- Healthcare 150

- Posts

- 75% of Leaders Back AI for Admin, While Biotech Leaves EU 40% Behind

75% of Leaders Back AI for Admin, While Biotech Leaves EU 40% Behind

Precision medicine targets $470B and Sobi bets $1.5B on gout, while small molecules drop to 53% of Phase III trials.

Good morning, ! This week we’re diving into small molecules losing the innovation spotlight, femtech concentrating where infrastructure rewards it, AI fixing healthcare’s admin mess before chasing clinical moonshots, Sobi’s $1.5B gout leap, and precision medicine turning into a $470B engine.

Want to advertise in Healthcare 150? Check out our self-serve ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

Precision Medicine’s Big Bang

The precision medicine market is quietly morphing into one of healthcare’s fastest-scaling engines. Global spend jumps from $119B in 2025 to $470B by 2034, a nearly 4x expansion driven by falling sequencing costs, maturing genomic infrastructure, and an explosion of AI-enabled analytics. The real kicker? More than 65% of today’s value comes from Big Data platforms, not the sequencers themselves. Think of NGS as the fuel and AI/ML as the combustion chamber. Meanwhile, the U.S. remains the sector’s gravitational center, powering a 16.7% CAGR on the back of dense R&D clusters and rapid integration of biomarker-driven care. For insurers, PE, and strategics, this is less “emerging niche” and more “system-level transformation in slow motion.”

TREND OF THE WEEK

The Shrinking Molecule

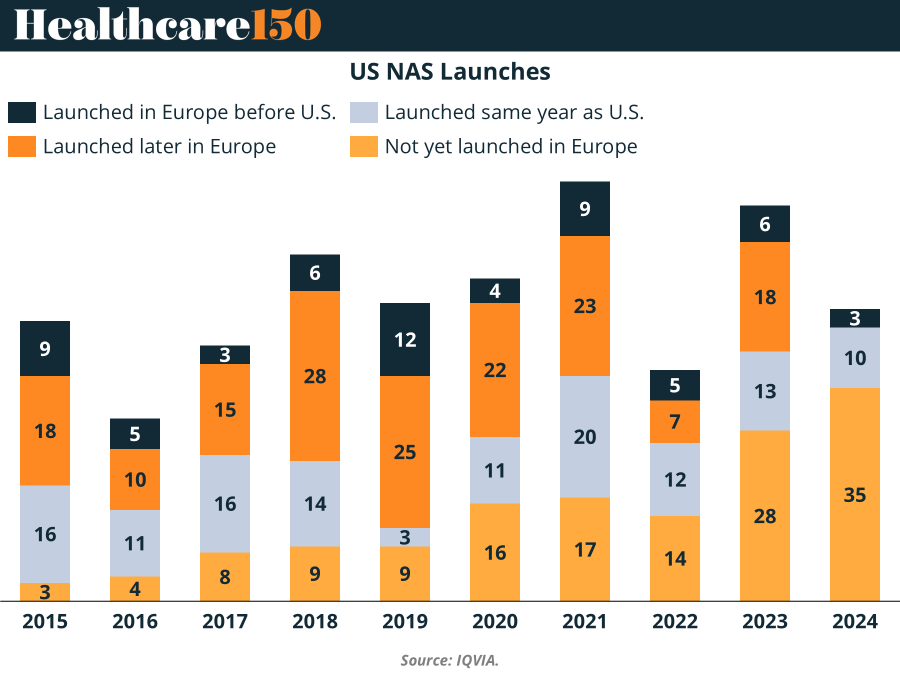

The small molecule is quietly losing ground. Over the past decade, its share in Phase III trials dropped from 65% to 53%, with similar slides in Phase II (62% to 47%) and Phase I (71% to 61%). This isn’t just pipeline reshuffling—it’s a directional shift. Biologics and cell/gene therapies are increasingly taking center stage, especially among larger biopharmas, while EBP (emerging biotech players) still hold tighter to their chemistry roots. Meanwhile, the U.S.-Europe launch gap is widening: 40% of U.S. NAS launches over the past five years haven’t yet hit major EU markets, compared to just 7% of European drugs skipping the U.S. It’s not just science evolving—it’s access, too. (More)

PRESENTED BY ATTIO

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

HEALTHTECH CORNER

AI's Bullseye in Healthcare? Admin and Productivity

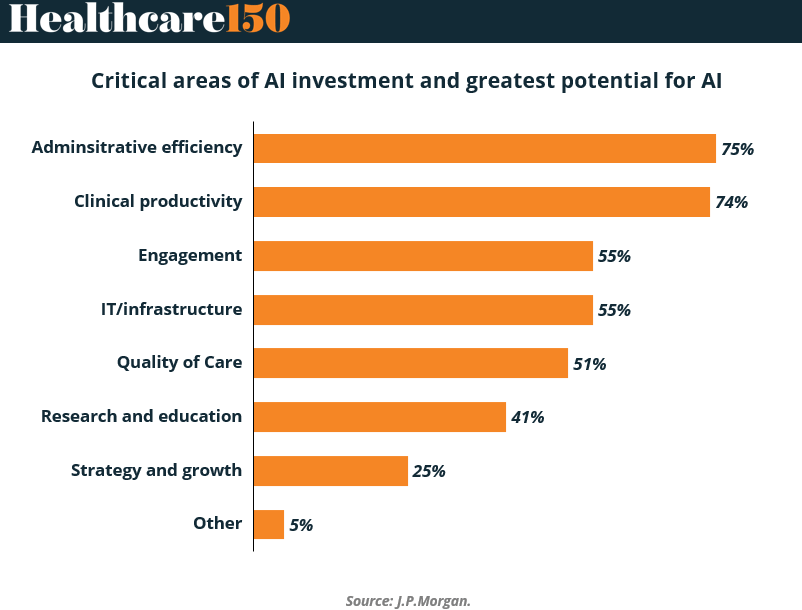

If you're wondering where AI will hit hardest in healthcare, follow the efficiency metrics. According to J.P. Morgan, 75% of industry leaders see administrative efficiency as the top area of AI investment potential—just ahead of clinical productivity (74%).

