- Healthcare 150

- Posts

- 2025 Mid-Year Review

2025 Mid-Year Review

Six months into 2025, healthcare’s trajectory is defined not by uniform growth, but by divergence.

Healthcare Is Moving — But Not in One Direction

Some sectors — like biotech and clinical wearables — are expanding rapidly, driven by platform innovation and structural demand. Others, like virtual care and healthtech investing, are plateauing or contracting, not due to weakness, but due to maturation.

This mid-year review captures the five defining trends we've tracked in Healthcare 150 so far:

The slowdown of online doctor consults, and what comes next

The rationalization of U.S. healthtech deals post-2021

The $5T trajectory of biotech and platform-driven scale

The freeze in PE/VC healthtech funding and the quiet rebasing

The rise of medical-grade wearables, beyond fitness

What ties them together: a shift from growth to integration, funding to fundamentals, and scale to strategy. The boom years are over — but the building years are here.

Online Doctor Consultations: Growth Slows, Integration Becomes the Priority

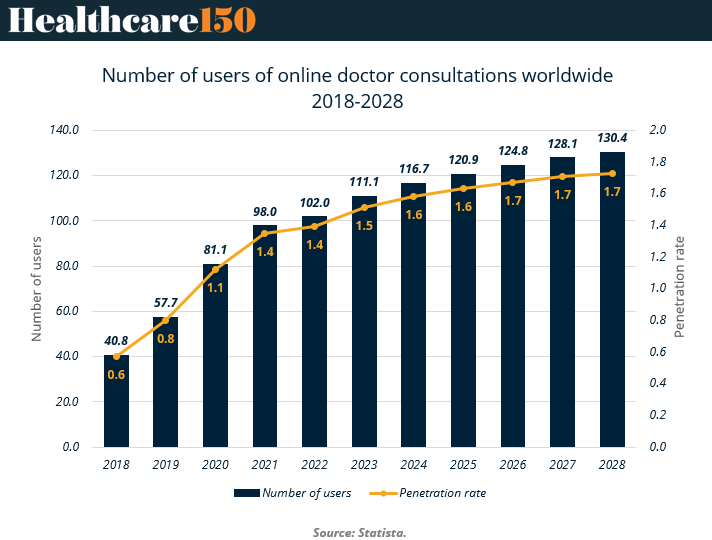

Online doctor consultations surged over the past five years, driven initially by necessity, then solidified by consumer behavior and institutional adoption. Global usage jumped from 40.8 million in 2018 to 111.1 million by 2023, reflecting a rapid normalization of telehealth as part of the healthcare delivery landscape.

However, from 2023 to 2028, the story changes: growth continues, but at a decelerated pace — the total number of users is projected to reach just 130.4 million by 2028, and the global penetration rate levels off at 1.7%.

This inflection signals a transition from a high-growth category to a more mature, infrastructure-dependent one. Investors should not misread the slowing growth curve as a decline in relevance. Instead, the market is moving into a phase where performance will be determined less by scale and more by integration — into electronic health record systems, insurance networks, and chronic care protocols.

Platforms able to evolve beyond one-off visits into longitudinal care models will hold the key to capturing value in the next phase of telehealth.

Key Takeaways and Strategic Implications

Deceleration of Global Growth

The total number of users is forecasted to grow just 17% from 2023 to 2028, compared to a 172% increase between 2018 and 2023. This suggests that major adoption hurdles have already been cleared, and the market has entered a consolidation and optimization phase. Future growth will come from underserved regions and use-case expansion rather than sheer user volume.Penetration Plateaus at 1.7%

Despite strong absolute numbers, the global penetration rate flattens, indicating that core markets (U.S., Europe, East Asia) are nearing saturation. Incremental increases are more likely to come from rural, emerging, and specialist-driven segments rather than general consumer growth.The End of “Pandemic Bump” Tailwinds

The data confirms that post-COVID tailwinds are dissipating. What remains are structural changes: employers incorporating virtual care into benefits packages, payers supporting certain reimbursable codes, and healthcare systems embedding virtual consults into standard pathways. Winning platforms will be those that prove clinical and economic value, not just convenience.Investment Focus Shifting to Infrastructure and Retention

