- Healthcare 150

- Posts

- Performance, Prevention, Profit: Where PE Fits in the Sports Med Boom

Performance, Prevention, Profit: Where PE Fits in the Sports Med Boom

An 8% CAGR, fragmented share, and rising APAC demand create a two-track deal runway: bolt-on niche innovators to orthopedic platforms for scale.

Good morning, ! This week we’re tracking the mega-mergers reshaping U.S. hospital systems, how sports medicine is scaling into a $13B mainstream market, Europe’s push to turn digital health into hard infrastructure, and why pharmacy giants like Walgreens are going private to survive the retail reset.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

Sports Medicine Steps into the Mainstream

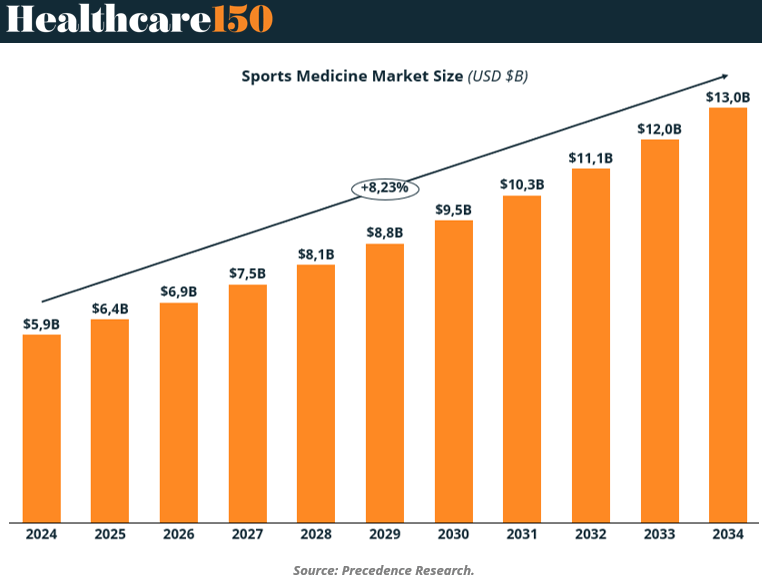

The global sports medicine market is set to more than double over the next decade—from $5.9B in 2024 to $13.0B by 2034, growing at a steady 8.23% CAGR. This is no longer a niche category for elite athletes.

Aging demographics, rising sports participation, and tech-driven solutions (like biologics and wearables) are driving structural demand across geographies and age groups.

North America dominates with a 47% market share, reflecting its healthcare infrastructure and performance culture. But APAC’s 16% share and steady rise position it as the next frontier. Meanwhile, sport-specific trends highlight clear entry points for product development: soccer accounts for 71% of injury-related hospitalizations in the EU, while the U.S. shows a diversified injury landscape led by basketball, cycling, and exercise-related activities.

Arthrex commands 38% of global market share, but the 18% held by smaller players (“Others”) signals white space for innovation in wearables, minimally invasive tech, and targeted therapies.

Bottom line: This is a rare convergence of performance, prevention, and profit. Investors can play both sides—established orthopedic platforms for scale, and niche innovators for upside. The sector is growing—and evolving—faster than the broader healthcare economy.

