- Healthcare 150

- Posts

- Healthcare’s New Reality: $191B Deals, 61% More M&A, Rising Scrutiny

Healthcare’s New Reality: $191B Deals, 61% More M&A, Rising Scrutiny

Digital health funding rebounds 35% and 74% cite innovation as the top cost driver, while regulators target pharmacy supply chains.

Good morning, ! This week we’re diving into regulatory crackdowns reshaping pharmacy and supply chains, healthcare PE’s $191B second act, AI-driven consolidation in digital health, and why innovation—not inefficiency—is driving healthcare inflation.

Want to advertise in Healthcare 150? Check out our self-serve ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

Healthcare PE’s Second Act

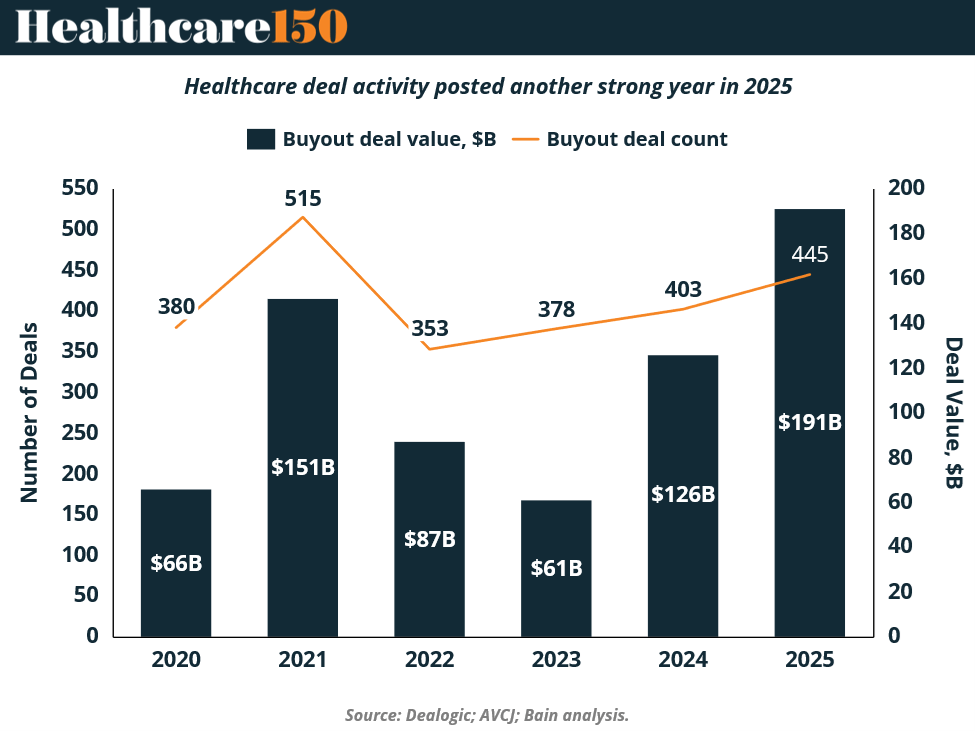

Healthcare private equity didn’t tiptoe back in 2025—it re-entered with conviction. Deal value climbed to roughly $191B, eclipsing the 2021 peak, while exit value nearly tripled year-over-year to $156B. Translation: capital is moving again, and liquidity followed.

But this wasn’t a valuation-fueled sugar rush. Deal count stayed high (~445 buyouts), with capital flowing toward services, biopharma, and asset-light models that can survive reimbursement pressure and labor shortages. Provider roll-ups remained active, but national hospital bets stayed on the bench.

The more telling stat sits on the back end. Over 40 exits above $1B cleared in 2025, driven largely by sponsor-to-sponsor transactions and continuation vehicles. IPOs stayed selective; scale and clean unit economics did the talking.

Bottom line: Healthcare PE is back—but it’s playing a longer, more operational game.

