- Healthcare 150

- Posts

- Telehealth Is Booming. Here’s What Comes Next.

Telehealth Is Booming. Here’s What Comes Next.

Telehealth’s trillion-dollar trajectory, 2026 tech budget priorities, and the engagement gap reshaping virtual care.

Good morning, ! This week we explore the rapidly expanding Telehealth market—examining its remarkable growth, the key barriers to adoption, and the strategic priorities shaping its future. Looking ahead to 2026, core business technologies and digital health solutions are leading health system investment pipelines, with AI and generative AI ranking close behind.

Sponsor Spotlight: Whereby is a video call API for telehealth platforms built to improve reliability, trust, and retention in virtual care, with a migration approach designed to reduce risk and time-to-value. In Huli’s case, the team launched an embedded telemedicine experience in ~1.5 weeks and has since seen 20X growth in video consultations, supporting 10,000+ healthcare professionals while reducing no-shows by 20%. Read the Huli story →

— The Healthcare150 Team

DATA DIVE

From Pandemic Patch to Core Infrastructure

Telehealth is no longer a stopgap — it’s scaling into infrastructure. The global market is projected to expand from $196.8B in 2025 to $1.37T by 2035, a >6x increase and one of healthcare’s highest-growth corridors. In the U.S. alone, the market is expected to grow from $74.8B to $528.7B, reinforcing its role as the industry’s economic bellwether.

Geographically, North America commands 54% share, followed by Europe (23%) and Asia-Pacific (17%), the latter representing the fastest growth vector.

Importantly, value capture sits with services, which dominate market share, while products (~39.9%) function as enabling infrastructure via RPM and connected devices.

The shift underway: from episodic video visits to integrated, outcomes-driven virtual care embedded within provider and payer workflows. (More)

TREND TO WATCH

The Great Rebalancing

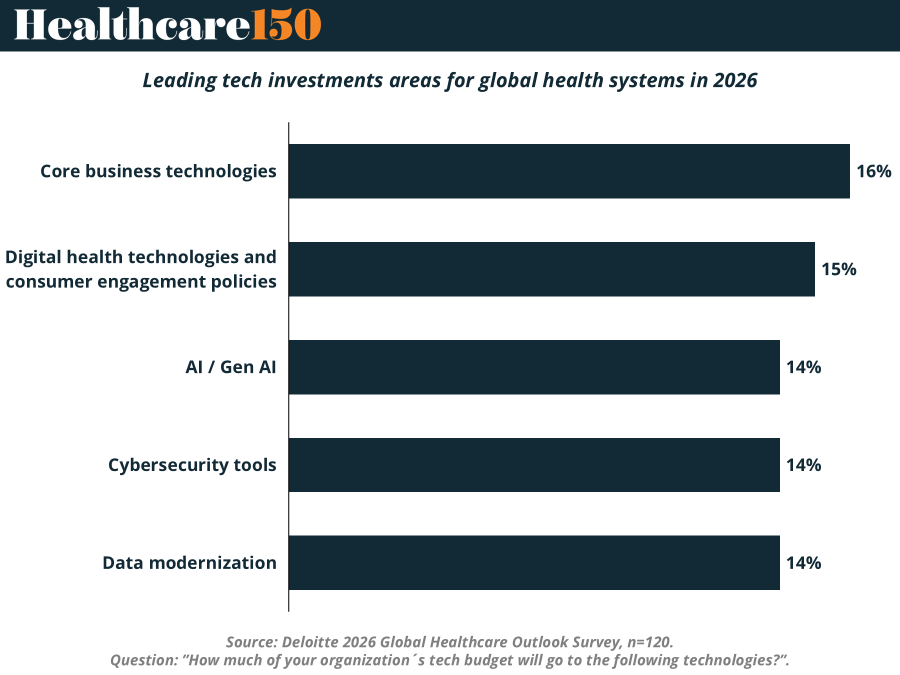

According to Deloitte’s latest outlook, health systems are spreading tech budgets across five nearly equal buckets: Core Business Technologies (16%), Digital Health & Consumer Platforms (15%), AI/Gen AI (14%), Cybersecurity (14%), and Data Modernization (14%).

Yes, AI is now a line item, not a lab experiment. But it sits shoulder-to-shoulder with cybersecurity and data infrastructure — because boards know intelligence is useless without clean pipes and locked doors.

