- Healthcare 150

- Posts

- The New Economics of Revenue Cycle Management

The New Economics of Revenue Cycle Management

Why Outsourcing, SaaS, and Data-Driven Denial Prevention Are Driving a USD 451B Market Expansion

I. Introduction

Revenue Cycle Management (RCM) has become one of the most critical—and most complex—operational priorities in U.S. healthcare. As reimbursement rules tighten and payer requirements evolve, providers face growing administrative friction in securing appropriate payment for billed claims. RCM sits at the center of that challenge, spanning every financial touchpoint from patient onboarding and eligibility checks to coding, claims submission, denials remediation, and collections.

What was historically an internal function is now a scaled, competitive, and fast-growing market for outsourced software and services. Hospitals, physician groups, ambulatory surgery centers, and other outpatient providers are increasingly partnering with third-party specialists—often using multiple vendors across front-end, mid-cycle, and back-end functions—to accelerate collections, reduce administrative overhead, and navigate a dynamic reimbursement environment.

Several structural tailwinds are reshaping the sector and driving sustained investment demand. Rising claim-denial rates, intensifying reimbursement pressure, payer policy complexity, provider consolidation, and expanding federal requirements all raise the cost-to-collect. At the same time, labor shortages in billing and coding roles are pushing organizations toward external partners and automation. These conditions underpin strong multiyear growth in both RCM outsourcing and RCM software platforms.

Technology adoption is also transforming the operating model. Artificial intelligence (AI), robotic process automation (RPA), and predictive analytics are streamlining front-end processes—from patient registration and eligibility verification to prior authorization. Providers are shifting from reactive denial management to proactive prevention, using machine-learning models to flag high-risk claims before submission and deploying clinical documentation improvement (CDI) programs to improve accuracy and compliance.

Backend workflows are undergoing similar modernization. Organizations are outsourcing claims processing and denials management to reduce turnaround times, while API-enabled platforms and cloud-based RCM suites integrate clinical, administrative, and financial data in real time. These tools improve interoperability, support payer-specific rule tracking, and automate routine tasks such as eligibility checks, claim submission, and payment posting.

As more providers embrace patient-facing digital tools—online scheduling, preregistration, portals, and payment channels—RCM is extending beyond pure billing into a consumer-finance layer. Combined, these shifts support a compelling sector thesis: RCM is moving toward an end-to-end, analytics-driven operating system for healthcare finance, creating meaningful runway for consolidation, platform maturation, and private-equity participation across multiple solution types and care settings.

II. Revenue Cycle Management Market Size

The Revenue Cycle Management market is entering a decade of outsized expansion, underpinned by rising administrative complexity, reimbursement friction, and a structural shift toward outsourced software and services. According to Precedence Research, the global RCM market is projected to scale from USD 151.9 billion in 2024 to more than USD 451 billion by 2034, effectively tripling in size over ten years.

This trajectory reflects a compound annual growth profile in the low-double digits, supported by broad adoption across hospitals, ambulatory care networks, physician groups, and digital health platforms. Annual market value is expected to surpass USD 200 billion by 2027, exceed USD 300 billion by 2031, and cross USD 400 billion by 2033, signaling acceleration rather than plateauing in the outer forecast years.

The sector’s expansion is closely tied to:

escalating claim-denial volumes and payer-policy variability

ongoing billing and coding labor shortages

higher patient financial responsibility and bad-debt exposure

outsourcing penetration across front-, mid-, and back-end functions

increasing integration of AI, RPA, and cloud-based RCM platforms

a steady pipeline of provider consolidation and PE-led roll-ups

As reimbursement pressure continues to challenge margin performance, RCM is transitioning from a back-office function to a strategic financial-performance engine. The forecasted USD 451 billion market size by 2034 highlights not only the scale of administrative spend in healthcare, but also the clear monetization runway for software platforms, automation vendors, and BPO operators positioning themselves as end-to-end financial partners for providers.

