- Healthcare 150

- Posts

- Value-Based Care: The Next Margin Lever in U.S. Healthcare

Value-Based Care: The Next Margin Lever in U.S. Healthcare

How outcome-linked payment models are redefining profitability, reshaping delivery systems, and creating a trillion-dollar opportunity across the healthcare value chain.

Introduction

For decades, the economics of healthcare have revolved around volume. Hospitals, physicians, and payers operated in a fee-for-service world that rewarded the number of procedures, not the quality of outcomes. But that model is reaching its limits. Margin pressure, chronic disease prevalence, and payer reform have created a system where doing more no longer guarantees doing better—financially or clinically.

As a result, value-based care (VBC) has emerged as the next structural lever for profitability and resilience. It is not just a reimbursement experiment anymore, it is a business transformation. By tying payments to outcomes, efficiency, and patient satisfaction, value-based models aim to realign incentives across the healthcare ecosystem. And the shift is accelerating: according to the Health Care Payment Learning & Action Network (HCP-LAN), nearly 70% of U.S. healthcare payments are now linked to some form of value-based arrangement, up from less than 30% a decade ago.

The implications reach far beyond policy. Payers are redesigning contract structures to share financial risk with providers. Hospitals are investing in care coordination, analytics, and chronic disease management to achieve cost savings and boost performance under shared-risk models. Tech players and private equity investors are deploying capital into “VBC enablers” — companies that provide the digital infrastructure, predictive models, and workflow tools needed to operationalize value.

Early adopters are proving that the economics work. Organizations like Humana and Oak Street Health have demonstrated that risk-based care can deliver lower per-member costs and higher patient satisfaction, while driving returns on invested capital that exceed those of traditional fee-for-service systems. The model is also reshaping healthcare labor: instead of billing-centric workflows, teams are being reoriented around outcome metrics, preventive interventions, and data-driven decision-making.

Still, the path to full-scale adoption is complex. Fragmented data systems, uneven regulatory incentives, and operational inertia slow progress. Smaller providers often lack the analytical and financial infrastructure to manage downside risk. Yet the direction of travel is unmistakable — healthcare is moving from volume to value, and the organizations that master this transition will define the next decade of margin performance.

This report explores how value-based care is evolving as a core business strategy, not just a policy ideal. We examine the financial rationale, payer and provider strategies, enabling technologies, case studies from leading adopters, and the capital markets shaping the ecosystem. Ultimately, the rise of VBC signals a new phase in healthcare economics — one where outcomes, efficiency, and accountability are not just moral imperatives, but financial ones.

U.S. Market Size: A Trillion-Dollar Shift Toward Value

The U.S. healthcare industry is in the middle of one of its most significant financial transitions in modern history — the migration from volume-based to value-based care models. What began as a policy experiment under CMS is now a trillion-dollar market transformation that is redefining how healthcare organizations earn, spend, and measure success.

