- Healthcare 150

- Posts

- Medical Tourism: A Global Healthcare Market on the Rise

Medical Tourism: A Global Healthcare Market on the Rise

In recent years, medical tourism has emerged as one of the fastest-growing segments in the global healthcare economy.

Introduction

At its core, medical tourism refers to the practice of patients traveling across international borders to access medical treatment—ranging from elective surgeries and dental procedures to complex treatments such as cancer therapy, fertility services, and organ transplants. What was once seen as a marginal solution for those seeking cosmetic procedures or lower-cost surgeries abroad has evolved into a mainstream option for millions of patients worldwide.

Several factors have contributed to this shift. In high-income countries, rising healthcare costs, limited insurance coverage, and long wait times have driven patients to seek timely and affordable care elsewhere. Simultaneously, healthcare providers in emerging markets have made significant investments in medical infrastructure, talent acquisition, and global accreditation, creating centers of excellence capable of delivering high-quality care at a fraction of the cost. Add to this the growing accessibility of international travel, increased health literacy, and the digitalization of patient-provider communication, and the foundation for a booming cross-border healthcare economy becomes clear.

Today, medical tourism is not only a cost-saving option—it is also increasingly about access to specialized expertise, integrated recovery experiences, and personalized care that may not be available locally. For countries with robust healthcare offerings and competitive pricing—such as India, Mexico, Turkey, Thailand, and Costa Rica—the sector has become a vital source of economic activity, contributing to both GDP growth and the expansion of related industries like hospitality, wellness, and pharmaceuticals.

