- Healthcare 150

- Posts

- From Line Item to National Imperative: The $36B Trauma Bet

From Line Item to National Imperative: The $36B Trauma Bet

Trauma care is no longer just an emergency response—it’s a growth sector projected to nearly double by 2034.

Good morning, ! This week we’re diving into the sustained growth of Healthcare Trauma Centers, Telehealth keeps the lead in HealthTech VC activity, Clinicians worldwide are intrigued but cautious about AI, and Permira is exploring a $4B exit from Cambrex.

Want to advertise in Healthcare 150? Check out our self-serve ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

Data Dive: Trauma Care’s Strategic Inflection Point

Trauma care is undergoing a structural revaluation—from a hospital line-item to a national investment imperative. The U.S. trauma market is projected to nearly double, from $18.7B in 2025 to $36.2B by 2034, driven by population aging, climate volatility, and the growing burden of violent and accidental injuries. But the data reveals something deeper: the infrastructure is scaling—and strategically shifting.

The number of trauma centers has surged 80% since 2002, with the most growth concentrated in Levels III, IV, and V—indicating a pivot toward distributed, regionally integrated systems. Access has expanded too: today, 89% of the U.S. population lives within 60 minutes of trauma care when Level III centers are included. Meanwhile, the 155.4M annual emergency department visits, 43.5M of which are injury-related, expose the pressure facing frontline acute care. Only 2% of ED cases escalate to critical care, but the system must be ready for all of them.

Why it matters: This is no longer just about emergency response. Trauma centers are now part of a high-acuity command network. They’re getting payer attention, PE interest, and federal funding—all while absorbing growing population risk. Investors, operators, and health systems who treat trauma as a core strategy—not a compliance checkbox—will be best positioned as care decentralizes and trauma volumes scale.

TREND OF THE WEEK

Healthcare Breaches Are Peaking—Then Plunging

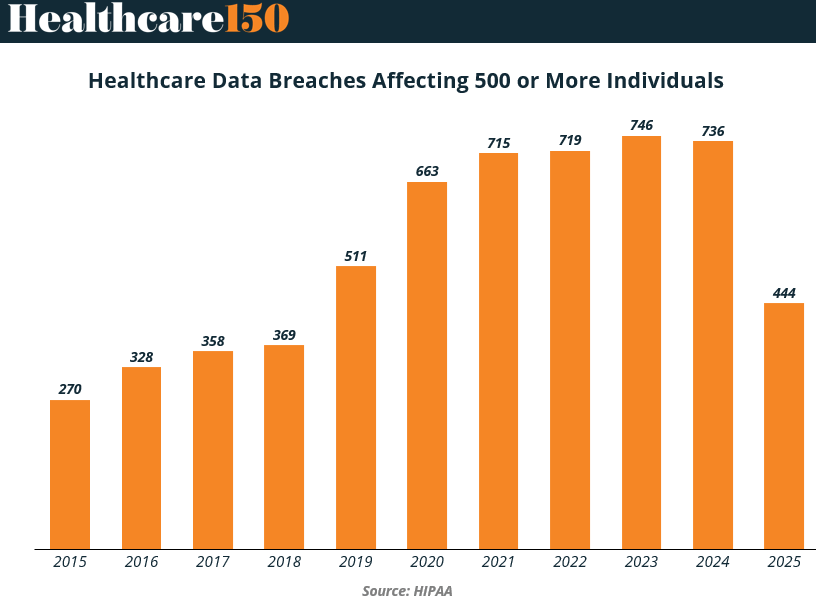

After a decade-long surge, healthcare data breaches—affecting 500+ individuals per incident—may finally be slowing. From 270 breaches in 2015 to a record 746 in 2023, the sector saw a staggering 176% increase over eight years. But 2025 (YTD) tells a different story: only 444 breaches, on track for the first meaningful decline in five years.

Why now? Possible factors include stricter federal enforcement, vendor hardening post-SolarWinds/Change Healthcare fallout, and cyber insurance carriers pushing higher standards. The drop could also reflect underreporting or lagged incident disclosures—something investors should monitor closely.

Why it matters: Breaches have become a material financial and reputational risk, especially for PE-backed platforms and healthtech startups handling PHI. The decline is welcome news—but don’t mistake it for a trend yet. With AI-enabled attacks, API vulnerabilities, and an expanding digital footprint across EHRs and wearables, cybersecurity remains one of the most underpriced risks in healthcare investing. (More)

PRESENTED BY REMOFIRST

International HR and payroll in 185+ countries

Growing your team outside your HQ country? RemoFirst helps you employ anywhere, with EOR services available in 185+ countries.

International HR and payroll for global employees and contractors— without setting up a local entity.

