- Healthcare 150

- Posts

- 2025 HealthTech Dealmaking Report

2025 HealthTech Dealmaking Report

The HealthTech sector closed 2025 at a decisive point in its capital cycle, reflecting a market that had largely completed its post-pandemic reset and transitioned into a more disciplined, fundamentals-driven environment.

1. Introduction

While total investment activity remained meaningful relative to historical norms, the year was defined less by volume and more by selectivity, capital concentration, and strategic clarity. Both acquirers and investors demonstrated a heightened focus on assets capable of delivering near-term economic value, regulatory durability, and scalable integration into existing healthcare ecosystems.

Across mergers and acquisitions, 2025 was marked by fewer but larger transactions, with deal value increasingly concentrated among a limited number of scaled, category-leading platforms. Corporate buyers pursued acquisitions aligned with adjacency expansion—data, automation, diagnostics, and procedure-driven device platforms—while private equity sponsors continued to emphasize platform strategies and operational value creation.

In venture markets, total dollars deployed proved resilient even as deal counts declined, reinforcing the continued bifurcation between well-capitalized later-stage companies and a more constrained early-stage ecosystem.

Importantly, 2025 did not represent a return to pre-2022 exuberance. Instead, it reflected a new equilibrium in which valuation discipline, execution risk, and reimbursement certainty shaped investment decisions.

This report examines HealthTech dealmaking throughout 2025, synthesizing transaction data, valuation trends, and capital flow dynamics to provide actionable insight for healthcare investors and advisors navigating an increasingly selective market environment.