As growth normalizes, capital is flowing toward companies building sticky, interoperable systems — not necessarily the biggest platforms, but those with strong churn control, AI-supported triage, and chronic condition modules. PE firms and strategics should be evaluating LTV/CAC ratios, provider retention, and integration depth with EHR and claims platforms as primary diligence points.Policy Will Determine the Next Ceiling

Regulatory clarity and payer willingness to reimburse non-urgent virtual consults will shape whether penetration rates can rise meaningfully above current levels. Without aligned incentives, particularly in multi-payer markets like the U.S., further growth could stall.

U.S. Healthtech Deals: From Peak Frenzy to Market Discipline

After a decade of steady growth, the U.S. healthtech funding market hit an inflection point in 2021 — and what followed was a necessary reality check. Deal volume soared to 740 transactions in 2021, an all-time high fueled by pandemic urgency, zero-interest capital, and inflated valuations.

But by 2022, the correction was well underway, with total deals falling 20% to 594, and continuing to decline in 2023 and 2024 to 503 and 497, respectively. Though the dip has been significant, what’s emerging is a more disciplined and strategically rational market.

Investors are no longer chasing category generalists or pandemic-fueled growth at any price. The new landscape rewards sustainable models, cash efficiency, and clinical validation. This recalibration doesn’t mean healthtech is losing steam — it means it’s maturing.

The volume of nearly 500 deals in 2024 still dwarfs pre-2018 levels, and capital is consolidating around companies with differentiated infrastructure, strong payer/provider partnerships, and scalable B2B models. The downturn may have culled the excess, but for operators and investors who stayed lean, the field has been cleared.

Key Takeaways and Strategic Implications

Post-2021 Correction Signals a New Market Era

Deal count fell 33% from the 2021 peak to 2024, signaling that the speculative growth period has ended. However, current volumes (~500 deals/year) remain 26% above pre-COVID averages, suggesting continued momentum — just under tighter capital controls.Flight to Quality Over Quantity

The volume dip reflects investor selectivity, not disinterest. Funds are flowing toward fewer, more established companies, particularly those with revenue traction, regulatory approvals, and demonstrated ROI for payers or providers.Valuation Pressure Resetting Expectations

Alongside volume declines, healthtech has seen fewer up rounds and a sharp increase in flat or undisclosed deal terms. Startups are adapting by focusing on unit economics, customer stickiness, and capital-efficient growth. PE sponsors are stepping in as early-stage VCs retrench.Strategic M&A Taking the Wheel

With IPO windows closed and venture exits compressed, M&A is increasingly being used as a growth and exit strategy. Consolidation is now a feature, not a fallback — with venture-to-venture and strategic acquisitions accounting for a growing share of deal flow.Implications for Operators

The bar is higher. Early-stage healthtech companies must demonstrate clinical relevance, cost-reduction potential, and infrastructure readiness (integration with EHRs, payers, or hospital systems) earlier in their lifecycle. Fundraising is no longer about storytelling — it’s about defensibility.

Biotechnology’s $5 Trillion Trajectory: Momentum with Maturity

Biotechnology is no longer a niche sector—it’s one of the global economy’s most consequential innovation engines. The market is projected to more than triple from $1.51 trillion in 2023 to $4.91 trillion by 2033, according to a composite forecast from Precedence, Grandview, Skyquest, and Biospace.

This represents a 12.2% compound annual growth rate (CAGR)—remarkably consistent over a decade-long horizon. Underpinning this growth is a shift from one-off breakthroughs to platform scalability: gene editing, AI-driven discovery, synthetic biology, and precision medicine are no longer isolated bets—they are now foundational technologies shaping pharma pipelines, food systems, and sustainable materials.

But the capital picture has grown more complex. While public market enthusiasm cooled after the 2021 peak, biotech is rebalancing toward later-stage, capital-efficient models with clearer paths to revenue and regulation.

Dry powder remains plentiful in VC and private equity—what’s changed is the underwriting. Investors are moving away from preclinical lottery tickets and toward validated platforms with asset-light approaches, strong CDMO partnerships, and regulatory clarity. The industry’s maturation doesn’t mean lower returns—it means tighter capital discipline and higher barriers to entry, setting the stage for a more strategically durable cycle.