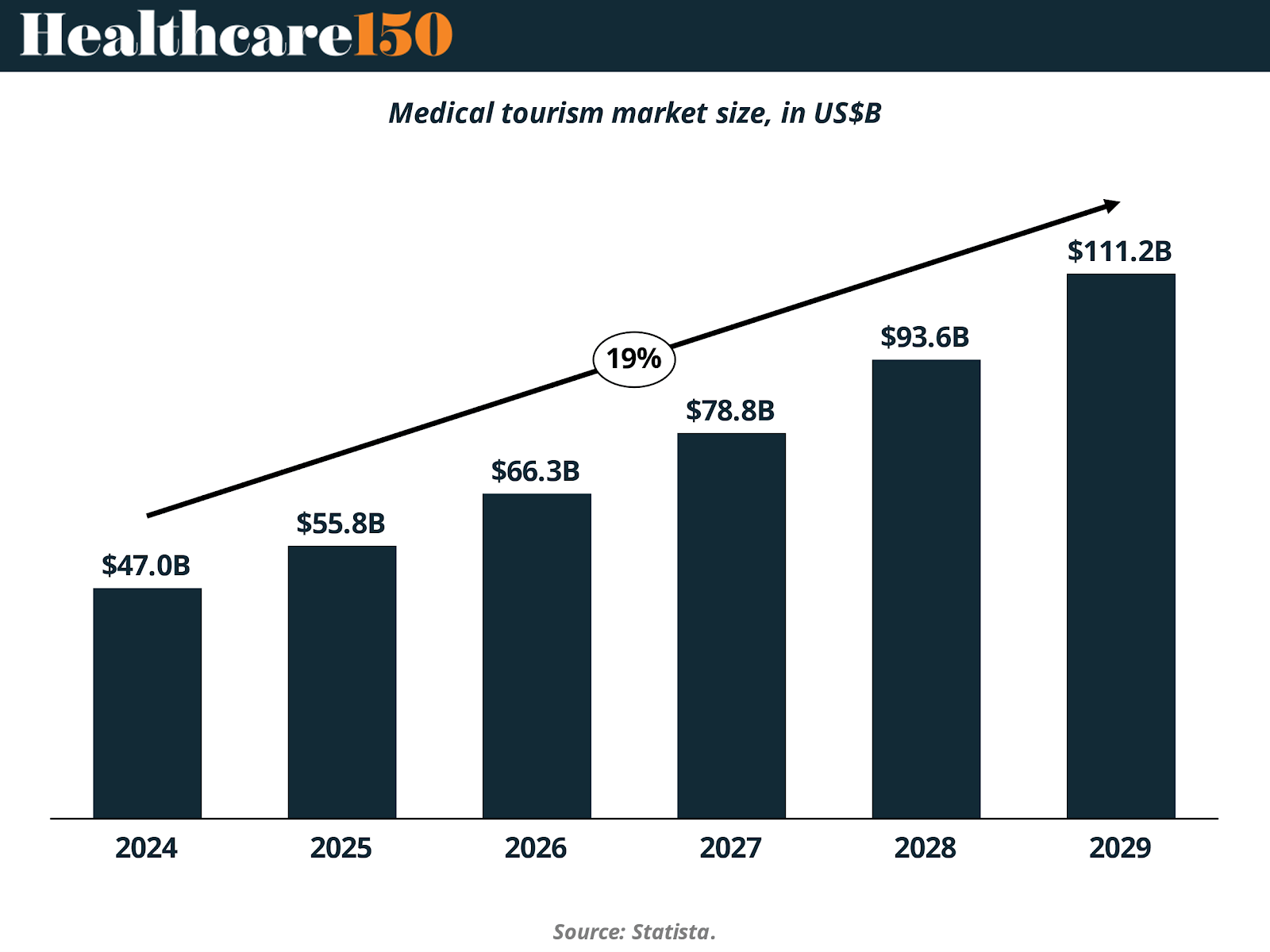

This momentum is clearly reflected in the numbers. According to Statista, the global medical tourism market is projected to grow from $47.0 billion in 2024 to $111.2 billion by 2029, representing a compound annual growth rate (CAGR) of 19%. This more than doubling of market size in just five years underscores the sector’s transformation from niche alternative to cornerstone of globalized healthcare. As the patient journey continues to transcend borders, understanding the forces behind this growth—and the implications for providers, payers, and policymakers alike—has never been more important.