2. Strategic M&A and the Return of Scale

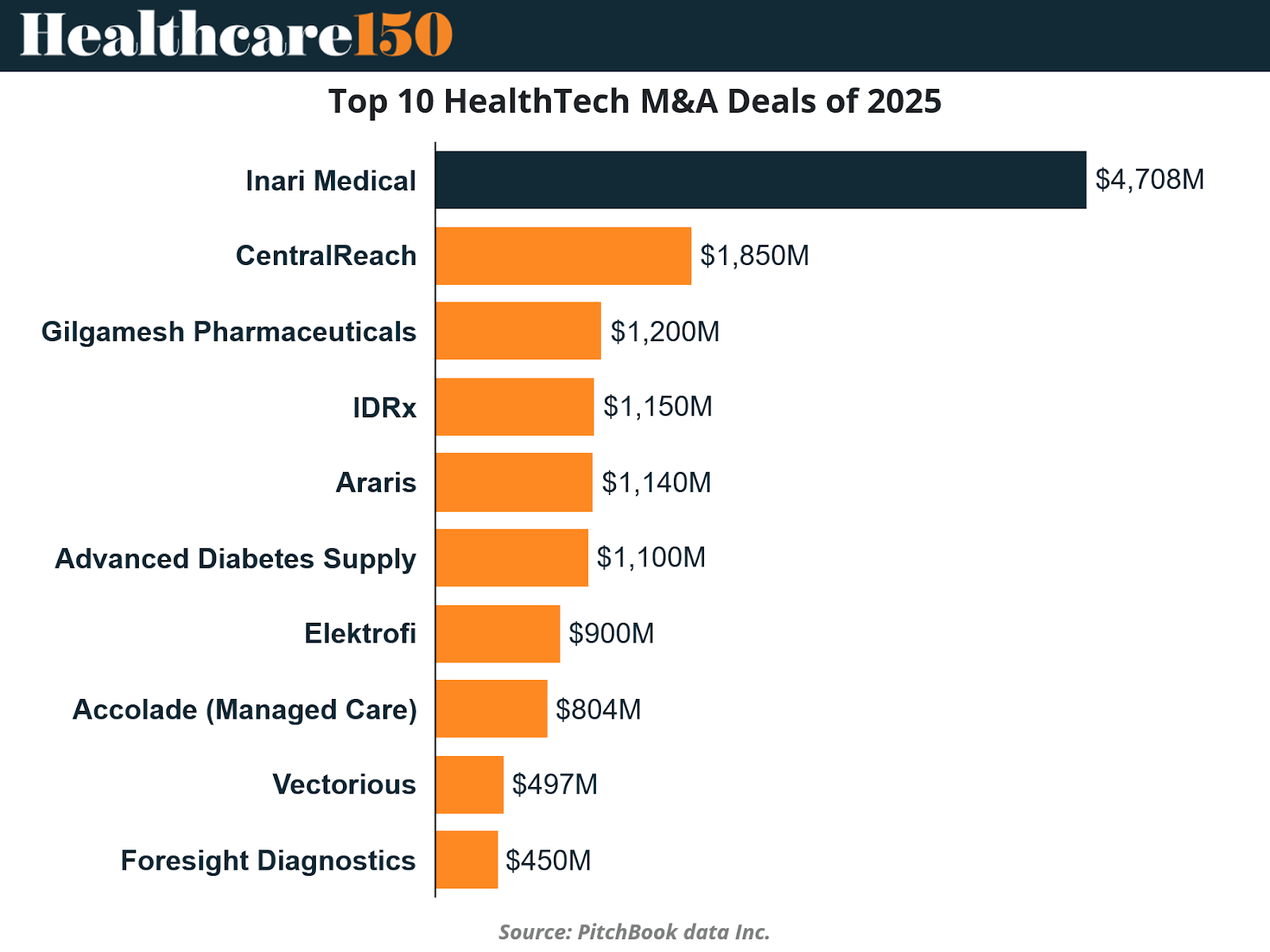

The largest HealthTech M&A transactions completed in 2025 underscored a clear market preference for scale, defensibility, and strategic indispensability. The year’s largest transaction—Inari Medical at approximately $4.7 billion—was emblematic of this trend, commanding a premium valuation due to its strong clinical adoption, procedural economics, and entrenched position within a high-growth therapeutic category. This transaction alone accounted for a disproportionate share of total annual M&A value, reinforcing the increasingly top-heavy nature of HealthTech dealmaking.

Beyond the headline deal, the remainder of the top ten transactions clustered between roughly $800 million and $1.8 billion. These acquisitions spanned medical devices, specialty pharmaceuticals, diagnostics, and tech-enabled healthcare services, with a common thread: proven commercial traction and predictable revenue streams. Notably absent were early-stage or concept-driven assets, highlighting the diminished appetite for speculative M&A and the premium placed on execution certainty.

For private equity sponsors, these transactions reinforced the importance of platform scale. Assets capable of supporting add-on acquisitions, operational optimization, and multiple exit pathways continued to attract competitive interest. Corporate acquirers, meanwhile, prioritized acquisitions that accelerated time-to-market, strengthened reimbursement positioning, or expanded data and analytics capabilities.

The implications for sellers were equally clear. Companies that entered 2025 with mature go-to-market models, embedded customer relationships, and demonstrable outcomes were rewarded with premium valuations, while subscale or narrowly positioned businesses faced a materially more challenging exit environment.