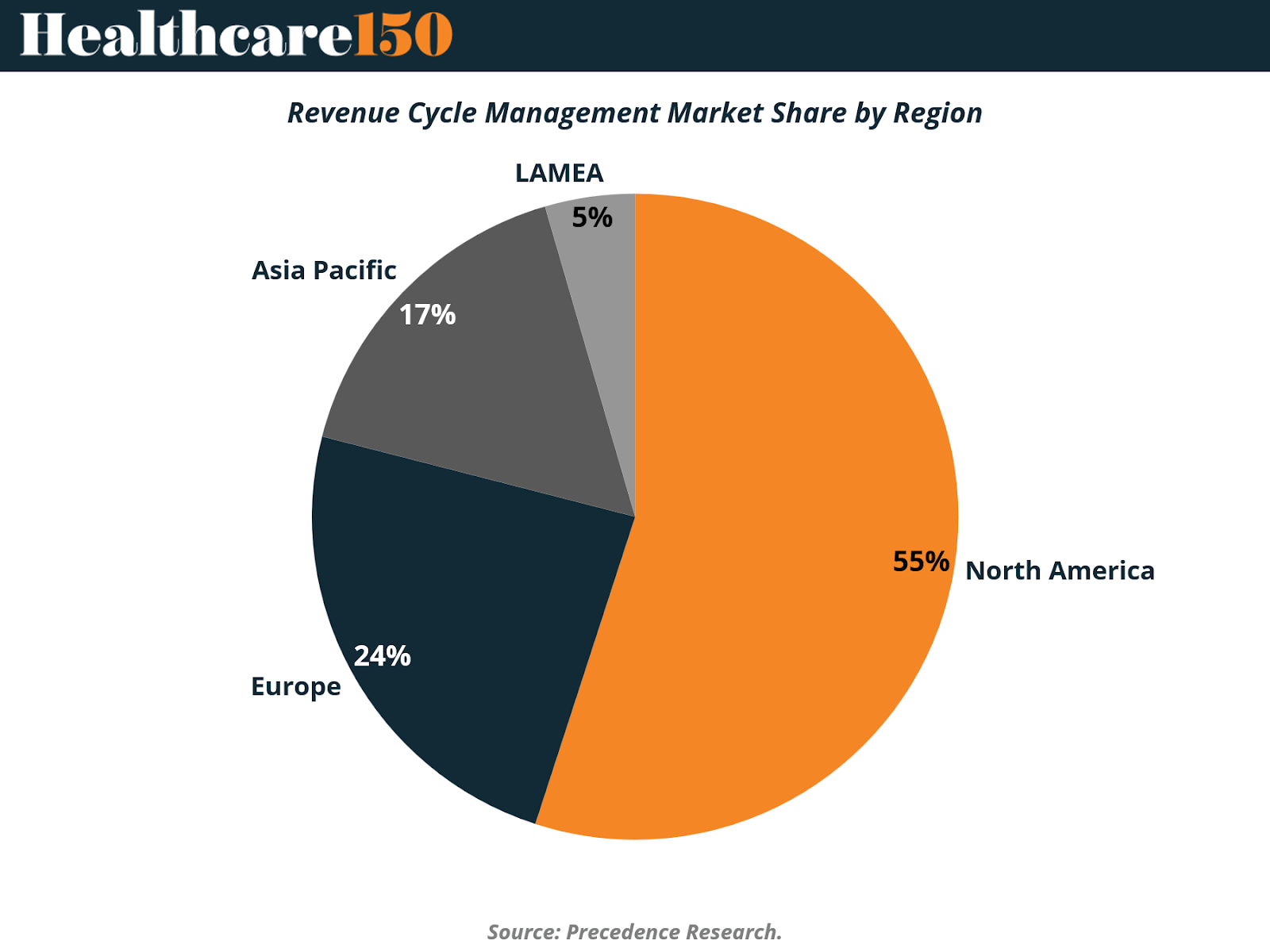

III. Revenue Cycle Management Market Share by Region

The RCM industry remains heavily concentrated in North America, which accounts for 55% of global market share in 2024. The U.S. alone drives a disproportionate share of spending due to high administrative intensity, complex payer networks, and a mature ecosystem of outsourced billing, coding, and denial-management providers. The region also leads in EHR penetration, AI-enabled workflow tools, and private-equity consolidation—further reinforcing its dominant position.

Europe holds 24% of the market, supported by expanding reimbursement digitization, broader adoption of hospital information systems, and rising outsourcing in the U.K., Germany, and the Nordics. While regulatory structures differ materially from the U.S., the continent is experiencing similar pressures around staffing, claim processing efficiency, and cross-border payer interoperability.

Asia-Pacific represents 17% of current share, but stands out as the fastest structural growth opportunity. Healthcare infrastructure modernization, private-hospital expansion, and increased insurance coverage are pushing providers toward automated billing, eligibility checks, and claims platforms. India and Southeast Asia are also emerging as delivery hubs for RCM business-process outsourcing.

