- Healthcare 150

- Posts

- The $8.55T Shift Reshaping Healthcare — And What Comes Next

The $8.55T Shift Reshaping Healthcare — And What Comes Next

Value-based care, private equity, and GenAI are redrawing healthcare’s financial map. The next phase isn’t about growth alone—it’s about redefining where and how value is created.

Good morning, ! This week we’re diving into the $8.55T shift to value based care, GenAI represents a $4.3B opportunity in healthcare supply chain management, Uninsured rates rose across all age groups, and Hologic Goes Private in a $18.3B strategic deal.

Want to advertise in Healthcare 150? Check out our self-serve ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

The $8.5 Trillion Pivot From Volume to Value

The U.S. value-based care (VBC) market is on pace to double to $8.55 trillion by 2034, marking one of healthcare’s biggest financial rewrites in modern history. The pivot from fee-for-service to outcome-based models is transforming how hospitals, payers, and physicians earn revenue — and how they define success. Nearly 70% of all payments are now tied to some form of value-linked contract, a stark reversal from just 30% a decade ago. Behind the shift: AI-enabled analytics, Medicare Advantage growth, and an aging population driving chronic disease costs. The result? Efficiency and prevention are the new profit centers — and mastering risk-bearing models is fast becoming the next great healthcare margin strategy.

TREND OF THE WEEK

Trend of the Week: Health Coverage Slippage Is Quietly Accelerating

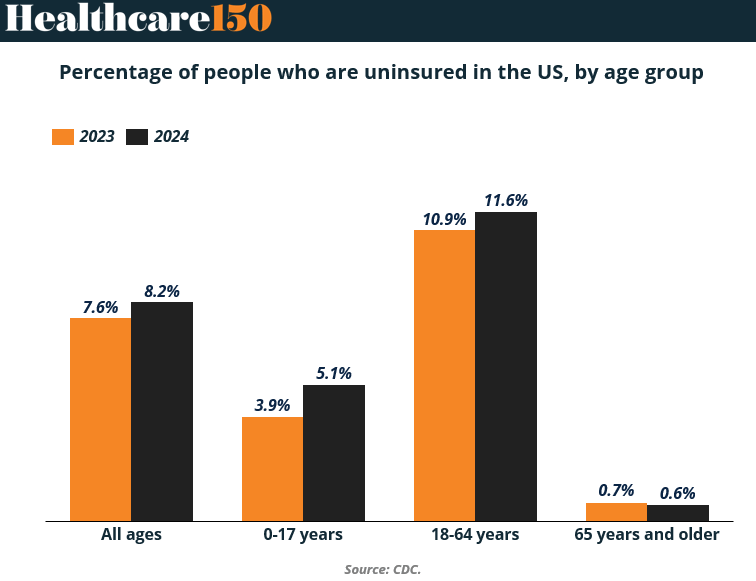

Uninsured rates in the US are rising again—a trend with strategic implications for payers, providers, and policymakers. According to CDC data, the percentage of uninsured individuals increased across all major age groups from 2023 to 2024, with the biggest jump among children (from 3.9% to 5.1%) and adults aged 18–64 (from 10.9% to 11.6%).

This uptick reverses a decade-long downward trend and reflects the aftershocks of pandemic-era policy rollbacks—especially the unwinding of Medicaid continuous enrollment. While the elderly remain largely covered (0.6% uninsured), the working-age and pediatric populations are slipping through the cracks.

Why it matters: Rising uninsurance introduces revenue risk for providers, shifts payer mix unfavorably, and signals renewed strain on safety-net systems. For investors and operators, it may pressure margins and boost demand for affordable care models like urgent care, retail clinics, and virtual-first plans.

Watch list: Medicaid MCOs, community health centers, ASC operators, and digital health platforms serving low-income or uninsured populations.