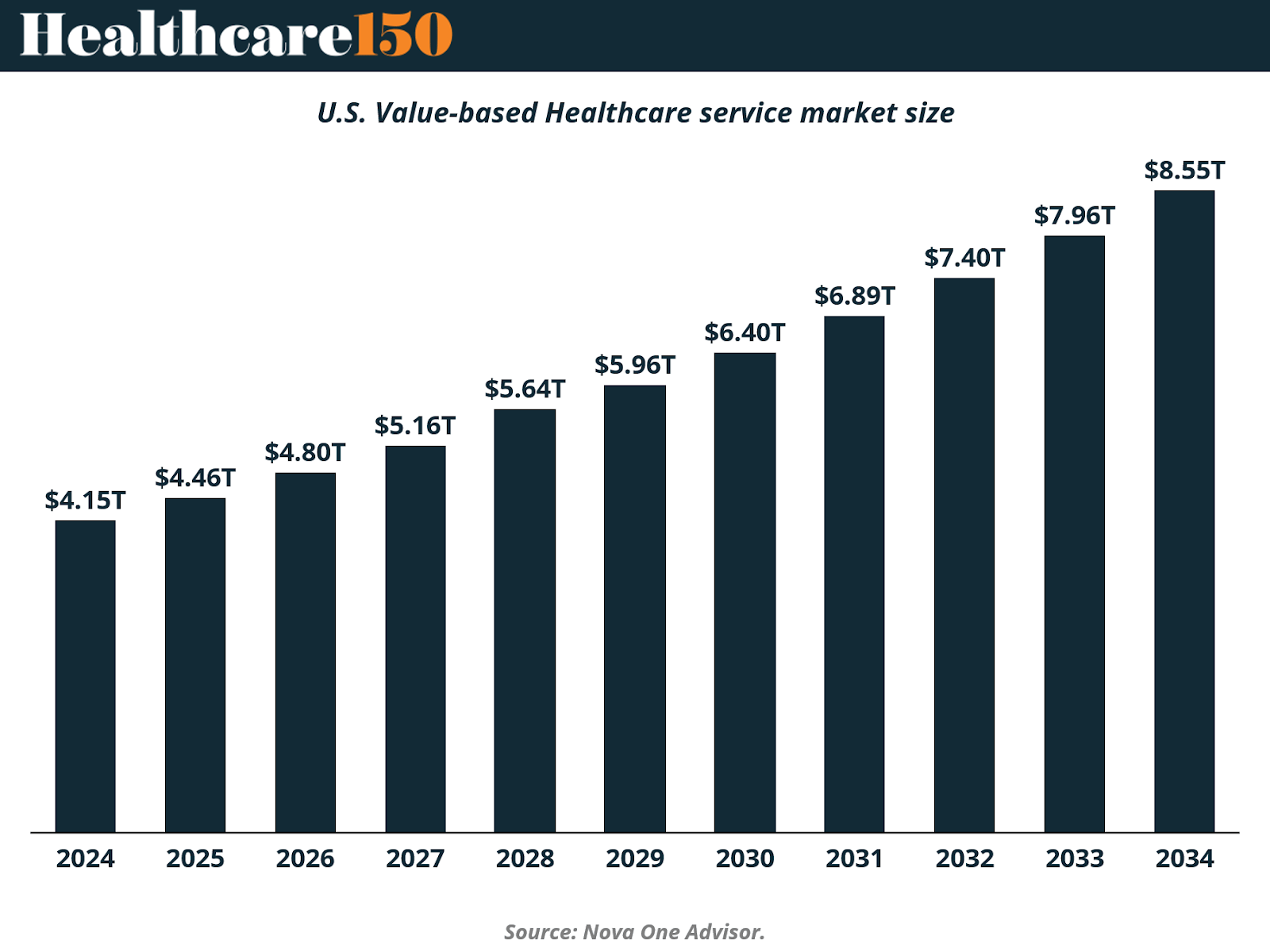

According to Nova One Advisor, the U.S. value-based healthcare services market is projected to expand from $4.15 trillion in 2024 to $8.55 trillion by 2034, representing a compound annual growth rate (CAGR) of roughly 7.8%. This doubling of market size over a decade reflects both policy-driven acceleration and private-sector adoption. Hospitals, payers, and physician groups are increasingly restructuring their contracts and operations around risk-sharing and outcome-based reimbursement.

The expansion is being fueled by several converging forces:

Policy momentum: CMS continues to push for full-risk models through Medicare Advantage and ACO REACH programs.

Private capital investment: Private equity and venture funds are backing enablers—data analytics platforms, population health management firms, and virtual care networks—that support VBC infrastructure.

Employer demand: Large self-insured employers are adopting direct-to-provider VBC arrangements to manage chronic disease and reduce total cost of care.

Technological scalability: Advances in EHR interoperability, AI-driven risk prediction, and remote monitoring are finally making population-level outcomes management viable.

If the current trajectory holds, by the early 2030s, value-based models will represent the majority of U.S. healthcare payments, marking a complete inversion of the historical fee-for-service structure. The economic implications are profound: the system’s revenue growth will be increasingly tied to efficiency, prevention, and data-driven patient engagement rather than procedural volume.

In essence, this market expansion is not just about growth — it is about recomposition. The $8.5 trillion market of 2034 will look fundamentally different from today’s $4 trillion baseline: leaner in acute care, richer in primary and preventive services, and far more integrated across technology and delivery.