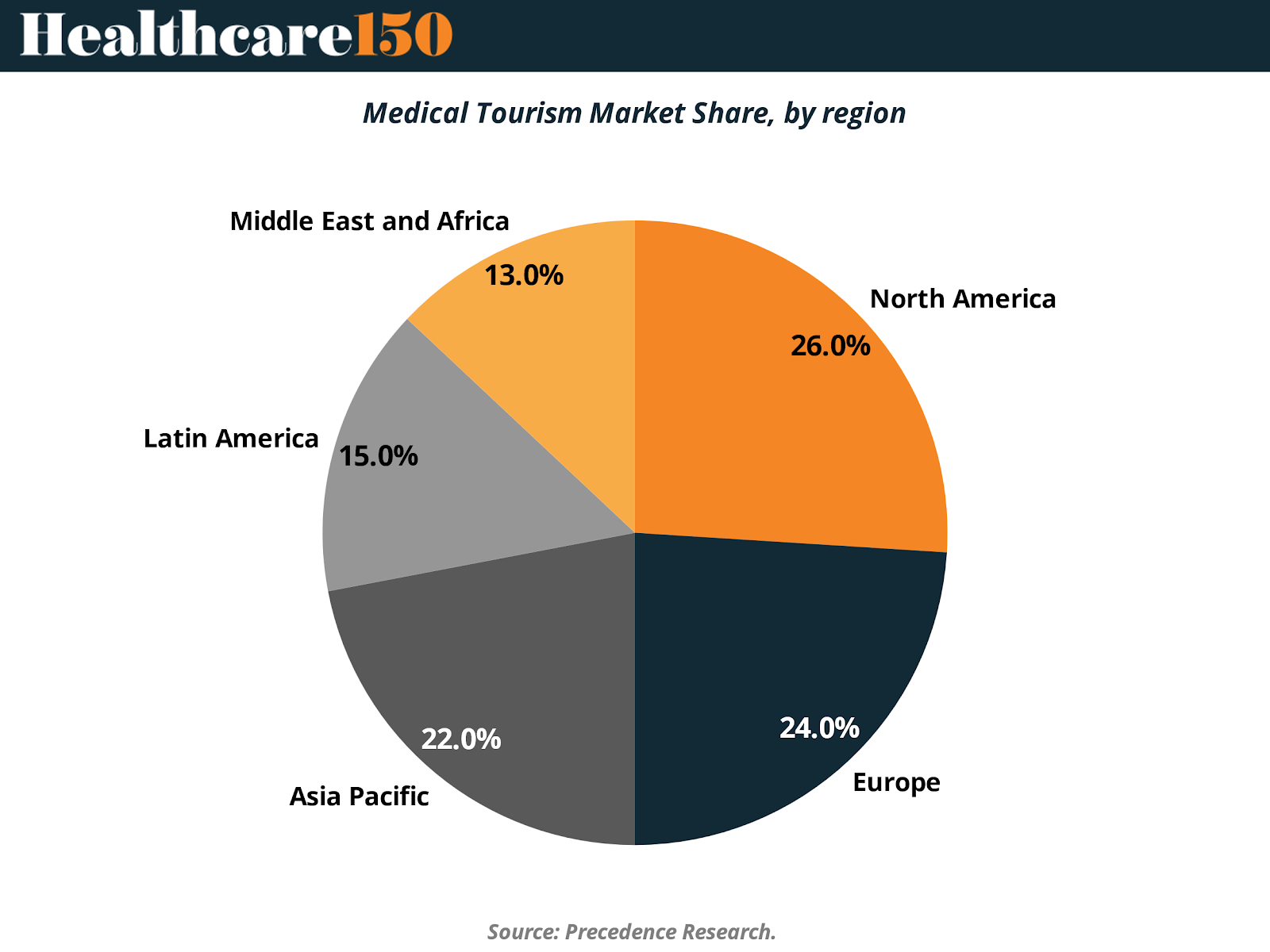

As medical tourism continues to gain global traction, the distribution of market share across regions offers a window into how both patient demand and healthcare infrastructure are evolving worldwide. According to recent data, North America currently holds the largest share of the global medical tourism market in 2024, accounting for 26% of total activity. It is followed closely by Europe (24%) and Asia Pacific (22%), with Latin America and the Middle East & Africa (MEA) holding 15% and 13%, respectively.

North America’s leading position reflects a dual reality: while the U.S. is a key source of outbound patients—seeking more affordable care abroad—it also remains a destination for complex and specialized treatments.

Europe’s robust performance is driven by its mix of public and private systems, medical excellence in countries like Germany and Spain, and ease of travel within the EU. For intra-European patients, medical tourism is often about avoiding wait times or accessing specialized elective care unavailable in their home country.

Asia Pacific stands out as a fast-growing region, driven by competitive pricing, skilled medical professionals, and strong government backing. Countries like Thailand, India, and Malaysia have become global hubs for procedures such as orthopedic surgery, fertility treatments, and wellness care—offering a compelling mix of affordability, quality, and destination appeal.

Latin America’s 15% share is bolstered by proximity to North America and a growing reputation for dental, cosmetic, and bariatric procedures. Mexico, Costa Rica, and Colombia are seeing an influx of patients drawn by convenience, affordability, and relatively high standards of care.

Lastly, the Middle East and Africa are beginning to carve out a more prominent role in the industry. The UAE—especially Dubai and Abu Dhabi—has launched targeted initiatives to build state-of-the-art medical facilities, attract internationally accredited providers, and market the region as a destination for luxury medical experiences.

This geographic breakdown reveals that medical tourism is no longer concentrated in just one corner of the world. Instead, it is a multi-regional story—shaped by local investment, international mobility, and patients’ increasing willingness to cross borders in search of value, speed, and quality.

