in digital therapeutics, sleep tech, and behavioral health tools.

Regional divergence presents investment opportunities

Latin America (Brazil) leans on health systems and basic wellness access.

East Asia (China, Japan) shows strong demand for beauty and self-enhancement.

Western markets (US, UK, Germany) are integrating performance, nutrition, and tech-enabled fitness.

Overall, the chart highlights a maturing but fragmented global wellness ecosystem, where diversified strategies — not single-category bets — will drive superior investor outcomes.

Products vs. Services: The Next Battleground for Wellness Growth

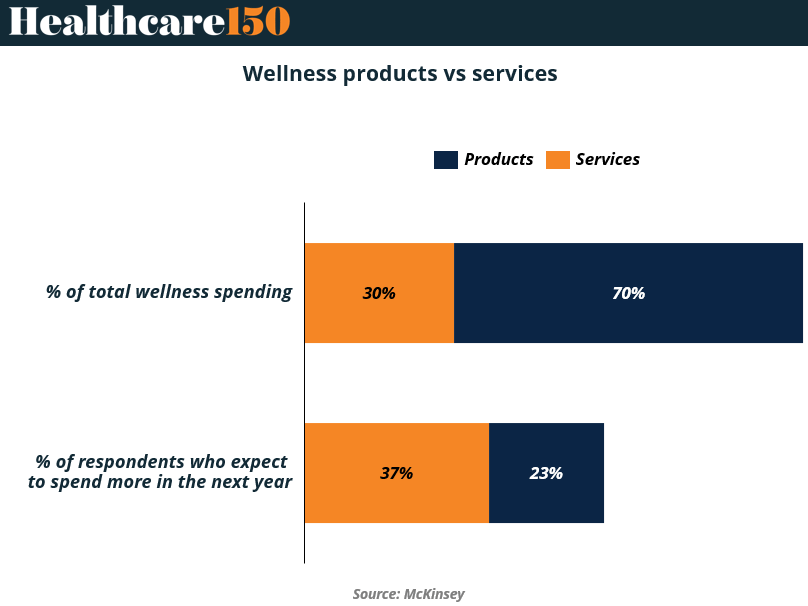

The wellness economy has long been dominated by services — fitness studios, spas, nutrition coaching, and aesthetic treatments — which currently absorb 70% of global wellness spending. Yet, a quiet shift is underway: consumers are signaling stronger intent to increase spending on products than on services in the coming year.

According to McKinsey, 37% of respondents plan to spend more on wellness products, compared to only 23% who expect to boost their service spending. That delta represents a structural rebalancing that investors cannot afford to ignore.

This changing mix is being driven by accessibility, personalization, and scalability. Consumers are gravitating toward home-based wellness — from supplements and wearable health tech to sleep aids and recovery tools — which combine convenience with measurable outcomes. Unlike service models that rely on human capacity and geographic footprint, product-based wellness companies can scale globally, often with higher margins and recurring revenue potential. This creates a ripe environment for both direct-to-consumer brands and hybrid service-product ecosystems to thrive.

For investors, this trend points to a broader transformation: the convergence of consumer packaged goods (CPG) with digital health technology. The next generation of wellness brands will not simply sell products but deliver continuously adaptive experiences, guided by data, community, and behavioral design. As services become saturated and price-sensitive, product innovation offers a more defensible and diversified route to capture the wellness dollar.

Key Insights and Takeaways

Services currently dominate the wellness economy, accounting for 70% of total spending, but this dominance masks a growing consumer appetite for products.

Products command only 30% of current spend but show higher forward momentum — 37% of consumers plan to increase spending, compared to 23% for services.

The shift toward products reflects consumer empowerment: people prefer solutions they can control, track, and integrate into daily routines.

Product-based wellness categories such as supplements, smart wearables, recovery devices, and functional beverages are benefiting from e-commerce and social media distribution advantages.

Service models face rising cost pressures and talent shortages (e.g., trainers, therapists, aestheticians), limiting scalability compared to product-driven channels.

Investment implications:

Expect venture and M&A activity to increase in wellness product startups with tech integration.

Hybrid models — for instance, fitness brands launching proprietary recovery tools or nutrition lines — will outperform single-category incumbents.

Private equity and growth investors should focus on brand ecosystems that blend the intimacy of service with the scale of consumer goods.