Market Composition: Where Value Is Being Delivered

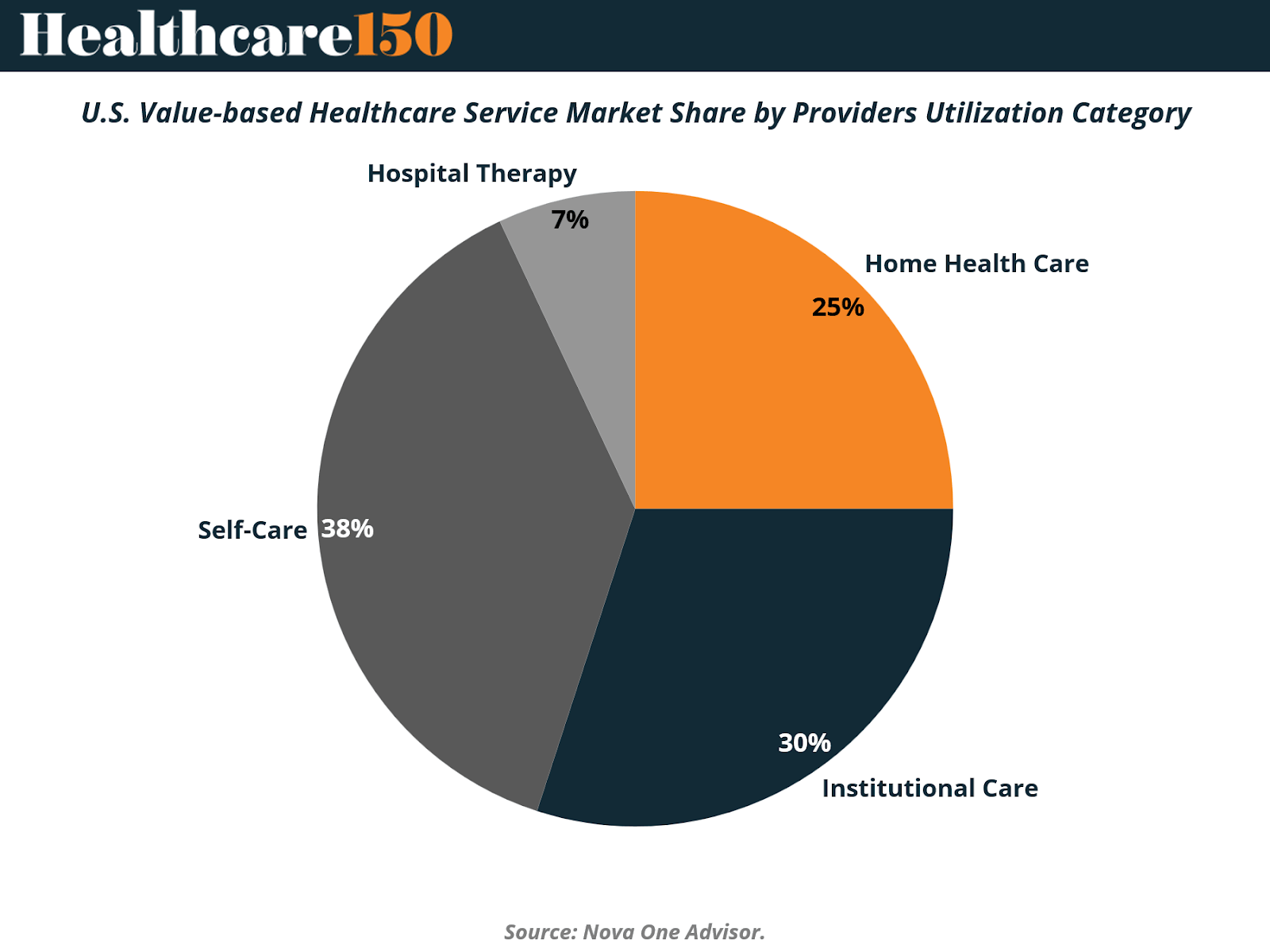

While the overall market for value-based healthcare is expanding rapidly, the distribution of spending across provider types reveals where the shift in care delivery is truly happening. According to Nova One Advisor, the 2024 U.S. value-based healthcare market shows a diverse mix of utilization categories, reflecting how providers are adapting to outcome-driven reimbursement models.