Segmentation Analysis: By Healthcare Services

Rising Number of Medical Tourists Travelling for Medical Treatment Boosted Segment Growth

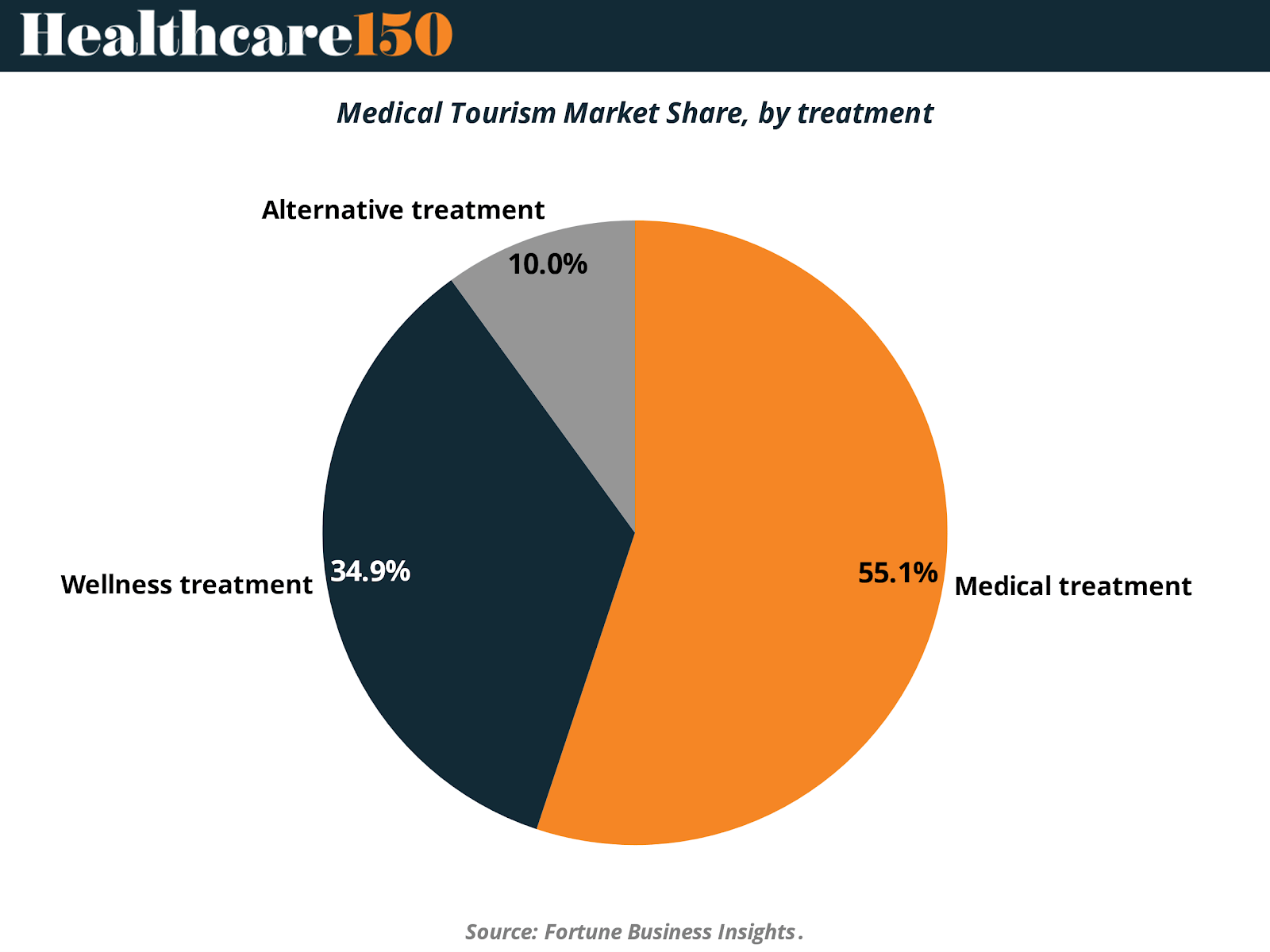

Medical tourism is not a one-size-fits-all industry. Patients travel for a wide array of health-related services, and segmenting the market by healthcare service type helps clarify where demand is most concentrated—and where it is gaining ground.

