- Healthcare 150

- Posts

- Healthcare M&A Under Pressure, Gavi Funding at Risk, and the Rise of Personalized Medicine

Healthcare M&A Under Pressure, Gavi Funding at Risk, and the Rise of Personalized Medicine

The U.S. conditions Gavi funding on thimerosal elimination and North America holds 45% of the personalized medicine market, while integration risk tops M&A concerns.

Good morning, ! Today, we’re examining the key constraints shaping healthcare M&A, the U.S. government’s plan to condition future funding for Gavi, and North America’s 45.33% share of the global personalized medicine market.

Want to advertise in Healthcare 150? Check out our ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

HEADLINE OF THE WEEK

U.S. Conditions Global Vaccine Funding on Preservative Phase-Out : Vaccine Economics Enter a New Policy Risk Era

The U.S. decision to condition future funding to Gavi on the elimination of thimerosal marks a decisive shift in how public-health policy intersects with global vaccine markets. While framed as a safety measure, the move diverges from long-standing scientific consensus and effectively rewrites the operating assumptions for vaccine manufacturing, procurement, and scale—particularly for low- and middle-income countries reliant on multi-dose formulations.

Why it matters: For healthcare leaders and investors, this is not a narrow regulatory tweak but a structural policy signal. Vaccine developers now face heightened political and reimbursement uncertainty, with implications for capital allocation, late-stage pipeline prioritization, and global supply-chain design. Over time, this could accelerate underinvestment in vaccines relative to other modalities, increase fragmentation between U.S. and international immunization standards, and force manufacturers to rethink unit economics in price-sensitive markets.

Bottom line: Vaccine policy risk has become market risk, and leadership teams should plan accordingly. (More)

DEAL OF THE WEEK

VCs Go All In on Cells

Cytotheryx just landed a $60M Series A, one of the largest early-stage biotech raises this month. The pitch? A cell-based therapeutics platform with actual clinical legs and scalable manufacturing cred. Investors are flocking to startups that don’t just dream in Petri dishes but can translate into pipelines.

Proceeds will scale up R&D, push lead programs toward trials, and build out infrastructure. It’s another datapoint in the trend of capital clustering in fewer, bolder bets—VCs no longer want the next Theranos. They want a biologics factory with a path to FDA. (More)

REGIONAL FOCUS

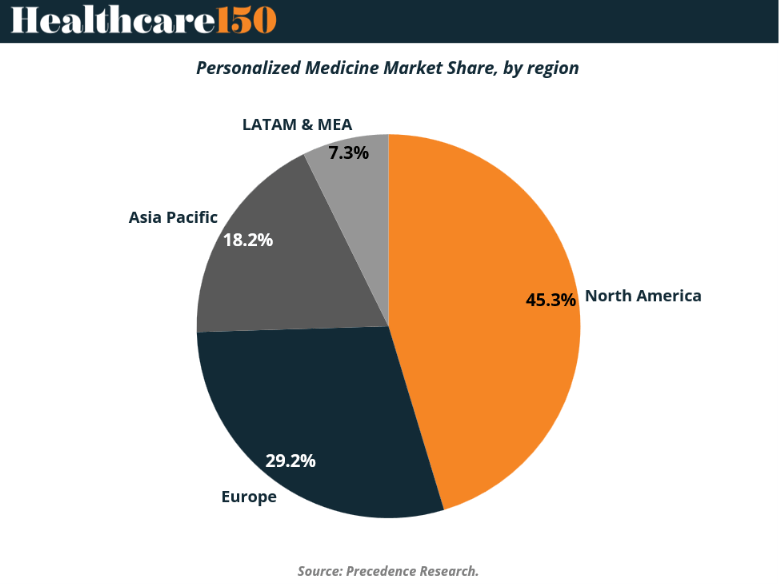

Personalized Medicine Finds Its Geography

North America still calls the shots, controlling 45.33% of global market share in personalized medicine. That dominance isn’t accidental—it’s the result of deep biopharma R&D spend, mature genomic infrastructure, and a U.S. healthcare system that has embraced precision diagnostics, AI-driven analytics, and companion diagnostics faster than most.

