- Healthcare 150

- Posts

- The Convergence of Performance, Prevention, and Profit

The Convergence of Performance, Prevention, and Profit

The global sports medicine market stands at a pivotal intersection of healthcare innovation, cultural transformation, and economic potential.

As athletic participation surges across age groups and geographies, the demand for injury prevention, performance optimization, and rehabilitation solutions has evolved from a niche specialty into a robust, mainstream sector. What was once primarily reserved for elite athletes has now become essential care for millions—from weekend warriors and youth competitors to aging populations seeking active lifestyles. This convergence has created a powerful engine of sustained growth, ripe with opportunity for investors, medical device manufacturers, and healthcare providers.

What distinguishes sports medicine today is not just the sheer volume of demand, but the precision of its expansion. Growth is being driven by structural megatrends—rising healthcare literacy, improvements in orthopedic technologies, and the global democratization of sport and fitness. Meanwhile, innovation in biologics, wearables, and minimally invasive treatments is transforming how injuries are diagnosed and managed. Regional dynamics reveal unique investment frontiers, while sport-specific injury patterns offer actionable intelligence for product development and market entry. Whether entering through dominant incumbents or disruptive startups, stakeholders positioned in this market are aligned with a sector that is not only expanding, but evolving—consistently outpacing traditional segments of the healthcare economy.

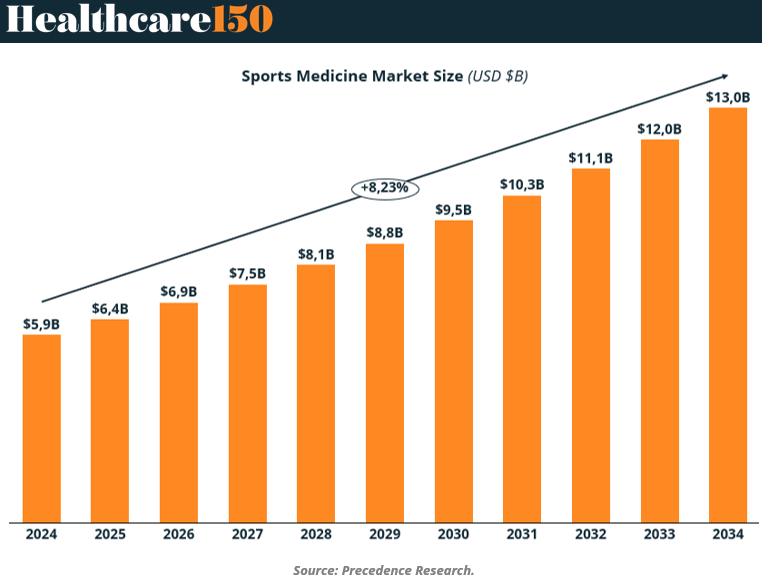

A Decade of Growth: Projected Expansion in the Sports Medicine Market

The sports medicine industry is poised for a remarkable decade of growth, as evidenced by the projected market expansion from $5.9 billion in 2024 to a staggering $13.0 billion by 2034. This forecasted trajectory reflects the increasing global emphasis on injury prevention, rehabilitation, and performance enhancement—fueled by both elite athletic programs and the broader adoption of active lifestyles.

With a compound annual growth rate (CAGR) of 8.23%, the market’s momentum is undeniable and underscores a rising demand for innovative medical solutions tailored to sports and physical activity.

Investor interest in this space is further justified by the steady and consistent nature of the projected growth. Unlike volatile sectors, sports medicine benefits from multiple stable growth drivers: aging but active populations, technological advancements in treatment and diagnostics, and the increasing prevalence of sports-related injuries among youth and amateur athletes.

These factors make the market both resilient and scalable. As the data shows, the market is set to more than double in size over ten years—signaling substantial opportunities for healthcare companies, device manufacturers, and investors seeking long-term value in the health and wellness ecosystem.

Key Takeaways from the Chart

Steady CAGR of 8.23%: The market is forecasted to grow from $5.9B in 2024 to $13.0B by 2034, with consistent year-over-year gains.

Strong Momentum Starting in 2025: Growth begins accelerating from $6.4B in 2025, reaching $8.8B by 2029.

Crossing Key Milestones: The market crosses the $10B mark by 2031, and $12B by 2033, signaling increasing confidence and maturity.

Favorable Long-Term Trends: Factors such as active aging demographics, rising sports participation, and innovation in orthobiologics are supporting this expansion.

Investor Implication: High CAGR and sustained upward trend suggest a promising return profile for long-term investments in sports medicine-related ventures.

