- Healthcare 150

- Posts

- Pharma’s 10.7% Bounce, AI’s 75% Promise & Rising $ Pressure

Pharma’s 10.7% Bounce, AI’s 75% Promise & Rising $ Pressure

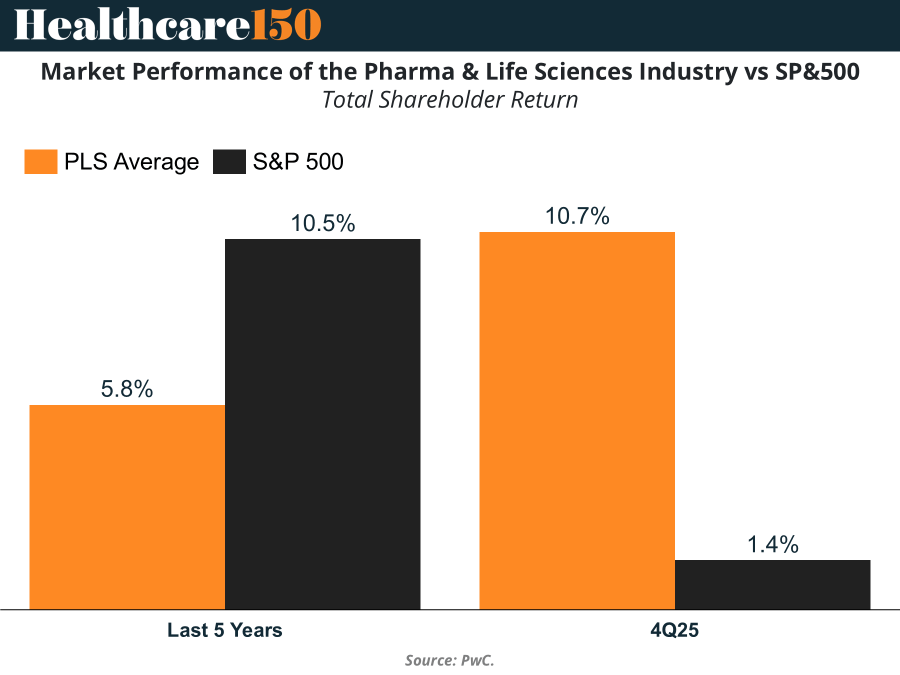

After a 5-year lag, Pharma rebounds with 10.7% TSR while 23 states target drug pricing and 75% of leaders eye AI for admin efficiency.

Good morning, ! This week we’re breaking down rising FDA and state pressure on drug pricing and promotion (70+ enforcement letters, 23 states), where healthcare leaders see AI delivering value (75% admin, 74% clinical—despite 77% maturity concerns), and why pharma’s next inflection hinges on execution after a 5.8% five-year TSR lag—and a 10.7% Q4 rebound.

Sponsor spotlight: Affinity’s report breaks down 7 best practices top PE firms use to turn relationship intelligence into better sourcing—finding warm paths early, tightening banker coverage, and building firm-wide visibility. Download Report →

TREND OF THE WEEK

Pharma’s Inflection Is About Execution

For most of the last cycle, pharma and life sciences have struggled to convert innovation into returns. Over the past 5 years, the sector delivered 5.8% annualized TSR, well below the S&P 500 at 10.5%. That gap shaped investor skepticism, even as drug approvals and scientific breakthroughs accelerated. Q4 2025 offered a notable, if early, counter-signal. Pharma generated 10.7% TSR versus 1.4% for the broader market. One quarter does not mark a full recovery, but it suggests expectations may have reset enough for fundamentals to reassert.

What is changing is not just science, but economics. AI-enabled discovery, precision medicine, and new modalities beyond GLP-1s are compressing timelines, while unsustainable healthcare costs above $5T are forcing sharper value scrutiny. Investors are no longer paying for innovation alone.

Why this matters now. The next winners will be those that pair breakthrough science with capital discipline, lower-cost operating models, and direct-to-patient strategies. Pharma’s challenge is execution. Its opportunity is proving that innovation can still earn a premium. (More)

HEALTHTECH CORNER

AI Finds Its Lane (For Now)