Self-Care (38%) currently accounts for the largest share of value-based care spending. This category encompasses remote monitoring, digital therapeutics, and patient engagement platforms that empower individuals to manage chronic conditions outside traditional clinical settings. The prominence of self-care illustrates a clear pivot toward prevention and home-based management, both of which reduce readmissions and overall system costs.

Institutional Care (30%) including rehabilitation centers, long-term care facilities, and specialized clinics — remains a core component of value-based arrangements. These organizations are increasingly being reimbursed based on recovery outcomes, functional improvement, and readmission avoidance rather than procedure volume.

Home Health Care (25%) is emerging as one of the most dynamic segments, driven by aging populations and post-acute care models that prioritize comfort and cost-efficiency. Value-based contracts are incentivizing providers to integrate home visits, remote diagnostics, and telehealth into patient management strategies, often yielding lower per-patient costs.

Hospital Therapy (7%), while still essential, represents the smallest portion of the value-based ecosystem. This reflects the model’s broader intent: to reduce hospital dependency by managing conditions earlier and outside high-cost inpatient environments.

This distribution underscores a central economic truth of the value-based era — margin expansion increasingly depends on shifting care away from hospitals and into lower-cost, higher-touch settings. The growing dominance of home health and self-care categories signals a structural reallocation of healthcare expenditure toward proactive, digitally connected, and patient-centric care delivery.

In other words, the future of value-based care is not confined within hospital walls — it is being built in living rooms, community clinics, and connected devices across the country.

Market Segmentation by Payment Model: Shared Savings Still Leads, but Bundled Payments Are Catching Up

