- Healthcare 150

- Posts

- Saudi & UAE Drive $38.5B Post-2024 Surge

Saudi & UAE Drive $38.5B Post-2024 Surge

It’s Thursday, and we’re diving into middle east healthcare opportunities, the market adoption of robotics in surgery, and the remote patient monitoring market.

Good morning, ! It’s Thursday and we’re diving into middle east healthcare opportunities, the market adoption of robotics in surgery, and the remote patient monitoring market.

Want to reach 350,000+ executive readers? Start Here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

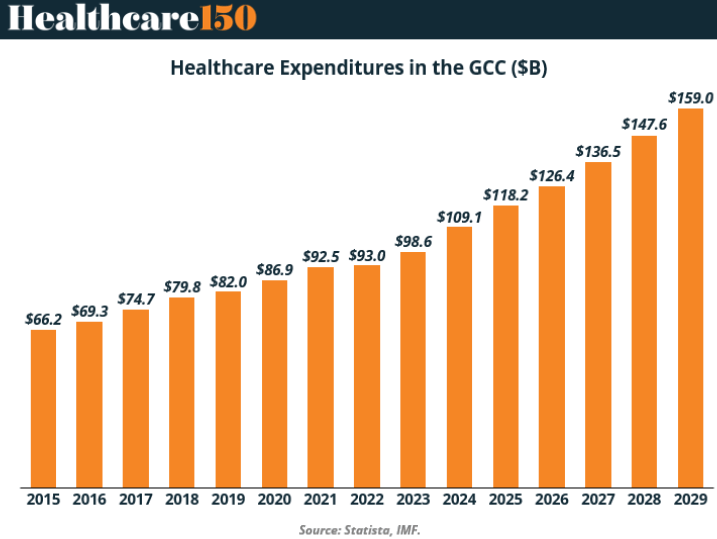

GCC Healthcare’s $159B Runway

From $66.2B in 2015 to $159B by 2029, healthcare in the GCC is more than doubling—driven not by recovery, but by design. This is deliberate, policy-backed growth with structural depth: government vision plans, aging populations, chronic disease, and a pivot toward digital and private-sector models.

The reacceleration post-2024 is striking: a $38.5B increase in just four years. Saudi Arabia and the UAE are leading on all fronts—from insurance reform and infrastructure investment to healthtech sandboxing and PPP platforms. But it's not just spend that’s scaling—so is brand power. King Faisal Specialist Hospital & Research Center ($1.15B) and Dr. Sulaiman Al Habib ($718M) reflect the new axis of influence: institutional trust + private sector scalability.

Cost inflation is high—10.5% in UAE, 10.2% in KSA—but so is strategic response. Digital pharmacies dominate the current revenue stack ($2.6B of $4B total), while usage of condition-management and mental wellness apps remains below 20%. This signals a clear mismatch between health burden and digital penetration—and a corresponding opportunity for investors who can bridge that gap.

The takeaway: GCC healthcare isn’t just a spending story. It’s a maturing, high-growth market reshaping itself through regulation, digital ambition, and consolidation logic. For investors, this is the rare case where inflation, fragmentation, and low adoption rates are bullish signals.

TREND OF THE WEEK

Remote Patient Monitoring: From Pilot Projects to Pivotal Infrastructure

Remote Patient Monitoring (RPM) is transitioning from a niche innovation to a foundational pillar of modern healthcare. According to recent projections, the global RPM market is set to grow from $11.5B in 2024 to $69.3B by 202. This growth is fueled by rising chronic disease prevalence, cost pressure on health systems, and increasing payer reimbursement support.

What’s most striking is the shift in provider behavior. A 2023 HIMSS survey found that 57% of health systems now have active RPM programs, up from 34% in 2020. Adoption is strongest in cardiology, endocrinology, and post-acute care, segments with high readmission risk and manageable clinical protocols.

Why it matters: As CMS continues to expand billing codes for remote monitoring and providers seek margin-saving models, RPM will move from “nice-to-have” to “non-negotiable” infrastructure. Capital will chase platforms that offer both outcomes and scale. (More)

PRESENTED BY BOXABL

A New Chapter in Home Construction

What if new-home construction were nearly as easy as opening a book? That’s the story with BOXABL.

How? By using assembly lines to condense homebuilding from 7+ months to hours, BOXABL ships readymade houses to their final destination. Then, they’re unfolded and immediately livable.

They’ve already built 700+. But the real transformation’s still coming.