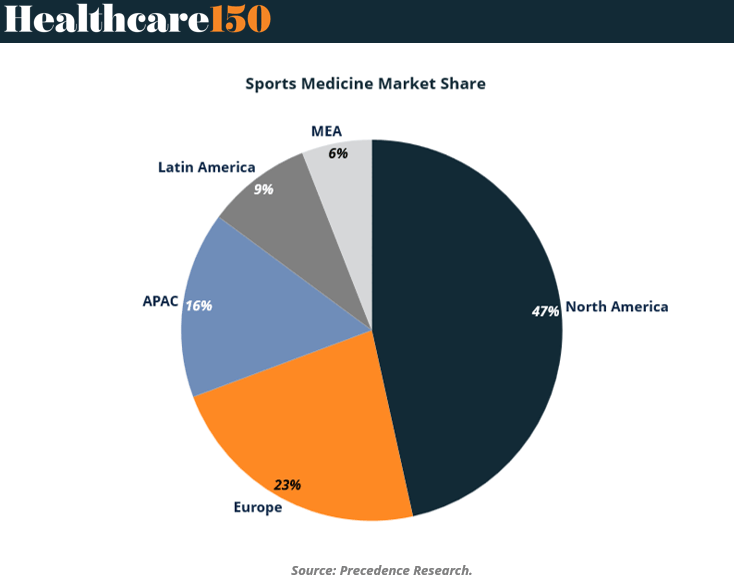

Regional Powerhouses: Geographic Distribution of the Sports Medicine Market

The sports medicine market is not only growing rapidly but also concentrated unevenly across the globe, with North America holding a commanding lead. As the chart reveals, nearly half of the global sports medicine market—47%—is dominated by North America.

This overwhelming share is a reflection of the region’s deeply embedded sports culture, advanced healthcare infrastructure, and high levels of investment in athletic performance and rehabilitation technologies. From professional leagues to recreational fitness, the demand for injury prevention and recovery solutions in the U.S. and Canada is both broad and sophisticated.

Europe follows as a strong second with 23% of the market, while Asia-Pacific (APAC) holds a meaningful 16% share. These regions are experiencing steady growth, driven by increased sports participation and expanding access to healthcare services.

Latin America (9%) and the Middle East & Africa (MEA, 6%) currently trail in market penetration but represent substantial opportunities for future expansion. These emerging markets, though smaller, are poised for growth as healthcare infrastructure improves and awareness of sports-related injuries rises. For investors, understanding this geographic segmentation is essential to identifying mature, high-margin regions as well as frontier markets ripe for disruption.

Key Takeaways from the Chart

North America Leads at 47%: Driven by strong sports culture, top-tier athletic programs, and high healthcare spending.

Europe Holds 23%: Mature market with steady demand for orthopedic solutions and rehabilitation technologies.

Asia-Pacific Rising (16%): Significant potential as regional economies invest in sports infrastructure and health access.

Latin America (9%) and MEA (6%): Currently smaller shares, but hold promise as developing markets adopt sports medicine innovations.

Strategic Implication: North America offers high revenue opportunities now, while APAC, Latin America, and MEA are regions to watch for long-term investment returns.

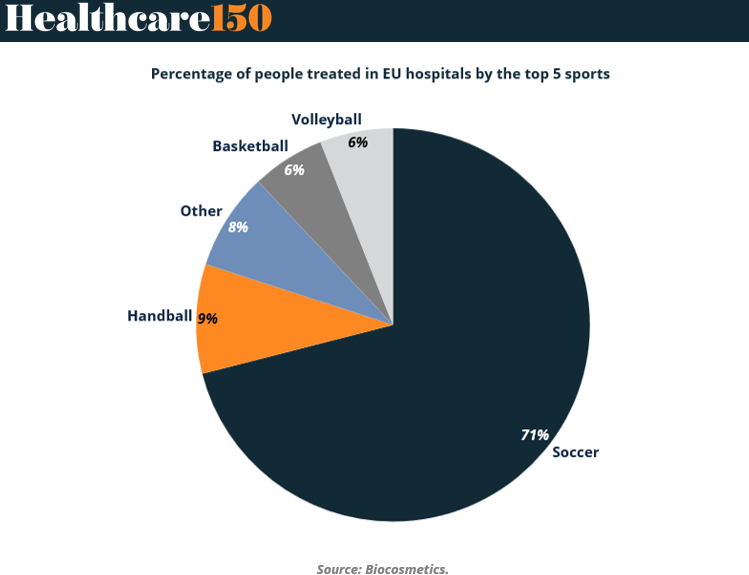

The Injury Epicenter: Sport-Specific Hospital Treatments in the EU

Understanding which sports are driving injury-related hospital visits is critical for targeting solutions in the sports medicine market. This chart reveals a striking insight: soccer overwhelmingly leads the charge, accounting for a staggering 71% of all hospital treatments linked to the top five sports in the European Union.