TREND OF THE WEEK

Innovation Is the Inflation

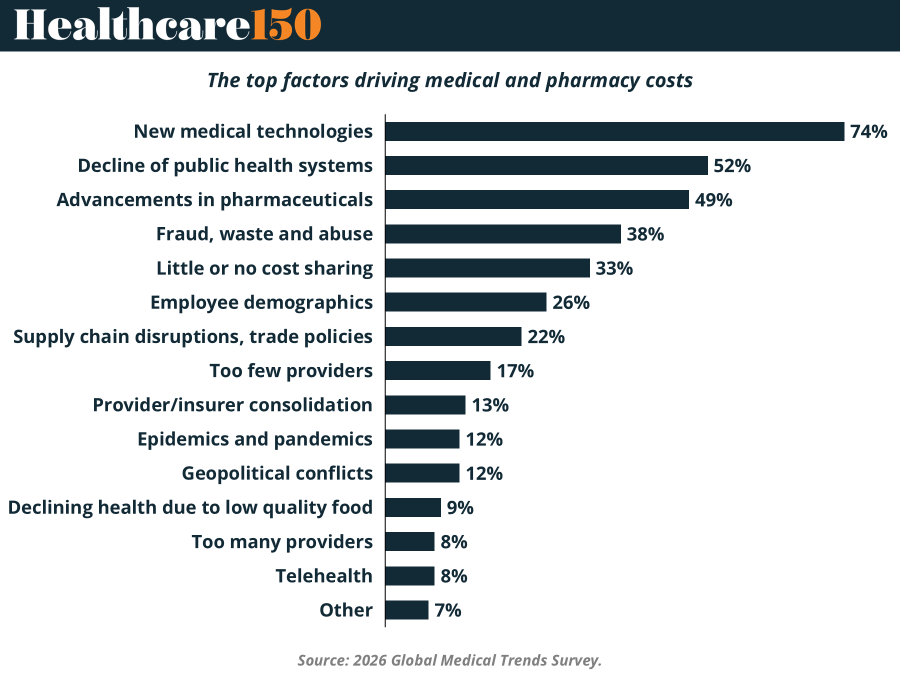

Global healthcare costs aren’t rising because systems are broken—they’re rising because they’re evolving faster than they can be financed. According to the 2026 Global Medical Trends Survey, new medical technologies top the list, cited by 74% of respondents as the leading cost driver. Advanced diagnostics, robotics, and digital tools improve outcomes, but they also arrive with premium price tags and rapid upgrade cycles.

Layer on the decline of public health systems (52%) and costs migrate from prevention to acute care—never cheaper, rarely reversible. Pharmaceutical advancements (49%) add another gear, as biologics and gene therapies redefine treatment while redefining budgets.

Meanwhile, fraud, waste, and abuse (38%) and limited cost sharing (33%) remind us that execution still matters.

Bottom line: Cost inflation isn’t just about excess—it’s about progress colliding with structural strain. (More)

HEALTHTECH CORNER

AI, Acquirers & Averages: Digital Health’s Barbell Year

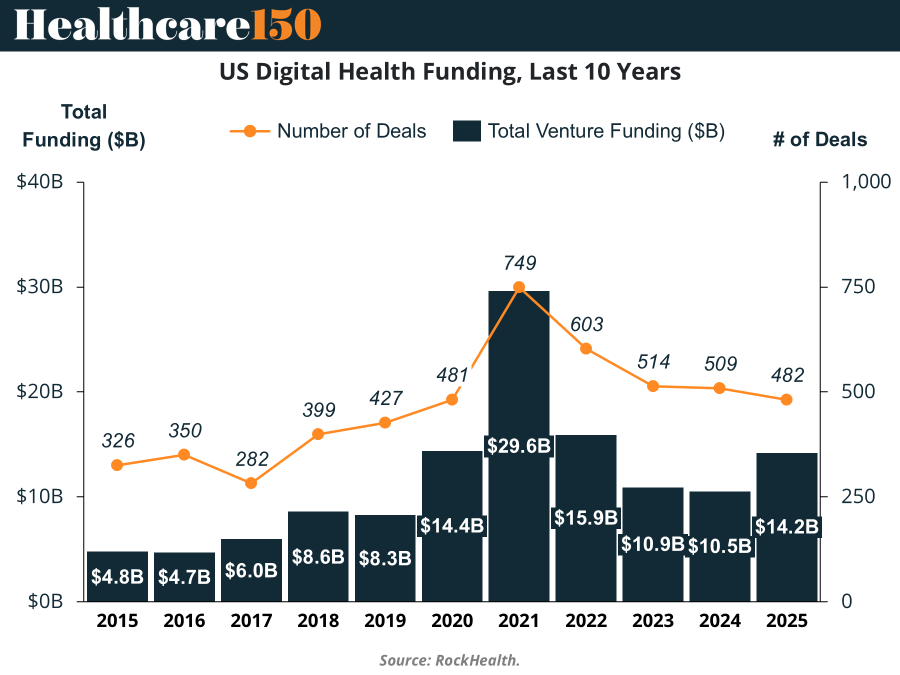

U.S. digital health funding hit $14.2B in 2025, rebounding 35% from 2024—but that growth masked a widening barbell effect. Mega funds and AI-native startups grabbed big checks and exit headlines, while mid-tier companies struggled for attention—or survival. Median deal sizes nudged up, but 42% of funding came from just a handful of outliers.

M&A surged 61% as Goliaths gobbled capabilities, and five companies broke the IPO drought. Meanwhile, 35% of rounds were unlabeled and a growing cohort of startups raised nothing at all. The playbook? Be an AI darling, court a mega fund, or become someone's bolt-on. Everyone else? Better get creative. (More)

COMPLIANCE CORNER

DOJ and FDA Ramp Up Enforcement on Specialty Pharmacies and Supply Chains

In 2025, DOJ and FDA intensified enforcement targeting specialty pharmacies, drug pricing practices, manufacturer relationships, device safety, and supply chain integrity. Notably, False Claims Act actions spotlighted opioid over-dispensing, undispensed drug billing, and spread pricing abuses. A $350 million Walgreens settlement for opioid-related violations and a $290 million judgment against CVS Caremark on inflated Medicare Part D pricing exemplify escalating financial penalties.

