- Healthcare 150

- Posts

- FDA–EMA Alignment, FemTech’s Regional Divide, and a $14.5B MedTech Bet

FDA–EMA Alignment, FemTech’s Regional Divide, and a $14.5B MedTech Bet

Boston Scientific acquires Penumbra for $14.5B and North America leads FemTech with 39% market share, while regulators set joint AI principles.

Good morning, ! This week we’re FDA and EMA agreements on drug development regulation, the femtech market share by region, and Boston Scientific $14.5B acquisition of Penumbra

Sponsor spotlight: In Affinity’s survey of nearly 300 private capital professionals, deal sourcing is still priority #1 for 2026—but bandwidth is the constraint. The 2026 Predictions report shows how firms are tightening data ecosystems and automating sourcing workflows to surface better opportunities faster. Read the Report →

REGIONAL FOCUS

Where Femtech Scales First—and Fast

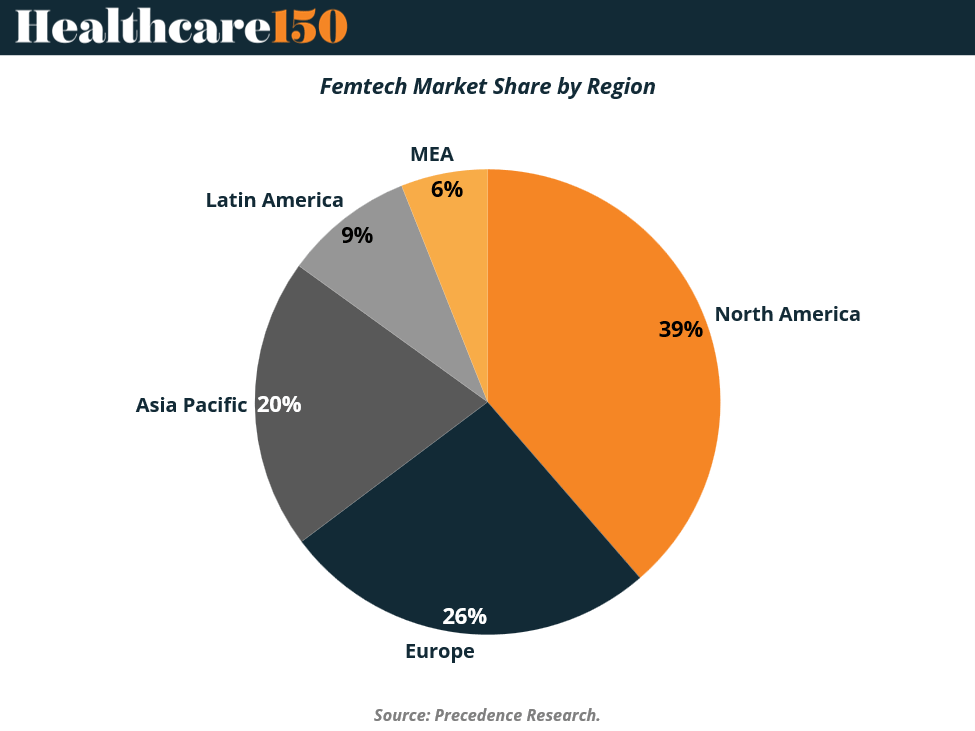

North America still calls the shots, controlling 39% of global femtech market share. That dominance isn’t accidental: high digital health adoption, clear reimbursement pathways, and a deep venture bench continue to fund solutions across fertility, pregnancy care, chronic disease, and menopause.

Europe, at 26%, is more policy-powered than hype-driven. Regulatory clarity, public investment, and a growing embrace of virtual care—especially around fertility access and reproductive equity—are quietly compounding adoption.

The real growth story, though, sits in Asia Pacific (20%). Smartphone penetration, rising middle-class healthcare spend, and a wave of local femtech startups are pushing scale across maternal health and menstrual care.

Latin America (9%) and MEA (6%) lag today, constrained by infrastructure gaps—but mobile-first ecosystems suggest long-term upside. Geography still matters. Less so every year. (More)

DEAL OF THE WEEK

Boston Scientific’s $14.5B Thrombectomy Bet

Boston Scientific is acquiring Penumbra for $14.5B, paying $374 per share in a ~73% cash and stock mix. The transaction pulls Boston Scientific decisively into mechanical thrombectomy, hemorrhage control, and neurovascular stroke, categories with strong procedure growth and defensible clinical differentiation.

Penumbra brings scale and momentum. Preliminary Q4 revenue reached $383M to $385M, up ~22% YoY, with full year revenue of $1.4B, up >17%. That growth profile helps explain the premium and the strategic urgency. Thrombectomy volumes continue to rise globally as stroke systems mature and indications expand, creating a long runway for device-led share gains.

The market reaction was cautious. Boston Scientific shares fell ~4% premarket, reflecting concern over balance sheet impact as the company funds roughly $11B in cash with a mix of reserves and new debt. Integration risk is real, particularly across sales forces and R&D roadmaps.

Why this matters now. After a muted JPM week, this deal reasserts large-cap medtech appetite for category ownership, not adjacency. For strategics and sponsors, it resets valuation expectations in high acuity neurovascular assets and signals that growth plus clinical relevance still clears the capital hurdle. (More)

HEADLINE OF THE WEEK

FDA and EMA Agree on Joint AI Regulatory Principles for Drug Development: Sets Global Regulatory Baseline for AI-Driven Life-Sciences Innovation.

So what? By establishing harmonized guiding principles on the safe, ethical, and lifecycle-wide use of artificial intelligence in drug discovery, clinical trials, manufacturing, and post-market surveillance, the world’s two leading drug regulators are laying the foundation for cross-border AI adoption, reducing regulatory fragmentation, accelerating innovation cycles, reshaping validation and compliance standards, favoring scaled vendors with regulatory infrastructure, lowering uncertainty for investors, and materially influencing R&D strategy, platform selection, and capital deployment across biopharma, medtech, and digital health for the next decade. (More)

PRESENTED BY AFFINITY

One-third of dealmakers are now spending 21–40 hours every week just researching companies. That's half a full-time job before a single conversation happens.

In Affinity's survey of nearly 300 private capital professionals, deal sourcing remains their top priority for 2026. But the real bottleneck is having the bandwidth to evaluate opportunities before competitors do.

The firms pulling ahead are automating the manual research work, surfacing higher-quality targets faster, and protecting their teams from drowning in data.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

MICROSURVEY

What will constrain healthcare M&A activity most in the next 12 months? |

INTERESTING ARTICLES

PUBLISHERS PODCAST

No Off Button: Real leadership shows up after the frameworks fail.

In this episode, Aram sits down with Konstantinos Papakonstantinou to unpack the uncomfortable gap between formal education and real-world execution. They get into why degrees, playbooks, and neat frameworks tend to break down when capital is at risk—and how judgment is actually forged through ownership and consequence.

The conversation zeroes in on decision-making under pressure, accountability, and the kind of lessons teams only learn when outcomes are real and reversible mistakes are gone.

Why PE should care: returns aren’t driven by credentials—they’re driven by operators who can make clear calls with imperfect information, carry responsibility, and execute when it counts.

Watch the full conversation and see what holds up when theory meets reality.

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"If you don't like something, change it. If you can't change it, change your attitude."

Maya Angelou