- Healthcare 150

- Posts

- $1.25T by 2029: Healthtech’s Time Is Now

$1.25T by 2029: Healthtech’s Time Is Now

As Healthtech scales past $1.25T, private equity sees a rare window for disciplined growth, digital buy-and-builds, and platform consolidation.

Good morning, ! It’s Thursday and we’re diving into the world of health tech and private equity, the resilience of healthcare costs vs inflation over the years, and the 3D bioprinting market.

Want to reach 350,000+ executive readers? Start Here.

Know someone in the healthcare space who should see this? Forward it their way. Here’s the link.

— The Healthcare150 Team

DATA DIVE

The Rise of Healthtech: A Prime Opportunity for Private Equity

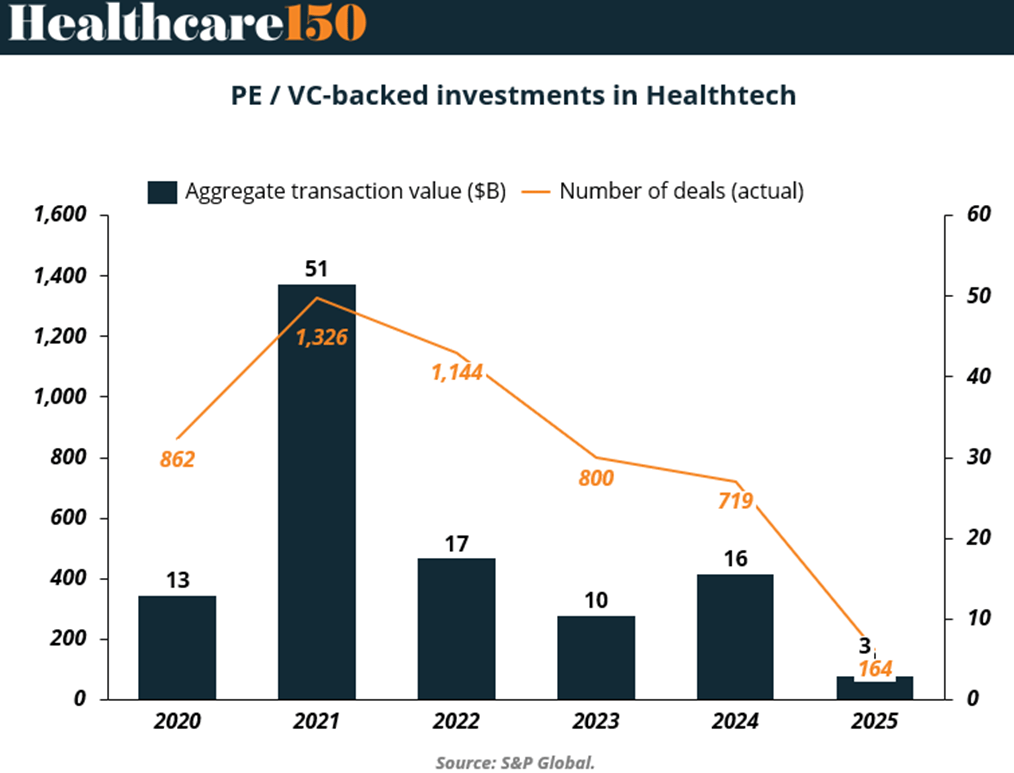

Healthtech is no longer a fringe play, it’s now the digital backbone of modern healthcare. The market is projected to more than double from $507.3B in 2024 to $1.25T by 2029 (20.6% CAGR), propelled by AI, telemedicine, data platforms, and regulatory shifts.

For private equity, the timing is strategic: valuations have corrected post-2021, PE firms are sitting on dry powder, and the market is flush with targets, many moving toward operational scale and profitability. Buy-and-build strategies in virtual care, revenue cycle management, and digital therapeutics are accelerating.

Meanwhile, VC confidence remains high. Healthtech drew $25.2B in 2024, ranking sixth across all sectors, above Robotics and Security. This signals a durable innovation pipeline and an ecosystem that’s now PE-compatible.

Geography matters. The US and Canada dominated with $10.5B in 397 deals, but Europe ($3.6B) and Asia-Pacific ($1.1B) are catching up fast, driven by policy shifts and digital-first care models.

Bottom line: Healthtech’s growth curve is intact, capital is increasingly disciplined, and operational PE plays are back in favor. For firms with sector expertise, now is the time to lean in, not wait. (Read or Listen to the Full Report)

