- Healthcare 150

- Posts

- Global Pharmaceutical Market: Scale, Shifts, and Strategic Imperatives

Global Pharmaceutical Market: Scale, Shifts, and Strategic Imperatives

Navigating Growth, Innovation, and Competitive Dynamics in a Transforming Global Pharma Landscape

Introduction

The pharmaceutical industry stands as one of the most resilient and strategically critical pillars of the global economy, with annual revenues surpassing $1.5 trillion and an expected trajectory of continued expansion. Far from being a monolithic sector, the market is a complex ecosystem shaped by regulatory frameworks, scientific innovation, demographic pressures, and capital markets dynamics. While developed economies remain the epicenter of research and development—driving breakthroughs in oncology, rare diseases, and biologics—emerging markets are fueling demand through expanding healthcare coverage, generics penetration, and rising middle-class consumption.

The industry’s evolution is defined by contradictory forces. On one hand, blockbuster therapies, precision medicine, and biologics continue to generate outsized returns for leading pharmaceutical companies. On the other, the sector is constrained by pricing scrutiny, patent expirations, and intensifying competition from generics and biosimilars. Investors and operators are also navigating a changing geopolitical environment: supply chain vulnerabilities exposed during the pandemic, growing localization of production, and government intervention in drug pricing are reshaping competitive strategies across regions.

At the same time, technology is opening new frontiers. AI-enabled drug discovery is shortening development timelines, digital platforms are expanding patient engagement, and advanced analytics are redefining commercialization models. These forces are not just incremental—they are transformative, challenging incumbents to adapt while creating space for new entrants and partnerships.

This report provides a comprehensive overview of the pharmaceutical industry’s structural dynamics, exploring the interplay between innovation, regulation, and market access. Beyond market size, we focus on the strategic levers that will determine which companies succeed in capturing value in an increasingly competitive and cost-sensitive environment.

Pharmaceutical Market Size

The global pharmaceutical market reached an estimated USD 1.67 trillion in 2024 and is forecast to expand from USD 1.77 trillion in 2025 to USD 3.03 trillion by 2034, reflecting a compound annual growth rate (CAGR) of 6.15%. This steady upward trajectory underscores the sector’s resilience and its central role in global healthcare spending.

The growth outlook is underpinned by several structural drivers:

Rising demand for vaccines and specialty drugs, accelerated by demographic shifts and heightened awareness of preventive care.

Personalized medicine and targeted therapies, particularly in oncology and rare diseases, which are expanding treatment options and pricing power.

The global burden of chronic illnesses such as cardiovascular disease, diabetes, and obesity, which continues to drive sustained demand for innovative drugs and long-term therapies.

While the trajectory is positive, the market will be shaped by countervailing pressures—notably patent expirations, intensifying competition from generics and biosimilars, and ongoing debates around pricing transparency and regulatory constraints. Nevertheless, the underlying fundamentals point toward robust demand, supported by both developed economies investing in innovation and emerging markets expanding access to affordable medications.

The global pharmaceutical market, valued at USD 1.77 trillion in 2025, displays notable regional disparities in both size and growth trajectory. While North America continues to dominate in absolute revenue, emerging regions such as Asia Pacific and the Middle East are positioned to expand at the fastest pace, reflecting demographic shifts, infrastructure development, and increased healthcare investment.

North America

North America remains the largest regional market, holding 39% of global pharmaceutical revenue in 2025. The industry grew from USD 531.3 billion in 2021 to USD 663.9 billion in 2025, with projections to reach USD 1.04 trillion by 2033 (CAGR 5.81%). The United States alone accounts for 66.5% of North America’s share, followed by Canada (24.4%) and Mexico (9.1%).

Key driver: High healthcare expenditure and concentration of global pharma leaders.

Europe

Europe captures 19.4% of global market share in 2025, expanding from USD 263.7 billion in 2021 to USD 330.2 billion in 2025, with a projected USD 520.1 billion by 2033 (CAGR 5.84%). Major contributors include Germany (20.7%), the United Kingdom (19.6%), and France (12.7%).

Key driver: Advanced healthcare systems and strong R&D ecosystems, but pricing pressures remain a constraint.

Asia Pacific

Asia Pacific holds 29% of the global market in 2025 and is expected to be the fastest-growing region, with revenue increasing from USD 372.9 billion in 2021 to USD 493.7 billion in 2025, reaching USD 862.3 billion by 2033 (CAGR 7.22%). Within the region, China (38.8%), Japan (19.7%), and India (11.6%) dominate.

Key driver: Expanding middle-class populations, increased healthcare access, and government-backed pharma infrastructure growth.

South America

South America accounts for 6% of global pharmaceutical revenue in 2025, with the market growing from USD 78.6 billion in 2021 to USD 102.1 billion in 2025, and projected to hit USD 169.7 billion by 2033 (CAGR 6.55%). Brazil (45.7%) leads the region, followed by Argentina (16.9%) and Chile (11.3%).

