- Healthcare 150

- Posts

- Pharma’s $3 Trillion Path and Pfizer’s $7.3B Obesity Push

Pharma’s $3 Trillion Path and Pfizer’s $7.3B Obesity Push

Global pharma races toward $3 trillion as Asia accelerates growth, while Pfizer doubles down on obesity drugs with a $7.3B bet.

Good morning, ! This week we’re diving into the pharmaceutical market landscape, the $24B back office revenue opportunity, smart healthcare data and analytics by market share, and biopharma median deal size valuations.

Want to advertise in Healthcare 150? Check out our self-serve ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

$3 Trillion Prescription

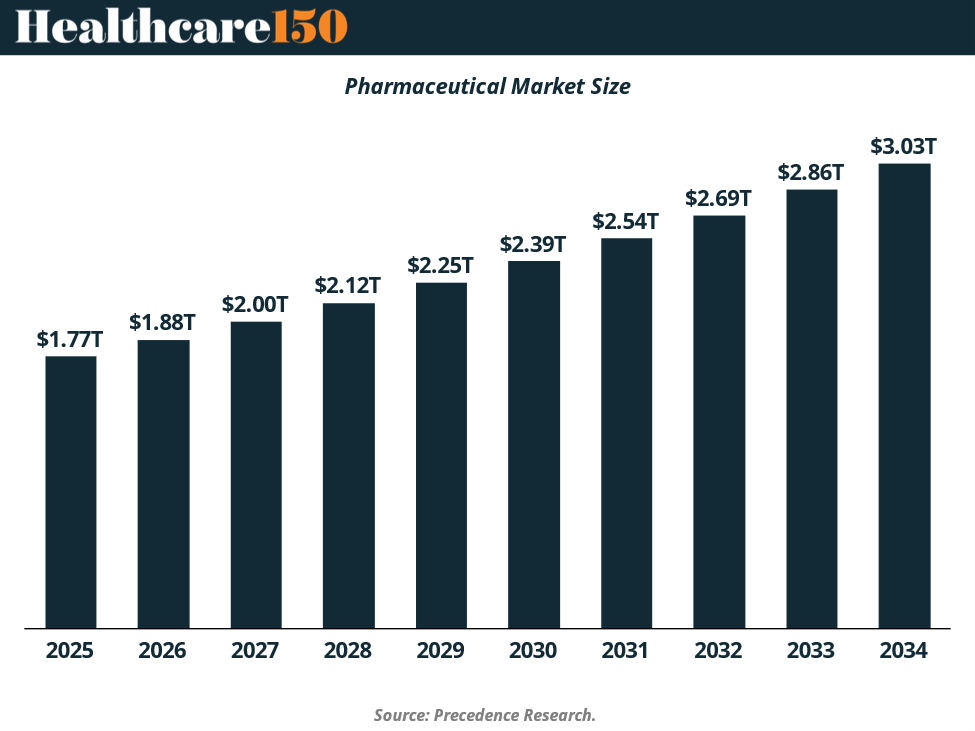

The global pharmaceutical market isn’t just healthy—it’s training for a marathon. Valued at $1.77 trillion in 2025 and forecast to top $3 trillion by 2034, the sector is powered by rising demand for oncology, rare diseases, and biologics. But not all regions are jogging at the same pace: North America still leads (39% market share), yet Asia Pacific is sprinting fastest with a 7.2% CAGR. The prescription side dominates (87% of 2024 revenue), thanks to chronic disease and insurer coverage, while OTC drugs are the plucky underdog, growing fastest off a smaller base. Add in AI-driven drug discovery—67 molecules hit trials in 2023 vs. just 1 in 2015—and the industry is shifting from lab coats to algorithms. For investors, it’s not whether pharma grows, but where the next blockbuster (or biosimilar) lands.