LAMEA accounts for the remaining 5%, reflecting earlier-stage digitization, lower billing complexity, and more limited population coverage under private insurance models. That said, rising Gulf-region private-care investment and payer modernization in Brazil are creating new footholds for vendors.

Overall, the geographic distribution reinforces a clear market sequence: the U.S. remains the commercial epicenter, Europe is scaling, and Asia-Pacific is building the next demand frontier, supported by both domestic adoption and global outsourcing flows.

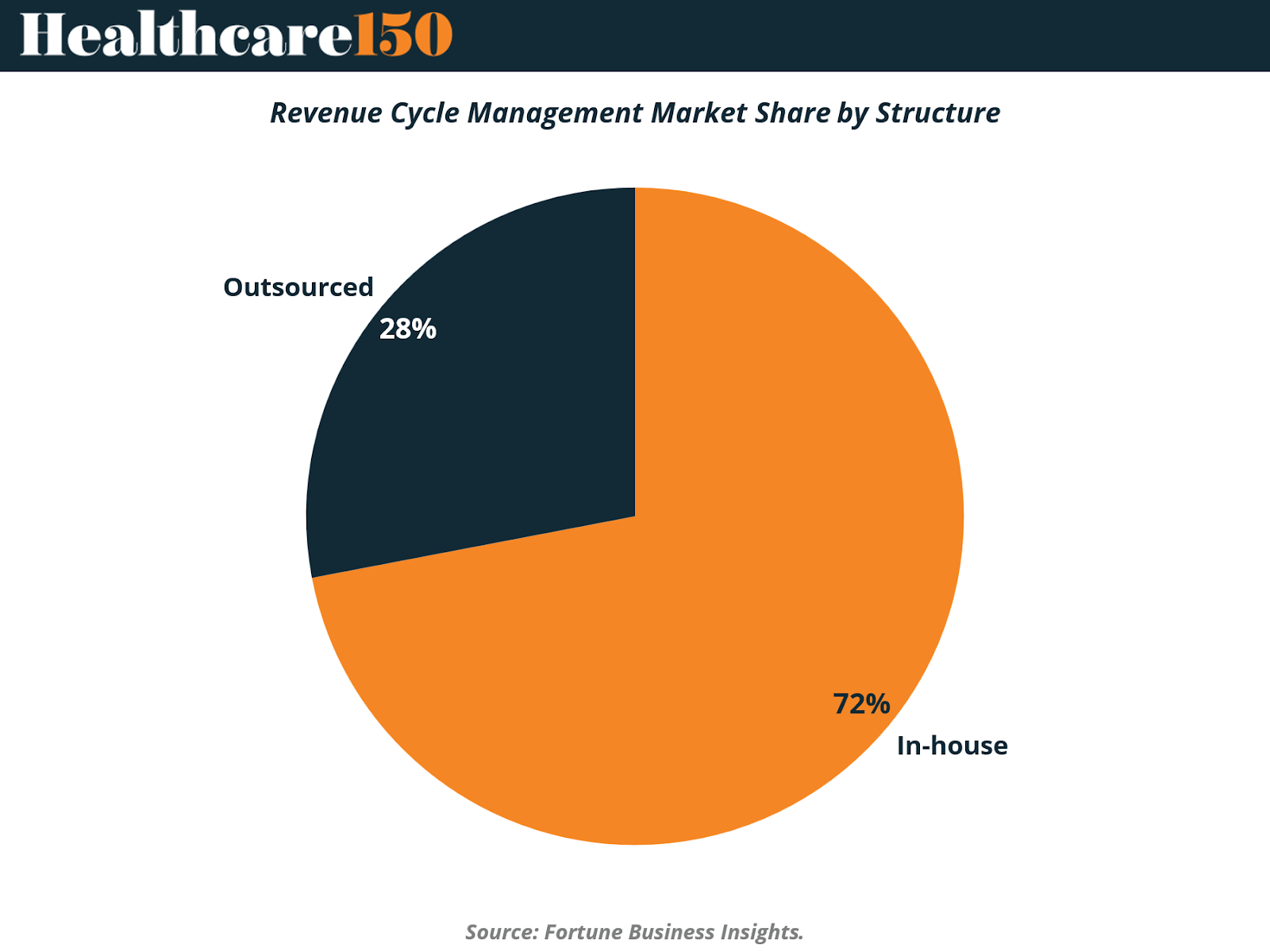

IV. Structure Analysis: In-House vs Outsourced Models

The RCM market today remains weighted toward internally managed functions, with 72% of activity handled in-house versus 28% outsourced. The in-house model continues to dominate largely because hospitals rely on RCM teams as an extension of clinical and financial performance management. Higher patient volumes reinforce this approach—**U.S. hospital admissions exceeded 33 million in 2021, according to the American Hospital Association—**driving sustained investment in billing staff, coding teams, and mid-cycle documentation improvement.