Quarterly M&A Activity and Capital Deployment Timing

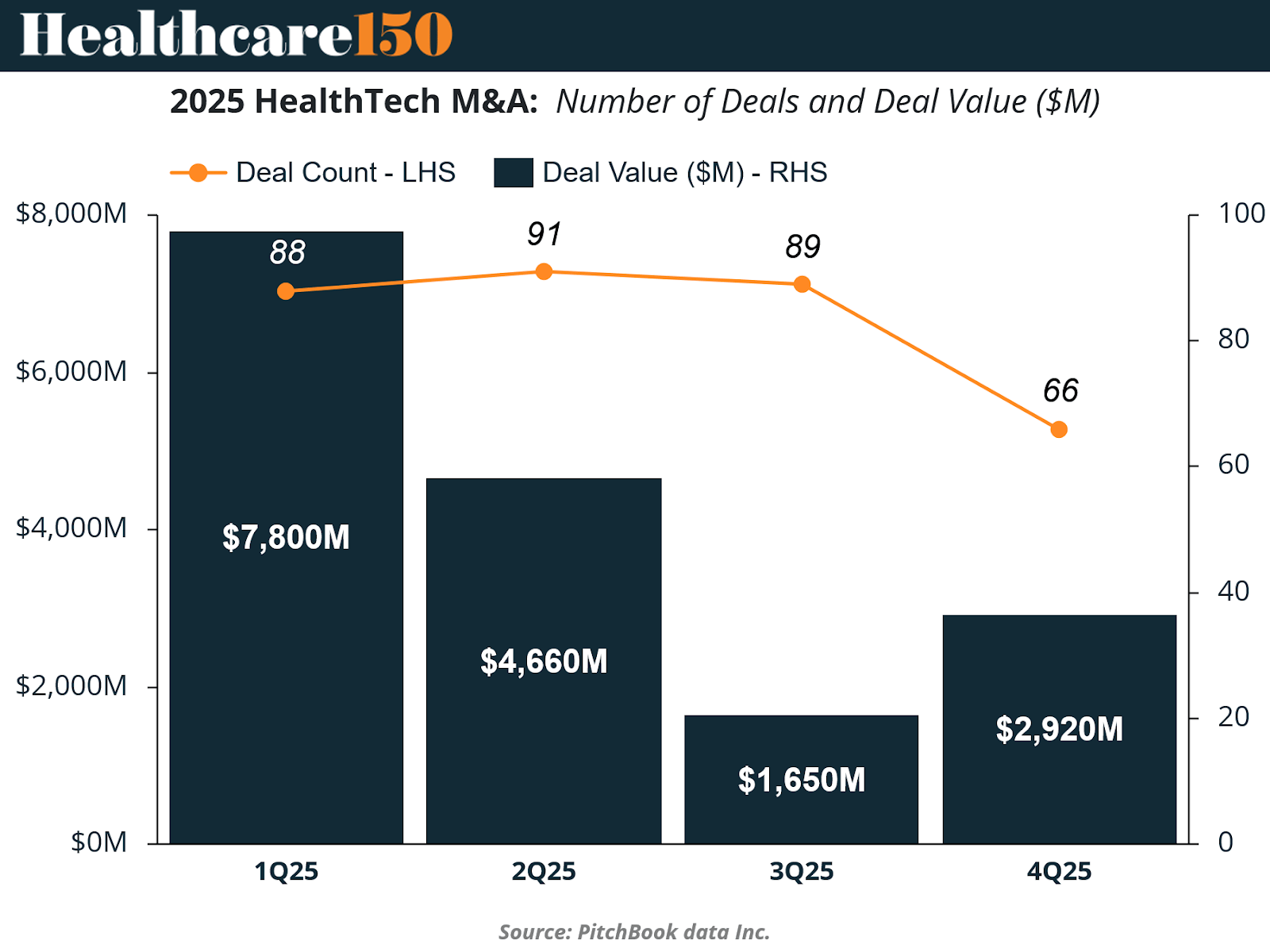

The quarterly cadence of HealthTech M&A activity in 2025 revealed a market shaped by front-loaded value and late-year selectivity. Aggregate deal value peaked early in the year, driven by one or two outsized transactions, while deal counts remained relatively stable through mid-year before declining meaningfully in the fourth quarter.

This divergence between deal value and deal volume highlighted the increasing concentration of capital among a small number of strategic transactions. While buyers remained active throughout the year, many deferred discretionary acquisitions as valuation expectations remained misaligned and financing conditions tightened incrementally. By the fourth quarter, fewer processes reached signing, reflecting heightened diligence standards and narrower buyer universes.

From an advisory and execution standpoint, 2025 reinforced the importance of transaction timing. Assets brought to market in the first half of the year benefited from stronger buyer engagement, more competitive processes, and greater certainty of financing. Conversely, late-year processes often encountered elongated timelines and increased pricing pressure.

For sponsors and corporate development teams, the lesson was clear: successful deal execution increasingly required alignment between market windows, internal readiness, and strategic urgency rather than reliance on sustained market liquidity.

Deal Size Dynamics and Valuation Polarization

Median deal sizes and post-transaction valuations in HealthTech exhibited pronounced volatility throughout 2025, culminating in a sharp fourth-quarter increase. Earlier in the year, median metrics remained subdued, reflecting a market characterized by caution, incremental acquisitions, and smaller bolt-on transactions.

The late-year surge in median deal size and valuation was not driven by an increase in transaction volume, but rather by the closing of a limited number of high-impact, strategically essential deals. These transactions involved assets with demonstrated category leadership, regulatory clarity, and strong economic profiles, enabling buyers to justify premium pricing despite broader valuation discipline.

This pattern highlighted a growing valuation bifurcation within HealthTech M&A. Top-tier assets continued to command premium multiples, while the broader universe of companies faced compressed valuations and limited exit optionality. For sellers, this reinforced the importance of differentiation and scale. For buyers, it emphasized the need to underwrite not just growth potential, but integration feasibility and margin durability.