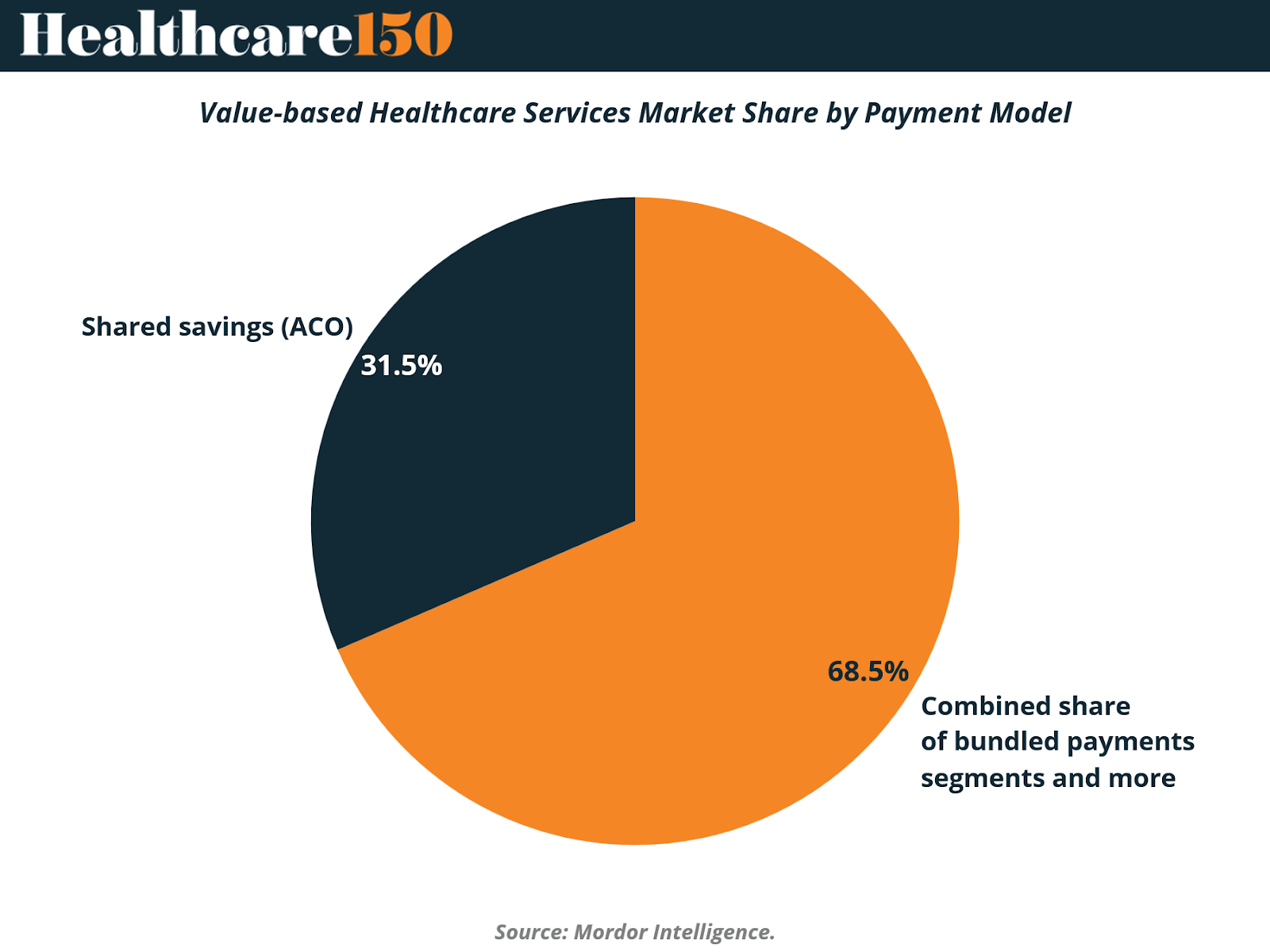

The value-based healthcare services market remains anchored by Shared Savings Programs (ACOs), which account for roughly 68.5% of total payment models in 2024, according to Mordor Intelligence. These models continue to dominate because they offer a low-risk entry point for providers transitioning from fee-for-service, allowing participation without full downside exposure.

Under shared savings arrangements, hospitals and physician groups are rewarded for reducing total costs while maintaining quality benchmarks—creating financial incentives for care coordination, early intervention, and chronic disease management. Programs like the Medicare Shared Savings Program (MSSP) have demonstrated measurable cost reductions and improved patient outcomes, setting a template for replication in commercial and Medicaid populations.

However, the Bundled Payments segment and related hybrid models—representing 31.5% of the market—are gaining momentum. These models offer greater accountability and predictable reimbursement by tying payments to specific episodes of care (such as joint replacements or cardiac procedures). The Centers for Medicare & Medicaid Services (CMS) continues to expand mandatory bundles under initiatives like the Transforming Episode Accountability Model (TEAM), slated to involve over 700 hospitals by 2026.

Adoption outside the U.S. is also rising, particularly in Europe and APAC, where bundled models are being adapted to local payer structures and digital health integration frameworks. Over time, these mechanisms are expected to evolve into fully capitated or population-based models, closing the gap between clinical and financial responsibility.

In short, the market’s current 70:30 split between shared savings and bundled payments underscores a transitional phase: one where incremental risk-sharing is the bridge toward comprehensive value-based contracting

Market Segmentation by Provider Setting: Hospitals Still Dominate, But Physician Groups Are Scaling Fast

