- Healthcare 150

- Posts

- GenAI Hits Healthcare: Innovation or Regulation Roadblock?

GenAI Hits Healthcare: Innovation or Regulation Roadblock?

Generative AI is no longer just hype—it’s entering clinics, hospitals, and care networks with unprecedented speed.

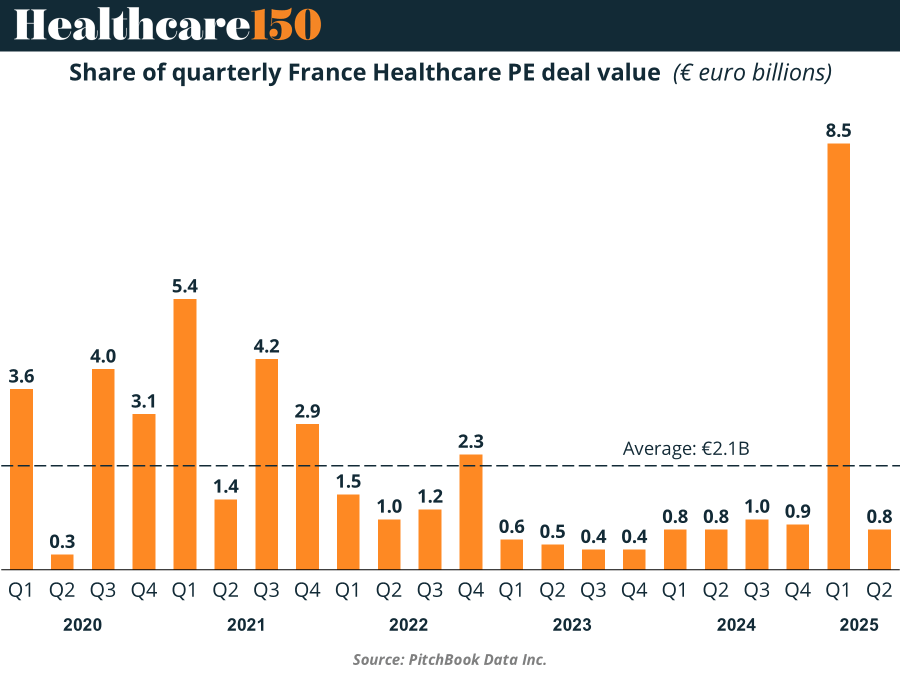

Good morning, ! This week we’re diving into the Gen AI irruption in the Healthcare industry, France reaches a peak in Healthcare PE deals value in 1Q25 by quadrupling the 5-years average. Employers struggle to balance costs with rising employee benefit demands.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

Healthcare Bets Big on GenAI But Demands Guardrails

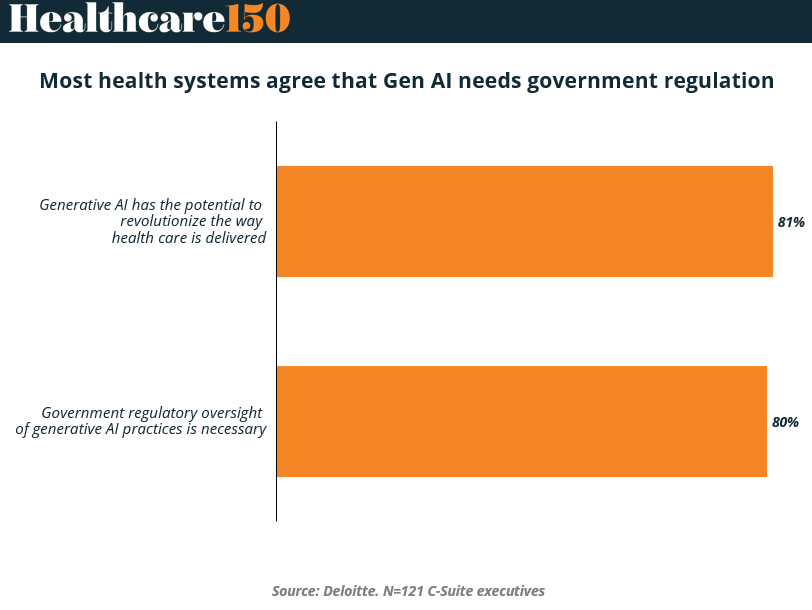

Generative AI is quickly moving from hype to hospital floors. In healthcare, 81% of C-suite executives say GenAI has the potential to revolutionize care delivery—powering faster diagnoses, personalized treatments, and more efficient operations. But that same transformative power is triggering a parallel call for caution: 80% also support government regulation.