That means AI isn't just about futuristic diagnostics or robotic surgeries. It's about cleaning up the mess behind the curtain—prior authorizations, scheduling, billing, documentation—all high-friction, low-glamour pain points ripe for automation.

Interestingly, Engagement (55%) and IT infrastructure (55%) match AI's potential for patient connection and backend backbone, while Quality of Care (51%) trails slightly. Strategy and growth? A distant 25%, suggesting investors aren’t chasing moonshots—they're backing tools that optimize what already exists.

Why it matters: For operators and investors, the AI thesis in 2025 is clear—bet on productivity, not novelty. (More)

TOGETHER WITH FISHER INVESTMENTS

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

DEAL OF THE WEEK

Sobi’s $1.5B Bet: No More Gouty Misfires

Sobi is going all-in on gout, dropping $950M upfront (plus another $550M in milestones) to acquire Arthrosi Therapeutics. The target? A Phase 3 URAT1 inhibitor called pozdeutinurad (AR882), which aims to do what Zurampic and others couldn’t: deliver a daily oral therapy without scaring off regulators or insurers.

Sobi gets a late-stage asset with readouts expected in 2026; Arthrosi skips the IPO headache and exits post-Series E. A win-win, if Phase 3 delivers. Bonus: Wilson Sonsini gets a shoutout for patent work, because even M&A needs lawyers with long names. (More)

REGIONAL FOCUS

Femtech’s Geographic Imbalance

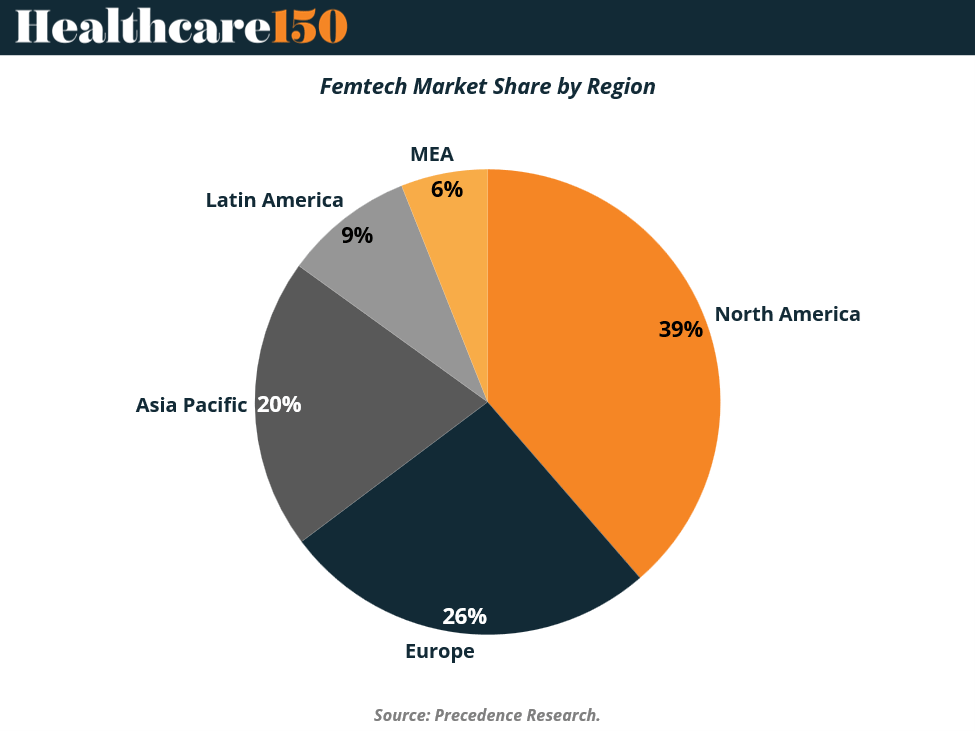

The global femtech map looks more like a power-law curve than a balanced global rollout. North America dominates at 39%, fueled by high digital-health adoption, predictable reimbursement, and a venture ecosystem that treats women’s health like a legitimate investment category instead of a niche. Europe follows at 26%, strengthened by coordinated regulatory frameworks and rising public-sector commitments to fertility and reproductive equity. The real momentum sits in Asia Pacific (20%), where smartphone ubiquity and a swelling middle class are pushing demand across maternal health, fertility, and menstrual care. Trailing regions — Latin America (9%) and MEA (6%) — remain constrained by fragmented systems but carry meaningful long-term upside as mobile-first care models expand. The global story is simple: femtech grows fastest where digital infrastructure and cultural openness intersect. (More)

INTERESTING ARTICLES

"Nothing is impossible. The word itself says 'I'm possible!'"

Audrey Hepburn