- Healthcare 150

- Posts

- KKR’s Bold Biopharma Play | Europe’s Hidden Healthcare Risk | AI’s Global Imbalance

KKR’s Bold Biopharma Play | Europe’s Hidden Healthcare Risk | AI’s Global Imbalance

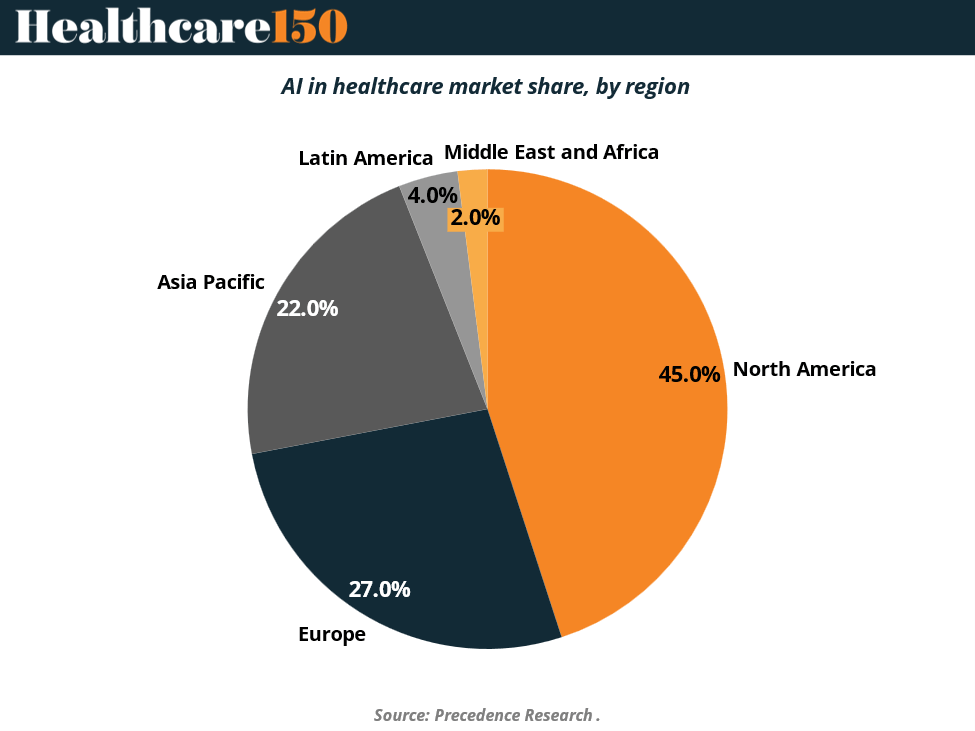

Biopharmaceutical industry is expected to hit $1.8 trillion by 2034, North America still dominates half of the world in AI applications to healthcare.

Good morning, ! This week we’re diving into Biopharmaceuticals 14% annual growth, North America still rules the world in AI`s healthcare applications, many European households are facing a hidden healthcare coverage crisis, and the German PE dealmaking activity in healthcare is still far behind its peak.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

Biopharma’s Bipolar Year

2025 is shaping up to be a biopharma paradox. Global market forecasts are glowing—on track to hit $1.8T by 2034—but on the ground, venture funding is fragmented and fragile. Yes, first financings rebounded to $8.2B in the US and Europe—but 73% of Q1 capital went to just six mega rounds. Then came Q2’s reality check: funding cratered to $900M, the lowest in over a year. Oncology deals tanked. Neurology, metabolic, and autoimmune? Still hot. Meanwhile, seed-stage activity rose, but mostly through insider-led rounds. The takeaway? Investors are choosing their science—and syndicates—very carefully.

TREND OF THE WEEK

German PE Healthcare Deals Swing—But Focus Shifts

German healthcare PE deal value surged in Q2 2022, topping €3.2 billion, then receded through 2023, only to bounce back to €2.7 billion in mid‑2023 and again hit €2.4 billion in early 2025. Interest remains high despite volatility.

This reflects accelerating buy‑and‑build strategies in MVZs—dental, ophthalmology, radiology—driven by structural reforms post‑2015 and demographic tailwinds.