Broader infrastructure expansion in emerging markets and the scaling of insurance coverage are also supporting internal deployment. National payers and insurance groups increasingly embed RCM functions to manage claims accuracy and improve patient affordability. A notable example is America’s Health Insurance Plans (AHIP), which adopted RCM tools to lower consumer out-of-pocket exposure and streamline the financial encounter, further strengthening demand for internal workflows.

However, the most significant structural momentum lies with the outsourced segment, which is expected to deliver the fastest CAGR over the forecast period. Providers across the U.S., U.K., India, and other major markets are shifting from internal teams toward third-party platforms and business-process outsourcing models—driven primarily by cost arbitrage and technology maturity. The economics are compelling: Advanced-Data Systems estimated in 2021 that in-house software and hardware can cost roughly USD 8,000, versus outsourcing fees closer to USD 500, highlighting more than an order-of-magnitude difference in upfront expense.

As denial pressure rises, labor markets tighten, and providers require analytics-driven automation, outsourcing becomes a strategic lever—offering scalable software, specialized labor, and turnkey revenue integrity solutions. While in-house teams will remain prevalent in high-volume hospital systems, outsourcing is positioned to capture incremental share as RCM evolves into an end-to-end managed service model.

V. Component Analysis: Services Dominate While Cloud Software Accelerates

The RCM market remains fundamentally service-driven today, with services accounting for 78% of total market value in 2024, reflecting providers’ continued reliance on specialized operational labor to stabilize collections performance. With billing and coding teams facing persistent turnover and wage inflation, outsourced partners offer an immediate bridge—absorbing technology investment, staffing needs, and ongoing workflow optimization. This model remains particularly attractive for hospitals under margin pressure, where every basis-point improvement in cost-to-collect materially impacts EBITDA.

In parallel, software represents 22% of market share, but is expanding faster than services as providers shift toward automated, cloud-based platforms. Mordor Intelligence notes that cloud RCM software is growing at a 14.2% CAGR through 2030—outpacing overall industry expansion, supported by subscription pricing, reduced capital requirements, API-based interoperability, and vendor-driven updates. Hospitals that deploy modern RCM suites often unlock secondary benefits, including real-time physician documentation dashboards, coding quality alerts, and payer-rule prompts, allowing operational teams to correct performance gaps within hours rather than weeks.

These analytics capabilities are gradually repositioning internal RCM labor away from transactional workloads—eligibility verification, data entry, claims rekeying—and toward strategic revenue-integrity roles centered on denial prevention and reimbursement maximization. The result is a dual-track growth dynamic: services continue to scale as providers outsource operational burden, while software accelerates as automation becomes a long-term structural solution.

Looking ahead, hybrid operating models—where a hospital retains strategic oversight, leverages cloud analytics for decision support, and outsources selected mid- and back-end functions—are expected to become standard. This convergence broadens the addressable market for both software vendors and service bureaus, reinforcing RCM’s evolution toward a coordinated financial-performance ecosystem across the provider landscape.

