- Healthcare 150

- Posts

- From HealthTech Deals to Mega Mergers: This Week in Healthcare

From HealthTech Deals to Mega Mergers: This Week in Healthcare

HealthTech M&A separates the scalable from the speculative and policy shifts top the 2026 agenda, while NYC sees a $2.2B hospital merger.

Good morning, ! This week we’re diving into the HealthTech dealmaking landscape along the past year. New York’s healthcare landscape shifts as Maimonides Health merges with NYC Health + Hospitals in a $2.2B state-backed deal, regulatory and policy changes are top priority for US healthcare leaders for 2026.

Sponsor spotlight: Affinity’s report breaks down 7 best practices top PE firms use to turn relationship intelligence into better sourcing—finding warm paths early, tightening banker coverage, and building firm-wide visibility. Download Report →

DATA DIVE

The Great HealthTech Sorting

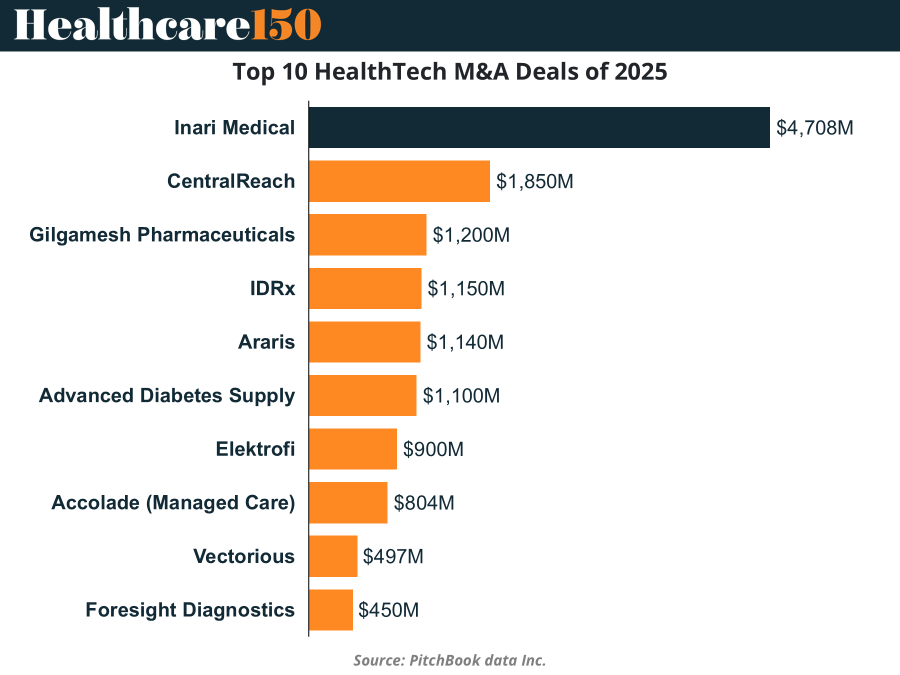

2025 HealthTech M&A resembled a game of “Who Wants to Be Acquired?” — except only contestants with scale, predictable revenue, and regulatory clarity got past the first round. Deal volume dipped, but deal value spiked thanks to mega-deals like Inari Medical’s $4.7B exit, soaking up a disproportionate share of annual M&A dollars. Buyers — both strategic and financial — zeroed in on assets with execution certainty, skipping anything that smelled of "early-stage." The result? A sharply bifurcated market where the best got bid up and everyone else…well, good luck out there. Capital is selective, and HealthTech is officially post-hype.

TREND OF THE WEEK

2026 Is About Execution, Not Vision

US healthcare leaders are heading into 2026 with a notably pragmatic playbook. Regulatory and policy changes dominate the agenda, cited by 80% of executives as a top strategic priority. Reimbursement complexity, CMS rulemaking, drug pricing oversight, and antitrust scrutiny aren’t background noise anymore—they’re shaping core business decisions.

Next comes AI, but with a twist. At 45%, interest in generative and agentic AI reflects a shift from experimentation to deployment, with the focus squarely on administrative automation, documentation, and revenue cycle efficiency. Think fewer pilots, more P&L impact.

Consolidation ties AI at 45%, though the emphasis has shifted toward platform depth and post-merger integration, not roll-up velocity.

Bottom line: 2026 rewards operators who can execute at the intersection of policy fluency, AI productivity, and scale. (More)

PRESENTED BY AFFINITY

Private equity firms face rising competition as auctions drive valuations higher and differentiation lower. The firms that consistently outperform are not simply deploying more capital. They are managing networks more strategically, uncovering warm paths into targets before processes begin, maintaining disciplined banker coverage, and creating visibility across every relationship.

This best practices guide highlights seven proven strategies used by leading firms to source proprietary deals, streamline execution, and position portfolio companies for stronger exits. Built around real-world examples, it shows how relationship intelligence is reshaping private equity deal making from origination through exit.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

PUBLISHERS PODCAST

Introducing No Off Button: Conversations with founders/investors

Relentless builders don’t wait for permission, and they don’t hit pause. No Off Button goes inside the minds of operators who keep compounding when others tap out.

This week, Aram sits down with Walker Deibel, WSJ bestselling author of Buy Then Build and founder of Acquisition Lab. Walker makes a PE-relevant case that hits close to home: building from zero is often the worst risk-adjusted bet, while buying profitable, owner-operated businesses offers immediate cash flow, control, and asymmetric upside.

The conversation dives into acquisition entrepreneurship, the Silver Tsunami of baby boomer exits, and why “boring” industries deliver better downside protection than most venture-backed plays.

Why PE should care: this is roll-up logic, applied at the individual-operator level, capital discipline, cash yield, and buying earnings instead of narratives.

