- Healthcare 150

- Posts

- End of Year Special Issue: A 2025 Review and key Topics for 2026 in Healthcare

End of Year Special Issue: A 2025 Review and key Topics for 2026 in Healthcare

Biotech is projected to cross $2.19T and wearables hit a strategic inflection point, while only 10% of systems report significant AI returns.

Good morning !,

If 2021 was the year of exuberance and 2022-23 the years of reset, 2025 was the year the industry looked itself in the mirror. Across AI, Medicare, cybersecurity, and wellness, healthcare leaders faced a common theme: transformation without payoff is no longer good enough.

Generative AI dominated headlines—but delivered modest returns. Medicare reforms yielded access parity, not disruption. Despite digital progress, cyber threats surged. And while wellness spending soared, it became clear that local nuance now defines global strategy.

As we look toward 2026, the market isn’t slowing—it’s sorting. From wearables moving into clinical territory, to biotech approaching a $2T milestone, to virtual care preparing for a new credibility test, the next 12 months will separate the scalable from the speculative.

Healthcare’s next phase won’t be defined by ideas—it will be defined by execution.

Want to advertise in Healthcare 150? Check out our self-serve ad platform, here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

Key topics in 2025

1. Generative AI: Returns Still in the Waiting Room

In 2025, generative AI was the most hyped technology in healthcare—but the returns didn’t quite follow. While 43% of health system execs reported moderate or significant ROI, a larger share (37%) said it’s too early to tell, highlighting a year defined more by deployment than by payoff.

The industry poured capital and attention into generative AI, expecting it to cut costs, streamline ops, and enhance diagnostics. But with just 10% citing significant returns, 2025 became a year of expectation management, not financial wins. The lag in measurable outcomes is pushing providers and investors alike to rethink implementation strategies heading into 2026.

Bottom line: Generative AI reshaped boardroom agendas in 2025—but its impact on the P&L remains on hold.

2. Wellness 2025: Global Demand, Local Priorities

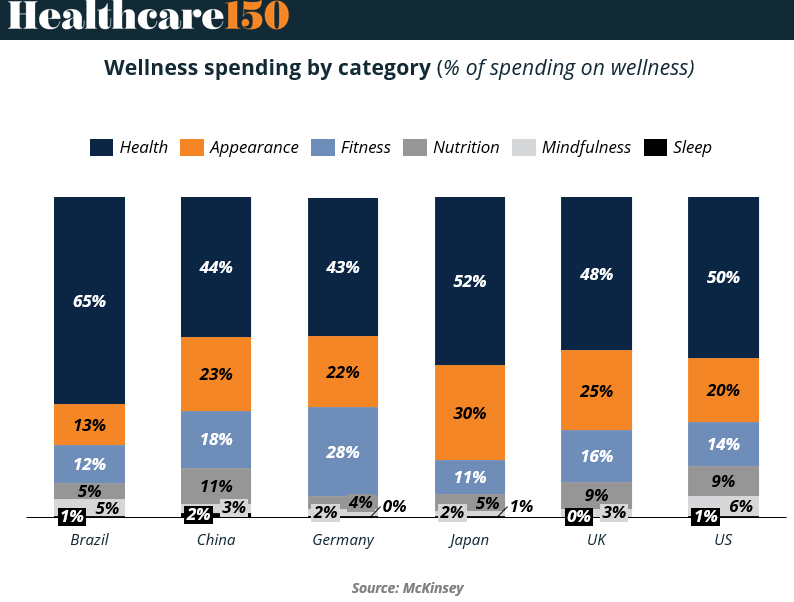

Wellness spending in 2025 revealed sharp regional divides. While Brazil (65%) led with health-focused spend, Japan (30%) and the UK (25%) prioritized appearance. The US balanced across categories but under-indexed on mindfulness and sleep.

For operators, the takeaway is strategic: there’s no one-size-fits-all wellness play. Consumer priorities vary widely, and success in 2025 meant tailoring offerings to regional preferences—not pushing a global template.

Bottom line: In wellness, 2025 rewarded localization over scale.

