- Healthcare 150

- Posts

- Where Healthcare M&A Is Most Likely to Hold Up in 2026

Where Healthcare M&A Is Most Likely to Hold Up in 2026

Healthcare dealmaking may be slower and more selective, but it’s far from stalled.

Our latest microsurvey shows that investors and operators aren’t pulling back evenly — they’re concentrating capital where visibility, scalability, and defensibility remain strongest.

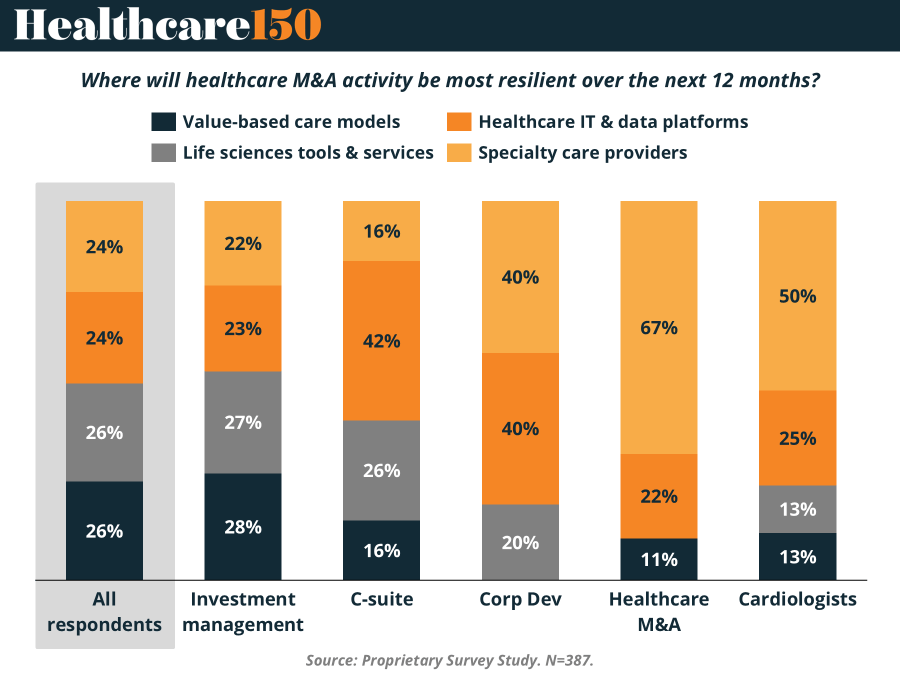

When we asked respondents where healthcare M&A activity will be most resilient over the next 12 months, four themes clearly emerged.

No Clear Leader Among All Respondents

Across all survey participants, expectations are broadly balanced. Value-based care models and life sciences tools & services each capture 26% of responses, while healthcare IT & data platforms and specialty care providers follow closely at 24% each.

This even split reflects a market that remains active but cautious — one where capital is being deployed selectively based on visibility of cash flows, regulatory risk, and execution certainty, rather than thematic momentum alone.

Specialty Care Gains Conviction Among Deal Practitioners

While the aggregate view is evenly distributed, specialty care providers emerge as a clear standout among respondents closest to clinical operations and transaction execution.

67% of healthcare M&A professionals expect specialty care to be the most resilient M&A segment

50% of cardiologists share that view

This strong conviction underscores continued interest in procedure-driven, outpatient-focused specialties with predictable demand, favorable reimbursement dynamics, and opportunities for platform consolidation. For operators and deal teams on the ground, specialty care offers a combination of near-term cash flow durability and scalable roll-up potential that is increasingly attractive in a more disciplined M&A environment.

Healthcare IT & Data Platforms Lead with Executives

Among senior decision-makers, Healthcare IT & data platforms stand out as the top area of expected resilience. 42% of C-suite respondents identify IT and data platforms as the most durable M&A target over the next year.

Corporate development teams reinforce this perspective, with 40% selecting healthcare IT & data platforms, tied with specialty care providers. This reflects sustained demand for software-driven assets that improve efficiency, enable interoperability, and generate recurring revenue, particularly as health systems and payers continue to prioritize cost control and digital transformation.

Value-Based Care Remains in Play — with Tighter Underwriting

Value-based care models continue to attract interest, especially among investment managers, where 28% expect resilience in the segment. However, enthusiasm appears more measured compared to prior years.

The data suggests value-based care is moving into a more selective phase, where proven performance, payer alignment, and unit economics matter more than growth narratives alone. M&A interest remains — but the bar has clearly risen.

Life Sciences Tools & Services Offer Defensive Stability

Life sciences tools & services maintain steady support across respondent groups, particularly among investors and corporate respondents. While not the most aggressive growth play, these assets benefit from long-term secular demand and recurring usage, positioning them as a more defensive component of healthcare M&A activity in the year ahead.

What This Means for Healthcare M&A

The survey points to a healthcare M&A market defined less by a single winning theme and more by who you ask:

Operators and deal teams favor specialty care for durability and execution certainty

Executives and corporate buyers prioritize healthcare IT and data platforms for scale and efficiency

Investors remain selectively engaged in value-based care and life sciences tools

In the next 12 months, resilience in healthcare M&A will be driven by precision, not breadth — with capital flowing toward assets that combine clear demand, defensible economics, and realistic paths to scale.