- Healthcare 150

- Posts

- Healthcare Robotics Hits $21B: PE Pivots to Platforms, Plus $7.7B IPO & CapLink × 150 Media Partnership

Healthcare Robotics Hits $21B: PE Pivots to Platforms, Plus $7.7B IPO & CapLink × 150 Media Partnership

CapLink deal, summit speakers, robots surge, $7.7B oncology IPO

Hi ,

Hi ,

This week, we’re excited to announce a strategic partnership between 150 Media and CapLink Group—two trusted platforms coming together to serve the private capital ecosystem.

Introducing CapLink × 150 Media: a new force in healthcare and M&A media, combining live summits, custom research, and precision-targeted newsletter advertising that reaches over 400,000 investors and executives every week.

Also in this issue:

Caris Life Sciences’ $7.7B IPO and the return of public market appetite for techbio

Cybersecurity’s new role as core infrastructure in healthtech

The affordability gap in Latin America—and the investment opportunities it's unlocking

📩 Want to reach 400,000+ decision-makers in healthcare and M&A? [Start here]

— The Healthcare150 Team

DATA DIVE

Robotics in Healthcare: From Moonshot to Mission-Critical

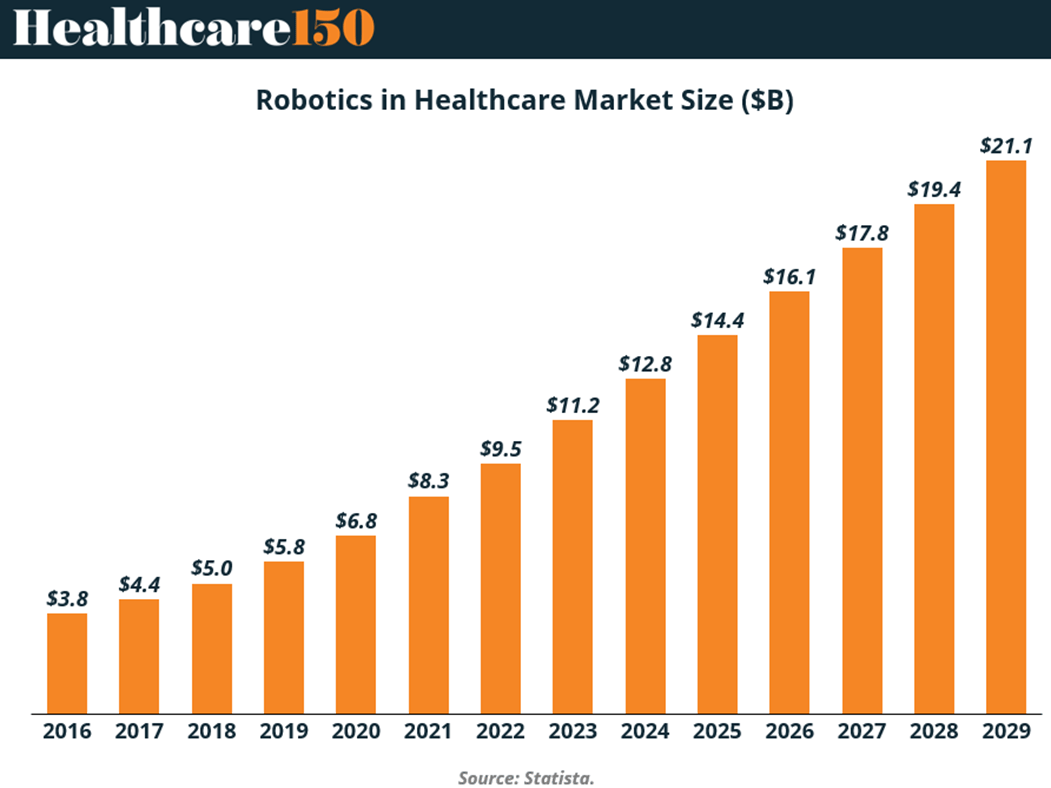

Healthcare robotics has quietly crossed the line from experimental capex to institutional infrastructure. The market is projected to grow 5.5x—from $3.8B in 2016 to $21.1B by 2029, signaling a strategic shift: robotics is no longer a speculative bet. It’s a necessity.

Post-2020, adoption accelerated sharply. COVID didn’t just stress-test healthcare—it opened the door for automation at scale. From Intuitive Surgical’s Da Vinci driving 2.7M procedures in 2024 (up 68% since 2021), to AI-powered rehab and logistics bots, the use cases have widened—and deepened.

Why it matters:

PE and VC firms are no longer circling futuristic hardware—they’re targeting recurring revenue platforms, aftermarket services, and robotics firms that plug into hospital workflows, not just ORs. The market is moving fast, but not equally: while transportation and hospitality dominate deployment (113K and 54K units), healthcare lags with just 6.2K units—a clear value gap ripe for capture.