3. HealthTech is one of the VC`s Favorite Investment Verticals

Venture Capital’s Largest Bets of 2025

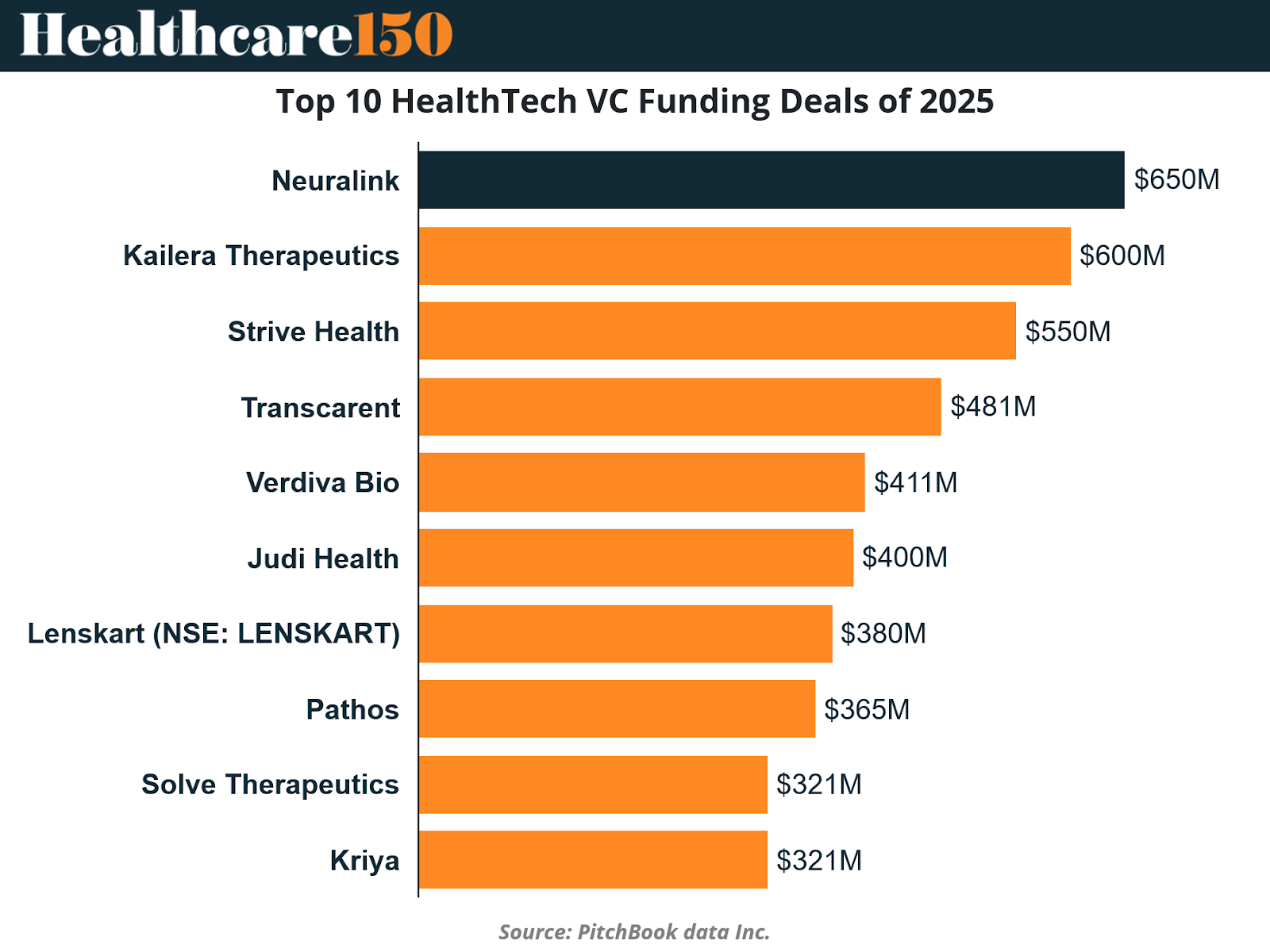

Venture capital investment in HealthTech during 2025 remained highly concentrated, with the largest funding rounds absorbing a disproportionate share of total dollars deployed. The year’s top VC transactions—led by companies such as Neuralink and Kailera Therapeutics—highlighted investor willingness to commit substantial capital to platforms perceived as category-defining or technologically transformative.

These large rounds were predominantly late-stage financings, often structured to extend runway rather than accelerate aggressive expansion. Investors prioritized capital efficiency, regulatory progress, and clear paths to commercialization or strategic exit. Notably, many of these companies operated in therapeutics, diagnostics, or infrastructure-adjacent segments rather than pure software, reflecting renewed interest in assets with defensible IP and clinical relevance.

For emerging HealthTech companies, the implications were stark. Access to capital in 2025 was increasingly contingent on scale, traction, and credibility. Early-stage companies without clear differentiation or near-term milestones faced a far more constrained fundraising environment.