3. 2025 Medicare: No Clear Winner on Access

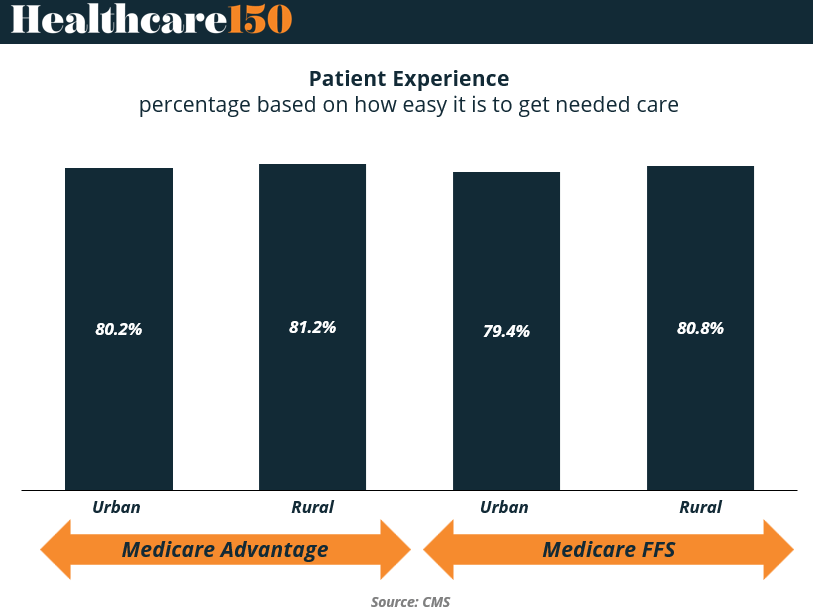

In 2025, patient experience between Medicare Advantage and Medicare FFS showed marginal differences when it came to accessing needed care. Rural Advantage enrollees reported the highest satisfaction (81.2%), but the spread across plans and geographies stayed within 2 percentage points.

The takeaway? Despite years of heated policy debate and plan reshuffling, access parity—not disruption—defined the year. For providers and payers, 2025 underscored the need to differentiate on outcomes and cost—not just access perception.

Bottom line: In Medicare, 2025 wasn’t about who won—it was about how little changed.

4. Cyber Risk in 2025: Healthcare Still Bleeding Data

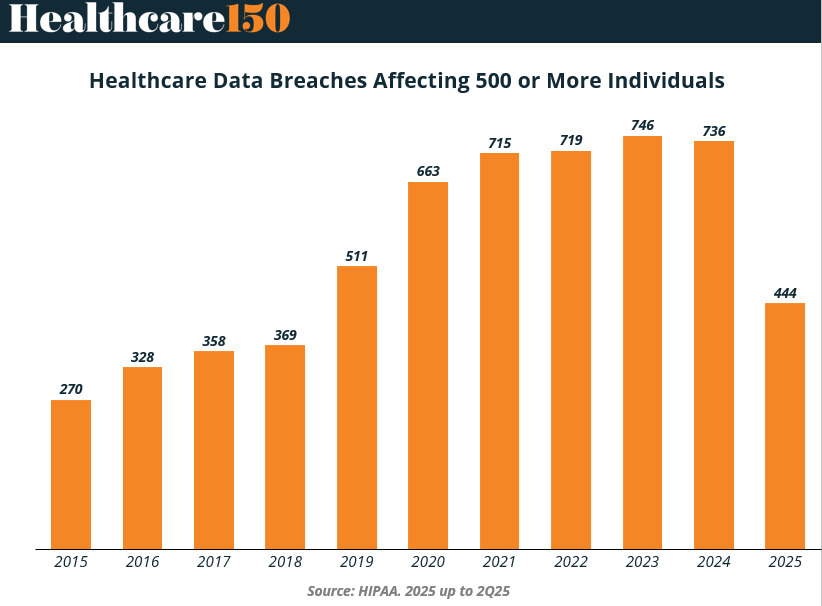

Through just the first half of 2025, there have already been 444 healthcare data breaches affecting 500+ individuals—putting the industry on pace to match or exceed previous years’ record highs.