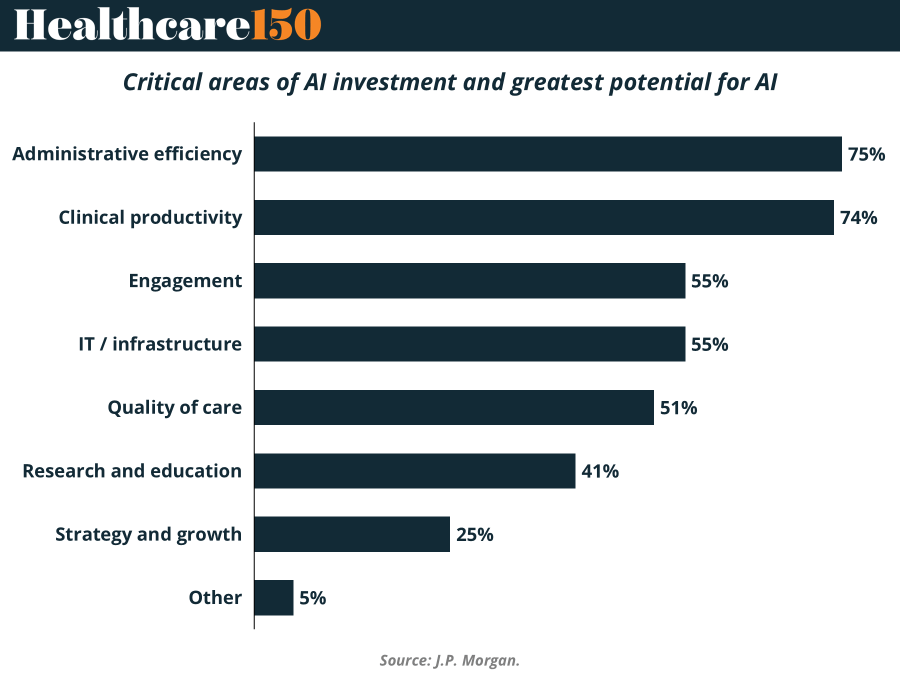

Healthcare AI has officially moved past the hype phase—and into the “show me the ROI” era. Leaders are clear on where AI value actually shows up: administrative efficiency (75%) and clinical productivity (74%). Translation: automate the paperwork, not the physician. Tools focused on billing, scheduling, documentation, and revenue cycle management are winning mindshare, while clinical AI is framed as burden reduction, not decision replacement.

What’s holding things back isn’t philosophy—it’s plumbing. Lack of AI maturity (77%) tops the barrier list, followed by cost concerns (47%) and regulatory uncertainty (40%). Notably absent: clinician resistance. Adoption isn’t stalled because doctors won’t use AI; it’s stalled because systems aren’t ready to deploy it safely, cheaply, and at scale.

For healthtech builders and investors, the message is blunt: near-term wins come from workflow augmentation, fast ROI, and low integration friction—not moonshots. (More)

PRESENTED BY AFFINITY

One-third of dealmakers are now spending 21–40 hours every week just researching companies. That's half a full-time job before a single conversation happens.

In Affinity's survey of nearly 300 private capital professionals, deal sourcing remains their top priority for 2026. But the real bottleneck is having the bandwidth to evaluate opportunities before competitors do.

The firms pulling ahead are automating the manual research work, surfacing higher-quality targets faster, and protecting their teams from drowning in data.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

COMPLIANCE CORNER

Promo Pressure and Price Probes

2025 has been a regulatory double whammy: the FDA is cracking down on drug promotion, while states sprint ahead on price transparency laws. Over 70 enforcement letters flew out of OPDP this year, targeting everything from DTC ads to influencer content, and the DOJ isn’t far behind. Meanwhile, 23 states passed pricing laws, and a dozen now have Prescription Drug Affordability Boards.

As for the feds? Still stuck in ACA implementation limbo. The FDA's new authority to revoke approvals tied to pricing noncompliance is the clearest signal yet: pricing is now a regulatory issue, not just a PR one. (More)

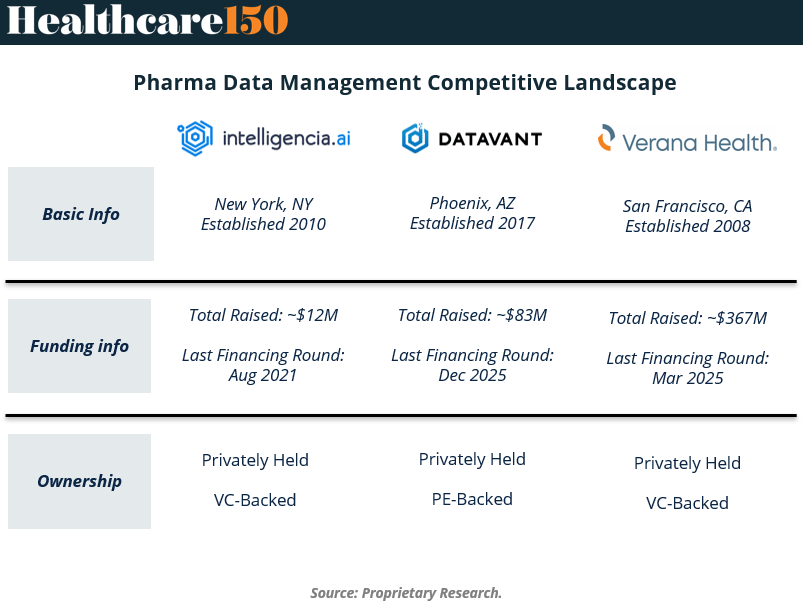

COMPETITIVE LANDSCAPE SNAPSHOT

PUBLISHERS PODCAST

No Off Button: Real leadership shows up after the frameworks fail.

In this episode, Aram sits down with Konstantinos Papakonstantinou to unpack the uncomfortable gap between formal education and real-world execution. They get into why degrees, playbooks, and neat frameworks tend to break down when capital is at risk—and how judgment is actually forged through ownership and consequence.

The conversation zeroes in on decision-making under pressure, accountability, and the kind of lessons teams only learn when outcomes are real and reversible mistakes are gone.

Why PE should care: returns aren’t driven by credentials—they’re driven by operators who can make clear calls with imperfect information, carry responsibility, and execute when it counts.

Watch the full conversation and see what holds up when theory meets reality.

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"If you don't like something, change it. If you can't change it, change your attitude."

Maya Angelou