VC Activity by Quarter: Dollars Resilient, Counts Declining

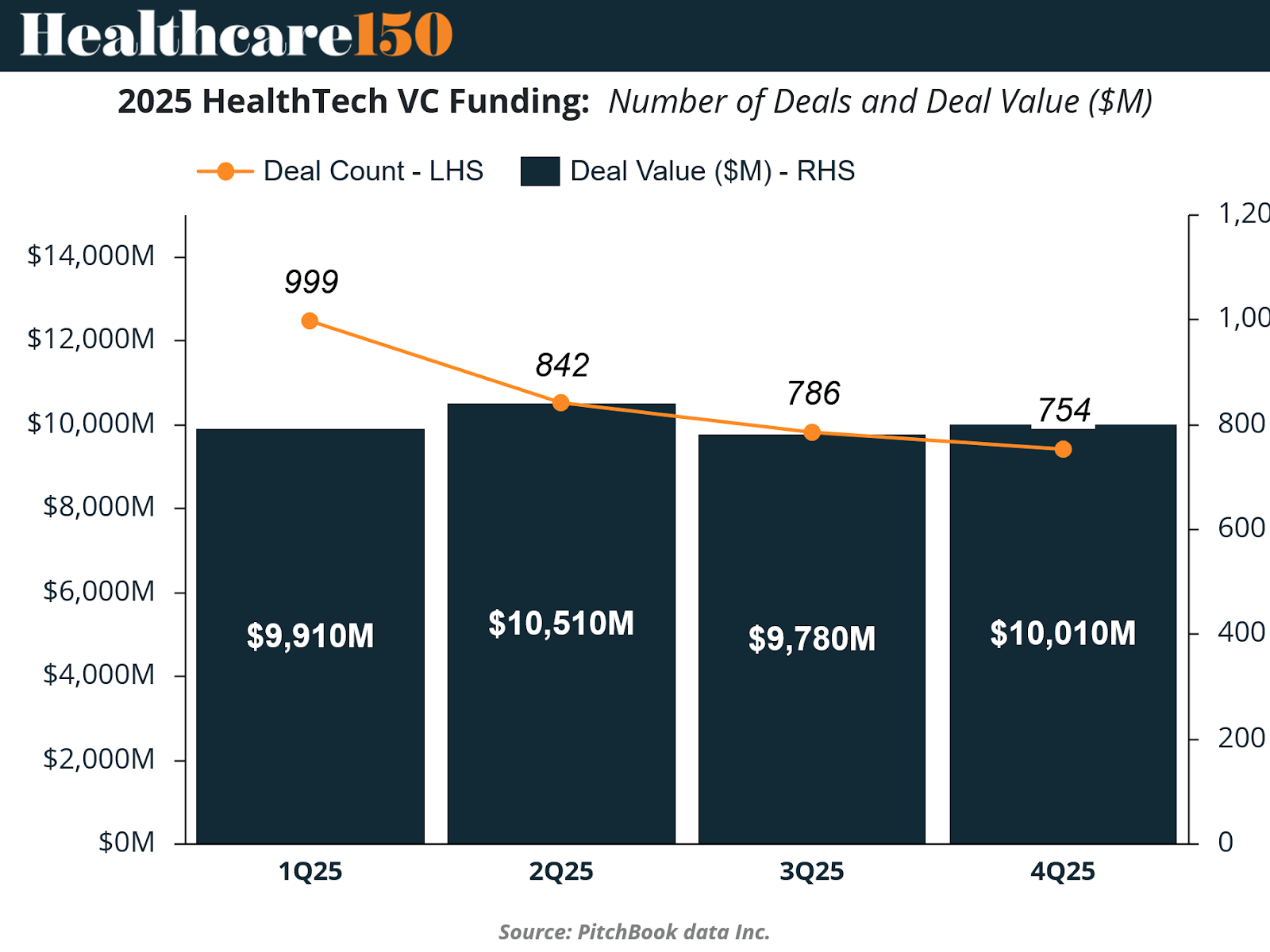

Quarterly venture funding data from 2025 illustrated a persistent divergence between capital deployed and deal volume. While total dollars invested remained relatively stable across quarters, deal counts declined steadily over the course of the year, reaching their lowest levels in the fourth quarter.

This pattern reflected continued investor consolidation around fewer, higher-conviction bets. Funds prioritized supporting existing portfolio companies and selectively backing later-stage opportunities, while reducing exposure to early-stage experimentation. As a result, average deal sizes increased even as overall activity slowed.

For venture investors, 2025 reinforced the importance of portfolio triage and capital concentration. For founders, it underscored the necessity of demonstrating tangible progress and capital efficiency to secure follow-on financing.

VC Deal Sizes and Valuation Trends

Median venture deal sizes and post-money valuations increased modestly through mid-2025 before stabilizing in the second half of the year. This trend reflected a normalization of pricing after several years of volatility, with investors anchoring valuations to revenue, regulatory progress, and defensible differentiation.

Unlike the M&A market, where valuation dispersion widened, venture valuations exhibited greater consistency, albeit at more conservative levels than prior peaks. The data suggested a market that had largely recalibrated expectations and established a more sustainable pricing framework.

Structural Growth in HealthTech Workforce Solutions

The decade-long capital deployment trends culminating in 2025 reveal that HealthTech workforce solutions evolved from a niche enablement layer into core healthcare infrastructure. Venture investment across all four subcategories expanded materially between 2015 and 2025, but the magnitude and composition of that growth offer critical insight into how investors redefined “mission-critical” healthcare technology over the period.

Medical record systems experienced the highest growth multiple, expanding from approximately $0.2 billion in cumulative venture investment in 2015 to $1.3 billion by 2025, representing a 7.7x increase. This growth reflects the sustained monetization of interoperability, clinical workflow digitization, and compliance-driven adoption following regulatory mandates and value-based care expansion. Importantly, by 2025, this category had largely transitioned from greenfield innovation to platform consolidation, making it especially attractive for strategic M&A and private equity roll-up strategies rather than early-stage venture formation.