Despite years of warnings and investment, breach volumes remain stubbornly high, with 2023 and 2024 both exceeding 736 incidents. The 2025 numbers suggest that cybersecurity remains the sector’s Achilles heel, especially as digital health adoption accelerates.

For payers, providers, and investors, the takeaway from 2025 so far is clear: security spend is no longer optional. Breaches aren’t just IT failures—they’re systemic, financial, and reputational risks.

Bottom line: 2025 confirmed what we already knew—healthcare’s digital transformation still isn’t secure.

Trends going into 2026

1.Wearables Set to Redefine Care by 2026

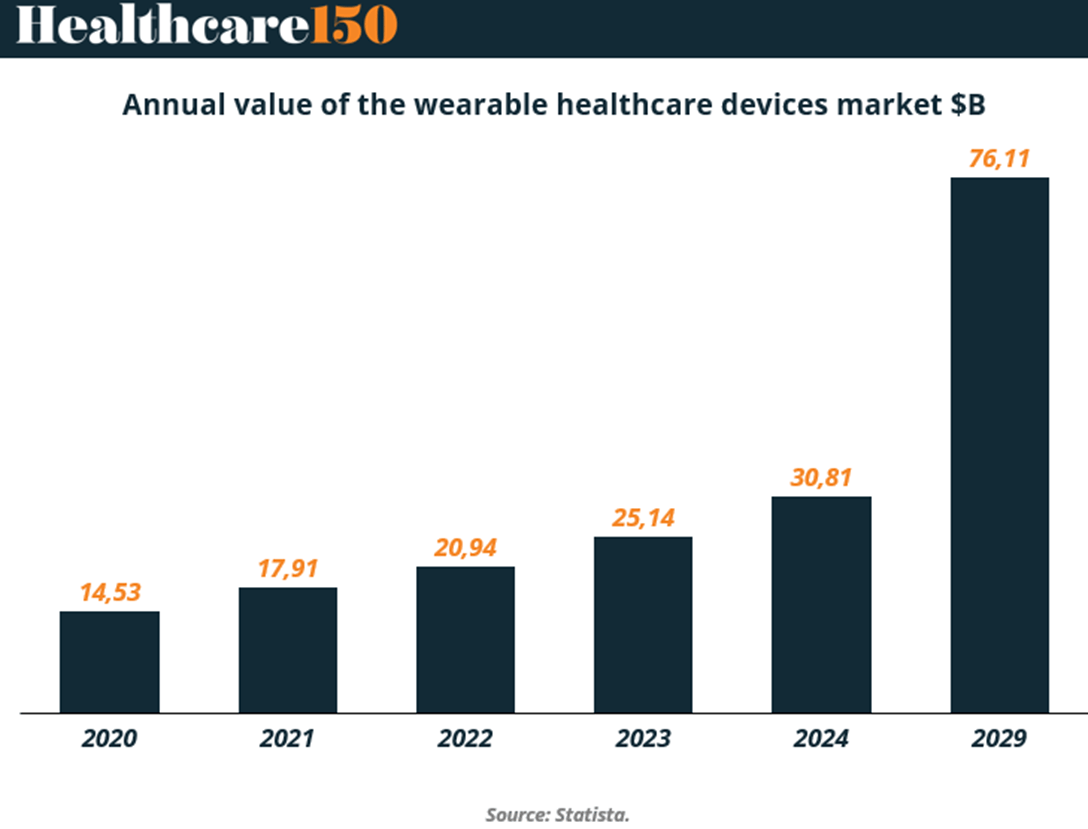

With the wearable healthcare devices market projected to hit $76.1B by 2029, momentum is building fast—and 2026 is shaping up to be the inflection point. After reaching $30.8B in 2024, wearables are no longer just consumer gadgets—they’re becoming core infrastructure for remote monitoring, chronic disease management, and clinical-grade data capture.

For operators, 2026 will be the year where reimbursement models, clinical adoption, and AI analytics catch up to the hardware curve. Expect increased M&A from MedTech and platform players racing to integrate wearables into broader care models.