Key driver: Growing healthcare coverage and rising demand for generics.

Middle East

The Middle East holds 3.8% of the global market in 2025, growing from USD 49.3 billion in 2021 to USD 64.7 billion in 2025, with an outlook of USD 111.3 billion by 2033 (CAGR 7.01%). Saudi Arabia (39.6%), Turkey (20.7%), and the UAE (16.4%) are the largest contributors.

Key driver: Heavy government investment in healthcare infrastructure and increased localization of drug manufacturing.

Africa

Africa represents 2.8% of the global market in 2025, expanding from USD 36.0 billion in 2021 to USD 47.7 billion in 2025, with projections of USD 75.1 billion by 2033 (CAGR 5.85%). Leading markets are South Africa (35.2%) and Nigeria (25.7%).

Key driver: Rising population growth and increasing urban access to pharmaceuticals, though infrastructure challenges persist.

The prescription drug segment dominated the global pharmaceutical market in 2024, accounting for 87% of total revenue. This overwhelming share reflects the central role of prescribed therapies in managing complex and chronic health conditions. Physicians continue to rely on prescription medications as the primary standard of care, and patients exhibit higher trust in these treatments compared to over-the-counter (OTC) alternatives.

Several structural drivers reinforce the prescription segment’s dominance:

Chronic disease prevalence: Rising rates of diabetes, cancer, and cardiovascular conditions, particularly among the elderly, drive sustained demand for advanced prescription drugs.

Reimbursement policies: Governments and private insurers worldwide maintain favorable reimbursement frameworks that cover prescribed medications, strengthening patient access.

Innovation pipeline: Pharmaceutical R&D efforts are concentrated in prescription therapies, including biologics, precision medicine, and specialty drugs.

At the same time, the OTC drug segment—though only representing 13% of the market in 2024—is expected to grow at the fastest CAGR through 2034. Convenience, accessibility, and cost-effectiveness make OTC products an increasingly attractive option, particularly for consumers embracing self-care and self-medication trends. Easy availability in retail pharmacies, supermarkets, and online channels is expanding the category’s reach across both developed and emerging markets.

