- Healthcare 150

- Posts

- The $37B Boom: Can Gamification Really Heal Healthcare?

The $37B Boom: Can Gamification Really Heal Healthcare?

Gamification is transforming patient engagement and digital care—but can it truly heal what healthcare can’t?

Good morning, ! This week we’re diving into the $37.6B move of Healthcare Gamification, data breaches are getting smaller in Healthcare as cybersecurity improves, North America commands 40% of the global medical devices market, and Warburg Pincus is buying roughly one-third of Sebia Diagnostics—a €5.4 billion deal.

Want to advertise in Healthcare 150? Check out our self-serve ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

Press Start: Healthcare’s $37B Motivation Engine

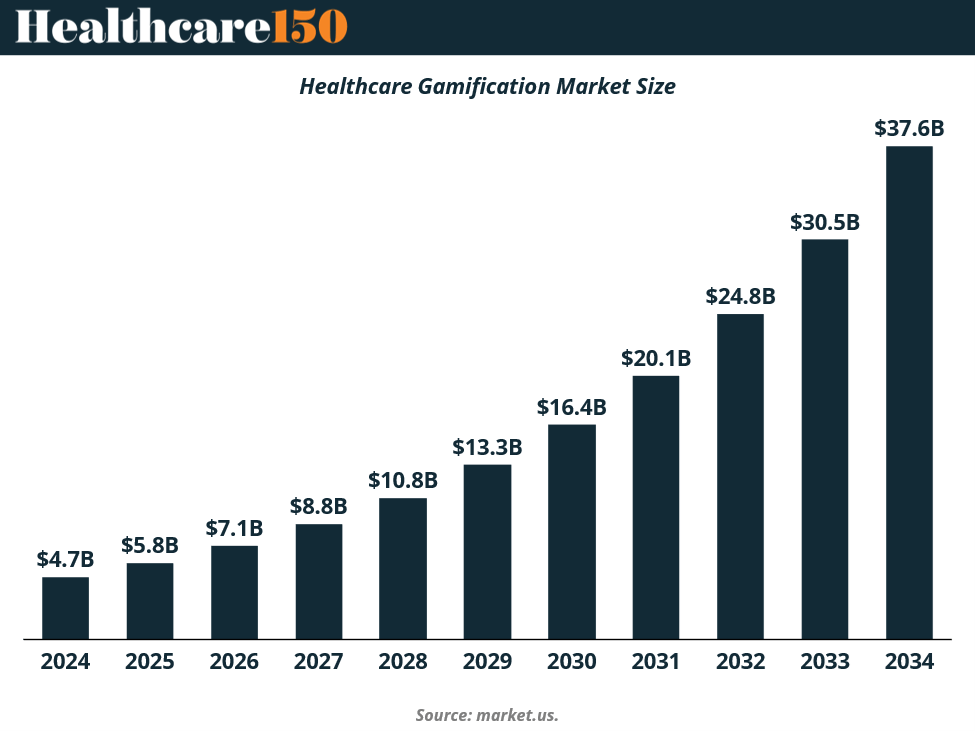

Healthcare is getting a game upgrade. The global healthcare gamification market—valued at $4.7B in 2024—is projected to hit $37.6B by 2034, growing 23.1% annually. That’s not just points and badges—it’s a fundamental shift in patient engagement. Over 60% of adoption comes from exercise and serious games, which are now powering chronic disease management and rehab programs. The push? A mix of aging populations, smartphone proliferation, and regulatory greenlights for digital therapeutics. The catch: long-term engagement fatigue and data privacy risks could dent momentum. The bottom line—gamification is no longer just about fun; it’s the next frontier in sustainable, value-based healthcare.

