- Healthcare 150

- Posts

- Where Leaders See Value—and What’s Still Holding Adoption Back

Where Leaders See Value—and What’s Still Holding Adoption Back

Artificial intelligence is no longer a theoretical discussion in healthcare.

Health system leaders are increasingly aligned on where AI can create immediate value, even as adoption continues to lag due to structural and regulatory constraints. Two signals stand out: clear prioritization of administrative and clinical use cases, and persistent friction around maturity, cost, and compliance.

AI Value Is Concentrated in Operational and Clinical Workflows

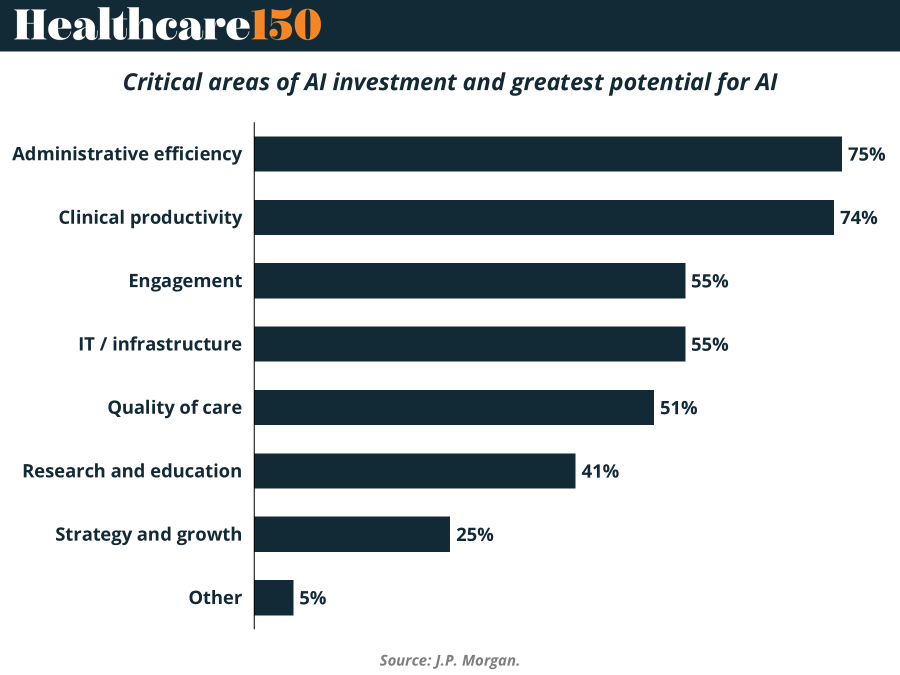

Healthcare leaders overwhelmingly point to administrative efficiency (75%) and clinical productivity (74%) as the areas with the highest AI potential. This reflects a pragmatic mindset: AI is being evaluated less as a transformation engine and more as a pressure-release valve for overstretched systems.

Key takeaways from the data:

Administrative efficiency leads the ranking, underscoring demand for automation across billing, scheduling, documentation, and revenue cycle management.

Clinical productivity follows closely, driven by tools that reduce clinician burden rather than replace decision-making.

Engagement and IT/infrastructure (both at 55%) highlight growing interest in AI-enabled patient interaction and system-level optimization.

Lower prioritization of strategy and growth (25%) suggests AI is still viewed as an operational lever, not yet a core growth driver.

The implication for healthtech builders and investors is clear: near-term AI adoption favors workflow augmentation, not disruption. Solutions that integrate cleanly into existing systems—and show fast ROI—are best positioned to scale.

Barriers Remain Structural, Not Conceptual

Despite strong interest, adoption friction remains significant. The top barriers are not about willingness—but readiness.

Lack of AI tool maturity (77%) is the dominant concern, signaling skepticism around reliability, explainability, and real-world performance.

Financial concerns (47%) reflect budget pressure and uncertainty around payback periods.

Regulatory and compliance uncertainty (40%) remains a critical blocker, especially in clinical and patient-facing applications.

Lower-ranked barriers—such as clinician adoption (17%) and in-house expertise (14%)—suggest that resistance is less cultural and more systemic.

This gap between perceived value and execution reality explains why pilots often outnumber scaled deployments. Health systems are waiting for proven vendors, clearer regulatory frameworks, and standardized implementation models before committing at scale.

What This Means for the Healthtech Ecosystem

AI in healthcare is moving forward—but selectively. The winners in this phase will be companies that:

Target administrative and clinical efficiency first

Demonstrate measurable cost savings or productivity gains

Build with compliance and explainability at the core

Reduce integration friction with legacy systems

For investors and operators alike, the message is consistent: AI adoption will be incremental, operationally driven, and ROI-led. The opportunity is real—but so is the bar for execution.