- Healthcare 150

- Posts

- Beyond the Hype: What Health Systems are Actually Buying for 2026

Beyond the Hype: What Health Systems are Actually Buying for 2026

Hospitals hold 27% of the RCM market and BMS invests $1.5B in CAR T, while 77% of systems stall AI adoption due to maturity issues.

Good morning, ! This week we’re diving into the fast growing space of Revenue Cycle Management where hospitals hold for the 27% of market share by end use, Core business technologies stands for top investment priorities among health systems for 2026, North America holds the 54% of the Global Precision Medicine Market.

Want to advertise in Healthcare 150? Check out our self-serve ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

RCM’s $451B Revenue Engine

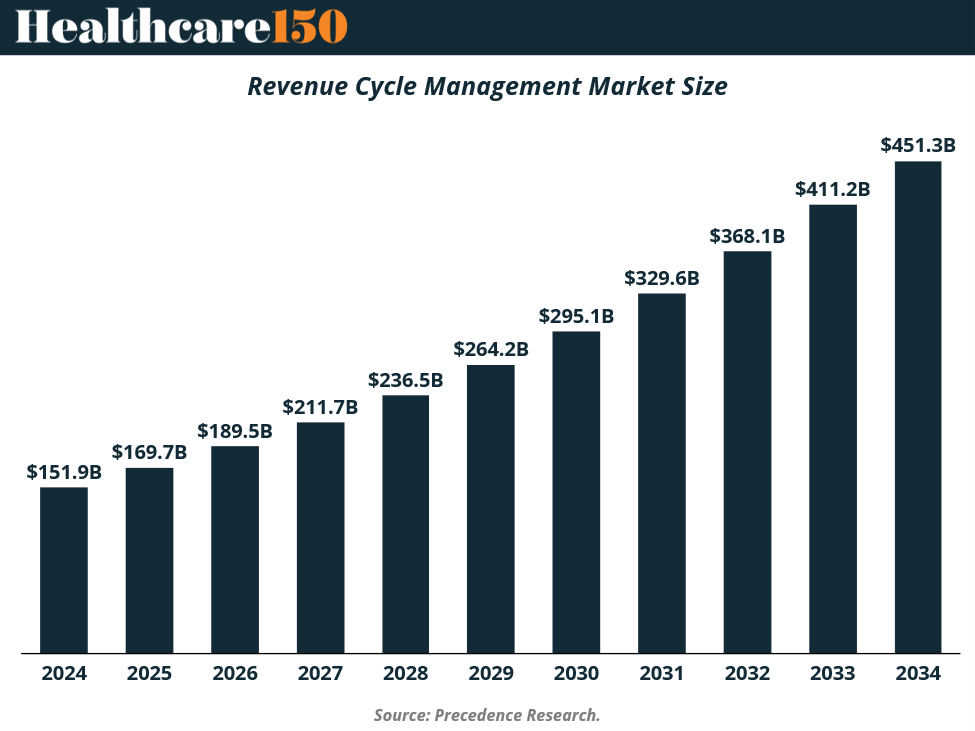

Revenue Cycle Management (RCM) is no longer back-office plumbing—it’s becoming a strategic profit lever. The global RCM market is projected to grow from $152B in 2024 to $451B by 2034, effectively tripling in size as reimbursement friction, denial rates, and labor shortages collide.

What’s driving the expansion is a clear shift toward outsourcing, SaaS platforms, and data-driven denial prevention. While services still account for ~78% of market spend, cloud-based RCM software is compounding faster, powered by AI, RPA, and real-time analytics that move providers from reactive appeals to proactive prevention.

Geographically, North America remains the profit center (55% share), but Asia-Pacific is emerging as the fastest-growth frontier—both as a delivery hub and adoption market. The takeaway for investors: RCM is evolving into an end-to-end financial operating system, creating durable runway for platform consolidation, PE roll-ups, and automation-first models across care settings.