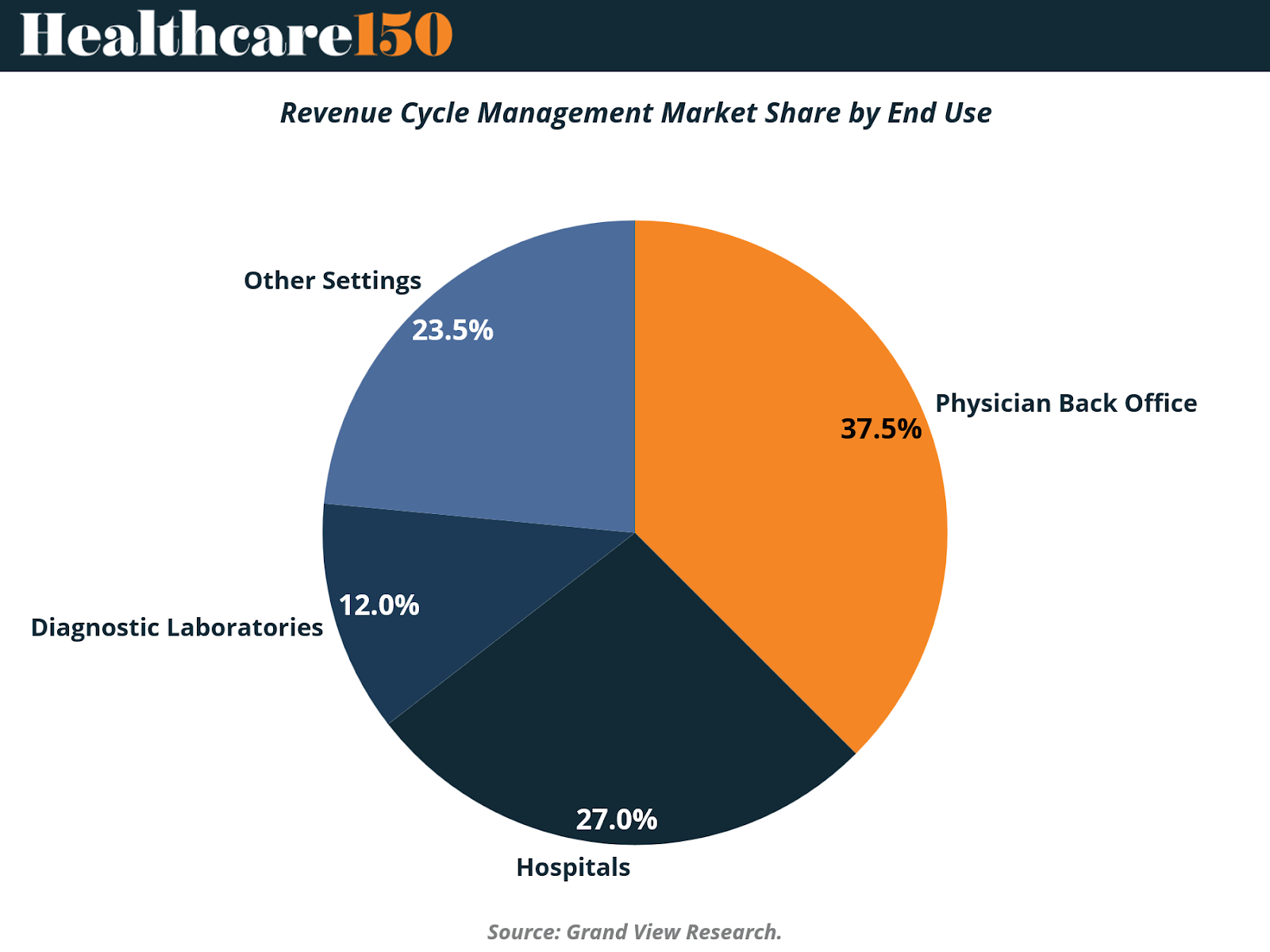

VI. Revenue Cycle Management Market Share by End Use

The Physician Back Office controls 37.5% of global RCM spend, making small- and mid-sized medical groups the industry’s economic center of gravity. These providers have limited in-house billing capacity, high denial exposure, and increasingly complex payer-credentialing requirements—conditions that create a structural outsourcing bias. For vendors, that translates into short sales cycles, sticky multi-year renewals, and rapid uptake of cloud-based claims automation.

Hospitals follow at 27%, reflecting a more mature—but margin-pressured—customer segment where labor shortages, prior-auth friction, and value-based reimbursement are forcing investment into denial prevention and coding accuracy. While hospital procurement moves slower, contract values and cross-sell opportunities are materially larger.

Diagnostic laboratories represent 12%—a smaller but strategically important niche where testing reimbursement, ICD-coding precision, and payer edits directly determine revenue capture. The lab segment’s exposure to volume volatility and payor audits makes automation an immediate ROI lever.

The remaining 23.5% (“Other Settings”) spans ambulatory centers, urgent care, behavioral clinics, dental, and emerging retail health providers, all facing consumer-payment complexity and high-deductible plans. This long-tail market is fragmented, under-penetrated, and primed for platform consolidation as healthcare continues to consumerize.