With over 21% of MVZs under PE ownership by 2021, platforms are operating at scale and PE continues to target specialty clusters. Expect deal volume to normalize around €2–2.5 billion per quarter, hinging on regulatory shifts and platform consolidation pace. (More)

PRESENTED BY ATTIO

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

MARKET MOVERS

Company (Ticker) | Last Price | 5D |

Eli Lilly and Company (LLY) | $ 764.19 | 0.13% |

Johnson & Johnson (JNJ) | $ 170.91 | 1.69% |

Novo Nordisk A/S (NVO) | $ 47.50 | -11.98% |

Roche Holding AG (ROG.SW) | $ 315.98 | -1.92% |

AbbVie Inc. (ABBV) | $ 197.29 | 3.17% |

HEALTHTECH CORNER

AI in Healthcare: Still a North American Play

North America owns the narrative in AI-driven healthcare, commanding 45% of global market share in 2024. With the U.S. market valued at $8.41B and expected to grow at a CAGR of 30.9% through 2034 — it’s an arms race. Europe trails with 27%, led by NHS-backed pilots in AI diagnostics and imaging. But the real momentum sits in Asia-Pacific, the fastest-growing region, driven by smart hospital rollouts and China’s deep-pocketed policy push. Latin America and MENA remain underweight but rising, as digital health finally starts to penetrate infrastructure-poor systems. Bottom line: AI in healthcare is going global, but it’s moving at five different speeds. (More)

TOGETHER WITH ATTIO

AI native CRM for the next generation of teams

Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

Join fast growing teams like Flatfile, Replicate, Modal, and more.

DEAL OF THE WEEK

Deal of the Week: KKR Doubles Down on Biopharma Royalties

KKR just added a new tool to its healthcare arsenal. The global investment firm has acquired a majority stake in HealthCare Royalty Partners (HCRx), a $3B asset manager specializing in royalty-based financing for commercial-stage biopharma assets.

HCRx isn’t new to the game. The Stamford-based firm has deployed $7B+ across 55 products in over 10 therapeutic areas, positioning itself as a leader in a niche corner of healthcare finance: royalty monetization. With the acquisition, KKR gains an experienced team and a foothold in a capital-efficient segment of the market that allows companies to raise non-dilutive funding.

This move complements KKR’s broader healthcare strategy—having deployed $20B+ in equity capital since 2004 across names like BridgeBio, Dawn Bio, and Treeline. But HCRx gives KKR a specialized edge in structured credit and royalty-linked products, a market still underpenetrated (<5% of biopharma capital needs).

Why it matters: As R&D-heavy biopharma firms look for alternatives to equity or traditional debt, royalty transactions are becoming a strategic financing lever. KKR is betting that demand for flexible, IP-backed capital solutions will grow—and that it can deliver them at scale. (More)

REGIONAL FOCUS

Europe's Hidden Healthcare Crisis

Universal Health Coverage (UHC) is more aspiration than reality across much of Europe. According to WHO’s new UHC Watch platform, up to 1 in 5 households in some European countries face catastrophic healthcare spending—meaning medical costs, especially for medicines, force families to cut essentials like food, housing, and heating.

This financial pain isn't confined to low-income countries. The data reveal that even Europe's wealthiest nations see millions pushed toward poverty by out-of-pocket payments, with 28 of 40 countries reporting worsening trends. On average, the incidence of catastrophic health spending is rising 1.7 percentage points, eroding economic security for the most vulnerable.

The main culprit? Medicines. Out-of-pocket drug costs, alongside dental care and medical devices like hearing aids, are driving the spike.

Why it matters: For investors, healthcare executives, and policymakers, this signals rising pressure for reform—particularly in drug pricing, reimbursement models, and national insurance coverage. UHC Watch is not just a warning—it’s a strategic map for market entrants and payers navigating the European healthcare landscape. (More)

TOGETHER WITH SYNTHFLOW

Voice AI Security That Impacts Your Bottom Line

Learn how enterprise IT and ops leaders are using compliance to unlock Voice AI scale—deploying faster, reducing risk, and accelerating procurement.

This guide shows why HIPAA, GDPR, and SOC 2 are now deal-makers, not blockers. From securing PHI to routing across 100+ sites, see how security-first platforms reduce friction and enable real-world rollout across healthcare, insurance, and more.

INTERESTING ARTICLES

"You build great companies by solving real problems."

Marcos Galperin