TREND OF THE WEEK

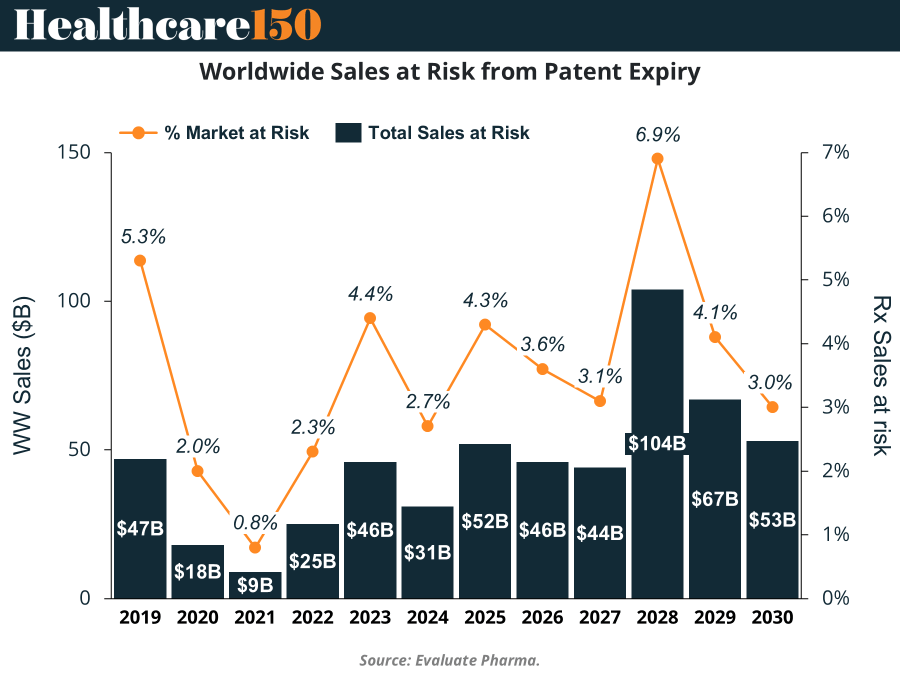

The $300B Question: Patent Cliff vs. Pharma Growth

Pharma’s staring down a $300B patent cliff between 2025 and 2030—yet analysts still forecast 7%+ annual growth. Cognitive dissonance? Not quite. As Evaluate notes, not all Loss of Exclusivity (LoE) is created equal. The real impact depends on portfolio mix, biosimilar threats, and a company’s ability to plug revenue gaps. The cliff peaks in 2028, with $104B in sales at risk—6.9% of the entire market. But the narrative isn’t all doom: smart players are already deploying replacement pipelines, BD deals, and pricing strategies to stay above water. Still, this chart should be printed and pinned to every biopharma CFO’s wall. (More)

PRESENTED BY SUPERHUMAN AI

Become the go-to AI expert in 30 days

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

HEALTHTECH CORNER

Data Breaches Are Getting Smaller—But Don't Celebrate Yet

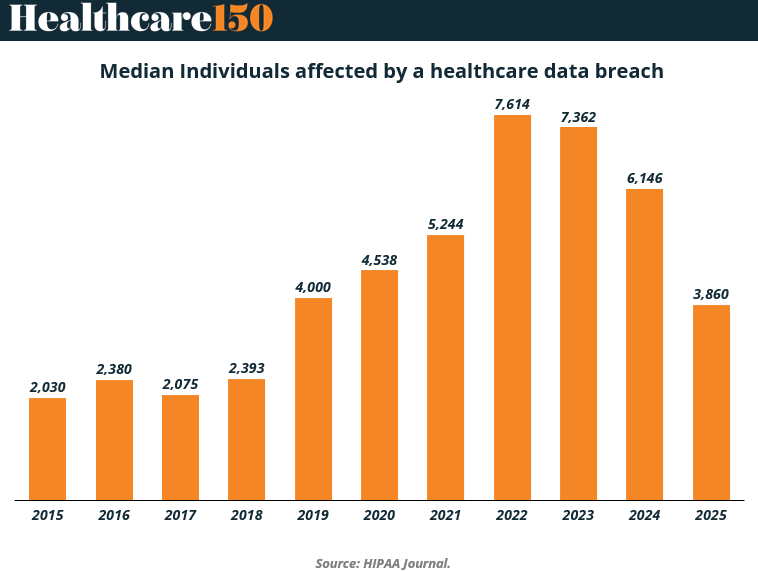

The median number of individuals affected per healthcare data breach dropped to 3,860 in 2025, down 49% from its 2022 peak of 7,614, per HIPAA Journal data.

But the story isn’t a clean win for cybersecurity. While breach size is shrinking, breach frequency is rising. More breaches are hitting smaller targets—think specialty clinics, outpatient providers, and healthtech startups lacking mature IT infrastructure.

This fragmentation reflects a shift in attacker strategy. Instead of chasing a few high-value targets, cybercriminals are casting wider nets across under-protected systems in a digitizing care environment.

Why it matters: As virtual care, wearables, and AI tools proliferate, patient data is more distributed than ever—multiplying points of vulnerability. For investors and operators, this means a growing compliance and cybersecurity burden, especially in M&A due diligence.