TREND OF THE WEEK

Healthcare Costs: The Unsung Inflation Engine

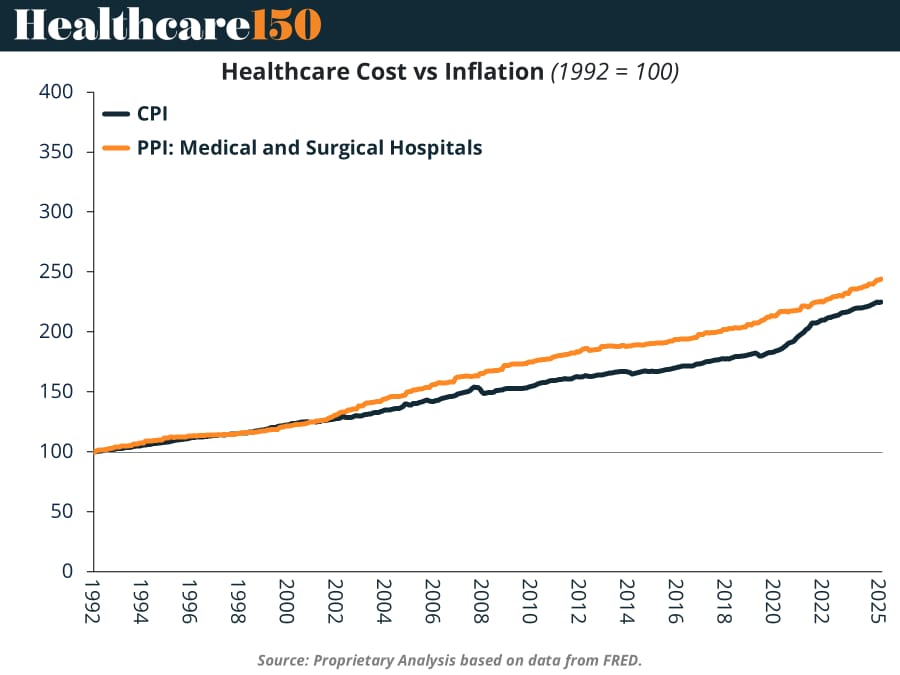

Healthcare costs are once again pulling a fast one on general inflation—and the gap is getting harder to ignore. Hospital expenses grew 5.1% in 2024, outpacing CPI’s 2.9% rise. Labor costs, making up 56% of hospital spend, are the main culprit—RN wages alone rose 26.6% faster than inflation in four years. Meanwhile, aging infrastructure is going neglected, threatening care quality. The accompanying chart? A three-decade reality check: healthcare prices have now grown 2.5x since 1992 vs. a much flatter CPI. With commercial healthcare spending projected to spike 8% in 2025, the pressure on margins, patients, and investors is only going up. (More)

PRESENTED BY DEEL

Global payroll complexity? Here’s the playbook.

Managing global payroll shouldn’t mean juggling vendors and compliance risks. Deel, recognized in the Gartner® Market Guide for Multicountry Payroll Solutions, helps finance teams automate payments, standardize reporting, and stay compliant in 100+ countries. Get key insights from industry experts to future-proof your payroll strategy.

MARKET MOVERS

Company (Ticker) | Last Price | 5D |

Eli Lilly and Company (LLY) | $ 784.48 | 4.32% |

Johnson & Johnson (JNJ) | $ 155.90 | 0.96% |

Novo Nordisk A/S (NVO) | $ 77.72 | 9.60% |

Roche Holding AG (ROG.SW) | $ 328.12 | 1.78% |

AbbVie Inc. (ABBV) | $ 190.30 | 1.63% |

HEALTHTECH CORNER

3D Bioprinting: From Concept to Clinical Growth

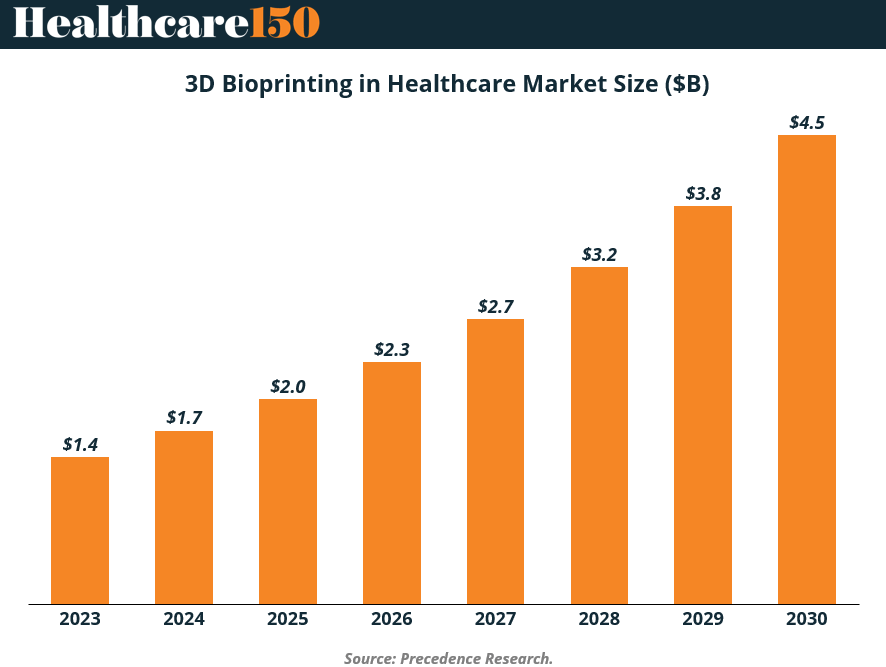

3D bioprinting in healthcare is quietly becoming one of the sector’s most promising frontiers. The market is projected to more than triple from $1.4B in 2023 to $4.5B by 2030, according to Precedence Research.

