- Healthcare 150

- Posts

- Borders, Bundles, $111B: Medical Tourism’s M&A Magnet

Borders, Bundles, $111B: Medical Tourism’s M&A Magnet

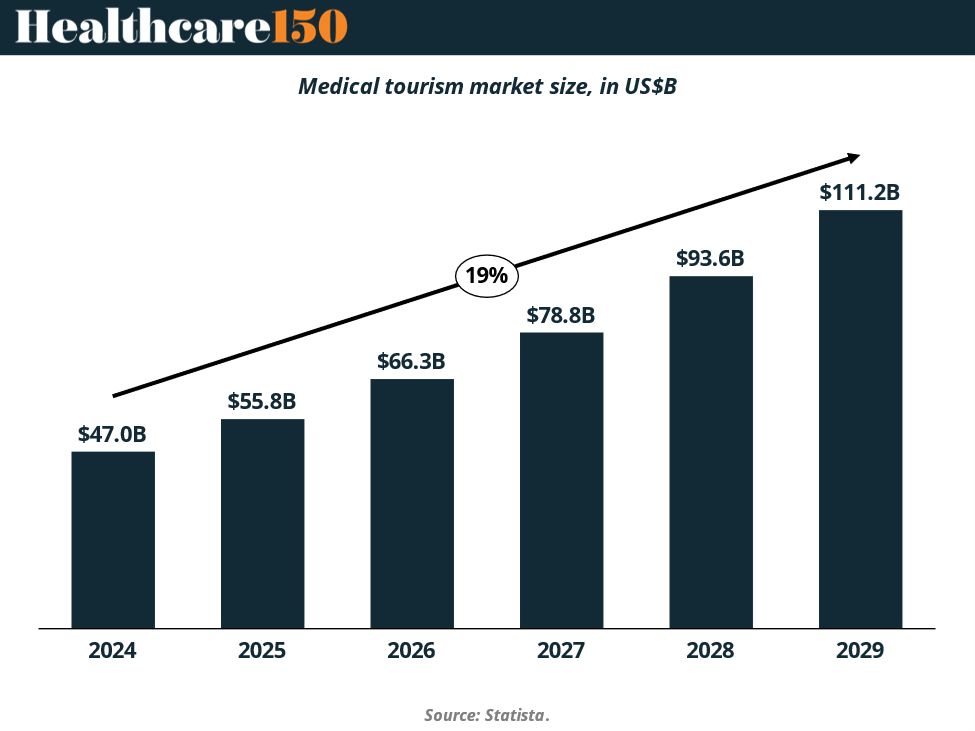

With a 19 % CAGR and widening cost-quality arbitrage, destination hospitals, facilitator platforms, and insurer-backed travel bundles are now prime roll-up targets.

Good morning, ! This week we’re diving into the sustained growth of Medical Tourism, the new Siemens Healthineers tech model for managing cardiovascular disease, Waters Corp is merging with BDS Biosciences and Diagnostic Solutions in a $17.5B deal.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

Medical Tourism’s $111B Growth Curve Has Entered the Chat

Turns out, healthcare isn’t just expensive—it’s also increasingly exportable. The global medical tourism market is set to more than double from $47B in 2024 to $111B by 2029, with 19% CAGR fueling a border-blurring boom. North America leads (26%), but Asia Pacific (22%) is gaining ground fast—Thailand, India, and Malaysia are now hubs for hip replacements and fertility fixes. And forget spa days—55% of medical travelers come for full-on treatments, not just Botox.

Why do people travel for healthcare? Simple: cost, quality, and a side of vacation. Also: insurance gaps, tech access, and TikTok-worthy recovery suites. The playbook is clear—high-income countries export patients, and emerging markets import economic growth.