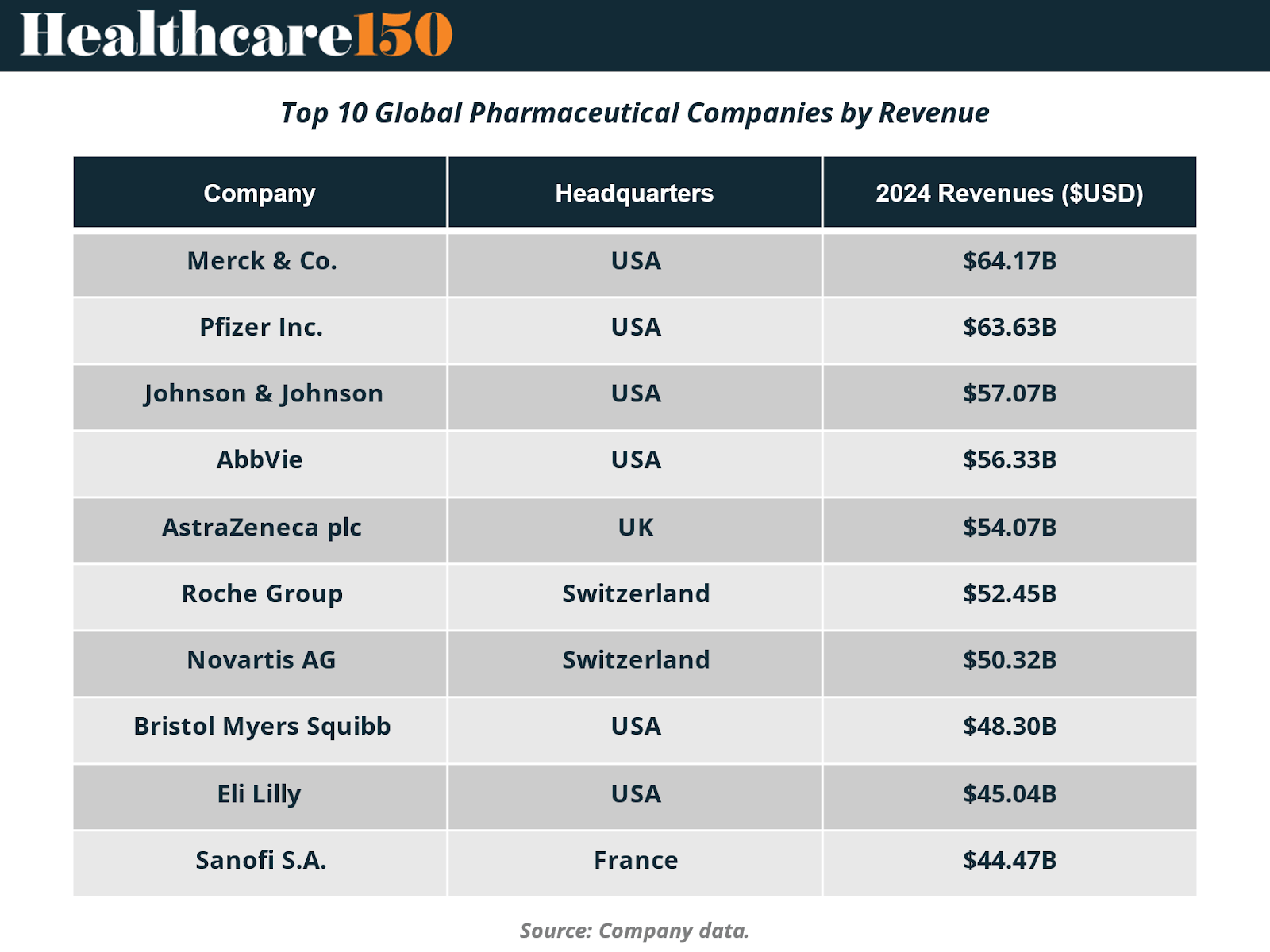

Top 10 Global Pharmaceutical Companies by Revenue (2024)

The global pharmaceutical industry is highly consolidated at the top, with a small group of multinationals generating a significant share of overall revenues. These firms not only dominate sales but also lead in R&D investment, therapeutic innovation, and global market access.

According to company filings and industry rankings, the following were the top 10 pharmaceutical companies by FY2024 revenue:

Key Insights

Oncology leadership: Merck, Roche, Bristol Myers, AstraZeneca, and Novartis continue to derive major revenue from oncology portfolios, underscoring cancer as the single most lucrative therapeutic area.

Shift in immunology: AbbVie, J&J, and Pfizer are aggressively diversifying into immunology to offset patent cliffs.

Metabolic revolution: Eli Lilly stands out with explosive growth in diabetes and obesity therapies, redefining the metabolic market.

Geographic concentration: 7 of the top 10 companies are US-headquartered, reinforcing the US as the industry’s financial and R&D hub.

AI-Driven Drug Discovery: A Decade of Acceleration

Artificial intelligence (AI) is no longer a peripheral tool in pharma—it is becoming a core driver of innovation. Over the past decade, AI and machine learning (ML) have increasingly shaped how molecules are discovered, screened, and advanced into clinical development. From 2015 to 2023, the number of AI-discovered molecules entering clinical trials surged dramatically, growing from just 1 in 2015 to 67 in 2023, representing a CAGR of more than 60%.

This rapid expansion illustrates how AI is streamlining target identification, optimizing compound design, and even reducing toxicity risks earlier in the drug pipeline. While most AI-discovered molecules are still in Phase I, a notable share has progressed into Phase II and III, with a few already reaching launch. This indicates that AI-driven discovery is no longer purely experimental but is generating commercially viable assets.

The second dimension of this transformation is the breadth of drug modalities enabled by AI. By 2023, AI was powering discovery across targets, small molecules, antibodies, vaccines, and repurposed drugs.

Together, these trends signal a fundamental reconfiguration of R&D. Instead of long trial-and-error cycles, pharmaceutical innovation is becoming data-driven, faster, and more precise. If current momentum continues, the industry could see AI-discovered drugs comprising a significant share of approvals in the next decade.

Conclusion

The global pharmaceutical industry is entering a decisive decade marked by both extraordinary growth opportunities and intensifying structural pressures. With the market projected to surpass USD 3 trillion by 2034, pharmaceuticals will remain a cornerstone of global healthcare and one of the most attractive long-term sectors for capital deployment. Regional divergence underscores the need for tailored strategies: while North America continues to dominate revenues through innovation and pricing power, Asia Pacific and the Middle East are poised to deliver the fastest growth, fueled by expanding healthcare infrastructure and rising patient access.

At the same time, the balance between prescription dominance and OTC expansion, coupled with the industry’s heavy dependence on a handful of multinational leaders, highlights both concentration risks and opportunities for challengers. The rise of AI-driven drug discovery represents perhaps the most transformative shift, redefining R&D timelines and reshaping the very economics of innovation.

For investors, operators, and policymakers, the imperative is clear: success will hinge on the ability to integrate scientific breakthroughs, regulatory agility, and digital transformation while navigating pricing scrutiny and competitive disruption. Those that adapt swiftly to demographic shifts, embrace new technologies, and strategically allocate resources across high-growth regions will be best positioned to capture enduring value in a pharmaceutical market that is larger, faster, and more complex than ever before.

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.