BOXABL’s currently preparing for Phase 2 – combining modules into larger townhomes, single-family homes, and apartments. And until 6/24, you can join as an investor for just $0.80/share.

They already fully maxed out a $75M investment campaign once, so don’t wait around.

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://invest.boxabl.com/#circular

MARKET MOVERS

Company (Ticker) | Last Price | 5D |

Eli Lilly and Company (LLY) | $ 744.58 | 2.79% |

Johnson & Johnson (JNJ) | $ 154.55 | 0.85% |

Novo Nordisk A/S (NVO) | $ 72.30 | 0.45% |

Roche Holding AG (ROG.SW) | $ 322.40 | 0.57% |

AbbVie Inc. (ABBV) | $ 185.36 | -0.16% |

HEALTHTECH CORNER

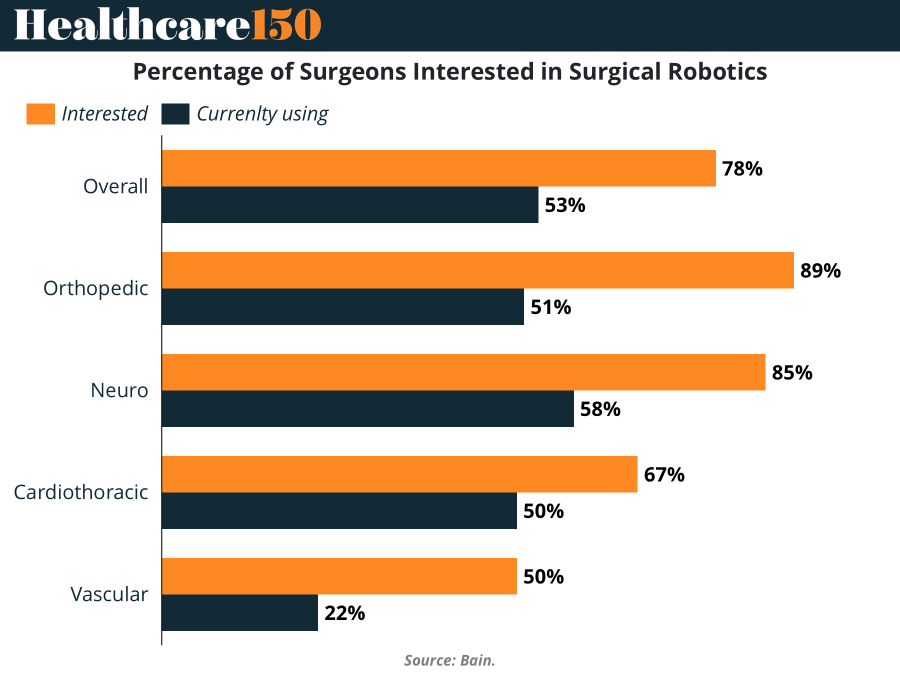

Robots in the OR, AI in the Hallway

Robotic-assisted surgery is hitting its stride — with 78% of surgeons interested, but only 53% using the tools, according to Bain & Company. The gap echoes the early AI hype: lots of buzz, but plenty of friction. Specialty-wise, orthopedic and neuro surgeons lead the interest parade, but actual usage lags (51% and 58%). Leading systems like HCA have logged over 1M robotic surgeries, proving that success isn't about replacing surgeons — it's about enhancing their capabilities and showing a clear ROI.

That’s the blueprint AI scribes are now trying to follow, especially as adoption hits 70–80% in pilot departments. The problem? Same old story: ROI, workflow fit, and physician buy-in. If robots teach us anything, it’s that “cool” tech still needs to make economic sense. (More)

TOGETHER WITH BOXABL

The Father-Son Duo Revolutionizing Homebuilding

Paolo and Galiano Tiramani founded BOXABL with a disruptive idea: bring factory efficiency to homebuilding. Today, new homes can roll off their assembly lines in ~4 hours – already building 700+. Now, they’re prepping for Phase 2, combining modules into larger townhomes, single-family homes, and apartments. And until 6/24, you can share in their growth.