Outcome management platforms similarly demonstrated outsized growth, increasing from $0.1 billion to $0.6 billion, a 5.2x expansion over the decade. This trajectory mirrors the healthcare system’s increasing reliance on longitudinal performance measurement, risk adjustment, and population health analytics. While smaller in absolute dollar terms, outcome management attracted premium investor interest in 2025 due to its direct linkage to reimbursement optimization and payer-provider alignment—key underwriting considerations for both sponsors and strategic acquirers.

Enterprise systems absorbed the largest absolute increase in capital, rising from $1.2 billion in 2015 to $5.7 billion in 2025, despite a comparatively lower 4.9x growth multiple. This reflects the category’s early maturity and scale, as well as sustained demand for end-to-end operational infrastructure spanning scheduling, staffing, revenue cycle, and analytics.

In 2025 dealmaking, enterprise platforms were disproportionately represented among large-cap M&A and sponsor-backed platform acquisitions, given their sticky revenue profiles and high switching costs.

Decision risk analysis exhibited the most modest growth multiple at 2.5x, expanding from $1.1 billion to $2.7 billion. This comparatively slower growth suggests that while decision-support tools became embedded within enterprise workflows, standalone risk analytics platforms faced commoditization pressure and longer sales cycles.

Investors in 2025 increasingly favored integrated decision-support capabilities over point solutions, shaping both valuation outcomes and acquisition strategies.

Collectively, these trends explain why workforce enablement and enterprise infrastructure remained among the most resilient and strategically valuable HealthTech categories in 2025. Capital flowed not merely toward innovation, but toward systems that reduced labor friction, improved throughput, and directly influenced margin performance—a defining characteristic of HealthTech dealmaking in a post-reset investment environment.