TREND OF THE WEEK

AI Pills, Bigger Bills

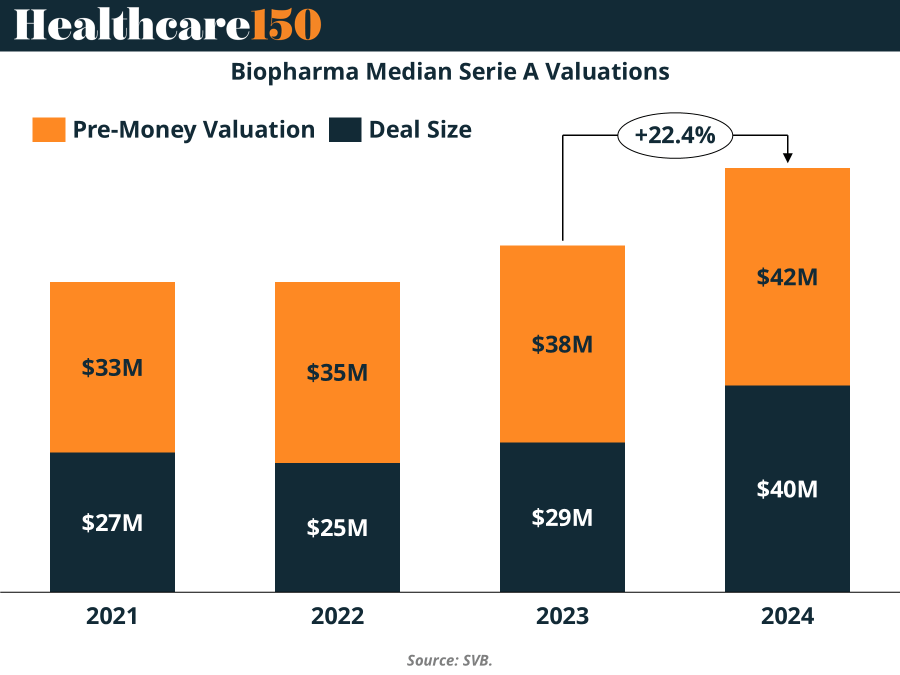

The median Series A in biopharma just bulked up: pre-money $42M and deal size $40M in 2024, lifting the combined check to $82M—a +22.4% jump from 2023’s $67M. Credit AI drug discovery for the heat. Xaira’s headline $1B Series A (co-founder David Baker, now a Nobel laureate) set the tone, as rivals like Isomorphic Labs chase similar ambition.

Even without Xaira, early-stage swelled to >1/3 of all biopharma investment (vs. 27% in 2023), its biggest dollar year since 2021. Scope widened beyond proteins: outsized A rounds hit metabolic, weight loss, asthma, immune, fibrosis, and oncology—with 4/6 of the year’s largest A’s tied to clinical-stage assets. Bottom line: VCs are buying runway and de-risked biology—AI for speed, assets for credibility. (More)

PRESENTED BY TEST DOUBLE

Survey: Tech challenges in the healthcare space

Know an engineering, IT, product, marketing, or strategy leader in healthcare or health tech? We're benchmarking challenges & priorities:

- Budget decreases or increases for IT, product, strategy, and AI

- Focused on legacy modernization, org transformation or something else

- Blockers to change

HEALTHTECH CORNER

The $24B Back Office Opportunity

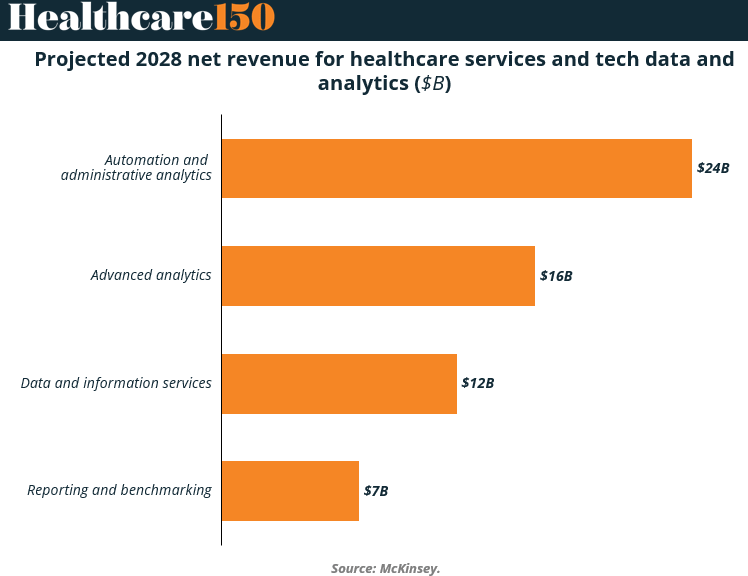

By 2028, automation and administrative analytics is expected to become the largest revenue-generating segment in healthcare tech analytics—$24B, according to McKinsey. That’s more than 3x the size of traditional reporting and benchmarking ($7B), and even outpacing more hyped segments like advanced analytics ($16B).