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://invest.boxabl.com/#circular

DEAL OF THE WEEK

BioNTech-BMS Team Up on Immuno-Oncology Power Play

BNT327 is no ordinary antibody — it’s bispecific, already in global Phase 3s, and now backed by $11.1B in potential BioNTech-BMS money. The co-development deal includes an equal profit split, shared ops, and flexibility for both parties to pursue additional combo plays independently. Trials are underway in lung and breast cancers, with TNBC next. With 1,000+ patients dosed, this partnership isn't starting from scratch — it’s aiming to rewrite the immuno-oncology rulebook. (More)

REGIONAL FOCUS

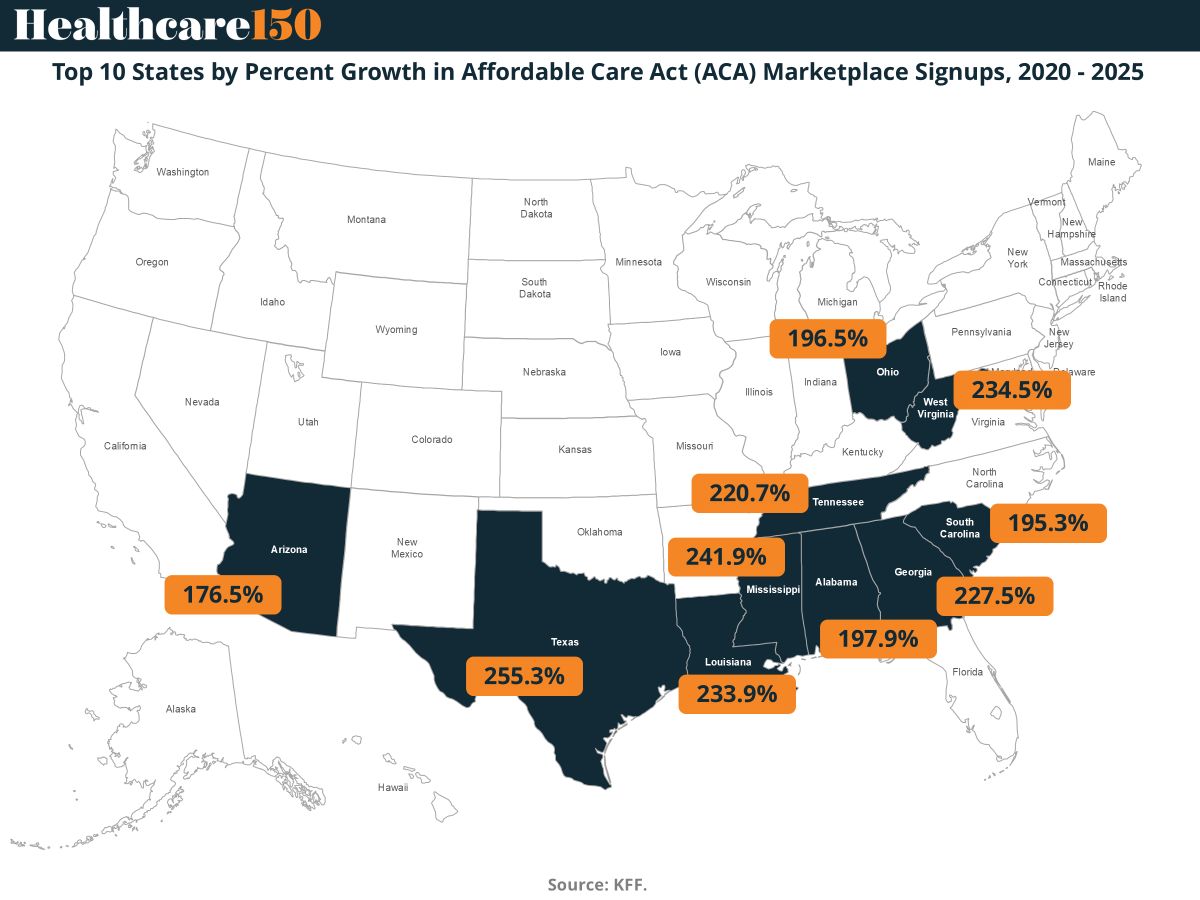

Southern Hospitality Meets Health Coverage

Since 2020, ACA Marketplace enrollment has more than doubled, reaching 24.3 million in 2025. The most significant growth? Red states. Texas leads with a 255% increase, followed by Mississippi (242%), West Virginia (234%), Louisiana (234%), Georgia (227%), and Tennessee (221%).

Why the surge? Enhanced premium tax credits, introduced in 2021 and extended through 2025, made coverage more affordable. Additionally, states that haven't expanded Medicaid saw a 188% growth, compared to 65% in expansion states.

The twist: 88% of the enrollment growth since 2020 comes from states that voted for President Trump in 2024. (More)

INTERESTING ARTICLES

"Don’t be afraid to give up the good to go for the great"

John D. Rockefeller