This tension—between innovation and oversight—is shaping how healthcare players adopt the technology. Nearly half (47%) of organizations have already implemented GenAI tools, with another 38% running pilots. Yet adoption isn't uniform. Tech-forward health services firms lead the charge, while traditional providers proceed with a more measured split between experimentation and rollout.

The workforce is shifting too: 84% of organizations plan to hire GenAI talent, favoring in-house expertise over partnerships. Meanwhile, early returns are mixed. Only 10% report strong ROI, and 37% haven't measured impact yet—a sign the tech is still in its scaling phase.

Bottom line: Healthcare isn’t waiting to embrace GenAI—but it’s building the plane while flying it. Regulation, talent, and execution discipline will determine whether the industry’s GenAI ambitions lead to transformation or turbulence.

TREND OF THE WEEK

Balancing Benefits

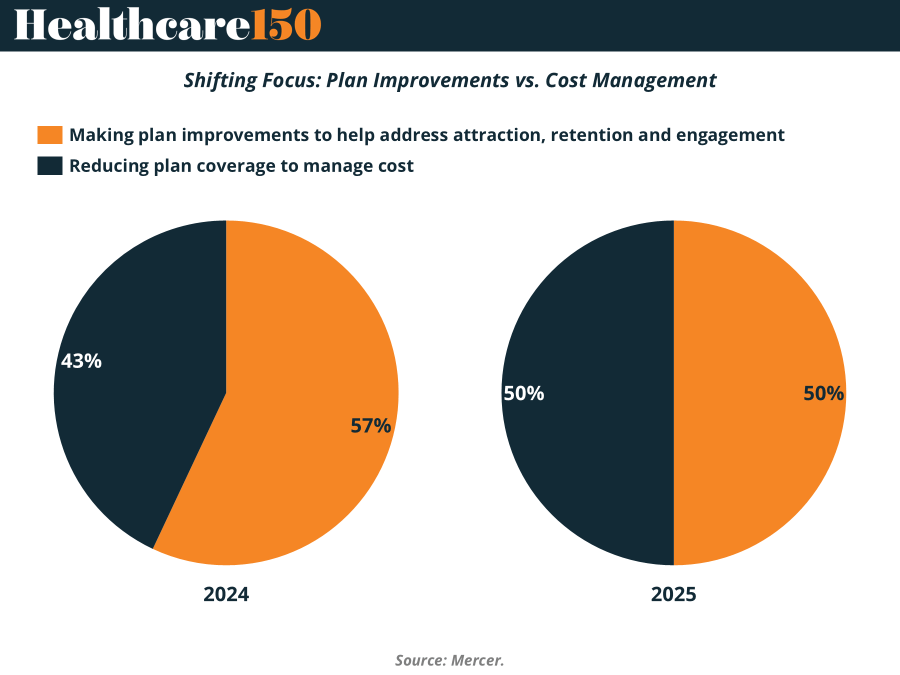

Employers are in a tug-of-war between enhancing coverage to attract talent and cutting benefits to manage costs. Mercer data shows a shift: in 2024, 57% prioritized plan improvements, but by 2025, it’s a dead-even split at 50/50. Meanwhile, worker expectations keep climbing. 39% want AI-powered mental health support, but just 15% of insurers offer it. Add rising demand for menopause care, neurodivergent support, and family-building benefits, and the gap between coverage reality and workforce needs widens. Inflation only makes it worse, quietly eroding benefit maximums. Bottom line: benefit design is less about “what’s cheapest” and more about what employees actually use—and employers that miss this risk losing their workforce to someone who doesn’t. (More)

PRESENTED BY UNISWAP

Swap, Bridge, and Track Tokens Across 14+ Chains

Uniswap web app lets you swap thousands of tokens safely, in seconds. Open‑source, audited code and real‑time token warnings help keep you safe.