Capital Allocation by Venture Stage

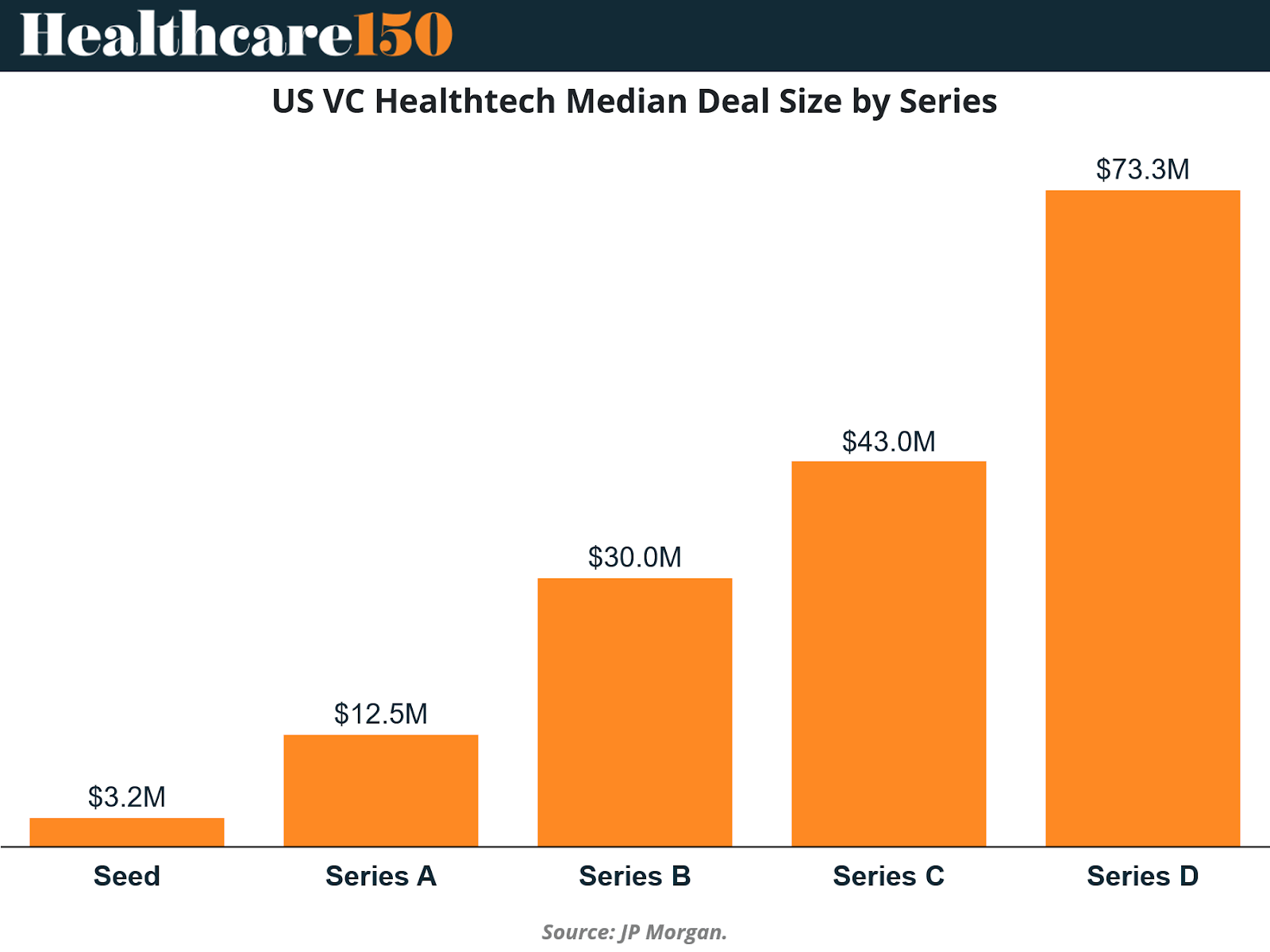

Median venture deal sizes in HealthTech during 2025 exhibited an exceptionally steep capital gradient across financing stages, underscoring a market that had become structurally skewed toward scale and late-stage de-risking. Seed-stage rounds recorded a median deal size of approximately $3.2 million, while Series A financings increased to $12.5 million, indicating a fourfold step-up even at the earliest institutional transition point. This early-stage differential already signaled heightened capital requirements for validation and a rising bar for progression beyond initial proof-of-concept.

The capital escalation accelerated materially at later stages. Median Series B rounds reached $30.0 million, more than doubling Series A levels, while Series C financings expanded further to $43.0 million. By Series D, median deal sizes surged to $73.3 million, reflecting both increased capital intensity and investor preference for funding companies with established revenue, regulatory clarity, and defensible market positions. In aggregate, the median Series D round in 2025 was more than 22x larger than the median seed financing, a stark illustration of the widening capital gulf across the venture lifecycle.

This stage-based polarization carried significant implications for the HealthTech ecosystem. Early-stage startups faced mounting pressure to demonstrate clinical validation, customer traction, and reimbursement alignment earlier than in prior cycles, often with limited capital. Conversely, late-stage companies benefited from investors’ willingness to deploy large amounts of capital to consolidate category leadership, fund international expansion, or position for strategic exit or IPO optionality.

From an investor perspective, the data explains the declining seed-to-Series A conversion rates observed in 2025 and the growing emphasis on insider-led bridge rounds. For founders, the environment elevated the strategic importance of capital efficiency, milestone-driven fundraising, and partnerships with incumbents capable of accelerating validation. For corporate acquirers and private equity sponsors, the pronounced escalation in late-stage deal sizes reinforced the attractiveness of pre-emptive M&A as an alternative to competing in increasingly expensive growth-stage rounds.

Seed Activity: Persistent Volume, Limited Dollars

Seed-stage activity remained a defining feature of the HealthTech venture ecosystem through 2025, but the data reveal a persistent and widening disconnect between deal volume and capital allocation. While seed rounds consistently represented a significant share of total deal count over the past decade, their contribution to total dollars invested remained structurally limited, underscoring the increasingly selective nature of capital progression beyond the earliest stages.

Between 2015 and 2021, annual seed deal counts expanded materially, rising from 254 transactions in 2015 to a peak of 782 deals in 2021. Over this period, seed rounds accounted for approximately 30%–31% of total HealthTech deal volume, reflecting a robust pipeline of early-stage formation. However, even at peak activity, seed-stage investments captured only 5%–8% of total capital deployed, highlighting an early and persistent capital imbalance within the ecosystem.

Following the 2021 peak, seed deal counts declined steadily, falling to 743 deals in 2022, 568 in 2023, 500 in 2024, and 381 deals in 2025. By 2025, seed rounds represented approximately 22% of total HealthTech deals, down nearly ten percentage points from peak levels. Notably, seed-stage share of total dollars remained constrained at approximately 6%, indicating that reduced activity did not translate into higher relative funding per company.

This dynamic illustrates a structural bottleneck in HealthTech capital formation. While investors continued to seed innovation, follow-on capital became increasingly concentrated, forcing many early-stage companies into extended seed phases, insider-led bridge rounds, or strategic partnerships to survive.

For founders, the data reinforced the importance of capital efficiency, early commercial validation, and alignment with acquirers or strategic partners. For investors and acquirers, the shrinking seed funnel in 2025 suggested a future pipeline that may be narrower but more disciplined—potentially reshaping innovation velocity and acquisition dynamics in subsequent cycles.

Mega-Deals and Capital Concentration

Mega-deals emerged as one of the most defining structural features of HealthTech capital deployment over the decade culminating in 2025, reflecting a market increasingly oriented around scale, capital efficiency, and category dominance. While mega-deals consistently represented a small fraction of total transaction volume, their share of total dollars invested expanded materially, underscoring a pronounced concentration of capital at the upper end of the market.