TREND OF THE WEEK

Trend of the Week: Hospital Systems Are Getting Bigger—and More Concentrated

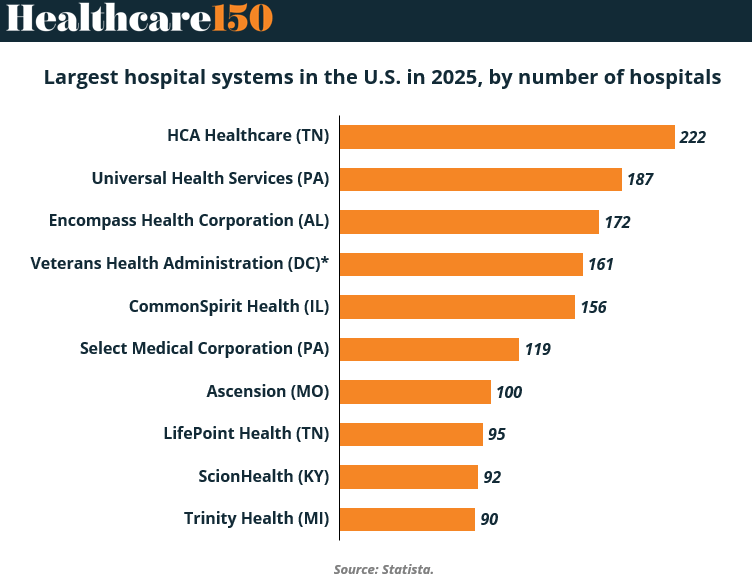

The U.S. hospital landscape in 2025 is dominated by a handful of mega-systems. HCA Healthcare (TN) leads with 222 hospitals, followed by Universal Health Services (PA) at 187 and Encompass Health (AL) at 172. Combined, the top 5 systems control over 898 hospitals—a scale that signals accelerating consolidation across the sector.

This growth isn’t just horizontal—it reflects strategic plays around outpatient expansion, cost leverage, and payer negotiations. Private operators like HCA and UHS are outpacing even the Veterans Health Administration (161 hospitals) in scale, underscoring the market-driven nature of today’s healthcare infrastructure.

Why it matters: For investors, this trend reaffirms the long-term thesis around healthcare M&A and platform roll-ups. Larger systems benefit from pricing power, tech integration, and clinical efficiency—key levers in a cost-pressured, value-based care world. But for regional hospitals and independent providers, the moat is shrinking fast. (More)

PRESENTED BY ATTIO

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

MARKET MOVERS

Company (Ticker) | Last Price | 5D |

Eli Lilly and Company (LLY) | $ 799.34 | 3.42% |

Johnson & Johnson (JNJ) | $ 156.82 | 1.00% |

Novo Nordisk A/S (NVO) | $ 68.94 | -1.01% |

Roche Holding AG (ROG.SW) | $ 323.18 | -0.04% |

AbbVie Inc. (ABBV) | $ 190.24 | 0.24% |

HEALTHTECH CORNER

Europe’s Digital Rx: More Mandates, Fewer Checks

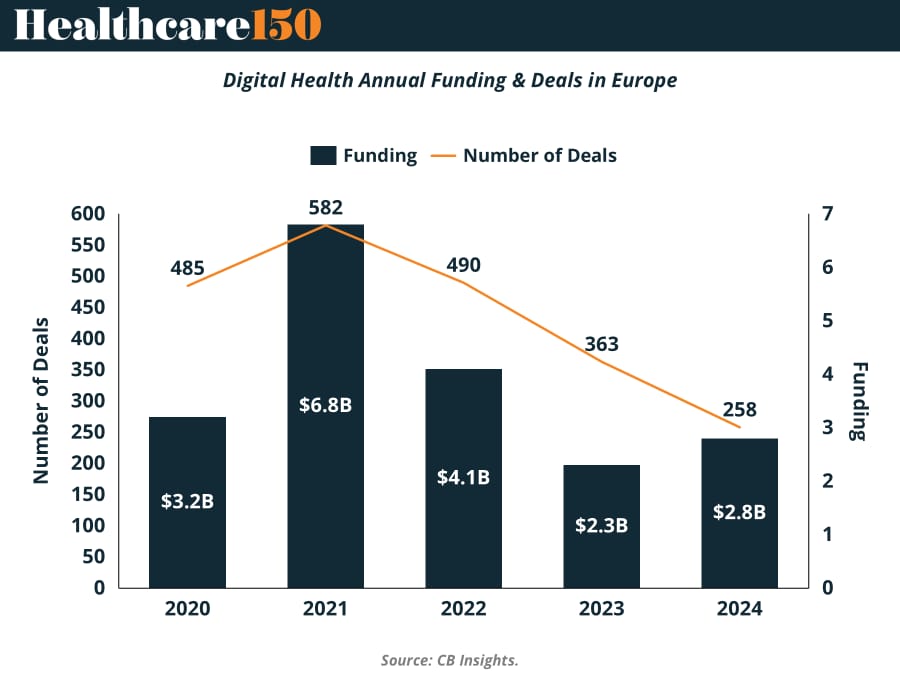

The EU’s HealthTech push is getting more teeth. Once a voluntary sprint, the digital transformation of Europe’s healthcare is now edging toward binding commitments. With targets like 100% electronic health record access by 2030, initiatives like the European Health Data Space are turning policy into infrastructure. But while €16B+ in EU funding has helped build pipes for ePrescriptions and telemedicine, investor enthusiasm isn’t keeping pace. 2024 deal volume hit a five-year low (258 deals)—down 56% from the 2021 peak, even as funding nudged up to $2.8B. (More)

TOGETHER WITH THE DAILY UPSIDE

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

DEAL OF THE WEEK

Sycamore to Take Walgreens Private in $10B Buyout

Walgreens shareholders have approved a $10 billion buyout by Sycamore Partners, taking the 123-year-old pharmacy chain private after nearly a century on public markets. The deal offers $11.45 per share, with up to $3 more contingent on future monetization of Walgreens' VillageMD stake.