Key Takeaways and Strategic Implications

Market Will Triple by 2033

The global biotechnology market is expected to grow from $1.51T to $4.91T, with notable acceleration between 2028 and 2033. This growth reflects both technological expansion and broader application fields: beyond healthcare, biotech is scaling across agriculture, materials science, and environmental engineering.12.2% CAGR Reflects Structural, Not Cyclical, Growth

Unlike COVID-era surges, this growth is not a one-time demand spike. It's underpinned by sustained R&D pipelines, demographic pressures (aging, chronic disease), and demand for biologics and cell/gene therapies. Institutional investors should view this sector as long-duration innovation infrastructure, not a volatile play.Platform Over Product

The current funding climate favors companies with modular platforms over single-asset plays. AI-assisted drug discovery, CRISPR toolkits, and synthetic biology enablers are getting capital because they scale across verticals. Exit multiples are shifting toward network effect and data moat models, not binary outcomes.Geographic Expansion Will Rebalance the Map

While the U.S. and Europe dominate biotech capital and talent, China and India are scaling domestic innovation with government backing and IP reforms. This opens new frontiers for cross-border JV opportunities, clinical trials, and regionalized manufacturing hubs.Implications for Dealmakers

PE firms should prioritize contract manufacturing (CDMO) platforms, regulatory services, and IP-rich mid-stage players with FDA/EMA alignment. Venture investors need to underwrite not just the science, but reimbursement risk, manufacturing readiness, and clinical trial execution as capital efficiency becomes paramount.

Healthtech Funding: From Frenzy to Freeze

The PE/VC healthtech market has gone from historic exuberance to a sharp contraction. In 2021, the space hit its peak with 1,326 deals totaling $51B in aggregate transaction value—a perfect storm of pandemic-fueled urgency, abundant capital, and bullish valuations.

But the pullback has been steep and sustained: deal count fell to 719 in 2024, and as of early 2025, only 164 deals have been recorded, with total disclosed value dropping to just $3B. The funding environment has shifted from capital abundance to capital caution, particularly in early-stage and non-revenue-generating models.

What remains is a bifurcated market. On one side: startups that raised in 2020–21 and failed to demonstrate commercial traction are running out of options.

On the other: a select cohort of healthtech companies with strong fundamentals are commanding attention from both PE and strategic buyers—often through secondary or growth equity rounds. Investors today are underwriting cash flow predictability, reimbursement alignment, and data infrastructure integration over top-line growth alone. Healthtech isn’t broken—it’s being repriced, restructured, and redefined.

Key Takeaways and Strategic Implications

Deal Count Fell by 88% Since Peak

The drop from 1,326 deals in 2021 to just 164 so far in 2025 is stark. It reflects not just macro tightening, but also a sector-wide recalibration: investors are no longer placing broad platform bets and are instead zeroing in on post-product-market-fit models.Capital Concentration and Selectivity Are Rising

Despite the pullback, quality deals are still getting done—but with smaller check sizes and tighter due diligence. Late-stage rounds are getting recapitalized, down rounds are common, and growth equity is being deployed to de-risked, infrastructure-adjacent plays.Massive Drop in Transaction Value

From $51B in 2021 to just $3B in 2025, aggregate transaction value has cratered. This suggests a dramatic shift in pricing, with investors prioritizing cash efficiency, unit economics, and strategic defensibility over headline growth or market sizzle.Implications for Founders

The bar for funding is materially higher. Startups must prove revenue maturity, a path to profitability, and quantifiable outcomes (cost savings, clinical value). The days of “demo-based diligence” are over. The shift is toward evidence-backed models with operational leverage.Opportunities for PE

This is a prime environment for roll-ups, secondary purchases, and distressed assets. Sponsors with dry powder can capitalize on price resets and selectively acquire digital health assets at a discount—especially those that complement existing provider services, billing platforms, or data ecosystems.2025 Is a Reset Year

With only 3 disclosed deals totaling $3B YTD, this year is shaping up to be a baseline reset. It’s not a sign of collapse, but of a market clearing excesses. Forward momentum will depend on valuation stabilization, exit visibility, and macroeconomic tailwinds (interest rates, policy clarity).