Meanwhile, the largest slice still goes to ERP and revenue cycle tools. Not sexy. Very necessary.

The takeaway: health systems are funding efficiency first, innovation second. It’s a pragmatic pivot from hype to execution — and a sign the industry’s digital strategy is finally maturing. (More)

PRESENTED BY WHEREBY

Huli, a Costa Rica-based healthtech platform that helps doctors manage their practices, needed to enable telemedicine fast without pushing doctors and patients into external apps. They chose Whereby, a video call API for telehealth, prototyped an embedded experience within days, and launched a production-ready solution inside their platform in ~1.5 weeks.

Since then, Huli has achieved 20X growth in video consultations, supports 10,000+ active healthcare professionals across multiple countries, and has seen a 20% reduction in no-shows, even in low-bandwidth environments.

They chose an approach that could roll out quickly, scale reliably, and keep ongoing maintenance low, so the team could focus on growth and experience improvements.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

HEALTHTECH CORNER Brought to you by Whereby

Telehealth’s Engagement Paradox

Telehealth has a growth problem disguised as a tech problem.

According to the latest State of Virtual Care data, 22% of leaders cite patient engagement as the biggest barrier to adoption today, more than financial sustainability at 15%, regulatory compliance at 14%, or technical issues at 14%. Data security at 13% rounds out the core concerns.

But here’s the sharper signal: engagement is not just today’s pain point. It is tomorrow’s capital priority.

A striking 55% of respondents rank increasing patient or practitioner engagement as their top future focus, followed closely by improving user experience at 53% and customer growth at 45%. Cost reduction at 37% and churn mitigation at 25% trail behind.

That spread matters. For years, telehealth strategy revolved around access, reimbursement parity, and platform functionality. The assumption was that once virtual rails were built, utilization would follow. The data suggests otherwise. Access has scaled. Stickiness has not.

This reframes telehealth from an infrastructure story to a behavioral economics story.

If engagement is both the leading constraint and the leading investment priority, we are entering a second phase of virtual care competition. The differentiator will not be video quality or scheduling tools. It will be retention curves, repeat visit frequency, and clinical pathway integration.

For operators, this implies deeper integration with care management, RPM, and value-based contracts. For investors, it shifts diligence toward cohort behavior and lifetime value, not just top-line visit growth. The engagement gap is not cosmetic. It is existential.

Telehealth’s next wave will be won by platforms that convert episodic access into longitudinal relationships. Those that cannot will plateau, regardless of how strong their tech stack looks on paper.

COMPLIANCE CORNER

FDA and DOJ Intensify Focus on Drug Pricing Transparency and Manufacturer Conduct

The regulatory spotlight in late 2025 has sharpened on drug pricing transparency and manufacturer behavior, with FDA and DOJ deploying new tools to enforce compliance. The Biden and Trump administrations' executive orders accelerated efforts to lower drug costs by promoting transparency and pressuring manufacturers and pharmacy benefit managers (PBMs) to disclose net prices. Despite statutory mandates, enforcement agility is tempered by ongoing delays in mandatory price disclosures, as regulators balance industry pushback with public outcry.

Simultaneously, DOJ has formed a False Claims Act working group targeting drug pricing schemes and anti-competitive conduct. FDA's authority has expanded to review or rescind drug approvals tied to manufacturers defying "most-favored-nation" pricing policies, signaling more aggressive oversight of pricing practices and manufacturer relationships.

Device safety recalls, specialty pharmacy compliance, and supply chain integrity remain critical yet less prominently featured in recent federal enforcement alerts. FDA's primary focus continues on generic drug competition and user fee program renewals, leaving those areas as latent risk zones requiring vigilance.

Why it matters: Pricing transparency enforcement raises substantial risk exposure for manufacturers and their partners. Noncompliance invites civil and criminal scrutiny, complicating market access and reputational standing.

Bottom line: Healthcare leaders must prioritize monitoring and governing manufacturer relationships and price disclosures under evolving FDA and DOJ oversight. Awareness of FDA advertising enforcement trends and unaddressed risks in device safety and specialty pharmacies also demands attention to avoid future liabilities. (More)

COMPETITIVE LANDSCAPE SNAPSHOT

See how Huli used Whereby to scale telemedicine quickly and reliably, with low ongoing maintenance as usage grew.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"You'll never do a whole lot unless you're brave enough to try."

Dolly Parton