From 2015 through 2019, mega-deal activity remained limited, with annual counts ranging from 6 to 16 transactions and accounting for just 1% of total HealthTech deals. During this period, mega-deals captured between 14% and 26% of total dollars invested, indicating that even at low volumes, large transactions already exerted outsized influence on aggregate capital flows. This early concentration foreshadowed the structural shift that would accelerate in subsequent years.

The inflection point occurred in 2020 and 2021, as mega-deal counts surged to 46 transactions in 2020 and peaked at 119 in 2021. In 2021, mega-deals represented approximately 5% of total deal volume, yet accounted for an extraordinary 50% of all HealthTech dollars invested. This level of concentration marked a decisive departure from historical norms and reflected aggressive late-stage financing, platform consolidation, and the emergence of multi-billion-dollar enterprise and therapeutics companies.

Although mega-deal counts moderated following the 2021 peak, concentration remained structurally elevated. Between 2022 and 2025, annual mega-deal counts stabilized between 48 and 69 transactions, while their share of total dollars consistently ranged from 35% to 42%. In 2025 specifically, mega-deals represented approximately 3% of total transactions but captured 42% of total capital, reinforcing the enduring premium placed on late-stage maturity and category leadership even in a more disciplined investment environment.

For investors and acquirers, this sustained concentration carried clear implications. Capital allocation increasingly favored companies with proven scalability, regulatory clarity, and credible exit pathways, while mid-stage and subscale assets faced heightened capital scarcity. For private equity sponsors and strategic buyers, the data validated continued emphasis on platform-scale investments and pre-emptive acquisitions, as competing for assets at mega-deal scale became both capital-intensive and strategically consequential.

Conclusion

HealthTech dealmaking in 2025 ultimately reflected a market that had completed its structural reset and entered a more durable, execution-driven phase of capital allocation. Across both M&A and venture markets, capital availability was not the binding constraint; rather, capital discipline, scale requirements, and proof of economic relevance dictated outcomes. The year was characterized by pronounced polarization—between large and small transactions, late- and early-stage companies, and category leaders versus subscale challengers.

On the M&A front, fewer but materially larger transactions reinforced the premium placed on scale, defensibility, and strategic indispensability. Acquirers—both corporate and sponsor-backed—demonstrated a clear willingness to pay for assets that could be integrated quickly, support adjacency expansion, or anchor long-term platform strategies. Conversely, companies lacking differentiation or operating leverage faced extended timelines and valuation pressure. Timing also emerged as a critical determinant of success, with early-year processes benefiting from stronger buyer engagement than those launched later in the year.

In venture markets, 2025 cemented a capital structure increasingly skewed toward late-stage deployment. While seed activity remained meaningful in absolute terms, the persistent gap between deal volume and capital allocation underscored growing friction in the innovation-to-scale transition. Mega-deals absorbed a disproportionate share of dollars, reinforcing a market that rewarded maturity, category leadership, and de-risked business models.

Taken together, the data from 2025 suggest that HealthTech has entered a phase where strategic clarity, capital efficiency, and integration readiness matter more than narrative momentum. For investors, sponsors, and corporate development teams, success going forward will depend less on market beta and more on disciplined selection, operational execution, and proactive portfolio construction in an increasingly selective dealmaking environment.

Sources & References

Fierce. (2025). Digital health leans on unlabeled rounds as front-runners mop up funds: Rock Health. https://www.fiercehealthcare.com/digital-health/rock-health-q3-report

Healthcare Dive. (2025). Digital health funding outpacing last year as huge rounds increase: report. https://www.healthcaredive.com/news/digital-health-funding-2025-outpacing-2024-q3-rock-health/802330/

JP Morgan. (2025). Healthtech sector spotlight: Investment trends and opportunities. https://www.jpmorgan.com/insights/markets-and-economy/outlook/2025-healthtech-trends

JP Morgan. (2025). Sector Spotlight: Healthcare Technology. https://www.jpmorgan.com/content/dam/jpmorgan/documents/cb/insights/outlook/jpm-sector-spotlight-healthcare-technology-final-ada.pdf?utm_source=www.healthcare150.com&utm_medium=newsletter&utm_campaign=what-s-holding-healthcare-back-from-ai-adoption&_bhlid=fdf56f3d6544c93f7838af073d7fb1ded499dca9

JP Morga. (2025). Top trends from the 2025 Healthcare Advisory Council. https://www.jpmorgan.com/insights/banking/commercial-banking/how-ai-m-and-a-and-policy-planning-are-shaping-health-care

PitchBook. (2025). Healthcare Outlook. https://pitchbook.com/news/reports/2026-healthcare-outlook

PitchBook. (2025). Healthtech VC Trends. https://pitchbook.com/news/reports/q3-2025-healthtech-vc-trends

PitchBook – NVCA. (2025). The definitive review of the US venture capital ecosystem. https://nvca.org/wp-content/uploads/2025/07/Q2-2025-PitchBook-NVCA-Venture-Monitor-19728.pdf

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.