Wearables Go Clinical: From Wellness to Medical-Grade Infrastructure

The global wearable health device market is undergoing a structural transformation. Between 2021 and 2024, global unit shipments are expected to climb from 275 million to 440 million, with the medical-grade segment nearly doubling from 85 million to 160 million.

While smartwatches and fitness trackers still lead in volume, the fastest-growing category is wearable medical sensors and trackers—a sign that the sector is transitioning from lifestyle accessory to clinical utility.

This evolution is not just about form factor or features—it’s about the business model. Payers and providers are increasingly embracing wearables for remote patient monitoring, chronic care management, and early diagnostics.

Regulatory bodies are approving more device types for clinical use, while reimbursement frameworks are being adjusted to support digital therapeutics and continuous monitoring. The smart money is no longer chasing step counters; it’s flowing toward platforms that capture real-time data, support interventions, and plug directly into health system infrastructure.

Key Takeaways and Strategic Implications

Total Shipments Will Hit 440M in 2024

Wearable health devices are projected to grow 60% from 2021 to 2024, with annual shipments rising from 275M to 440M. This reflects robust demand across both consumer and clinical settings, with growth driven by aging populations, chronic disease burden, and demand for scalable care delivery.Medical Devices Are Catching Up Fast

Wearable medical sensors and trackers are the fastest-growing subsegment—up 88% over three years, from 85M in 2021 to 160M in 2024. These include devices for glucose monitoring, cardiac telemetry, sleep apnea, and medication adherence. Investors should expect increasing FDA/CE regulatory momentum in this space.Consumer Wellness Is Maturing, Not Declining

Smartwatches and fitness trackers still dominate volumes (280M in 2024), but their value is shifting. Consumer demand is moving from basic fitness to health insights, stress tracking, and hybrid preventive care. Integration with clinical-grade software (e.g. ECGs, blood oxygen, fall detection) is a key value unlock.Reimbursement and Policy Are the Catalysts

CMS and private payers are expanding reimbursement codes for remote patient monitoring (RPM), especially in chronic conditions like diabetes, hypertension, and COPD. This is creating strong tailwinds for device adoption in U.S. and EU healthcare markets.Strategic Investment Priorities

Stakeholders should focus on companies that enable data interoperability, AI analytics, and outcome-based partnerships with health systems. Key M&A targets will likely include device makers with regulatory clearances, sensor IP portfolios, and EHR-integrated platforms.

Conclusion: The Year of Strategic Sorting}

2025 isn't about explosive headlines. It’s about market sorting — between infrastructure and noise, between sustainable models and pandemic relics. What we’re seeing isn’t a sector pulling back, but a sector growing up. Winners in this environment won’t be the loudest or fastest. They’ll be the most embedded, the most interoperable, and the most aligned with clinical and financial value.

In a capital-constrained environment, every dollar deployed — and every strategic decision — matters more. The themes surfaced in this report are not just trends; they are signals of where healthcare is headed. If the first half was about identifying the shift, the second half will be about executing against it.

Sources & References

Deloitte. (2023). When digital tech becomes a medical device. https://www.deloitte.com/nl/en/Industries/tmt/perspectives/when-digital-tech-becomes-a-medical-device.html#:~:text=Deloitte%20Global%20predicts%20that%20320,become%20comfortable%20with%20using%20them

S&P Global. (2025). Private equity investment in healthcare tech companies up 50% in 2024. https://www.spglobal.com/market-intelligence/en/news-insights/articles/2025/4/private-equity-investment-in-healthcare-tech-companies-up-50-in-2024-88326116

Rock Health. (2025). 2024 year-end market overview: Davids and Goliaths. https://rockhealth.com/insights/2024-year-end-market-overview-davids-and-goliaths/

Statista. (2025). Annual number of users of online doctor consultations worldwide from 2017 to 2029. https://www.statista.com/forecasts/1456718/online-doctor-consultations-worldwide-forecast

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.