Why now? Advances in biomaterials, precision printing, and regenerative medicine are enabling breakthroughs in customized implants, prosthetics, and even tissue engineering. Clinical applications are expanding from academic labs to commercial-scale production, with regulators increasingly engaged.

For investors and strategic healthcare players, this is a space to watch—not for short-term returns, but for long-term platform bets. Partnerships between bioprinting firms and device manufacturers are accelerating, and M&A is likely to heat up as IP-rich startups reach clinical milestones.

Bottom line: As healthcare systems seek cost-effective, patient-specific solutions, 3D bioprinting is evolving from a futuristic concept to an investable reality. Now is the time to build an informed position. (More)

TOGETHER WITH START ENGINE

StartEngine’s $30M Surge — Own a Piece Before June 26

StartEngine is the investing platform providing exposure to pre-IPO companies like OpenAI, Perplexity, and Databricks.

After doubling their revenues YoY in 2024 ($23M to $48M), StartEngine’s now tripled first quarter revenue YoY to a record $30M, based on its unaudited Q1 2025 financials. Now you can join 45K+ shareholders across all offerings before this round closes next month.

Reg A+ via StartEngine Crowdfunding, Inc. No BD/intermediary involved. Investment is speculative, illiquid & high risk. See OC and Risks on page.

DEAL OF THE WEEK

IPO Drought Ends With a Chronic Comeback

Omada Health kicked off its public debut at $23/share, a tidy 21% premium over its IPO price, raising $150M and ending a long dry spell for digital health IPOs. Just weeks after Hinge Health’s own IPO, Omada’s Nasdaq listing (ticker: OMDA) marks only the second digital health firm to go public this year. Founded in 2011, Omada manages chronic conditions like diabetes and hypertension via digital platforms and connected devices. While Hinge’s initial pop has cooled, Omada rode that momentum, prompting some to call this a bellwether moment. Still, don’t expect a stampede: “Not many are ready,” one VC told Healthcare Dive. Translation: this might be the spark, but we’re still waiting for fuel. (More)

REGIONAL FOCUS

Digital Health: Different Zip Codes, Different Reactions

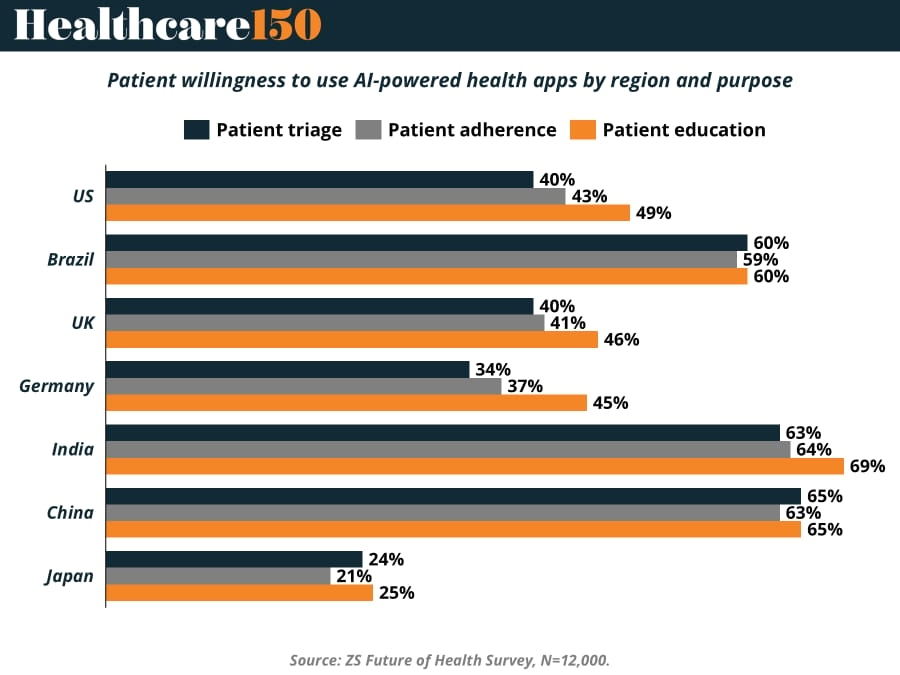

The promise of AI in healthcare is universal. The willingness to actually use it? Not so much. While India, China, and Brazil are already swiping right on AI-powered patient education and triage, Western markets—think U.S., UK, and Germany—are still cautiously dating the idea, with engagement rates in the 40% range. Japan? Still ghosting, with trust levels near rock bottom.

For life sciences firms, this isn’t just an adoption curve—it’s a design brief. Tailor your tools to regional behaviors, or risk building brilliant tech that nobody uses. (More)

INTERESTING ARTICLES

"Success is the sum of small efforts, repeated day-in and day-out."

Robert Collier