The Fastest-Growing Frontiers of Wellness: Real Estate, Mind, and Experience

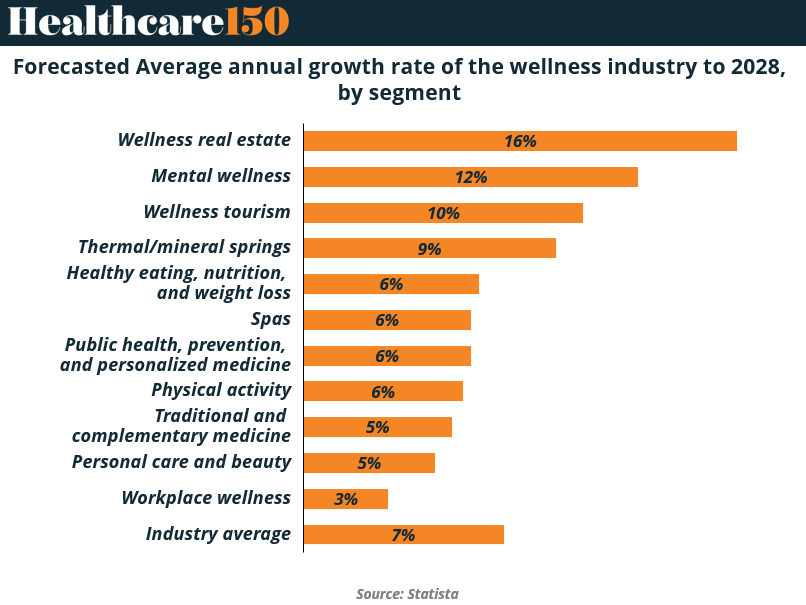

The wellness industry is no longer confined to gyms and supplements — it’s reshaping how people live, travel, and connect. According to Statista, the sector is forecasted to grow 7% annually through 2028, but certain subcategories will expand at more than double that rate. Wellness real estate leads the pack with a striking 16% annual growth rate, followed closely by mental wellness (12%) and wellness tourism (10%). These three categories are redefining the wellness experience from a consumer service into an immersive lifestyle infrastructure, offering investors access to a broader, more resilient economic ecosystem.

This reordering of growth signals the integration of wellness into daily environments. From residential developments centered on preventive health and community well-being, to travel experiences designed around mindfulness and recovery, wellness is becoming a physical and spatial asset class. The expansion of mental wellness — from meditation apps to corporate mental health benefits and digital therapy — reinforces a cultural and financial pivot toward psychological sustainability as an investment theme. As consumers prioritize emotional resilience and quality of life, capital is following suit.

The implications are profound: the next decade of wellness investment will move from reactive health to preventive, experiential, and lifestyle-driven models. The lines between healthcare, hospitality, and real estate are blurring — and the winners will be those who build integrated ecosystems, not isolated brands. Investors who anticipate this convergence early will capture the most defensible positions in a market that’s evolving beyond products and services into whole-person infrastructure.

Key Insights and Takeaways

Wellness real estate is projected to grow at 16% annually, the fastest of all segments, reflecting demand for built environments that support health, sustainability, and community.

Mental wellness is expanding at 12%, driven by growing acceptance of psychological care, hybrid therapy platforms, and corporate wellbeing programs.

Wellness tourism (10%) and thermal/mineral springs (9%) illustrate how experiences are becoming a premium part of the wellness economy — connecting leisure, restoration, and luxury.

Traditional segments like nutrition, spas, and physical activity continue steady growth (around 6%), indicating maturity rather than saturation, with space for tech-enabled differentiation.

Workplace wellness lags at 3%, signaling an opportunity for innovation as hybrid work normalizes and companies seek scalable wellbeing strategies.

Investment implications:

Expect real estate developers and hospitality groups to expand wellness-integrated offerings.

Mental health tech remains a priority sector for private capital and strategic partnerships.

Cross-sector collaboration — between healthcare providers, tourism, and property — will define the most scalable future wellness models.