Why it matters: While predictive AI gets the buzz, it's the unglamorous work—claims processing, billing optimization, and RCM automation—that’s quietly building billion-dollar companies. Administrative waste still eats up nearly 25% of U.S. healthcare spend, creating fertile ground for startups and incumbents solving real inefficiencies at scale.

For investors, the signal is clear: follow the inefficiencies, not just the innovation. Workflow automation and data plumbing may not make headlines—but they’re where the margin is. (More)

TOGETHER WITH THE DAILY UPSIDE

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

DEAL OF THE WEEK

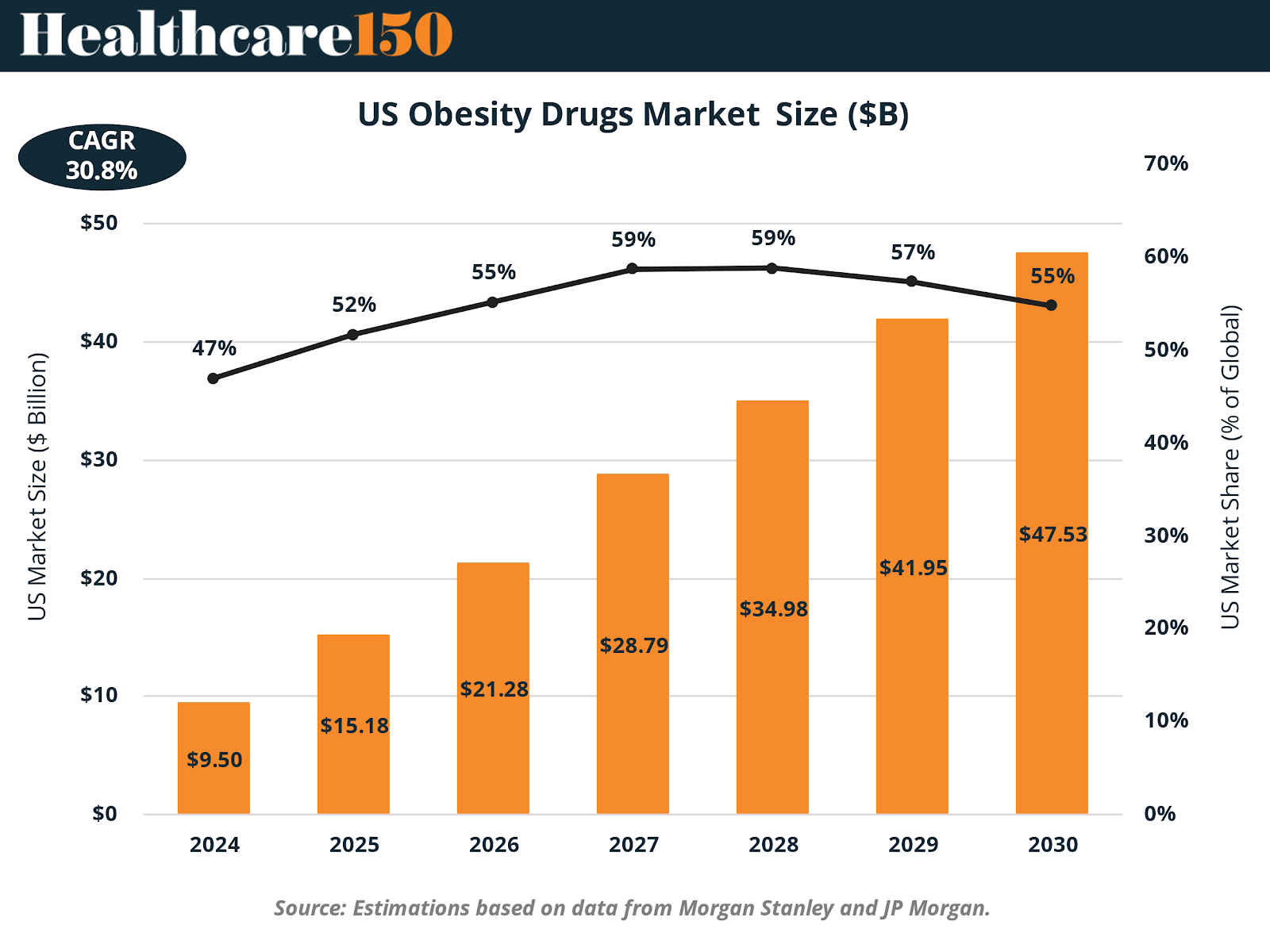

Pfizer's $7.3B Second Shot at Obesity

Pfizer is paying $4.9B upfront to acquire Metsera, a biotech startup with big GLP-1 dreams and an even bigger promise: helping Pfizer reboot its faltering obesity ambitions. After its own oral GLP-1 assets bellyflopped (hello, danuglipron), Pfizer’s now buying its way back into the game. Metsera brings a pipeline of injectables and orals, including MET-097i and MET-233i, with monthly dosing and a dual-mechanism combo that could eventually put pressure on Lilly and Novo Nordisk. Add a $2.4B CVR to the mix, and Pfizer’s betting up to $7.3B that this is more than a rebound fling. (More)