HEALTHTECH CORNER

Healthtech Corner: CES 2026 – The GLP-1 Era Meets AI-Driven Longevity

At CES 2026, healthtech didn’t just show up—it took over the keynote. Three megatrends took center stage: GLP-1s, precision medicine, and remote care—each signaling a shift in how healthcare will be consumed, delivered, and monetized.

GLP-1s are no longer just a weight loss story. With 12% to 18% of U.S. adults having already used these drugs, and Novo Nordisk launching its first GLP-1 pill just days ago, the ecosystem is rapidly scaling. Expect ripple effects across adjacent markets: fitness, food, sleep apnea, and cardiovascular care are being re-architected for a leaner, post-obesity population.

Precision medicine is getting a serious AI upgrade. AI tools are moving from diagnostics to personalized forecasting—guiding users from “something feels off” to actionable treatment paths. For investors, the play is clear: bet on platforms that own patient-level data and apply it with clinical-grade AI.

Remote care is growing up. Wearables are shifting from wellness trackers to clinical-grade monitors, empowering consumers to be their own care managers. This “datafication of the consumer” is turning patients into health CEOs, with implications for every stakeholder in the delivery chain—from EHR vendors to insurers to pharma.

Bottom line: CES 2026 confirmed what many already suspected—longevity is the new tech frontier. Health investors betting on GLP-1 adjacencies, AI-first platforms, and wearable-driven care models are no longer ahead of the curve. They are the curve. (More)

DEAL OF THE WEEK

$2.2B Lifeline Merges Public Health Powerhouses in NYC

New York’s healthcare landscape just shifted. Maimonides Health, a financially strained safety-net provider in Brooklyn, is merging with NYC Health + Hospitals, the largest municipal healthcare system in the U.S. The deal is backed by a $2.2B state grant over five years, aimed at preserving critical services in Brooklyn and integrating Maimonides into the city’s public system.

Why it matters: Beyond the usual merger synergies, this is a strategic bailout. The deal allows Maimonides to access higher Medicaid reimbursements, adopt NYC H+H’s Epic EHR infrastructure, and shore up its operations amid rising financial pressure on standalone safety-net hospitals.

The funding stems from New York's $2.6B Health Care Safety Net Transformation Program, designed to stabilize providers while encouraging consolidation. Expect similar moves across urban centers where underfunded community hospitals face survival questions.

For investors and strategics: This is a signal. Public-private and intra-public integrations—with regulatory and financial tailwinds—are now a viable pathway for scale, EHR consolidation, and population health expansion. Safety-net alignment may no longer be a philanthropic gesture—it’s becoming a structural imperative. (More)

REGIONAL FOCUS

Telehealth’s Uneven Playing Field

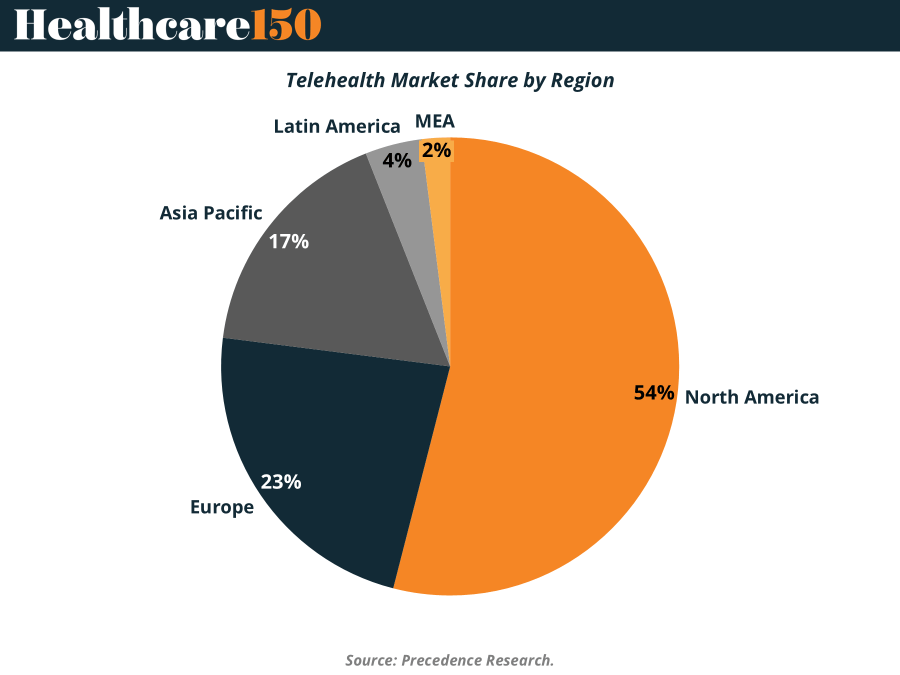

The global telehealth market remains highly concentrated, with North America commanding roughly 54% of global revenue in 2025. That dominance reflects a rare alignment of digital health infrastructure, favorable reimbursement, and early buy-in from both payers and providers. High healthcare spend and employer-sponsored coverage keep virtual care firmly embedded.

Europe, at about 23% share, is catching up more deliberately. Public systems are embracing remote consultations, particularly in primary care and behavioral health, while policy pushes on interoperability are slowly easing historical fragmentation.

The real growth story sits in Asia-Pacific. At 17% share, it’s smaller today but expanding fastest, driven by smartphone penetration, government access initiatives, and mounting clinician shortages.

Bottom line: scale lives in developed markets; upside lives elsewhere. (More)

INTERESTING ARTICLES

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"Our greatest weakness lies in giving up. The most certain way to succeed is always to try just one more time."

Thomas Edison