TREND OF THE WEEK

AI in Healthcare Hits a Wall

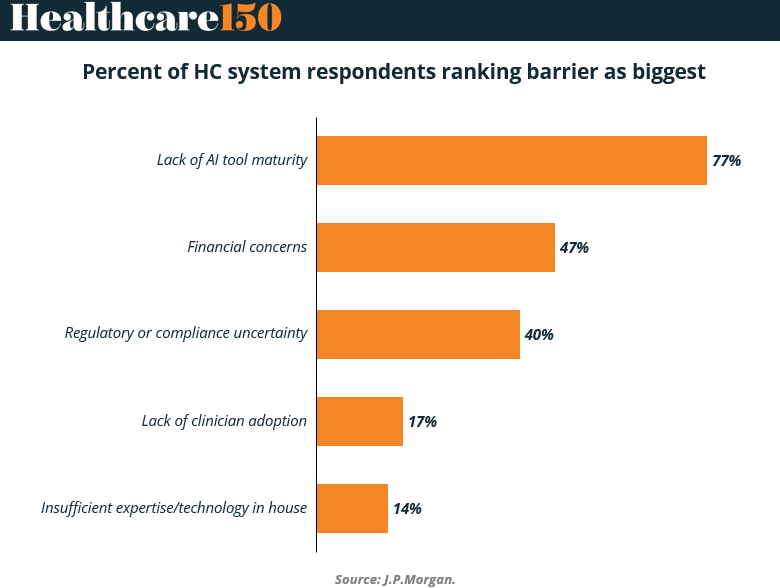

The AI arms race in healthcare may be loud—but on the ground, it’s stalled. A striking 77% of healthcare system respondents cite “lack of AI tool maturity” as the biggest barrier to adoption, according to a new J.P. Morgan survey. That’s nearly double the share who flagged financial concerns (47%) or regulatory uncertainty (40%).

Clinician adoption and internal expertise? Barely blips at 17% and 14%, respectively.

This flips the typical narrative. AI isn’t facing resistance from doctors or lack of in-house tech—it’s a product problem. Health systems are waiting for AI tools that can actually deliver clinical value, at scale, and within regulatory guardrails.

Why it matters: As AI hype collides with hospital P&Ls, capital will shift from generative vaporware to validated infrastructure. Investors should look for startups that pass the bar on clinical maturity, regulatory clarity, and EMR integration—not just slick demos.

Bottom line: Until AI proves it can drive outcomes and not just headlines, provider adoption will remain in holding pattern. (More)

PRESENTED BY ATTIO

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

HEALTHTECH CORNER

Cybersecurity Moves to the Front Line

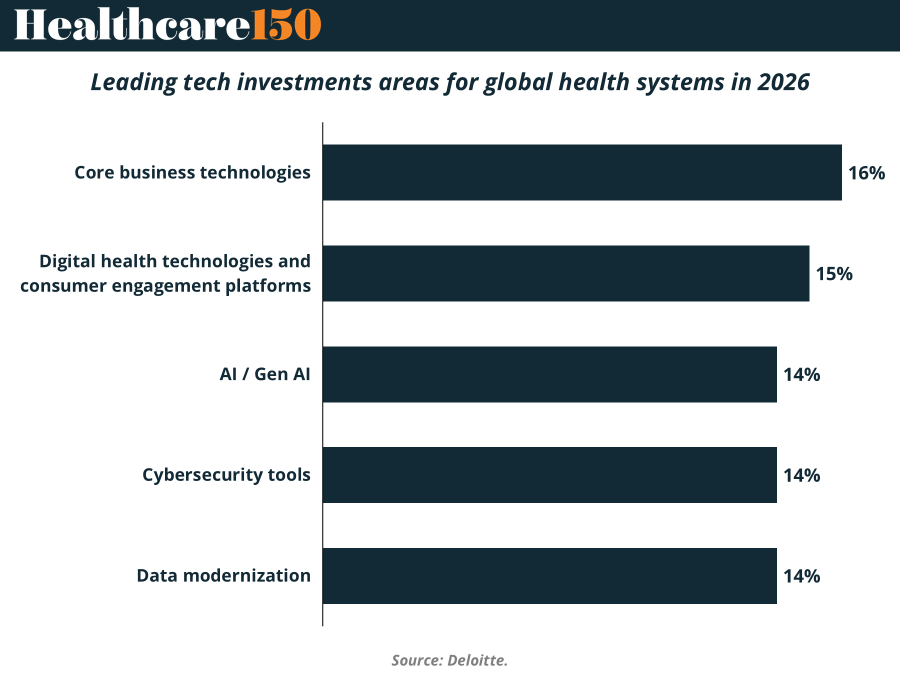

In global health systems, cybersecurity is no longer an IT line item—it’s a patient safety issue. Nearly 48% of non-US health executives now rank cybersecurity and data privacy as a top concern for 2026, with plans to allocate roughly 14% of tech budgets toward cyber tools and processes. That puts cybersecurity on par with AI / Gen AI, digital health, and consumer engagement platforms, and ahead of cloud spending.