The move comes amid a brutal retail pharmacy reset. Between reimbursement pressure, thinning margins, and a shift away from traditional drugstore models, national chains are in retreat. Walgreens plans to shutter over 1,000 locations by 2027, adding to a broader wave of store closures across the industry.

Taking the company private gives Walgreens cover to execute a turnaround—without the quarterly scrutiny of public markets. For Sycamore, known for distressed and retail-heavy plays, it’s a textbook platform bet: decaying but cash-generative, asset-rich, and ripe for cost rationalization.

Why it matters: This is the biggest U.S. retail privatization in years and signals private equity’s growing role in transforming legacy consumer brands. LPs should watch closely: as public markets turn their back on low-growth incumbents, PE may find long-term value—if it can stomach short-term pain. (More)

REGIONAL FOCUS

Margins Flatline, Costs Surge in Hospital America

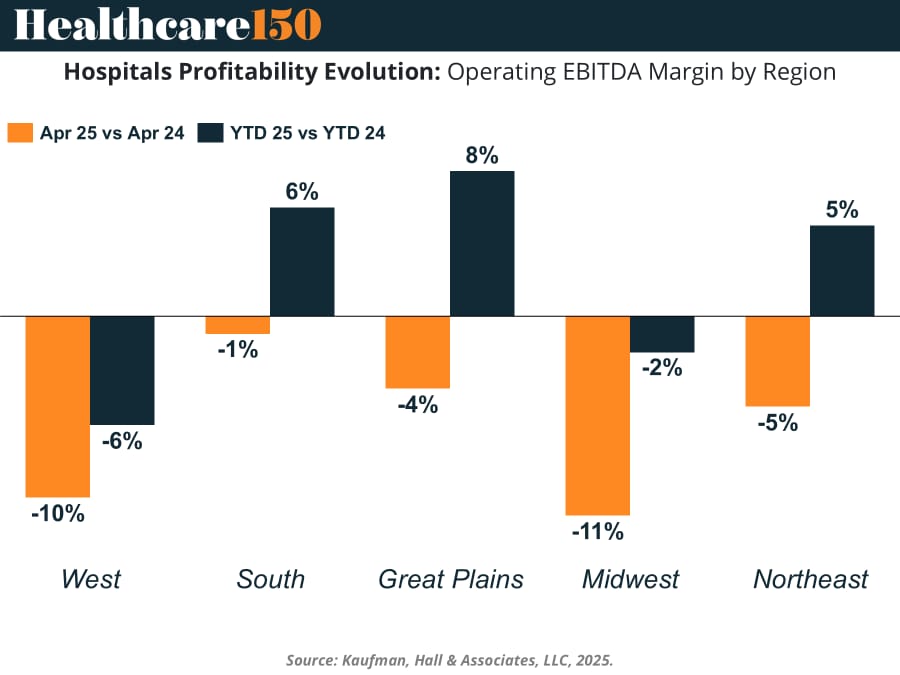

Despite two years of YOY revenue gains, hospitals are still battling uphill—mostly against their own expense sheets.

April marked another month of meh for hospital finances, with the median operating margin stuck around 1%, a fourth month of near-zero fluctuation. Outpatient revenues popped 9.7% YOY (West leading at 12.3%), but non-labor expenses outpaced labor again, driven by soaring supply (+8.5%) and drug (+5.6%) costs. The South saw the steepest YOY drug cost increase at 9.1%. Patient volumes wobbled, with ER visits down 7.1% MoM, even as outpatient volumes eked out a 2.9% rise. Meanwhile, U.S. hospital services are projected to reach $2T by 2030, whether or not margins tag along. (More)

INTERESTING ARTICLES

"The only place where success comes before work is in the dictionary."

Vidal Sassoon