Net result: RCM’s fastest-moving dollars sit outside the hospital, where staffing constraints and reimbursement complexity are expanding the total addressable outsourcing pool.

VII. Market Drivers: Structural Forces Expanding RCM Demand

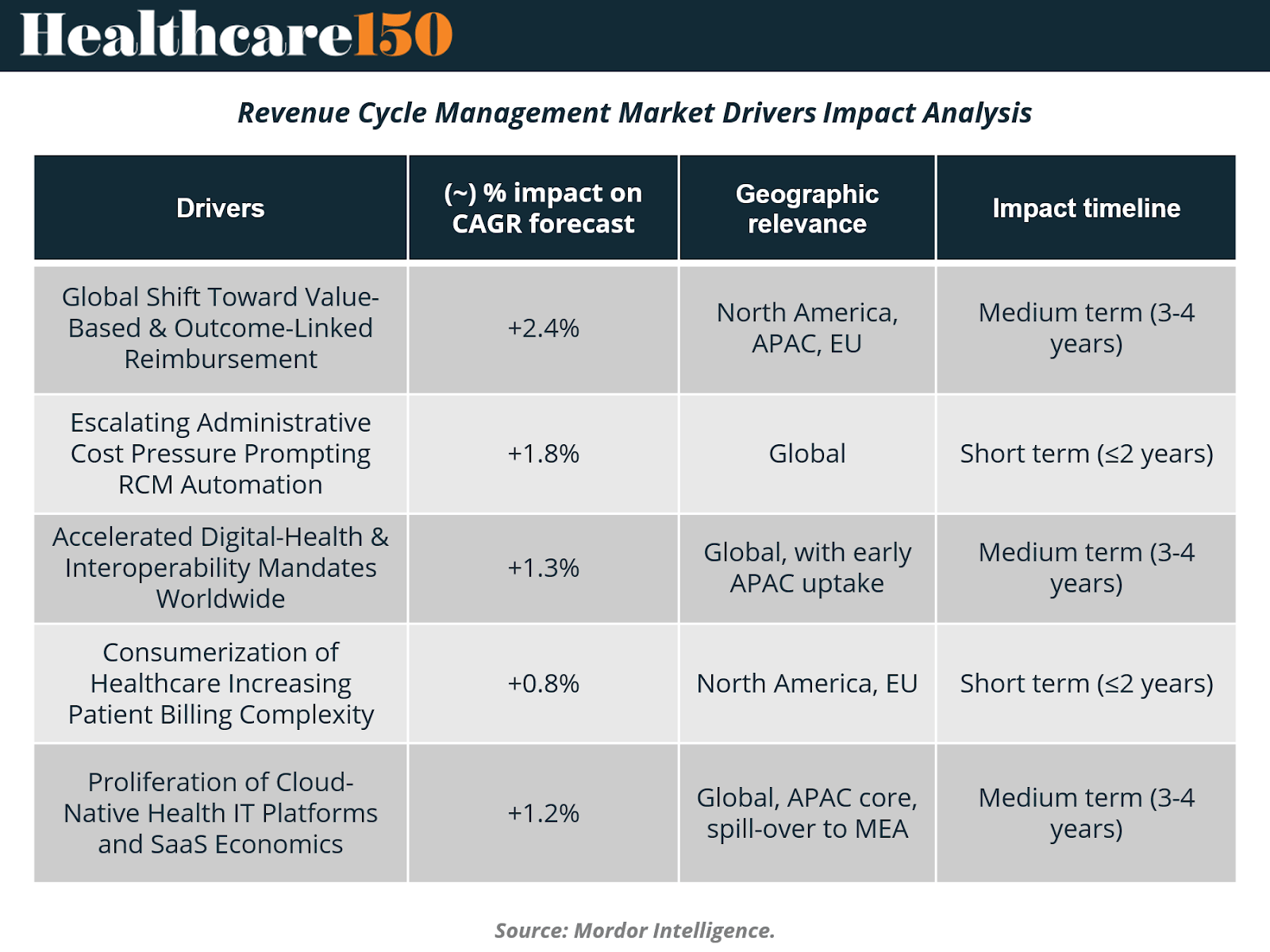

Global Shift Toward Value-Based & Outcome-Linked Reimbursement

The transition from fee-for-service toward value-based care is fundamentally restructuring revenue capture. Payment is now tied to clinical performance rather than procedure volume, compelling providers to measure quality, document outcomes, and manage population-health indicators as a commercial prerequisite.