In 2024, medical treatment accounts for the largest share of the global medical tourism market, representing 55.1% of total activity. This dominance is driven largely by rising medical costs in high-income countries like the U.S. and Germany, prompting patients to seek more affordable—but still high-quality—care abroad. Countries such as Thailand, Malaysia, and India have emerged as hubs for dental, orthopedic, and cardiovascular procedures, offering advanced medical care at a fraction of the cost found in Western markets. According to the Malaysia Healthcare Travel Council, healthcare travel to Malaysia surged by 51.5% in 2022 compared to the prior year, with 850,000 travelers seeking treatment—a sign of growing momentum in the region.

The wellness treatment segment is also on the rise and is expected to register considerable growth over the coming years. This growth is fueled by increased global awareness and demand for cosmetic, rejuvenation, and anti-aging procedures. Destinations like South Korea have become top choices for international patients seeking aesthetic services. According to the Korea Herald, international arrivals for cosmetic procedures rose 26% between 2019 and 2023, reaching 114,074 patients in 2023.

Finally, the alternative treatment segment—covering services such as homeopathy, traditional therapies, and medical spas—is expected to grow at a modest pace. The expanding availability of these offerings in countries with strong wellness infrastructure is supporting steady, if more niche, demand.

This breakdown by treatment type highlights how the market is not only driven by cost-saving incentives, but also increasingly shaped by consumer wellness trends, elective care preferences, and cultural interest in alternative therapies.

Understanding Patient Motivation: Why Do People Travel for Healthcare?