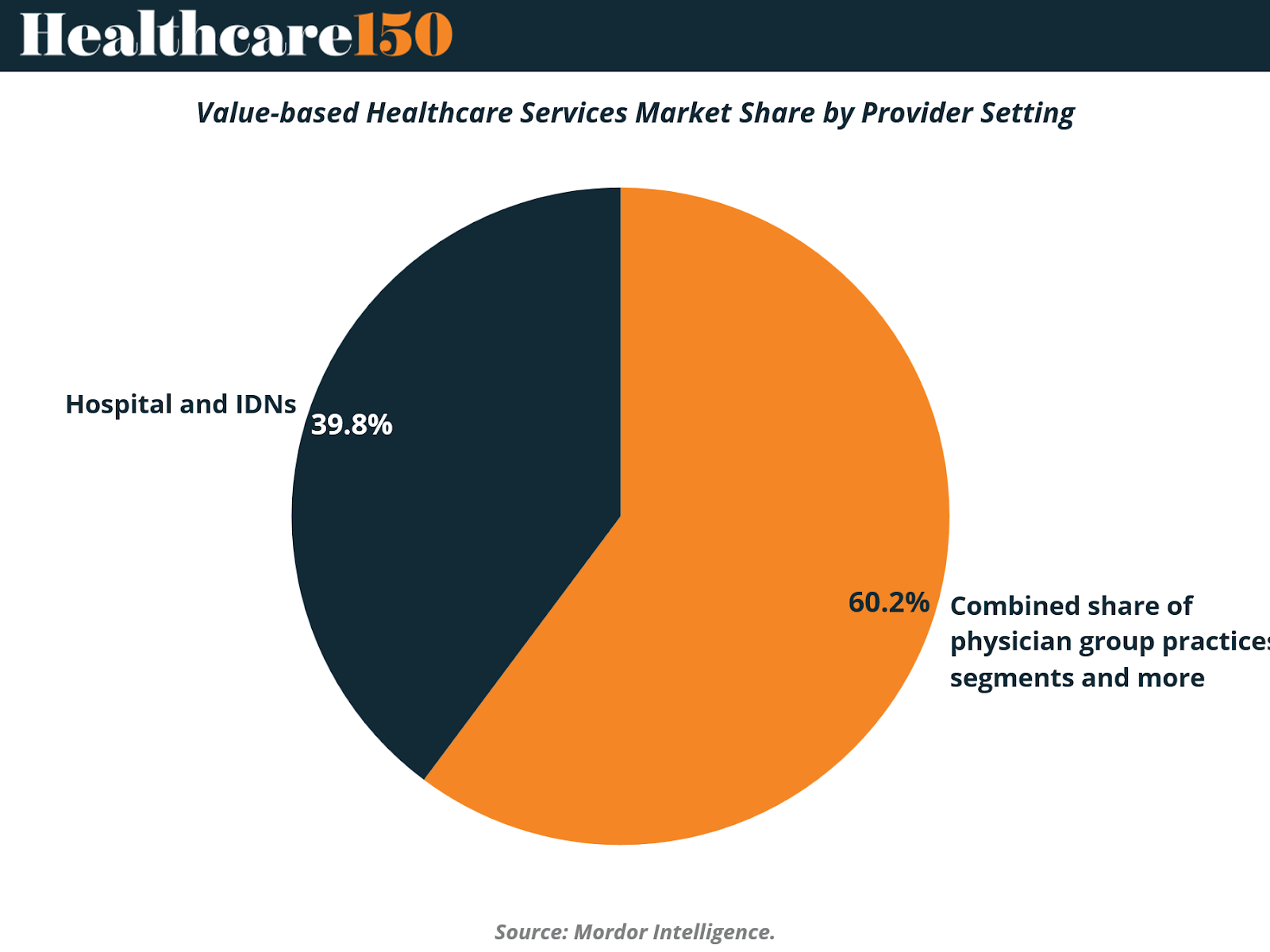

In 2024, Hospitals and Integrated Delivery Networks (IDNs) represent the majority of the value-based healthcare services market, holding a 60.2% share, according to Mordor Intelligence. Their leadership is driven by the infrastructure advantages hospitals bring—comprehensive electronic health records (EHRs), data analytics systems, and multidisciplinary teams capable of managing population health at scale. Large IDNs like Kaiser Permanente and Providence Health have become early adopters of risk-based contracting, using their size to absorb downside risk and align care delivery across acute, post-acute, and outpatient settings.

However, Physician Group Practices, which account for 39.8% of the market, are emerging as the fastest-growing segment. Independent practices are increasingly joining Accountable Care Organizations (ACOs) and participating in shared savings or bundled payment programs, empowered by digital tools that simplify performance tracking and care coordination. The shift reflects a broader decentralization of value-based care delivery, as payers seek to engage primary and specialty providers earlier in the care continuum.

Crucially, technology platforms and enablement companies (such as Privia Health, Agilon, and Aledade) are reducing administrative barriers that once kept smaller practices out of risk-bearing contracts. Their presence has allowed physician-led models to achieve competitive cost and quality metrics, strengthening their position in both Medicare and commercial value-based networks.

Over the next decade, growth among physician groups is expected to outpace hospitals as policy and payment reforms lower entry barriers and accelerate risk delegation to the point of care—the front line of patient engagement and chronic condition management.

