- Healthcare 150

- Posts

- Inside: Nutraceutical Surge, GCC’s Digital Pivot, Home Care Winners

Inside: Nutraceutical Surge, GCC’s Digital Pivot, Home Care Winners

The $1T nutraceuticals market takes center stage as GCC bets big on AI and genomics. Plus, a dive into monitoring PE, the Kenvue deal, and North American home health.

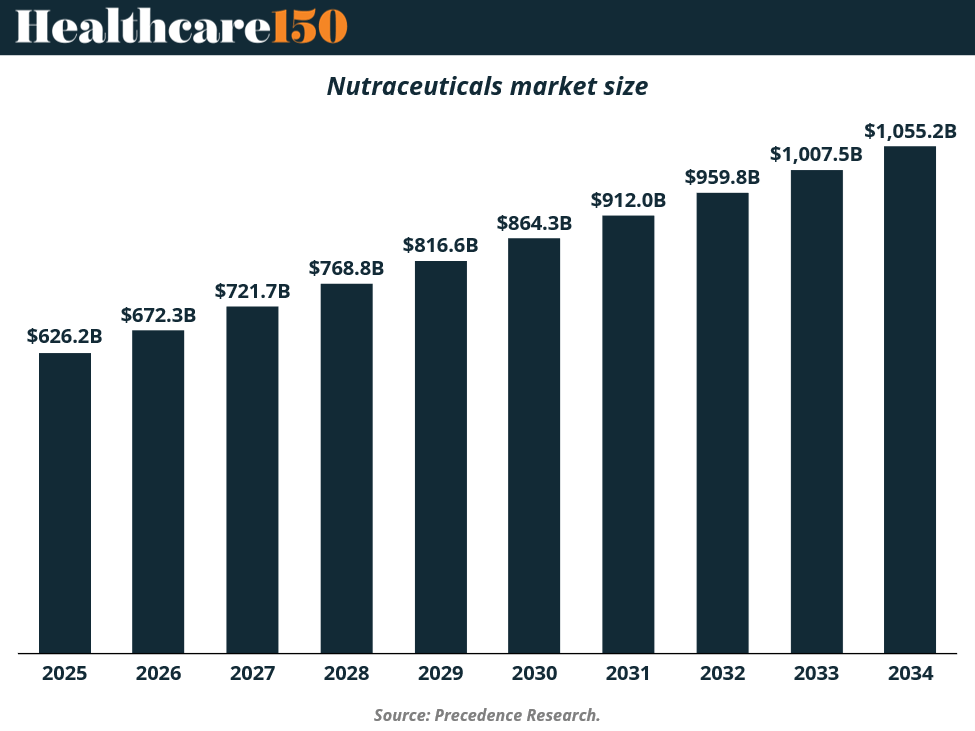

Good morning, ! This week we’re diving into the $626B Nutraceuticals market, monitoring equipment PE deal activity, Home Healthcare market share, and GCC’s healthcare newly found tech driven focus. Want to advertise in Healthcare 150? Check out our self-serve ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

The trillion-dollar vitamin habit

The nutraceuticals market isn’t just having a moment—it’s quietly becoming a $1T healthcare bypass. Consumers are shifting from “fix me later” to “optimize me now,” with 75% using supplements to fill nutrient gaps and 52% chasing general wellness. And the industry is rewarding that mindset: global sales are projected to climb from $626B in 2025 to $1.05T by 2034. The format evolution is just as telling—pills still dominate, but gummies, RTDs, and functional snacks are becoming lifestyle accessories, especially for younger buyers. Asia-Pacific may be the fastest-growing region, but North America still commands the biggest wallet share. The throughline? Consumers want science-backed, personalized, and convenient health upgrades baked into daily life.

PRESENTED BY GALACTIC FED

Executive 1:1 for Healthcare M&A readers: uncover your top 3 untapped growth levers

Before you allocate another dollar of your budget, why not get a senior growth team to analyze your entire marketing strategy for free first?

Galactic Fed is the agency trusted by the world's biggest investors and high-growth companies like Varo, Edible, and Quiznos.

⚠️ Limited spots.