Strategic implication: Breach resilience is now a valuation factor. Expect premiums for healthtech firms that demonstrate robust data governance, and discounts for those that treat HIPAA as a box-check. (More)

TOGETHER WITH MORNING BREW

An espresso shot for your brain

The problem with most business news? It’s too long, too boring, and way too complicated.

Morning Brew fixes all three. In five minutes or less, you’ll catch up on the business, finance, and tech stories that actually matter—written with clarity and just enough humor to keep things interesting.

It’s quick. It’s free. And it’s how over 4 million professionals start their day. Signing up takes less than 15 seconds—and if you’d rather stick with dense, jargon-packed business news, you can always unsubscribe.

DEAL OF THE WEEK

Warburg Pincus Takes a Healthy Slice of Sebia

Private equity heavyweight Warburg Pincus is buying roughly one-third of Sebia Diagnostics—a €5.4 billion deal that cements its status as the French diagnostics firm’s largest shareholder. GIC, Singapore’s sovereign wealth fund, is co-investing, signaling how global capital is circling Europe’s fast-growing in vitro diagnostics (IVD) market.

Founded in 1967, Sebia has quietly built a diagnostics empire across 120+ countries with 20,000 instruments in operation. Since being acquired by CVC Capital Partners and Téthys Invest in 2017, its valuation has more than doubled, proving there’s still rich DNA in European healthcare assets.

The bottom line: With peers like Stada (€10B) and Zentiva (€4.1B) already changing hands, this deal underscores how private equity is doubling down on European healthcare, where innovation meets aging demographics—and strong returns. (More)

REGIONAL FOCUS

North America Still Dominates Devices, But APAC Is Catching Up

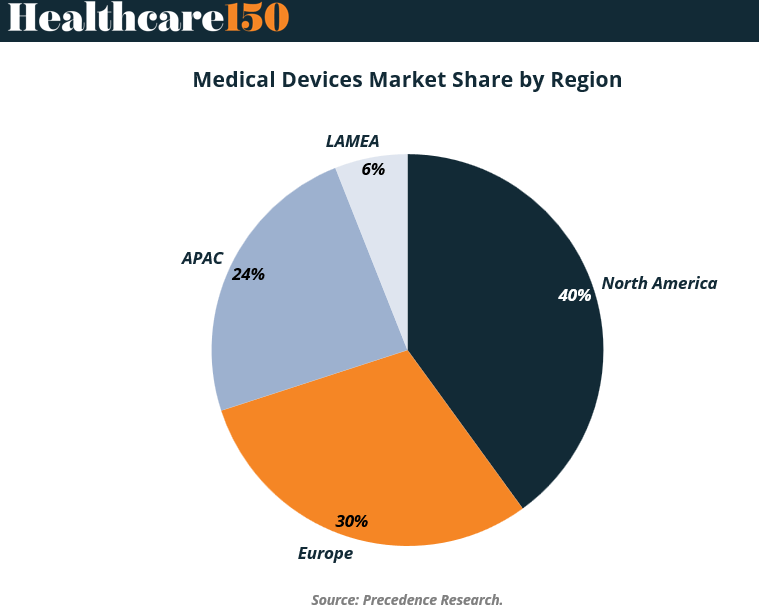

North America commands 40% of the global medical devices market—nearly double that of Asia-Pacific (24%) and far ahead of Europe (30%). While the U.S. remains the global epicenter of MedTech innovation, its lead is narrowing.

Europe’s 30% share reflects its strength in regulatory sophistication and clinical adoption, especially in diagnostics and orthopedics. But the real movement is coming from APAC, which now accounts for nearly a quarter of the market.

Rising chronic disease rates, expanding healthcare infrastructure, and aggressive government support—particularly in China, India, and Southeast Asia—are driving APAC’s growth. Expect this region to become the fastest-growing MedTech consumer by the end of the decade.

Why it matters: Investors and strategics betting on global medical devices need to think beyond FDA approval. Market access, local manufacturing incentives, and regional regulatory frameworks are becoming just as critical in Asia as they are in the U.S. and EU.

Strategic implication: For scale-ups and acquirers, APAC isn’t just a distribution play anymore—it’s a core growth market. (More)

INTERESTING ARTICLES

"To succeed in business, to reach the top, an individual must know all it is possible to know about that business."

J. Paul Getty