Europe, at 29.19%, plays a strong second fiddle, powered by personalized oncology, rare disease research, and large-scale initiatives like the UK Genomic Medicine Service. The focus here is less speed, more coordination—especially around data interoperability and cross-border research.

But the real plot twist is Asia Pacific. With 18.20% share and the fastest projected growth, countries like China, Japan, and South Korea are scaling genetic testing, digitizing healthcare, and turning the region into a hub for clinical trials and pharmacogenomics.

Bottom line: Leadership stays in North America—but growth is clearly heading east. (More)

MICROSURVEY

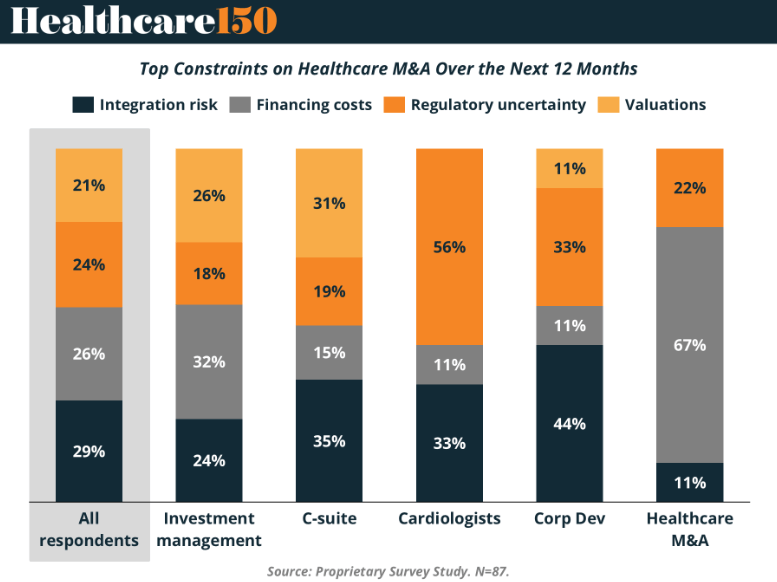

What Will Really Slow Healthcare M&A in 2026?

Healthcare dealmaking isn’t running out of capital, or targets. It’s running into confidence gaps.

Our latest survey reveals a market where the biggest constraints on healthcare M&A depend entirely on where you sit. Integration risk looms largest for operators, reflecting hard lessons from the last consolidation wave. Financing costs dominate for deal professionals, reshaping leverage assumptions and deal math. And for clinicians, regulatory uncertainty remains the headline risk—far outweighing valuations.

The takeaway? This isn’t a frozen M&A market. It’s a selective one, where execution risk, capital structure, and regulatory exposure matter more than price alone.

In the year ahead, the winners won’t just source deals, they’ll prove they can integrate assets, finance them creatively, and manage scrutiny before signing. (More)

INTERESTING ARTICLES

PUBLISHER PODCAST

No Off Button: Work/Life Lessons To Reach 700,000 Subscribers And #1 In Your Niche

Champions don’t slow down. They don’t wait for shortcuts. And they definitely don’t have an off switch. No Off Button is where Aram sits down with founders and creators who treat their craft like a long game—obsessive execution, high standards, and zero excuses.

This week’s guest is Rocky Xu, a finance filmmaker who built a 700,000+ subscriber audience and became #1 in his niche by skipping the creator playbook entirely. From day one, Rocky approached YouTube like a media company—producing Netflix-level documentaries from his bedroom and focusing on assets that compound, not viral hits.

The conversation digs into lessons PE minds will recognize instantly: why consistency beats hacks, why distribution is power, why AI is a tool—not a replacement for judgment—and why real value is built by owning evergreen catalogs, not chasing weekly spikes.

Why it matters: this is capital allocation and brand-building logic applied to media. Long-term thinking, defensible taste, and doing the work when no one’s watching.

"Always bear in mind that your own resolution to succeed is more important than any other."

Abraham Lincoln