Key Market Drivers: Forces Powering the Value-Based Shift

The momentum behind value-based care is not accidental—it is the result of demographic, policy, and structural pressures converging on the same goal: improving outcomes while containing costs. According to Mordor Intelligence, six primary drivers will shape the sector’s CAGR over the next decade, led by aging populations, regulatory mandates, and payer–provider integration.

1. Rising Burden of Chronic Diseases and Aging Population

The demographic wave is irreversible. By 2030, adults aged 65 and older will number 73 million in the United States, and roughly 85% will live with at least one chronic ailment, while 60% will manage multiple conditions (Vizient, Demographic Shifts and Chronic Disease Prevalence). This population already accounts for more than half of hospital admissions and drives the majority of healthcare spending.

Value-based care directly targets this burden by incentivizing coordinated, longitudinal management through shared savings models that reward prevention and early intervention. Providers are leveraging home-based monitoring, data analytics, and multidisciplinary care teams to improve chronic condition management, reduce readmissions, and deliver measurable quality gains.

2. Government-Led Shift Toward Alternative Payment Models

Policy remains the most decisive accelerant. The CMS Innovation Center continues to push providers away from fee-for-service through mandatory and voluntary reform programs. The upcoming Transforming Episode Accountability Model (TEAM), set to launch in January 2026 across 741 hospitals, introduces mandatory episode bundles that align reimbursement with patient outcomes (AJMC, CMS TEAM Model Details).

Internationally, nations like the Netherlands have proven the model’s efficacy, using bundled payments to improve care standardization without inflating total costs. Such mandates compel providers to assume financial risk and accelerate adoption of value-based frameworks.

3. Payer–Provider Push for Integrated, Longitudinal Care

The market’s structural evolution is being led by vertically integrated players. Optum now manages 4.7 million patients under value-based contracts, while Kaiser Permanente’s Risant Health has acquired Geisinger and Cone Health to expand its regional reach (UnitedHealth Group, Optum Investor Presentation 2025).

These integrated delivery models enable real-time data exchange, shared clinical governance, and coordinated patient journeys, eliminating silos between insurance, primary care, pharmacy, and specialty services. The result is a seamless continuum of care that aligns incentives across stakeholders around total-cost-of-care metrics.

4. Expansion of Medicare Advantage and Risk-Based ACO Programs

Public reimbursement structures are now central to the value-based care economy. Medicare Advantage enrollment is expected to reach 35.7 million members in 2025, representing 51% of all Medicare beneficiaries, while average premiums continue to decline.

Meanwhile, the Medicare Shared Savings Program (MSSP) generated $2.1 billion in net savings in 2023, demonstrating that upside/downside models can effectively balance cost control and care quality. New CMS initiatives, such as Health Equity Benchmark Adjustments, aim to attract providers serving historically underserved populations—further expanding participation and promoting inclusivity in outcomes-based care.

5. AI-Enabled Risk Stratification and Predictive Analytics

Artificial intelligence is no longer a futuristic ambition—it is a critical enabler of value-based performance. Predictive models allow providers to identify high-risk patients before costly events occur, improving resource allocation and enabling proactive interventions.

Adoption is strongest in North America and Europe, where integrated data networks support machine learning algorithms capable of optimizing care pathways and reimbursement accuracy.

6. Employer-Funded Value-Based Contracts

Large, self-insured employers are entering the arena with direct-to-provider contracts that link reimbursement to employee health outcomes and total cost of care. By bypassing traditional payer structures, employers can negotiate outcome-based pricing while improving chronic disease management for working-age populations.

This emerging segment—particularly active in North America and Western Europe—illustrates how value-based principles are moving beyond public payers and into private workforce health management.

Summary

Together, these forces represent a structural, not cyclical, transformation. Aging demographics supply the demand; policy sets the rules; integration and analytics provide the tools. As these drivers converge, value-based care is evolving from a reform initiative into the dominant financial architecture of the modern healthcare system.