HEALTHTECH CORNER

Health Tech Corner: Telehealth Still Dominates, but Infrastructure Rises

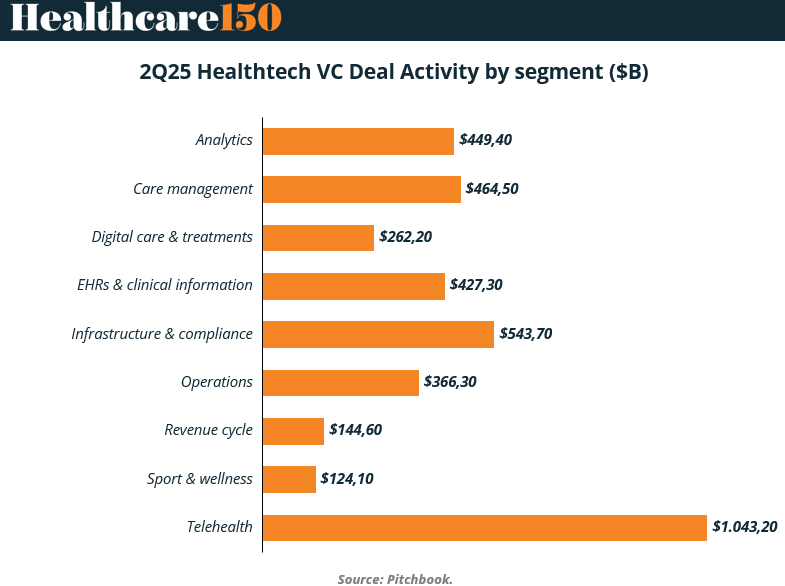

Venture capital in healthtech remains highly concentrated, with Telehealth commanding $1.04B in 2Q25—nearly double the next largest category. The pandemic-era momentum hasn’t faded; instead, telehealth is proving to be the foundational layer of digital care delivery.

The next tier of deal activity is led by Infrastructure & compliance ($543.7M), a clear sign that investors are betting on the “picks and shovels” of healthtech—tools that address interoperability, data security, and regulatory pressure. Close behind are care management ($464.5M) and analytics ($449.4M), both categories aligning with payers’ and providers’ push for efficiency in value-based care.

Lower down the table, revenue cycle ($144.6M) and sport & wellness ($124.1M) continue to lag, underscoring investors’ preference for enterprise-grade solutions over consumer wellness plays.

Bottom line: Capital is concentrating where healthcare infrastructure meets scale—telehealth at the front door, compliance in the backbone, and analytics in the workflow. For investors, the signal is clear: platform plays are winning, while point solutions are getting squeezed. (More)

TOGETHER WITH PACASO

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

DEAL OF THE WEEK

Permira’s $4bn Pill to Swallow

Permira is lining up a potential $4bn exit from Cambrex, the US-based contract drug manufacturer it bought in 2019 for $2bn. Since then, Cambrex has ridden the wave of re-shoring as pharma companies pivoted to US production amid threats of tariffs up to 250% on imported drugs. Headquartered in New Jersey, Cambrex provides manufacturing and testing services across the entire drug lifecycle, making it a go-to partner for biopharma firms bolstering supply chains. The timing is classic PE playbook: buy during uncertainty, scale under favorable regulation, and exit when strategic and financial buyers need US-based capabilities. Permira, managing €85bn in assets, recently teamed with Nordic Capital on a $3bn bid for Bavarian Nordic—reminding everyone that in healthcare, they’re playing both offense and defense. (More)

REGIONAL FOCUS

AI Optimism Splits by Geography

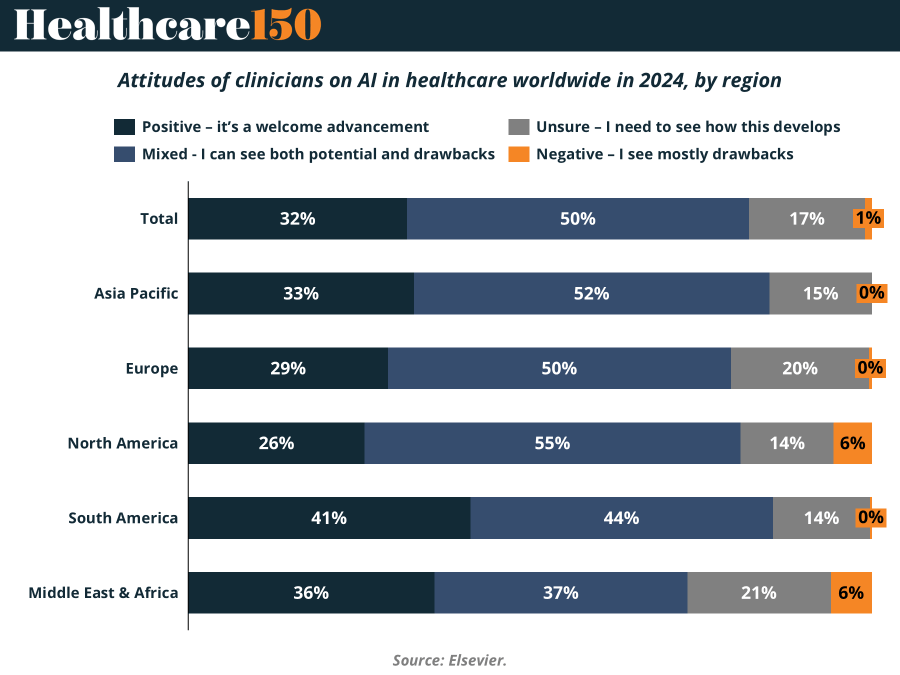

Clinicians worldwide are intrigued but cautious about AI: just 32% call it a welcome advancement, while half sit in the “it depends” camp. Negativity remains low at 1% globally—but region matters.

South America is the clear optimist, with 41% positive, the highest globally.

North America lags at 26% positive, with 6% negative, highlighting trust and liability worries.

Asia Pacific (33% positive, 52% mixed) reflects pragmatic balance.

Europe has the highest uncertainty (20% unsure).

Middle East & Africa shows a split personality—36% positive, 37% mixed, but also 6% negative.

The bottom line: AI adoption won’t be one-size-fits-all. For investors and providers, success depends on tailoring strategies to regional sentiment—or risk pushing AI tools clinicians aren’t ready to trust. (More)

INTERESTING ARTICLES

"The purpose of our lives is to add value to the people of this generation and those that follow."

Buckminster Fuller