The $5 Trillion Wellness Economy: Scale, Segments, and Strategic Momentum

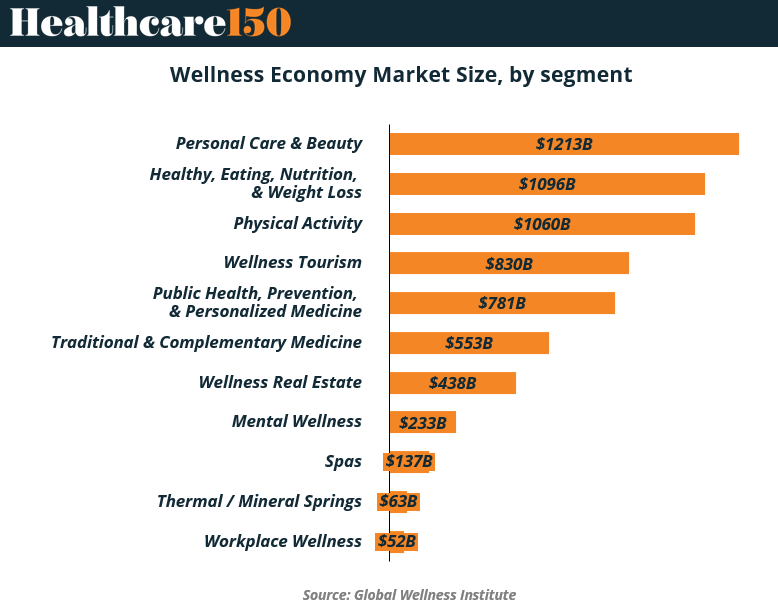

The wellness economy is vast — and still expanding. According to the Global Wellness Institute, the total market size across all wellness segments now exceeds $5 trillion globally, spanning everything from beauty and nutrition to real estate and digital mental health. The largest contributors are Personal Care & Beauty ($1.2T), Healthy Eating, Nutrition & Weight Loss ($1.1T), and Physical Activity ($1.06T). Together, these three sectors alone account for more than half of total wellness spending, underscoring how wellness has evolved from a niche pursuit into a mainstream consumer necessity.

This distribution highlights the dual nature of wellness growth: massive, established markets coexist with fast-emerging, undercapitalized niches. While mature categories like beauty and fitness remain strong due to recurring demand and brand loyalty, rising segments such as wellness tourism ($830B), personalized medicine ($781B), and mental wellness ($233B) are scaling quickly from smaller bases — offering investors room for both stability and upside. The inclusion of wellness real estate ($438B) and traditional medicine ($553B) further expands the ecosystem beyond consumer products, connecting wellness directly to infrastructure, healthcare delivery, and cultural tradition.

For investors, this landscape is an invitation to think horizontally, not vertically. The wellness market’s interconnected structure rewards strategies that span categories — for example, combining nutrition with physical activity, or mental health with preventive medicine. The data suggests not just where the money is, but where it’s moving. As health, lifestyle, and experience industries converge, the most resilient portfolios will bridge the science of health with the aspiration of wellness, capturing both economic scale and emotional resonance.

Key Insights and Takeaways

The global wellness economy exceeds $5 trillion, anchored by three mega-segments:

Personal Care & Beauty ($1.21T) — reflecting continued consumer investment in self-image, aesthetics, and premium personal care.

Healthy Eating, Nutrition & Weight Loss ($1.1T) — driven by functional foods, supplements, and data-backed nutrition solutions.

Physical Activity ($1.06T) — encompassing gyms, connected fitness, sports tech, and performance wearables.

Wellness tourism ($830B) and personalized medicine ($781B) show strong alignment with post-pandemic trends in health travel and data-driven care.

Emerging markets such as mental wellness ($233B) and wellness real estate ($438B) represent high-growth, high-potential areas with increasing institutional interest.

Smaller categories — spas, thermal springs, and workplace wellness (<$150B each) — remain specialized but offer targeted investment plays for niche or experiential portfolios.

Investment implications:

Diversified exposure across both consumer and infrastructure verticals will provide stronger returns than single-sector concentration.

Expect consolidation and cross-industry partnerships as companies seek end-to-end wellness ecosystems.

The real opportunity lies in integration — connecting the $1T+ consumer segments with emerging categories through technology, data, and service design.

Conclusion

The wellness economy’s trajectory points to one of the most powerful realignments in modern consumer markets. What began as a reactive response to lifestyle disease has become a proactive movement toward holistic, personalized, and preventive living. The data shows that health remains the foundation, but the future of wellness lies in its adjacencies — in the products, spaces, and digital experiences that embed wellbeing into everyday life.

Investors now face a landscape defined by scale, fragmentation, and convergence. Scale offers stability — the trillion-dollar pillars of beauty, nutrition, and fitness ensure predictable demand. Fragmentation invites innovation — in rising sectors like mental health, wellness tourism, and real estate. Convergence delivers the greatest potential — where healthcare, hospitality, and technology combine to deliver whole-person wellness ecosystems.

As we move toward 2028, the winners in this market will not simply sell wellness — they will design it, operationalize it, and scale it. The global wellness economy is entering its most transformative phase yet, where health is no longer treated but experienced, and where investment in wellbeing is, increasingly, investment in the future of humanity itself.

Sources & References

Global Wellness Institute. Market Size by Segment. https://globalwellnessinstitute.org/press-room/statistics-and-facts/

Statista. Wellness and Fitness growth. https://www.statista.com/topics/1336/wellness-and-spa/?srsltid=AfmBOopk8FZX_S2FPq9ZYAhdPR1nJzSr8FDuia9QYr3hiEzksKd55KkH#editorsPicks

McKinsey. The future of the wellness market.https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/feeling-good-the-future-of-the-1-5-trillion-wellness-market

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.