The data points to the sport’s sheer volume of participation across all levels—from youth leagues to elite professional play—as well as its physically demanding nature. With constant running, rapid direction changes, and frequent contact, soccer poses a high risk for injuries ranging from ACL tears to concussions.

While other sports like handball (9%), basketball (6%), and volleyball (6%) also contribute to the injury landscape, they pale in comparison to soccer’s dominance. This breakdown not only reflects exposure levels but also presents a targeted opportunity for stakeholders in sports medicine—whether developing preventative gear, surgical solutions, or rehabilitation programs.

For investors, this chart acts as a roadmap: investing in innovations tailored for soccer injury treatment in Europe can provide outsized returns, particularly in orthopedic devices, imaging technologies, and sports-specific physical therapy solutions.

Key Takeaways from the Chart

Soccer Accounts for 71%: The sport is the clear leader in hospital-treated injuries, driven by high participation and physical intensity.

Handball Takes 2nd Place (9%): A contact-heavy sport with frequent shoulder, knee, and finger injuries.

Basketball and Volleyball Each at 6%: Both contribute evenly, mostly involving joint injuries and sprains.

“Other” Sports Combine for 8%: Lesser-known or lower-participation sports make up the remainder.

Strategic Focus: Targeted innovations for soccer injury treatment—especially in the EU—offer concentrated opportunity for market impact.

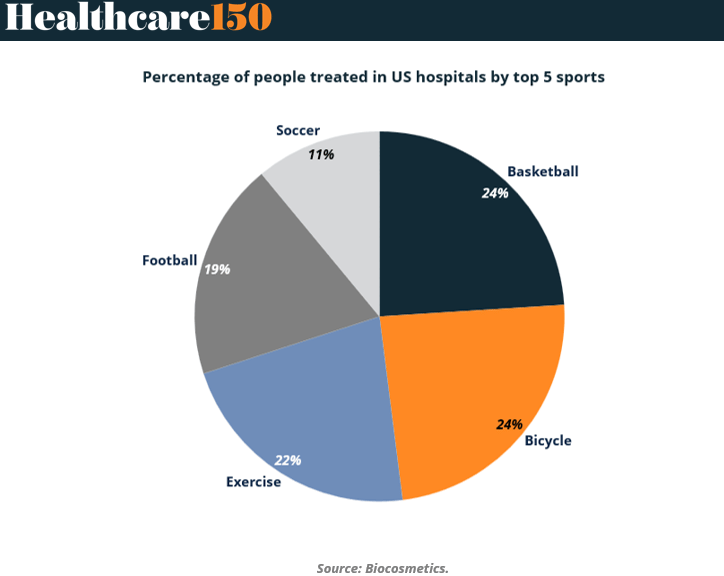

Collision, Cardio & Courts: The U.S. Sports Injury Landscape by Activity

The U.S. sports medicine market presents a strikingly diverse injury profile, shaped by the country’s unique athletic culture. Unlike in the EU, where one sport dominates, the U.S. market is more evenly distributed among multiple high-impact and high-participation activities.

According to this chart, basketball and bicycling each account for 24% of hospital-treated sports injuries, followed closely by exercise-related activities (22%), football (19%), and soccer (11%). This data not only reflects participation rates but also the physical demands and injury risks associated with each category—from falls and collisions to overuse injuries.

This diversification of risk profiles opens the door to a broader spectrum of innovation and investment opportunities. Basketball injuries are often orthopedic—ankles, knees, and wrists—whereas cycling presents more traumatic cases involving fractures and concussions.

Exercise-related injuries, driven by gym-based workouts and home fitness, point to a growing need for preventative care, wearables, and diagnostics tailored to general fitness rather than organized sports. Football remains a well-known source of both acute and long-term injuries, especially concussions. For stakeholders, this fragmentation underscores the importance of offering a wide portfolio of solutions across disciplines—not just for athletes but also for everyday fitness enthusiasts.

Key Takeaways from the Chart

Basketball & Bicycling Lead at 24% Each: High participation rates combined with frequent falls and collisions make them top contributors to hospitalizations.

Exercise (22%): Includes gym, fitness classes, and home workouts—highlighting injury risk even in recreational, non-competitive contexts.

Football (19%): Continues to be a major driver of sports injuries, particularly in youth and high school athletes.

Soccer (11%): While lower than in Europe, it still represents a meaningful segment of U.S. hospital visits for sports injuries.

Investment Insight: The U.S. market calls for diverse injury-management solutions spanning competitive sports and general fitness—presenting wide applicability for wearable tech, orthopedic innovations, and digital health tools.