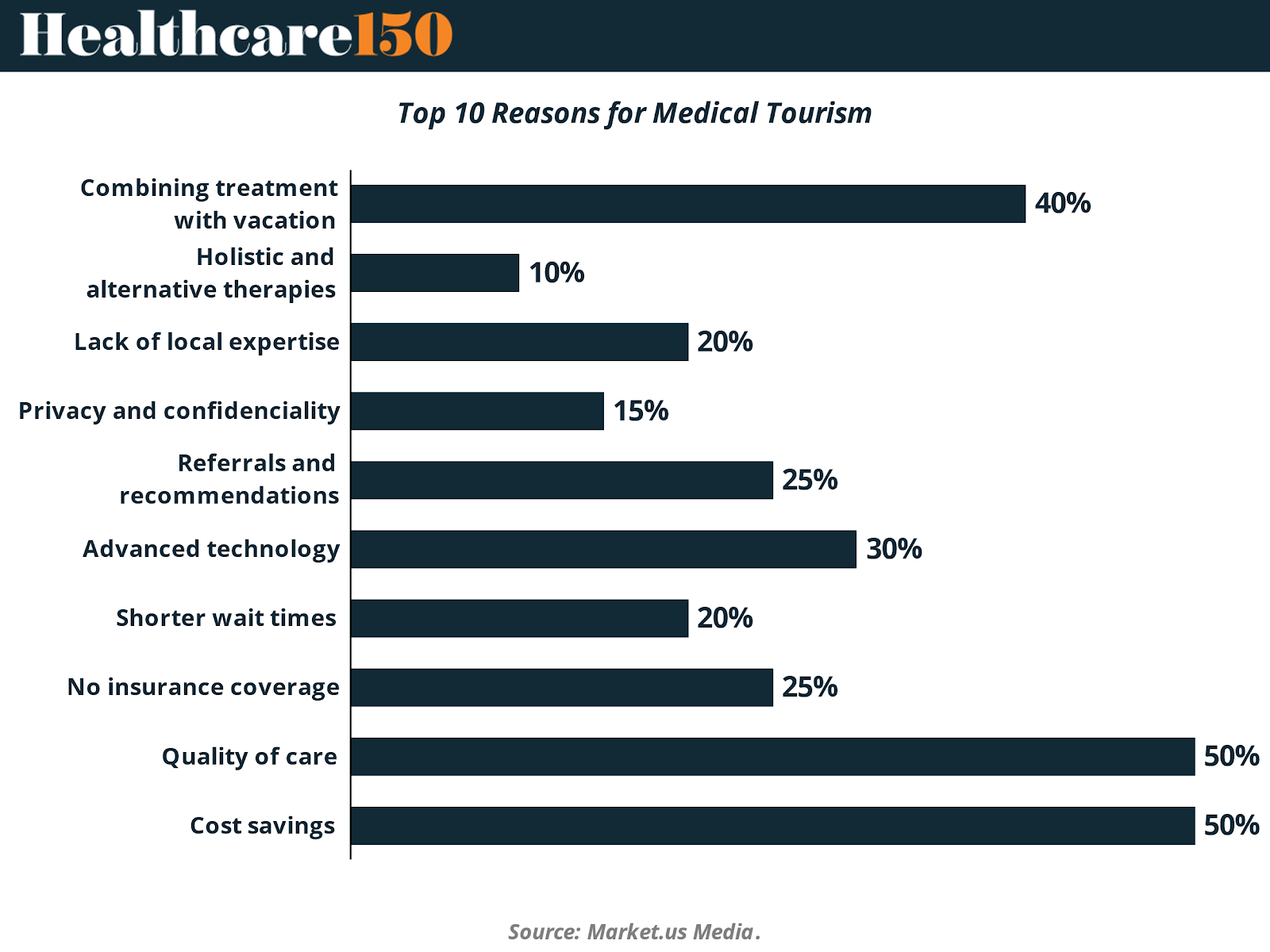

As medical tourism becomes more mainstream, understanding what truly drives patients to cross borders for care is essential for providers, policymakers, and investors alike. A recent survey highlights the top 10 reasons behind this growing trend—and while cost is a dominant factor, it is far from the only one.

At the top of the list, cost savings (50%) and quality of care (50%) are tied as the most cited reasons for seeking medical treatment abroad. This reflects the dual motivation many patients experience: the need to save money without sacrificing care standards. Countries like India, Mexico, and Turkey have emerged as top destinations by offering high-quality services at a fraction of Western prices.

The third most common driver is the desire to combine treatment with vacation (40%). Medical tourism is often intertwined with wellness and leisure, especially in countries like Thailand, Costa Rica, and the UAE, where recovery can be integrated with relaxing or scenic environments. This travel-meets-treatment appeal enhances the overall patient experience and often influences destination choice.

Technology and infrastructure also play a role, with 30% of respondents citing access to advanced technology as a key motivator. Patients seeking cutting-edge procedures, such as robotic surgery or fertility treatments, are often drawn to destinations known for medical innovation.

A lack of insurance coverage (25%), referrals from trusted sources (25%), and shorter wait times (20%) round out the mid-tier reasons. These findings reflect growing patient awareness and a greater willingness to proactively seek solutions beyond their domestic options—especially when local systems are overburdened or limited in scope.

Other notable factors include:

Lack of local expertise (20%) – Patients may travel abroad to access specialists or rare treatments unavailable in their home countries.

Privacy and confidentiality (15%) – For stigmatized or personal treatments, privacy concerns often lead patients to seek care elsewhere.

Interest in holistic or alternative therapies (10%) – Especially in Asia and Latin America, traditional medicine and wellness retreats continue to attract a niche segment of international patients.

Together, these insights reveal that the medical tourism decision is multi-dimensional. While price and quality remain foundational, factors like personal experience, convenience, trust, and even lifestyle are shaping how and where patients choose to access care.

Key Drivers of Growth: What’s Fueling the Rise of Medical Tourism?

The rapid expansion of the medical tourism market is no coincidence. Several interconnected forces are driving patients to seek care across borders, transforming the sector into a core component of global healthcare. These are the primary factors accelerating growth:

Cost Advantages in Destination Markets

The most consistent driver is cost savings. Medical procedures can cost 30% to 80% less in countries like India, Mexico, and Thailand compared to the U.S. or Western Europe, even after factoring in travel and accommodation. For patients facing high out-of-pocket expenses or limited insurance coverage, traveling abroad often becomes the most financially viable option.

Reduced Wait Times and Faster Access

In countries with public healthcare systems—such as Canada or the U.K.—patients may wait weeks or even months for non-emergency procedures. Medical tourism offers a fast-track alternative. Providers in medical tourism hubs have built business models around efficient scheduling and low-latency service, which appeals to time-sensitive patients.