TREND OF THE WEEK

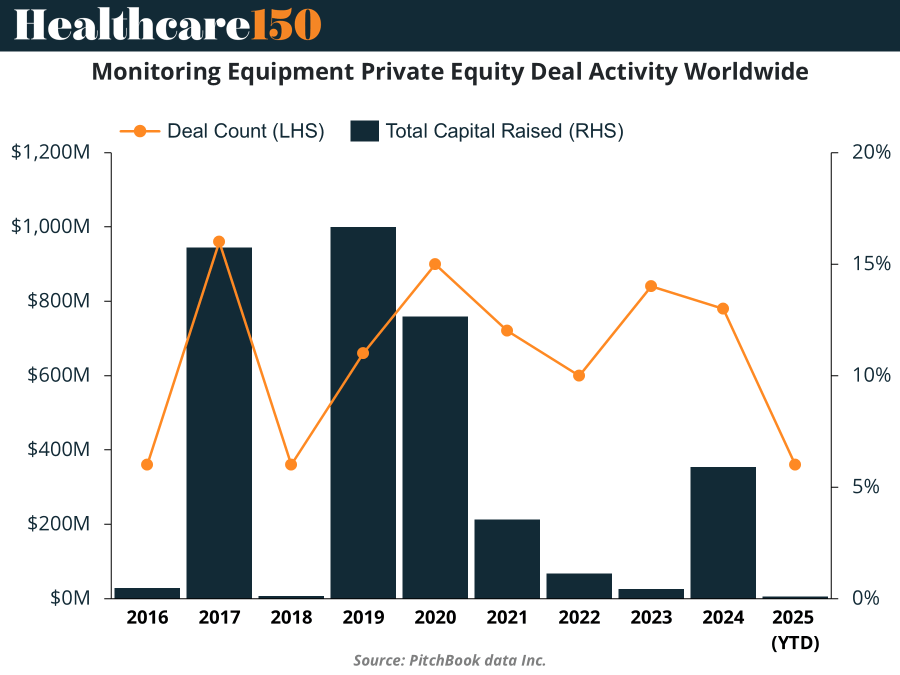

Monitors Are Booming, But Deals Aren`t (yet)

Private equity loves a growth story—but it's not writing blank checks for medical monitoring equipment anymore. Despite a market that's set to nearly double by 2032, with wearables and remote patient monitoring (RPM) driving an 18.9% CAGR in some segments, PE activity is increasingly fragmented. Deal volume is holding steady, but capital raised has nosedived since its 2017 peak. The reason? Likely a cocktail of regulatory risk, long sales cycles, and the fact that not every monitoring business is a wearable unicorn. The smart money is now chasing platform plays—companies that combine hardware, software, and services—rather than betting big on the next bedside monitor. (More)

HEALTHTECH CORNER

GCC’s $135B Tech-Driven Healthcare Pivot

The Gulf Cooperation Council (GCC) is fast becoming a proving ground for digital health transformation. With healthcare spending projected to hit $135.5B by 2027, the region is leaning into technologies like AI, genomics, and virtual care to rewire patient delivery models—and the investment implications are massive.

AI and robotics are leading the charge, particularly in diagnostics and cardiac care. The UAE’s appointment of a Minister of AI and Saudi Arabia’s projected $15–$27B digital health market by 2030 signal long-term structural shifts. Meanwhile, telehealth platforms like Altibbi and the Seha Virtual Hospital are expanding access across 170+ hospitals.

The region is also doubling down on genomics and precision medicine, especially in the UAE, Saudi Arabia, and Bahrain, to transition from reactive to predictive care. On the reimbursement front, GCC players are pushing into value-based care, with early models taking root in Saudi Arabia and the UAE.

For investors, the GCC offers rare alignment: tech-forward governments, expanding budgets, and a population open to digital-first healthcare. As AI-enabled, sustainable care models gain traction, this may be the most investable frontier in global healthtech. (More)

PRESENTED BY GAIN PRO

Who are the biggest private equity investors in the US? See the top 250 shaping the market.

Discover the most influential private equity investors in the United States, ranked by the total enterprise value of their US portfolio companies.