Dominating the Field: Global Market Leaders in Sports Medicine

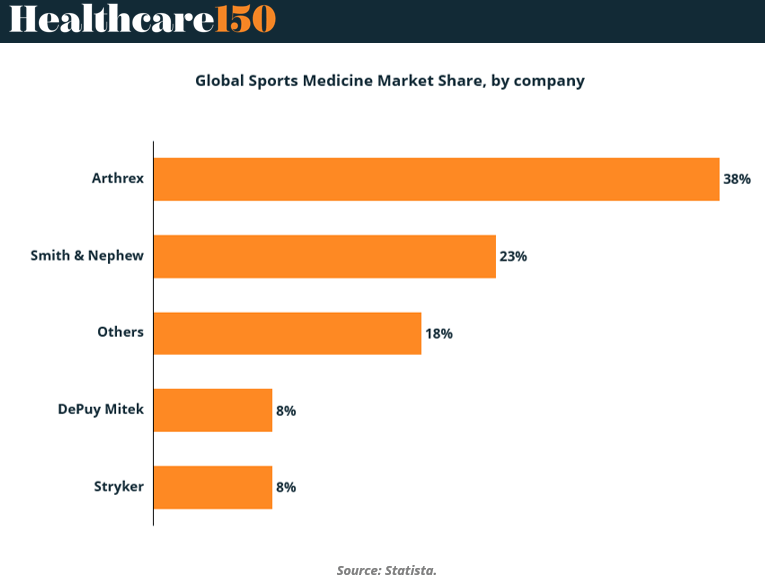

In the highly competitive global sports medicine market, a few key players control a substantial share—defining innovation pipelines, setting pricing benchmarks, and influencing clinical adoption trends.

As this chart reveals, Arthrex leads decisively with a 38% market share, cementing its status as the industry’s dominant force. Known for its specialization in minimally invasive orthopedic products, Arthrex has built its position through a relentless focus on R&D and surgeon education. Smith & Nephew follows at 23%, leveraging a broad orthopedic portfolio and strong international presence. Together, these two companies alone command more than 60% of the global market.

The remaining 39% is split among "Others" (18%), DePuy Mitek (8%), and Stryker (8%). While these players are smaller in market share, they remain significant—especially in niche areas or emerging technologies such as biologics, robotic-assisted procedures, and regenerative medicine.

The 18% share held by “Others” also indicates a healthy level of fragmentation, suggesting room for new entrants or specialized firms to carve out valuable subsegments. For investors, this market structure offers a dual opportunity: back dominant leaders with proven scale, or identify innovative challengers poised to disrupt specific verticals within sports medicine.

Key Takeaways from the Chart

Arthrex Dominates with 38%: The clear global leader, thanks to strong specialization in sports medicine tools and surgeon engagement.

Smith & Nephew at 23%: A major player with a comprehensive orthopedic strategy and a global footprint.

Significant Fragmentation (18% "Others"): Reflects space for emerging companies to innovate and differentiate.

DePuy Mitek and Stryker Each Hold 8%: Still important players with the potential to gain share through M&A or tech innovation.

Strategic Investor Lens: Consider balancing investments between incumbents like Arthrex and high-growth disruptors in the “Others” segment.

Conclusion: Capturing Value in a High-Growth, High-Impact Sector

The sports medicine market offers a rare combination of sustained growth, medical necessity, and cultural relevance—making it a uniquely attractive space for long-term investment. As shown across the data, this is a sector with momentum: projected to more than double in value over the next decade, geographically diversified with both mature and emerging markets, and strategically fragmented in ways that favor both established players and innovative challengers. From North America’s dominant position to the rise of Asia-Pacific and Latin America, the geographic footprint of opportunity is broadening. At the same time, injury trends—whether dominated by soccer in the EU or spread across multiple sports in the U.S.—offer clearly defined entry points for specialized solutions.

For investors, the message is clear: sports medicine is no longer a peripheral segment of healthcare—it is central to the future of movement, performance, and recovery. Whether the investment thesis centers on orthopedics, physical therapy, diagnostics, or preventative tech, the market fundamentals remain strong and the innovation pipeline robust. Backing companies that improve how athletes—and increasingly, everyday people—move, heal, and perform is not just profitable; it is future-proof. The decade ahead is not just one of growth for sports medicine—it is one of transformation, and those who position early stand to benefit from a rare alignment of health impact and economic return.

Sources & References

Precedence research. Sports medicine market. https://www.precedenceresearch.com/sports-medicine-market

NSC. Sports and recreational injuries. https://injuryfacts.nsc.org/home-and-community/safety-topics/sports-and-recreational-injuries/

Biocomposites. Sports injuries. https://biocomposites.com/your-specialty/sports-injuries/

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.