The opportunity:

Post-acute and logistics robots offer faster time-to-value than surgical systems

Service firms (training, maintenance, integration) are margin-rich PE plays

Cross-vertical robotics roll-ups (from hospitality to healthcare) can bridge adjacent use cases

Firms like Intuitive, Stryker, and PROCEPT are embedding defensibility through volume, training, and data moats

Bottom line: Healthcare robotics isn’t nascent—it’s just hard. That’s precisely why it’s becoming one of the most compelling infrastructure plays in medtech. Investors who move now won’t just buy into automation—they’ll shape the operating system of modern care.

TREND OF THE WEEK

Paging Dr. Burnout: Workforce Is the New Crisis

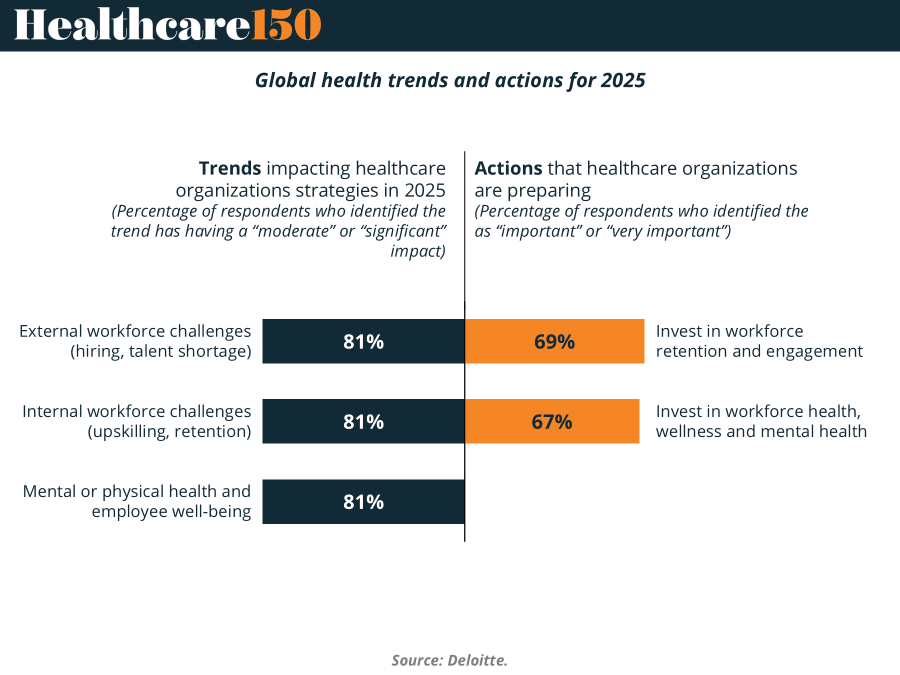

Digital transformation may grab the headlines, but in 2025, it’s talent that’s keeping healthcare executives up at night. A staggering 81% of providers cite hiring shortages, retention gaps, and upskilling issues as top threats to their strategy. But it’s not just about filling shifts—employee well-being is now boardroom-level urgency. With 69% of systems investing in engagement and 67% in mental health, organizations are learning that resilience starts with retention. The takeaway? If your people strategy isn’t keeping pace with your tech stack, your transformation is already in trouble. (More)

PRESENTED BY MONEY

Outsmart college costs

Ready for next semester? June is a key time to assess how you’ll cover college costs. And considering federal aid often isn’t enough, you might have to consider private student loans.

You’re just in time, though—most schools recommend applying about two months before tuition is due. By now, colleges start sending final cost-of-attendance letters, revealing how much you’ll need to bridge the gap.

Understanding your options now can help ensure you’re prepared and avoid last-minute stress. View Money’s best student loans list to find lenders with low rates and easy online application.

