- Healthcare 150

- Posts

- AstraZeneca’s $15B Bet, €4bn Pharma Exit, and 36% Skip Care

AstraZeneca’s $15B Bet, €4bn Pharma Exit, and 36% Skip Care

AstraZeneca commits $15B to China and Permira eyes a €4bn sale of Neuraxpharm, while high costs force 36% of rural U.S. patients to forgo treatment.

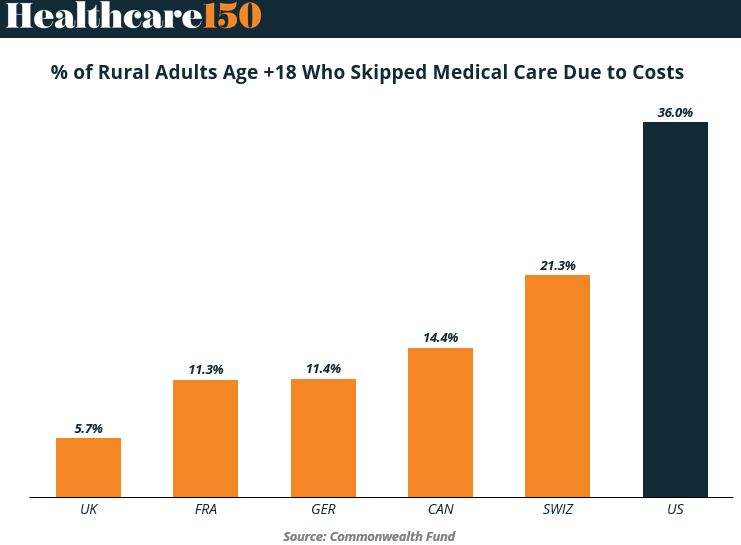

Good morning, ! Today we’re diving into the long-term $15B play of Astra Zeneca in China, new data shows U.S. rural care gaps are cost-driven: 36% skip care versus 6–21% in peers, Permira launches Neuraxpharm sale at €3–4bn, with €1.5bn debt lined up.

Sponsor Spotlight: Whereby is a video call API for telehealth platforms that enables embedded virtual visits with reliability, compliance, and UX control at scale.

Their State of Virtual Care survey highlights what’s actually stalling adoption as virtual care becomes infrastructure, and the benchmarks leaders are using to prioritize trust and experience in 2026. Read report highlights →

— The Healthcare150 Team

REGIONAL FOCUS

Rural Access Is a Cost Problem, Not a Capacity Problem

New Commonwealth Fund data highlights a stark rural access gap driven by affordability, not provider availability. In the U.S., 36.0% of rural adults report skipping medical care due to cost. That compares with 21.3% in Switzerland, 14.4% in Canada, 11.4% in Germany, 11.3% in France, and just 5.7% in the UK.

The implication is structural. The U.S. is not an outlier on rural geography. It is an outlier on cost exposure. Higher deductibles, uneven Medicaid expansion, and fragmented safety nets leave rural patients absorbing more financial risk at the point of care. Peer systems with fewer access complaints rely on income-linked cost sharing and stronger primary care coverage, even in sparsely populated regions.

For providers, this shows up as deferred demand that later converts into higher acuity and worse margins. For payers, it signals avoidable downstream cost driven by benefit design, not utilization abuse. For investors, it sharpens the case for models that lower upfront cost friction, including capitated primary care, rural-focused value based platforms, and supplemental benefit infrastructure.

Why this matters now: rural hospital closures, workforce shortages, and margin pressure are intensifying. Without addressing cost exposure, access initiatives risk treating symptoms while the underlying driver keeps worsening. (More)

PRESENTED BY WHEREBY

Virtual care is becoming the backbone of modern healthcare. But access and delivery are only the beginning. The real challenge is building virtual care systems people can trust, and that work reliably at scale.

In Whereby’s State of Virtual Care survey, telehealth leaders highlight the same pressure points that slow adoption: keeping patients engaged, building trust, and delivering a smooth experience without technical issues.

Whereby, a video call solution for telehealth platforms, pulled the key findings into a practical set of benchmarks you can use to check priorities for 2026.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

DEAL OF THE WEEK

Permira Lines Up the Exit”

Permira has officially put Neuraxpharm on the block, kicking off a sale process that could value the German CNS-focused pharma company at €3bn–€4bn. Jefferies and JPMorgan are advising, with non-binding bids due February 5.

The financing appetite is already there. Banks and private credit funds are prepping up to €1.5bn of leveraged debt, translating to roughly 5.5x–8x EBITDA. That leverage story leans heavily on growth expectations, with EBITDA projected at ~€230m this year.

The key asset is Briumvi, a recently approved monoclonal antibody for relapsing multiple sclerosis in both the US and EU. If the numbers hold, this shapes up as one of 2026’s largest leveraged healthcare deals—and a clear test of how aggressive lenders are willing to get on specialty pharma risk. (More)

HEAD LINE OF THE WEEK

AstraZeneca Goes All-In on China

AstraZeneca just placed one of the biggest long-term bets we’ve seen from a Western multinational in years: $15 billion committed to China through 2030. This isn’t incremental capex. It’s a full-stack push across R&D, advanced manufacturing, and next-generation therapies, including cell therapy and radioconjugates.

China already represents roughly 12% of AstraZeneca’s global revenue, and this move aims to hardwire the country into the company’s global innovation engine. New and expanded hubs across Shanghai, Beijing, Wuxi, Taizhou, and Qingdao will deepen local partnerships and scale a workforce headed toward 20,000 employees.

The timing matters. Announced during UK Prime Minister Keir Starmer’s visit to Beijing, the investment doubles as industrial strategy plus diplomacy. The message is clear: despite geopolitical noise, China remains too large—and too central to global tech-enabled life sciences—to ignore. (More)

MICROSURVEY

Where will healthcare M&A activity be most resilient over the next 12 months? |

INTERESTING ARTICLES

Whereby helps telehealth platforms deliver embedded video that feels native, with the reliability and UX control needed to scale virtual care.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"It is not the strength of the body that counts, but the strength of the spirit."

J.R.R. Tolkien