REGIONAL FOCUS

Europe Leads, Asia Races

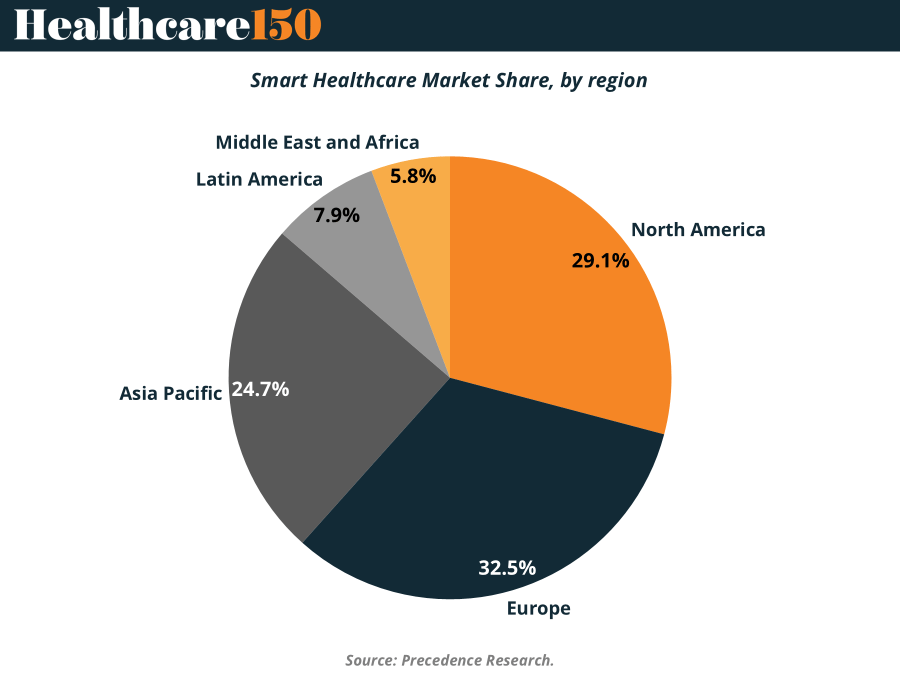

The smart healthcare market hit $306.9B in 2024 and is on track for a 17.2% CAGR through 2034, but the regional split tells the real story. Europe tops the leaderboard with 32.5% market share, thanks to deep integration of digital platforms and supportive regulation—though fragmentation across health systems slows uniform adoption. North America follows at 29.1%, powered by EHR uptake and the ubiquity of telehealth (76% of U.S. hospitals already onboard). But keep an eye on Asia Pacific at 24.7%: its mobile-first, urbanizing population is fueling the fastest growth, with China, India, and Japan in the driver’s seat. Latin America (7.9%) and Middle East & Africa (5.8%) remain smaller slices but offer long-term optionality as infrastructure matures. The takeaway: while Europe and North America still dominate, Asia Pacific may define the next decade’s digital health narrative. (More)

INTERESTING ARTICLES

"There's no shortage of remarkable ideas, what's missing is the will to execute them."

Seth Godin