Improved Quality and Global Accreditation

Destination countries have heavily invested in upgrading hospital infrastructure, training staff, and securing international certifications such as JCI (Joint Commission International). As quality and safety standards converge with global best practices, patient confidence in overseas treatment has grown significantly.

Ease of International Travel

The expansion of air travel routes and the relative affordability of flights have removed one of the main barriers to medical tourism. In regions like Latin America and Southeast Asia, proximity to key outbound markets (e.g., the U.S. or Australia) further supports travel-driven care decisions.

Digital Health and Pre-Treatment Engagement

Technology has made cross-border healthcare planning easier than ever. From teleconsultations to digital health records, patients can evaluate doctors, compare pricing, and initiate treatment plans before even leaving their country. This improved transparency and convenience lowers friction and builds trust.

Bundled Services and Integrated Wellness Experiences

Many medical tourism destinations now offer bundled packages that combine treatment with recovery stays in resorts or wellness centers. Countries like Costa Rica, Thailand, and Turkey are leveraging their tourism infrastructure to offer seamless medical + hospitality experiences, making the journey more attractive and comfortable.

Supportive Government Policies

Governments in countries like Malaysia, the UAE, and India have launched strategic initiatives to promote inbound medical tourism. This includes financial incentives for hospitals, national branding campaigns, and dedicated medical tourism agencies that coordinate efforts across sectors.

These drivers together are reshaping how healthcare is accessed, delivered, and financed. As more patients become proactive, digitally connected, and value-driven, the appeal of crossing borders for care is only expected to grow.

Challenges and Risks: What Could Slow the Momentum?

Despite its rapid growth, the medical tourism industry faces several structural and reputational risks that could limit its long-term potential.

First, legal uncertainty remains a core issue. Patients often have little protection if something goes wrong abroad, as malpractice laws and liability standards vary widely between countries. This can deter risk-averse travelers and raise ethical concerns.

Another challenge is continuity of care. Once patients return home, they may lack proper follow-up—especially if complications arise. This can compromise health outcomes and place pressure on local healthcare systems unfamiliar with the original procedure.

Quality inconsistencies are also a concern. While many top-tier facilities meet international standards, others may lack accreditation or qualified personnel, creating uneven care experiences.

Language and cultural barriers can further complicate diagnosis, treatment, and recovery—leading to potential misunderstandings or medical errors.

Lastly, there are rising concerns around data privacy, particularly with the increased use of telehealth and digital platforms. Ensuring secure and standardized handling of patient information is critical to maintaining trust.

As the industry scales, addressing these risks will be essential to building a resilient, high-trust medical tourism ecosystem.

Conclusion: A Global Patient Journey Redefined

Medical tourism is no longer a marginal or cost-saving workaround—it is a central pillar in the future of global healthcare delivery. What began as an alternative for elective procedures has evolved into a dynamic, multi-billion-dollar ecosystem connecting patients, providers, and policymakers across borders.

As this report shows, the industry’s expansion is fueled by a convergence of forces: rising costs in high-income countries, investments in world-class facilities across emerging markets, and a new generation of digitally connected, value-conscious patients. Market growth is also diversified—by geography, by treatment type, and by consumer motivation. Whether it is a patient from the U.S. seeking affordable cardiac surgery in India, or someone from Europe combining fertility treatment with a wellness retreat in Thailand, the patient journey is increasingly defined by choice, customization, and cross-border mobility.

Yet this momentum brings complexity. The success of the sector will depend on addressing risks around legal protection, continuity of care, quality control, and ethical oversight. Stakeholders will need to collaborate on setting clear standards and building trust across jurisdictions.

In the years ahead, countries that can offer a blend of medical excellence, affordability, convenience, and patient-centered experiences will emerge as global leaders. As healthcare continues to globalize, understanding and shaping this patient-driven transformation is not just an opportunity—it is a strategic imperative.

Sources and References:

Global Medical Tourism Overview

Medical Tourism Market Report

Medical Tourism Statistics

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.