Bottom line: By 2026, wearables won’t just track—they’ll intervene.

2.Biotech’s $2T Moment Is Coming—Fast

The biotechnology market is projected to cross $2.19T by 2026, nearly 50% growth from 2023. With consensus pointing to a $4.91T market by 2033, the next 12 months will be a key staging ground for companies betting on gene editing, AI-driven discovery, and next-gen biologics.

For investors, 2026 will be less about market hype and more about platform validation. The capital is shifting toward later-stage bets with regulatory clarity, scale potential, and real-world outcomes.

Bottom line: 2026 isn’t the biotech boom—it’s the filter year that decides who makes it to the $5T finish line.

3.Virtual Care Levels Off, But 2026 Brings a New Battleground

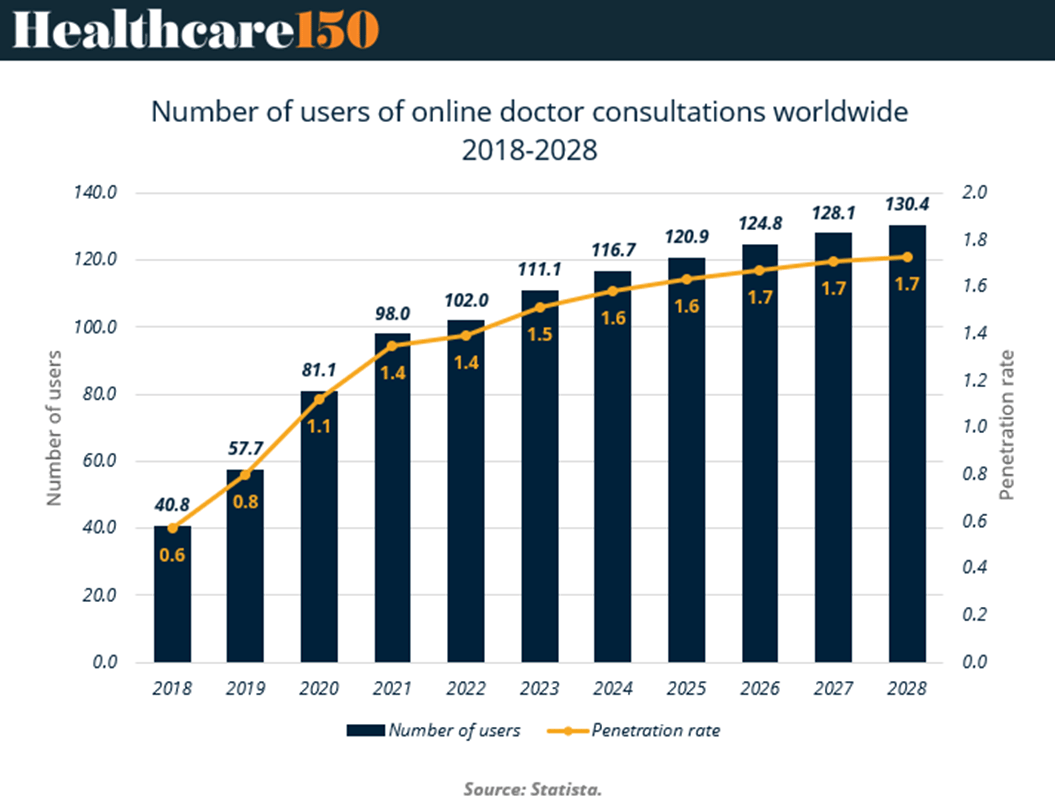

Global online doctor consultations are expected to hit 120.9M users in 2025, but penetration plateaus at 1.7%—a trend that holds through 2028. The explosive pandemic-era growth is over. What’s ahead in 2026 is consolidation, integration, and clinical proof.

As growth slows, platform players will need to differentiate through quality, reimbursement, and AI integration—not just access. Expect strategic M&A, tighter payer-provider alignments, and a shift from pure volume to value-based virtual care.

Bottom line: In 2026, virtual care moves from a growth story to a credibility test.

"Get busy living or get busy dying."

Stephen King