MARKET MOVERS

Company (Ticker) | Last Price | 5D |

Eli Lilly and Company (LLY) | $ 770.55 | -4,55% |

Johnson & Johnson (JNJ) | $ 151.50 | -2.38% |

Novo Nordisk A/S (NVO) | $ 70.31 | -8.71% |

Roche Holding AG (ROG.SW) | $ 325.67 | 0.29% |

AbbVie Inc. (ABBV) | $ 184.53 | -3.36% |

HEALTHTECH CORNER

Cyber Insecurity: The Case for Hardening Healthtech Infrastructure

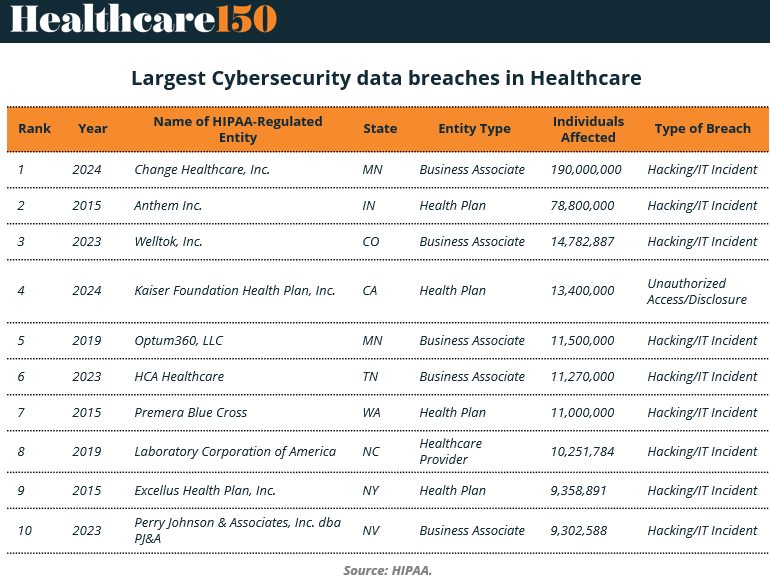

The top 10 healthcare data breaches in U.S. history—by number of individuals affected—tell a sobering story. Three of the top four happened in 2023–2024, with Change Healthcare’s breach alone compromising 190M records, more than half the U.S. population. Every breach in the top 10, except one, stemmed from Hacking/IT Incidents—a pattern too large to ignore.

As healthtech matures and care delivery digitizes, cybersecurity risk scales in lockstep. Business associates—tech vendors and service firms—are now just as exposed as the health plans and providers they serve. Yet investment in security infrastructure continues to lag behind front-end innovation.

Why it matters: For investors, these incidents reveal a structural gap: security is still seen as a cost center, not a differentiator. That’s changing fast. In a value-based care world where trust, uptime, and compliance determine viability, cyber resilience is a competitive moat.

The opportunity:

Expect increased PE interest in cybersecurity-as-a-service models tailored for healthcare.

Regtech and risk quantification tools could see accelerated demand from both payers and providers.

Next-gen EHRs and data-sharing platforms will need zero-trust architecture baked in.

Bottom line: The cybersecurity problem in healthcare isn’t theoretical. It’s historic—and urgent. The winners in healthtech will be those who treat security not as a patch—but as infrastructure. (More)

The Private Markets Intelligence Summit of the Year

📍 October 15, 2025 | Well& by Durst, NYC

Join 300+ private markets leaders—GPs, LPs, operating partners, and advisors—for a single day of insights, strategy, and dealmaking at the New York Private Capital Summit.

This isn’t another networking event. It’s where strategy meets substance:

→ Keynotes from HarbourVest, Bloomberg, Australian Super

→ Deep-dives on secondaries, direct lending, GenAI, and ESG

→ Practical panels on fund formation, human capital, and tax strategy

→ A spotlight on emerging liquidity tools and NAV-based financing

With over 50 senior speakers from firms like Apollo, KKR, Carlyle, Neuberger Berman, and Warburg Pincus, the Summit is designed for decision-makers driving the next decade of private capital.

Reserve your seat before it sells out: Early Bird Access

DEAL OF THE WEEK

Caris Cashes In

Texas-based Caris Life Sciences just showed the public markets still have a soft spot for precision oncology. The AI-driven diagnostics firm priced its Nasdaq IPO at $21, above its raised range, and shares popped 33% on Day 1, valuing the company at $7.7B. Caris banked $494M, backed by the usual suspect banks (BofA, JPM, Goldman), with Sixth Street cheering from the sidelines. Funds will go toward debt paydown and global expansion of its FDA-approved multi-omic cancer profiling platforms. Call it a techbio fairy tale or just investors finding their risk appetite again—but this deal also signals something bigger: public markets may be reopening for healthtech unicorns, especially if they’re fluent in AI + sequencing. (More)

REGIONAL FOCUS

Latin America and Affordability: A Growing Perception Gap

According to Ipsos data, Latin American respondents overwhelmingly believe their healthcare systems are unaffordable—with 75–79% of respondents in Brazil, Colombia, Chile, Peru, and Argentina agreeing that “healthcare is not affordable for most people.” That’s well above the global average of 61%, and higher than the U.S. (71%), where affordability remains a hot-button issue.

The irony? Many of these countries have public systems in theory—but in practice, gaps in access, quality, and coverage push large swaths of the population toward out-of-pocket spending or fragmented private options. In markets like Brazil and Colombia, rising inflation and economic instability have only widened this perception gulf.

Why it matters:

This perception is more than sentiment—it drives demand for insurance products, out-of-pocket fintech, and digital-first care models. It also points to structural market opportunities: mid-tier private plans, value-based public-private partnerships, and affordability-focused Healthtech platforms.

Bottom line: For investors and operators in Latin America, affordability isn’t just a problem—it’s a positioning opportunity. Models that speak to price sensitivity and deliver measurable outcomes will own the narrative. (More)

INTERESTING ARTICLES

"The future belongs to those who believe in the beauty of their dreams"

Eleanor Roosevelt