HEALTHTECH CORNER

AI Prescribes Capital

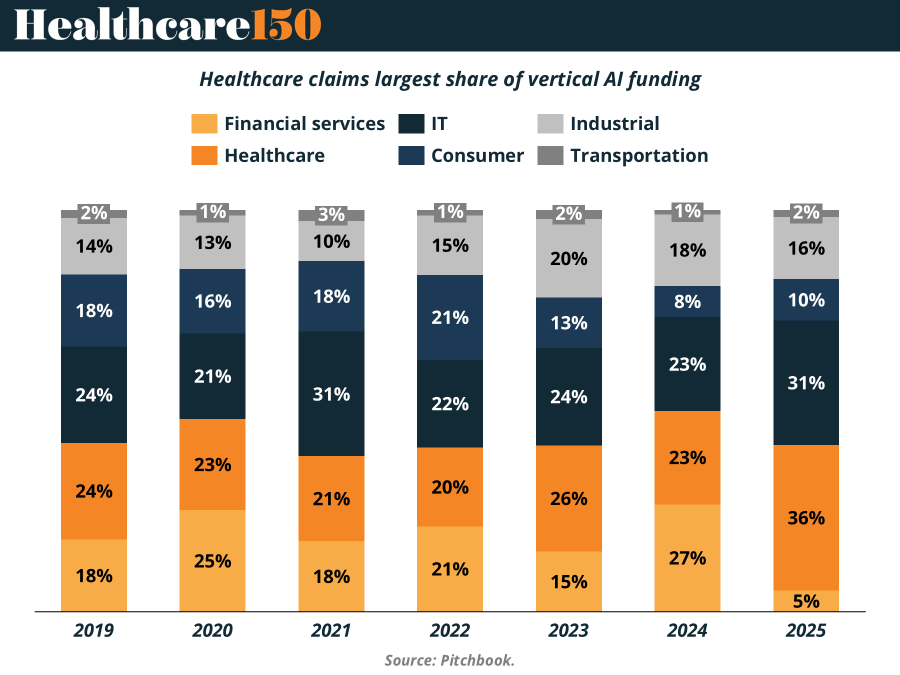

Vertical AI is the new investor darling, and healthcare is the star patient. With $2.1B already invested this year, deal value has surpassed 2023 totals. From drug discovery to medical data analysis, investors see real upside where big tech incumbents can’t easily play. Notable deals: Isomorphic Labs’ $600M round (its first outside funding) and Sweden’s Neko Health, which scanned its way to $260M. Compared to IT and legal AI startups, healthcare stands out not just for hype but for application—drug pipelines, diagnostics, and workflows that could actually change clinical outcomes. (More)

TOGETHER WITH PACASO

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

DEAL OF THE WEEK

Deal of the Week: CapVest Nabs Majority Stake in €10B Stada

CapVest Partners has acquired a majority stake in German pharma giant Stada Arzneimittel, valuing the company at ~€10B (including debt). The deal marks one of Europe’s largest private equity exits this year, as Bain Capital and Cinven step back from full ownership but retain a minority interest.

This isn’t a quick flip. Bain and Cinven originally took Stada private in 2017 for €5.3B, then fueled more than 25 bolt-on acquisitions, including brands from J&J, Sanofi, and GSK. That M&A spree turned one of Europe’s last independent generics players into a €4.2B revenue platform expecting nearly €990M in adjusted EBITDA this year.

An IPO had been on the table, but public markets weren’t cooperating. Enter CapVest—with M&A playbooks ready—backing a proven consolidator with margin upside and international reach.

Why it matters: This is a reminder that growth via consolidation still wins in Europe’s fragmented pharma landscape, especially for firms with OTC, generics, and consumer health exposure. With volatility delaying IPOs, expect more secondaries and GP-leds to fill the gap. (More)

REGIONAL FOCUS

France’s Medtech Paradox

French healthcare PE just had its best quarter on record—€8.5B in Q1 2025, quadrupling the average. And yet, for early-stage medtech, capital remains elusive. Despite an enviable public research ecosystem, France lacks local growth funds to help domestic champions scale. While Berlin and Boston pull away, French startups stay stuck in exit limbo, struggling to cross the €30M revenue line without buyers. Meanwhile, political resistance to private equity (see: CD&R’s Sanofi saga) isn’t helping. Without regulatory simplification and capital incentives, France risks becoming the world’s best medtech incubator… for American buyers. (More)

INTERESTIRTICLES

"The ones who are crazy enough to think they can change the world, are the ones who do."

Steve Jobs