Early results validate the model’s financial upside—accountable-care participants generated more than USD 700M in collective savings, demonstrating that reimbursement risk can convert into operating margin once quality metrics are mastered.

As a result, RCM platforms are evolving into analytics and interoperability engines, integrating population dashboards that convert care gaps into reimbursement triggers. That shift demands normalized data across EHRs, claims clearinghouses, and payer platforms, elevating interoperability from a compliance mandate to a revenue-protection requirement.

Escalating Administrative-Cost Pressure Prompting RCM Automation

Administrative spending absorbs 20–25% of U.S. healthcare outlays, making automation an immediate lever for cost containment. AI bots now complete routine prior-authorizations in seconds—a process that previously required multiday follow-up—and hospitals deploying robotic automation report up to a 50% reduction in claim-prep time.

These gains allow billing staff to refocus on complex exceptions, creating a productivity dividend that can be redeployed into patient-facing functions. Automation also removes tedious, error-prone data entry from the workforce experience, resulting in higher staff satisfaction and lower turnover—critical advantages in today’s strained labor market. The near-term impact profile aligns with the chart’s short-term (<2 years) contribution of +1.8% to CAGR uplift.

Accelerated Digital-Health & Interoperability Mandates Worldwide

Regulators across major health economies are hard-coding interoperability into policy, accelerating EHR standardization and forcing RCM vendors to provide plug-and-play APIs that synchronize clinical, financial, and payer records.

Yet maturity remains low. The Healthcare Financial Management Association’s five-stage RCM Technology Adoption Model shows that 42% of health systems are still at Stage 1, underscoring substantial whitespace for orchestration platforms and integrated revenue-integrity stacks.

As data harmonizes, payer friction declines—clean claims flow through adjudication with minimal intervention—supporting the chart’s medium-term CAGR lift of +1.3% across global and APAC early adopters.

Consumerization of Healthcare Increasing Patient-Billing Complexity

High-deductible plans shift financial burden to patients, transforming billing into a retail transaction. Providers must now offer real-time out-of-pocket estimates, digital wallets, payment plans, and flexible settlements aligned with household liquidity.

Eligibility automation reduces surprise billing, improves patient trust, and lowers bad-debt write-offs—all of which indirectly support procedure-volume growth. These factors reinforce rising demand in North America and the EU, correlating with the chart’s short-term CAGR impact of +0.8%.

Proliferation of Cloud-Native Health-IT Platforms & SaaS Economics (if needed for the 5th driver)

Cloud RCM accelerates deployment, eliminates capital hardware spend, and introduces usage-linked subscription economics that align well with margin-pressured providers. As APAC digitization spreads and MEA begins payer modernization, cloud is positioned to expand globally—supporting the medium-term +1.2% CAGR lift noted in the model.

VII. Conclusion

The Revenue Cycle Management industry is shifting from a labor-intensive back-office function into a strategic financial-performance platform, reshaping how providers secure reimbursement, manage payer friction, and optimize cost-to-collect. Structural forces—denial growth, payer-rule volatility, labor shortages, and value-based reimbursement models—are pushing hospitals, physician groups, and outpatient operators to modernize billing operations and embrace both outsourcing scale and cloud automation.

With North America as the commercial anchor, Europe scaling, and Asia-Pacific emerging as the next delivery and adoption frontier, global penetration is broadening faster than historical benchmarks. Services still dominate due to immediate operational relief, but software is compounding faster, supported by AI, RPA, interoperability APIs, and SaaS pricing models that enable proactive denial prevention rather than reactive appeals.

As providers blend in-house oversight with outsourced execution and analytics-driven software, RCM is evolving toward a hybrid operating model—one capable of supporting real-time documentation integrity, consumer-facing payment orchestration, and end-to-end revenue intelligence. Ultimately, the market’s projected expansion to USD 451B by 2034 reflects a long-duration runway where platform consolidation, automation maturity, and private-equity roll-ups will define the next decade of healthcare-finance infrastructure.

Sources and References:

Fortune Business Insights — Revenue Cycle Management Market Size, Share & Industry Analysis

Grand View Research — Revenue Cycle Management Market Size, Share & Trends

HCLS (Healthcare & Life Sciences) Report — Revenue Cycle Management Market Insights 2H 2025

Mordor Intelligence — Revenue Cycle Management Market Size & Share Analysis

Precedence Research — Revenue Cycle Management Market

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.