The urgency is obvious. Ransomware and AI-enabled cyberattacks are increasingly targeting hospitals, disrupting operations, delaying care, and creating real clinical risk—not just financial loss. Regulators are responding, from the EU’s upcoming Cybersecurity Reserve to stricter enforcement under HIPAA and state-level rules in the US.

For investors, cyber is becoming core infrastructure—less optional software, more mission-critical defense. (More)

DEAL OF THE WEEK

Bristol Myers Bets $1.5B on In Vivo CAR T

Bristol Myers Squibb is acquiring Orbital Therapeutics for $1.5 billion in cash, marking its first major M&A of the year and a strategic bet on in vivo CAR T-cell therapy. The deal adds preclinical asset OTX-201 and a proprietary RNA+AI platform to BMS’s growing immunotherapy arsenal.

Unlike conventional CAR T—which involves harvesting and reengineering patient cells—OTX-201 enables in vivo cell programming using circular RNA and lipid nanoparticles, potentially cutting costs and easing delivery. But it's early: the therapy is still preclinical, and real-world use may be limited to high-severity autoimmune cases. The acquisition comes as BMS pivots away from aging blockbusters Eliquis and Revlimid, seeking future growth in next-gen therapies. It also joins a broader market realignment: Takeda is pulling back from cell therapy, while AstraZeneca and Bayer are increasing exposure.

Strategic angle: This isn’t just about one drug. It’s about platform leverage and optionality in programmable immunotherapy—where RNA meets AI.

Advisors: Covington & Burling LLP advised BMS; Centerview Partners and Goodwin Procter LLP advised Orbital. (More)

REGIONAL FOCUS

Precision Medicine Still Has a Zip Code

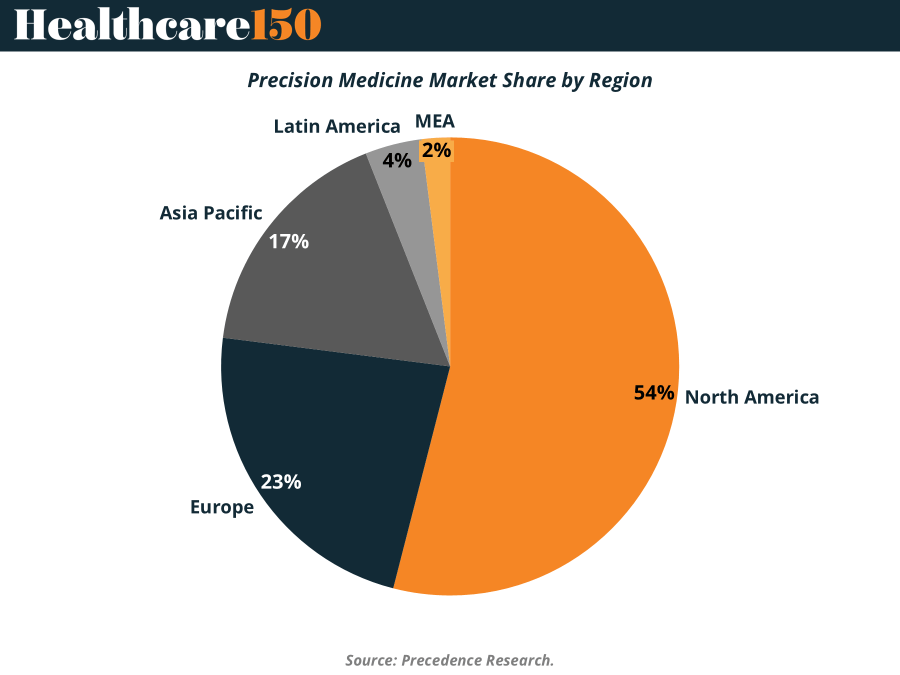

Precision medicine remains geographically concentrated—but the map is slowly expanding. North America continues to dominate with 54% of global market share, anchored by deep investment in genomics, early adoption of biomarker-driven therapies, and reimbursement systems that actually work. The region’s real advantage isn’t research—it’s execution, particularly in oncology and rare diseases.

Europe follows at 23%, supported by strong public health systems and coordinated genomics initiatives. Progress is real, but reimbursement fragmentation and uneven clinical integration keep growth a step behind the U.S.

The real swing factor is Asia-Pacific (17%). Government-backed genomic programs, AI-enabled diagnostics, and massive patient populations position the region as the next growth engine—even if penetration remains early.

Meanwhile, Latin America (4%) and MEA (2%) lag, constrained by infrastructure and funding. Long-term upside exists—but only with sustained policy and capital support. (More)

INTERESTING ARTICLES

"Get busy living or get busy dying."

Stephen King