In this report, you’ll find in-depth insights into investment trends, sector shifts, and regional dynamics that define US private equity today. Highlights include:

Where the most active investors rank — with Blackstone, KKR & Apollo leading at $446bn combined

Which sectors dominate — with TMT well ahead, followed by Services and Science & Health

How concentrated the market is — the top 25 firms manage nearly half of total US 250 EV

How US investment is shifting across regions

A differentiated view of market power, scale, and deal momentum

Whether you’re benchmarking peers, exploring potential partners, or tracking the most active players, this report is your essential guide to US private equity today.

Download the full US 250 report and uncover the trends shaping tomorrow’s dealmaking.

DEAL OF THE WEEK

K-C’s $49B Synergy-Driven Scale Play

This week’s CPG consolidation saw Kimberly-Clark agree to acquire Kenvue for $48.7 billion, underscoring a high-stakes bet on consumer health assets.

While the headline price pegs the valuation at a rich 14.3x LTM EBITDA, the rationale for strategic buyers—and a key insight for PE funds—is the sheer scale of the operational firepower. The deal promises a massive $2.1 billion in run-rate synergies from supply chain integration and cost-takeout. This efficiency gain brings the actual transaction multiple down to a compelling 8.8x adjusted EBITDA, transforming an expensive acquisition into a powerful, value-driven play dependent on flawless integration. (More)

REGIONAL FOCUS

North America’s Home Healthcare Stronghold

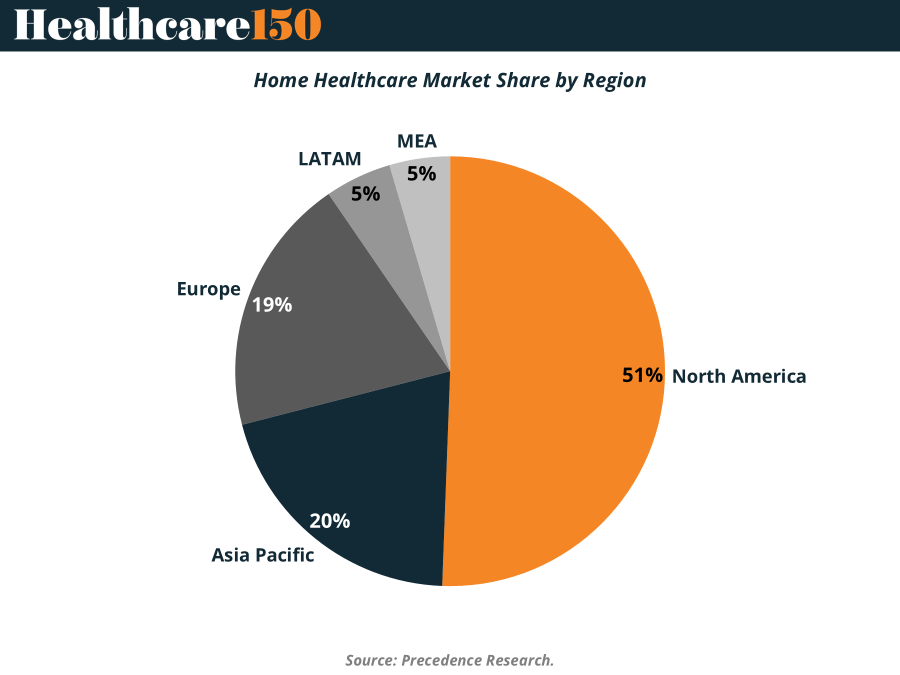

North America isn’t just leading the global home healthcare market—it’s lapping the field with 51% market share. The region’s dominance stems from a mature ecosystem anchored by reimbursement support, licensed clinical services, and consumers who increasingly prefer to age in place. The U.S. in particular is the engine, with telehealth, RPM, and advanced post-acute capabilities turning the home into a decentralized care hub.

Meanwhile, Asia Pacific—already at 20%—is the fastest-growing region, propelled by aging populations and rising chronic disease loads. Europe holds 19% as hospital-at-home expands, while LATAM and MEA (each 5%) build from smaller but increasingly strategic bases. Global momentum is clear: home-based care is shifting from niche to necessity. (More)

INTERESTING ARTICLES

"Do not be embarrassed by your failures, learn from them and start again."

Richard Branson