TREND OF THE WEEK

Margins March On

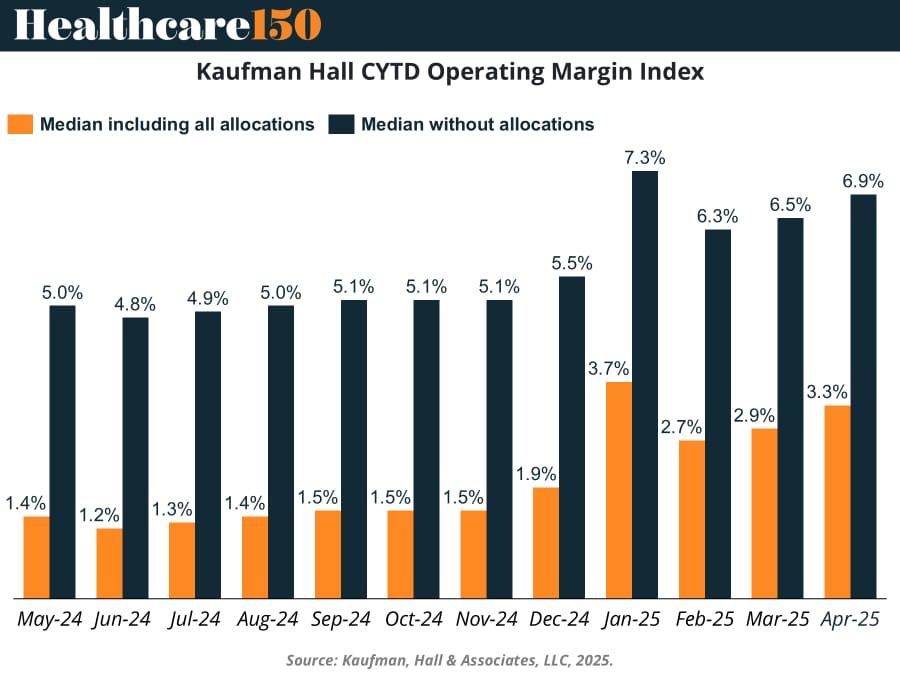

Hospitals posted a steady climb in calendar-year operating margins through April: 3.7% in January, sliding to 2.7% in February, then rebounding to 2.9% in March and 3.3% in April when including allocations. Excluding allocations, margins hit 6.9%, a 6% year‑over‑year y‑o‑y boost compared to early 2024. This upswing is no accident—it’s driven by a 7% lift in daily revenue, smarter patient throughput, and reduced average length of stay. It’s like hospitals sprinting a marathon, shedding excess baggage along the way—and getting rewarded with a fatter bottom line.

For insurers and deal‑makers: healthy margins signal PE attractiveness but lurking Medicaid cuts and tariffs could foul the track ahead. (More)

PRESENTED BY ATTIO

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

MARKET MOVERS

Company (Ticker) | Last Price | 5D |

Eli Lilly and Company (LLY) | $ 768.73 | -0.37% |

Johnson & Johnson (JNJ) | $ 165.69 | 6.78% |

Novo Nordisk A/S (NVO) | $ 66.13 | -1.65% |

Roche Holding AG (ROG.SW) | $ 317.89 | -0.55% |

AbbVie Inc. (ABBV) | $ 186.19 | -0.11% |

HEALTHTECH CORNER

Germany’s Cardiac Beta Test

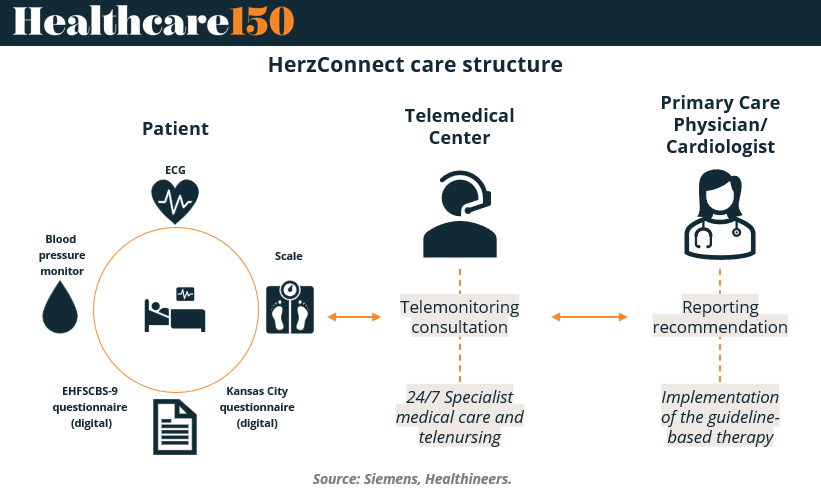

Siemens Healthineers is piloting a new model for managing cardiovascular disease, and Germany is the test lab. HerzConnect, now deployed across five federal states, integrates cardiologists, GPs, clinics, and patients through a shared digital platform. The goal? To tackle fragmented care and improve outcomes post-discharge—when many cardiac patients fall through the cracks. The program includes real-time diagnostics, AI-driven risk scoring, and the introduction of “cardio-coaches” who help patients stick to treatment plans. Early signals show better coordination, faster follow-ups, and higher adherence. If it scales, HerzConnect could reshape chronic care delivery—no unicorn valuations required. (More)

TOGETHER WITH ATTIO

AI native CRM for the next generation of teams

Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

Join fast growing teams like Flatfile, Replicate, Modal, and more.

DEAL OF THE WEEK

Waters’ $17.5B Play to Bulk Up in Life Sciences

Waters Corp. is betting $17.5 billion on scale—and structure. By merging with BD’s Biosciences and Diagnostic Solutions via a Reverse Morris Trust, Waters gains size, scope, and a dose of shareholder skepticism. The tax-friendly move gives BD shareholders 39.2% of the newco, plus a $4B cash dividend.

Strategically, this marries Waters’ analytical tools with BD’s diagnostics heft, creating an end-to-end life sciences machine. But investors weren’t thrilled—Waters stock dipped on fears over debt, dilution, and integration risk.

Still, this puts Waters in the consolidation ring alongside Thermo, Danaher, and Agilent—all chasing the same thing: platform power in diagnostics and R&D. (More)

REGIONAL FOCUS

Regional Focus: M&A Momentum in APAC Healthcare Slows, But Balances

Deal volume in APAC’s healthcare sector is stabilizing—but with notable shifts under the surface. In 2H24, Pharma and Life Sciences M&A clearly led the region with 371 deals, outpacing Health Services by 15%. Fast-forward to 1H25, and the two categories are nearly neck and neck: 323 vs 316 deals.

This convergence signals two things: (1) cooling interest in life sciences after a heated post-pandemic rebound, and (2) rising appetite for scalable, service-driven platforms in care delivery.

Why this matters: In a region where health infrastructure and life expectancy are climbing in tandem, investors are recalibrating. The sector shift from biopharma bets toward operational health services mirrors the growing demand for regional rollups, digital health integrations, and outpatient models.

Deal Volume Drop: Pharma M&A volume declined 13% in the last half-year, while Health Services dipped just 2%—underscoring shifting risk tolerance. (More)

INTERESTING ARTICLES

"In the middle of every difficulty lies opportunity."

Albert Einstein