PRESENTED BY 1440

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

HEALTHTECH CORNER

The $37B Cure for Inefficiency

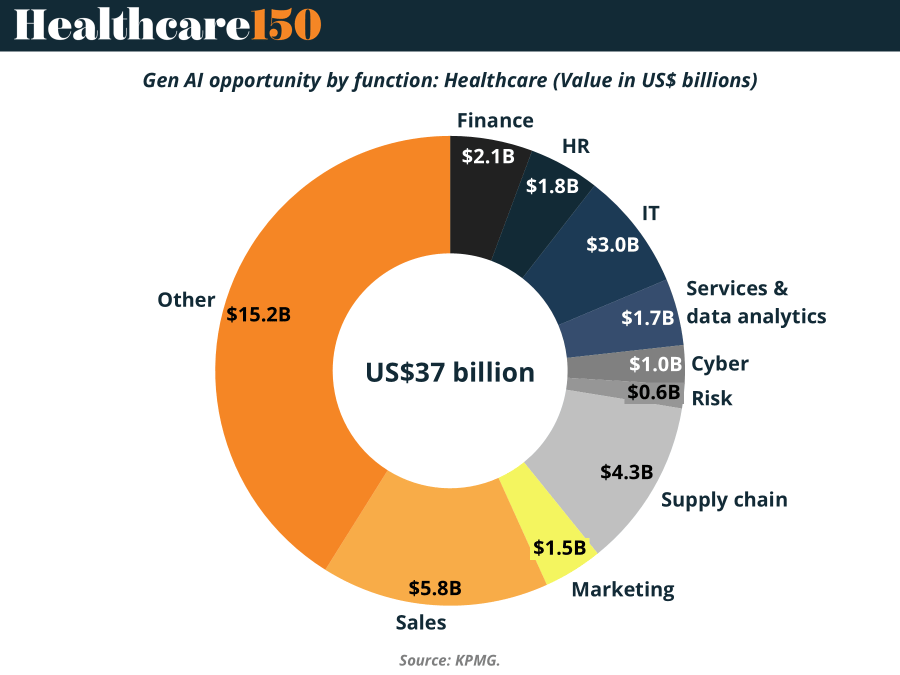

Generative AI isn’t just the next shiny thing in healthcare—it’s the $37 billion productivity prescription. According to KPMG, full-scale GenAI adoption could boost healthcare EBITDA by 4–18%, driven largely by labor productivity. The biggest windfall sits in the front office (worth $15.2B), where smarter automation means fewer no-shows and better patient engagement. The middle office adds another $15B from predictive analytics and claims optimization, while the back office contributes $6.8B by scrubbing inefficiencies from finance, HR, and IT. The takeaway: GenAI isn’t replacing clinicians—it’s scaling them. As hospitals struggle with staffing shortages and cost pressures, the technology is evolving from pilot projects to profit drivers. Healthcare’s next growth curve isn’t about discovery; it’s about doing more with the same humans—only faster, and a lot smarter. (More)

TOGETHER WITH 1440 MEDIA

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

DEAL OF THE WEEK

Hologic Goes Private in a $18.3B PE Power Play

Blackstone and TPG are taking Hologic private in a transaction valued at up to $18.3 billion, marking the largest medtech deal since 2006. The duo will pay $76 per share, with an additional $3/share CVR tied to Breast Health revenue milestones. That’s a 46% premium over pre-deal rumors.

Advisors lined up like a Dream Team: Goldman Sachs for Hologic, Citi and Kirkland & Ellis for the PE consortium, with Ropes & Gray handling healthcare regs. Five global banks, including Barclays and SMBC, committed the debt package. With a go-shop window open, this is a classic “rich deal, long fuse” scenario—closing expected 1H 2026, pending approvals. (More)

REGIONAL FOCUS

The Geography of Healthcare on the Move

Medical tourism is going global. North America leads the pack with 26% of total market share, but not for the reasons you might think. The region is both a source of outbound patients chasing affordability and a destination for high-complexity care. Close behind, Europe (24%) leverages its integrated healthcare networks and cross-border mobility, while Asia Pacific (22%) is scaling fast on the back of cost efficiency, medical expertise, and government promotion. Latin America (15%) thrives on proximity and pricing—especially in Mexico, Costa Rica, and Colombia—and MEA (13%) is catching up fast, led by Dubai’s luxury healthcare push. The takeaway: the medical tourism boom isn’t a one-region wonder; it’s a borderless business model built on value, access, and experience. (More)

INTERESTING ARTICLES

"To succeed in business, to reach the top, an individual must know all it is possible to know about that business."

J. Paul Getty