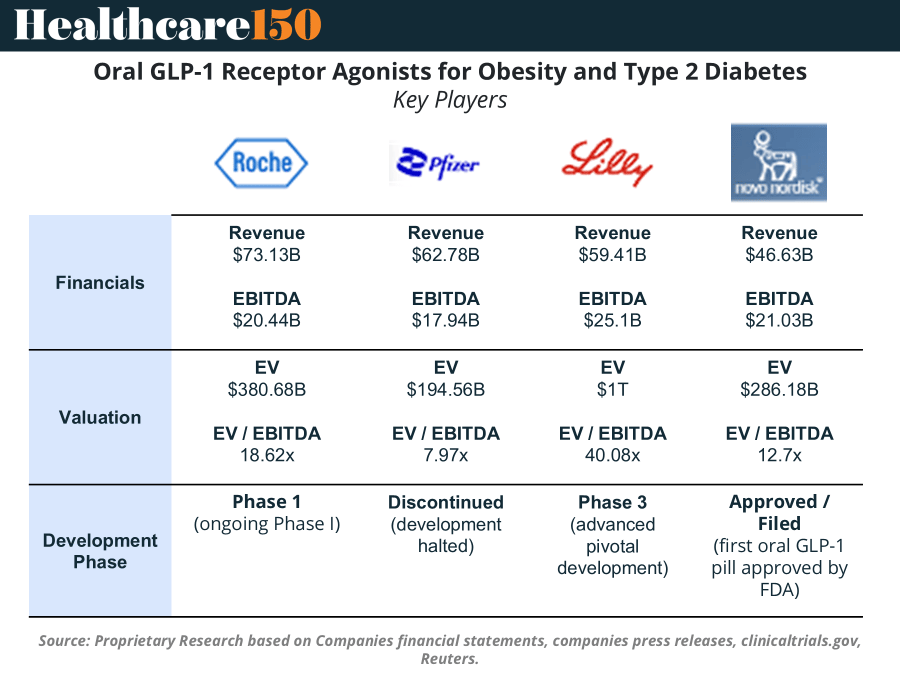

FDA issued numerous warning letters focusing on misleading claims by compounding pharmacies and telehealth companies, especially around unapproved compounded drugs like GLP-1 formulations. Meanwhile, DOJ created a new Enforcement & Affirmative Litigation Branch to address medical device quality failures and deceptive marketing integrating FDA regulatory violations with False Claims Act liabilities tied to reimbursement.

Pharmacy Benefit Managers (PBMs) and pharmacies face increased scrutiny through audits of inventory controls, supplier relations, and prior authorization processes. Independent and specialty pharmacies should expect heightened enforcement for documentation lapses and contract irregularities. Drug manufacturers must monitor promotional activities closely, including influencer and digital marketing content, to avoid FDA violations.

Why it matters: These developments expand regulatory risk beyond traditional fraud allegations to include supply chain integrity, marketing compliance, and algorithm-driven pricing practices. Enforcement is more aggressive, longer, and multidisciplinary.

Bottom line: Healthcare investors must ensure compliance programs across the portfolio companies, comprehensively cover specialty pharmacy operations, PBM contracts, drug promotion practices, and supply chain oversight. Proactive auditing, enhanced documentation, and cross-functional controls are imperative to mitigate rising FCA and FDA enforcement risks. (More)

COMPETITIVE LANDSCAPE SNAPSHOT

PUBLISHER PODCAST

No Off Button: Work/Life Lessons To Reach 700,000 Subscribers And #1 In Your Niche

Champions don’t slow down. They don’t wait for shortcuts. And they definitely don’t have an off switch. No Off Button is where Aram sits down with founders and creators who treat their craft like a long game—obsessive execution, high standards, and zero excuses.

This week’s guest is Rocky Xu, a finance filmmaker who built a 700,000+ subscriber audience and became #1 in his niche by skipping the creator playbook entirely. From day one, Rocky approached YouTube like a media company—producing Netflix-level documentaries from his bedroom and focusing on assets that compound, not viral hits.

The conversation digs into lessons PE minds will recognize instantly: why consistency beats hacks, why distribution is power, why AI is a tool—not a replacement for judgment—and why real value is built by owning evergreen catalogs, not chasing weekly spikes.

Why it matters: this is capital allocation and brand-building logic applied to media. Long-term thinking, defensible taste, and doing the work when no one’s watching.

"Always bear in mind that your own resolution to succeed is more important than any other."

Abraham Lincoln