Market Restraints: Operational Friction and Risk Aversion Slow the Transition

While the fundamentals of value-based care (VBC) remain strong, implementation challenges continue to temper growth. The shift from volume to value introduces technical, financial, and cultural friction—each shaping the pace at which providers, payers, and technology partners can scale new payment models. The most critical restraints collectively subtract an estimated 6.5–7% from the market’s CAGR potential, underscoring the sector’s uneven readiness.

1. Dual Revenue-Cycle Complexity (FFS vs VBC)

The coexistence of fee-for-service (FFS) and value-based payment models creates a costly operational paradox. Finance departments must maintain parallel billing, coding, and documentation workflows, each governed by different compliance rules. Smaller health systems, often without enterprise-grade IT, are hit hardest: staff time is diverted toward reconciliation tasks, while administrative overhead climbs.

Until a critical mass of contracts shift to value-based terms, duplicated back-office infrastructure will remain a drag on scalability and margins.

Estimated CAGR impact: -2.1% | Geographic relevance: Global, acute in transition markets | Impact timeline: Medium term (2–4 years)

2. Limited Readiness for Downside-Risk Exposure

Despite policy momentum, many providers remain reluctant to embrace full capitation or two-sided risk. The required foundation—actuarial expertise, financial reserves, and population-health analytics—is unevenly distributed, particularly across regional hospitals and safety-net systems.

Early examples of inadequate risk adjustment have also left lasting distrust among organizations serving socio-economically complex populations. This gap in risk readiness slows contract adoption, especially in emerging APAC markets that are still building risk-pooling mechanisms.

Estimated CAGR impact: -1.8% | Geographic relevance: North America and Europe, emerging in APAC | Impact timeline: Short term (≤ 2 years)

3. Interoperability Gaps Across Community-Based Providers

Despite progress in EHR adoption, data interoperability remains fragmented. Smaller, community-based providers often use disparate systems that cannot easily exchange patient data with hospitals or payers. This fragmentation undermines population-level insights, weakens performance tracking, and slows care coordination across episodes.

Global initiatives—such as FHIR standards in the U.S. and digital health directives in Europe—are improving the outlook, but regional variation remains high, delaying seamless information exchange.

Estimated CAGR impact: -1.4% | Geographic relevance: Global, with regional variation | Impact timeline: Long term (≥ 4 years)

4. Physician Burnout from Quality-Reporting Demands

Value-based contracts require intensive reporting on clinical outcomes, readmission rates, and patient experience metrics. While data transparency enhances accountability, the administrative load has become a leading contributor to clinician burnout, particularly in North America and Western Europe.

Excessive time spent on documentation—often duplicating information across multiple portals—erodes job satisfaction and may reduce physician participation in new programs. The challenge now is to automate reporting workflows and integrate AI-based clinical documentation to sustain provider engagement.

Estimated CAGR impact: -1.2% | Geographic relevance: North America and Europe | Impact timeline: Medium term (2–4 years)

Summary

The path to value-based care is not purely technological—it is cultural and operational. While aging demographics and policy support drive adoption, the executional strain on providers tempers speed and scale. Overcoming these constraints will require standardized data infrastructure, financial risk literacy, and clinician-centric workflow design—the true enablers of next-phase growth.

Conclusion: From Reform to Operating Model

Value-based care is no longer an experiment—it is becoming the financial and operational foundation of modern healthcare. What began as a policy-driven attempt to curb costs has evolved into a full-scale reengineering of incentives, workflows, and business models. The transition from fee-for-service to value-based frameworks marks a rare alignment of moral and financial logic: improving outcomes now directly enhances margins.

As the market doubles in size by 2034, the competitive frontier will shift from access to execution. Organizations that can integrate clinical, financial, and data capabilities into a cohesive system will lead the next wave of value creation. Those that remain mired in dual systems, fragmented data, or risk aversion will find themselves outpaced by tech-enabled, risk-literate incumbents and insurgents alike.

The ultimate winners will not be those with the most hospital beds or the largest patient volumes—but those that master population health at scale, automate quality tracking, and turn efficiency into strategy. The move to value is irreversible. What remains optional is how fast—and how effectively—each player adapts.

Sources and References:

U.S. Value-Based Healthcare Service Market– Nova One Advisor

Value-Based Healthcare Services Market Size & Share Analysis (2025-2030)” – Mordor Intelligence

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.